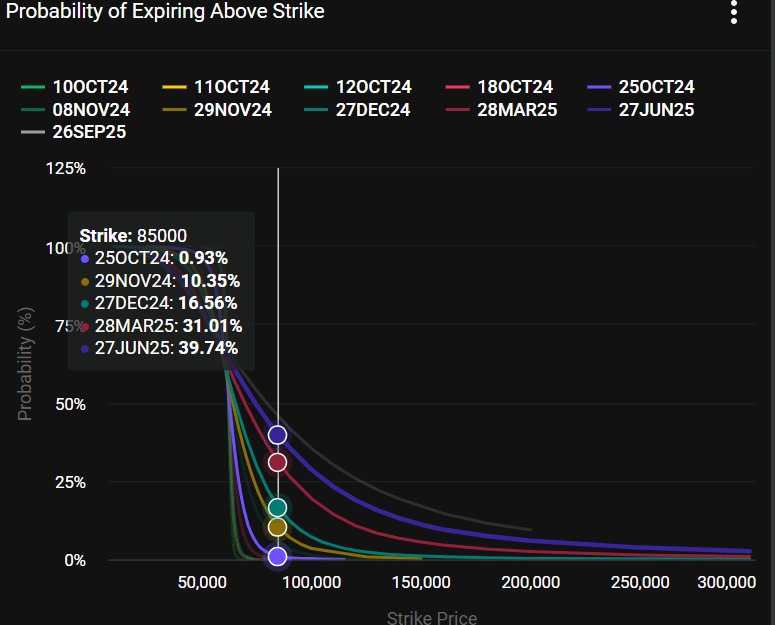

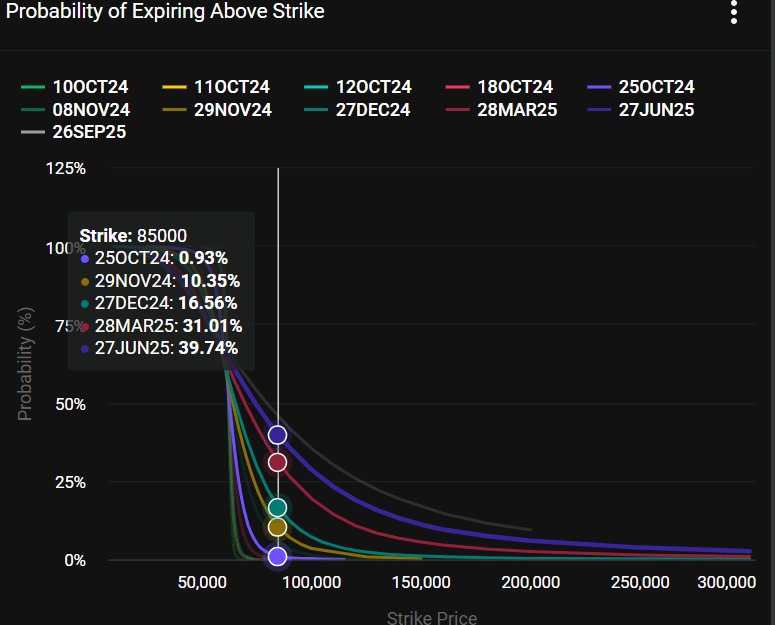

- Options data projected only a 16% chance of BTC hitting $85K by year-end.

- There was weak market demand and relatively little network growth.

Despite the high expectations of a bullish Q4 and end-2024 rally for Bitcoin [BTC], the options market remained eerily cautious.

According to Bitwise’s head of alpha strategies, Jeff Park, options markets were pricing only a 10% chance of BTC hitting $85K by the end of the year.

“Deribit 12/27 contracts now pricing in only ~10% chance that BTC will hit $85k by year-end (using 20x levered 5k CS pricing), while 7d VRP turned negative yesterday”

At press time, the odds of BTC hitting $85K by December 2024 were about 16% per Deribit data.

Source: Deribit

Positive catalysts for BTC

However, Park also noted that the options market outlook might get the target wrong.

He found that the 7-day VRP (Volatility Risk Premium), which captures the volatility difference between the actual (spot) and options markets, turned negative. This meant that spot market volatility was lower than options predicted.

Here, the same could be said for the year-end BTC price prediction from the options markets. It could overstate or underplay BTC’s outlook.

Park added that the upcoming FTX repayments and ongoing global easing cycle were positive catalysts for BTC.

Several firms and analysts have projected BTC price targets by the end of 2024. Bernstein projected $90K by 2024 and $200K by 2025.

According to Standard Chartered Bank, the asset could hit $150K by year-end and surge to $250K by 2025.

However, some market pundits believe that the geopolitical tensions in the Middle East and U.S. election outcomes could be crucial factors for BTC in the short term.

Network growth and demand

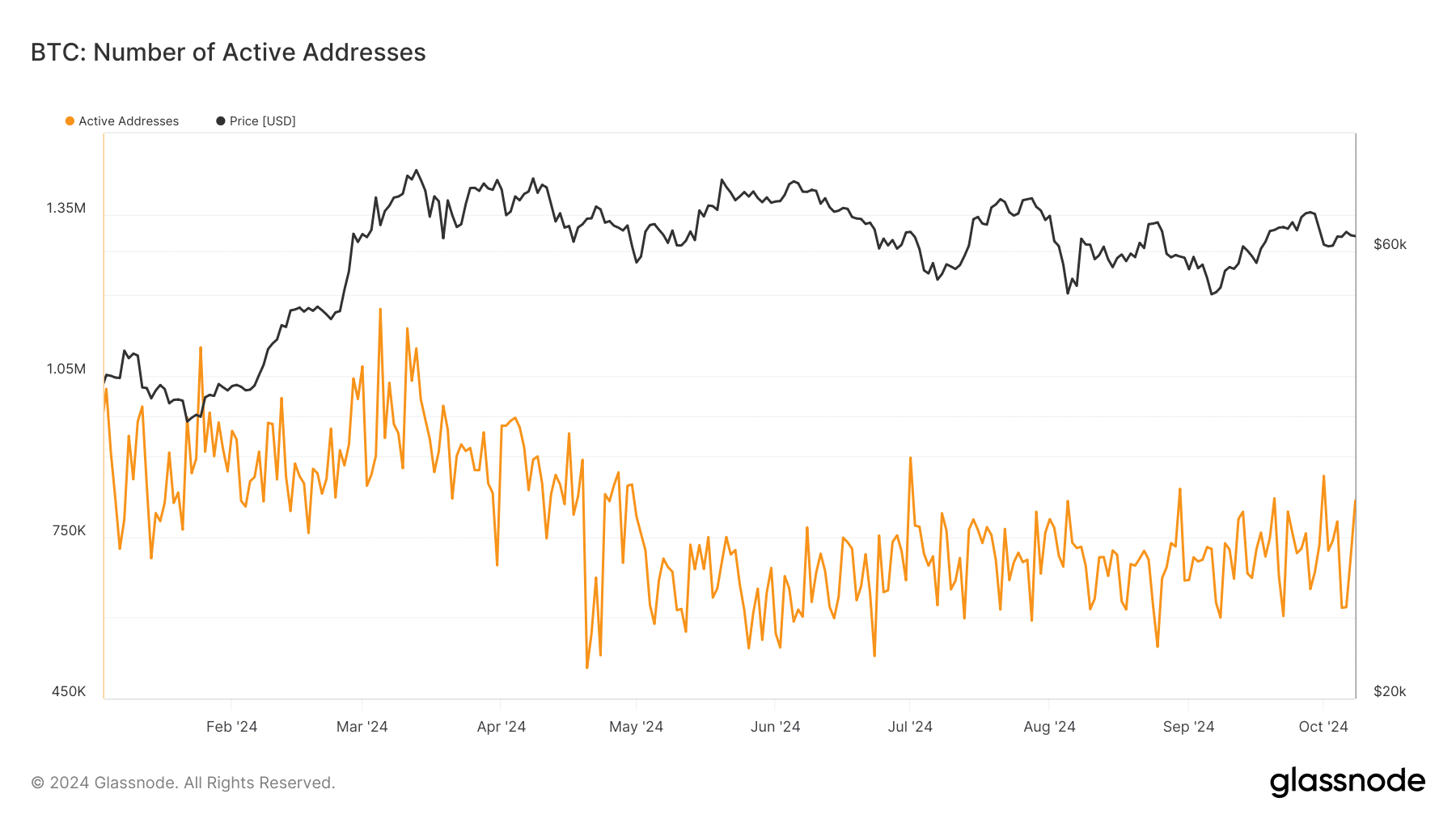

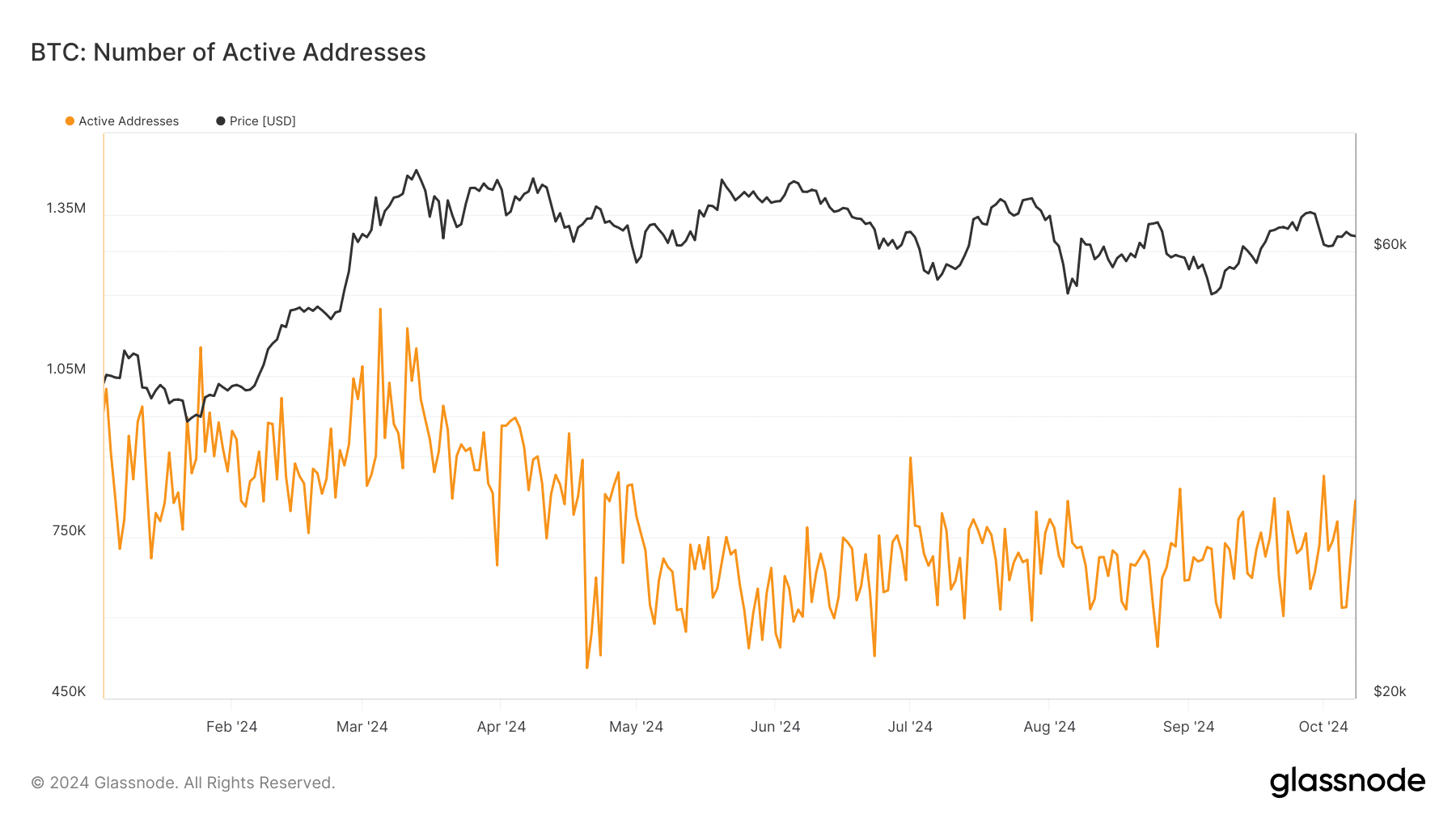

Source: Glassnode

Meanwhile, based on active addresses, BTC network growth has been oscillating around 750K since late September.

However, it remained below 1 million, a level it surpassed when BTC rallied to a new ATH in Q1 2024. This suggested less market interest in the asset in Q4 than in Q1.

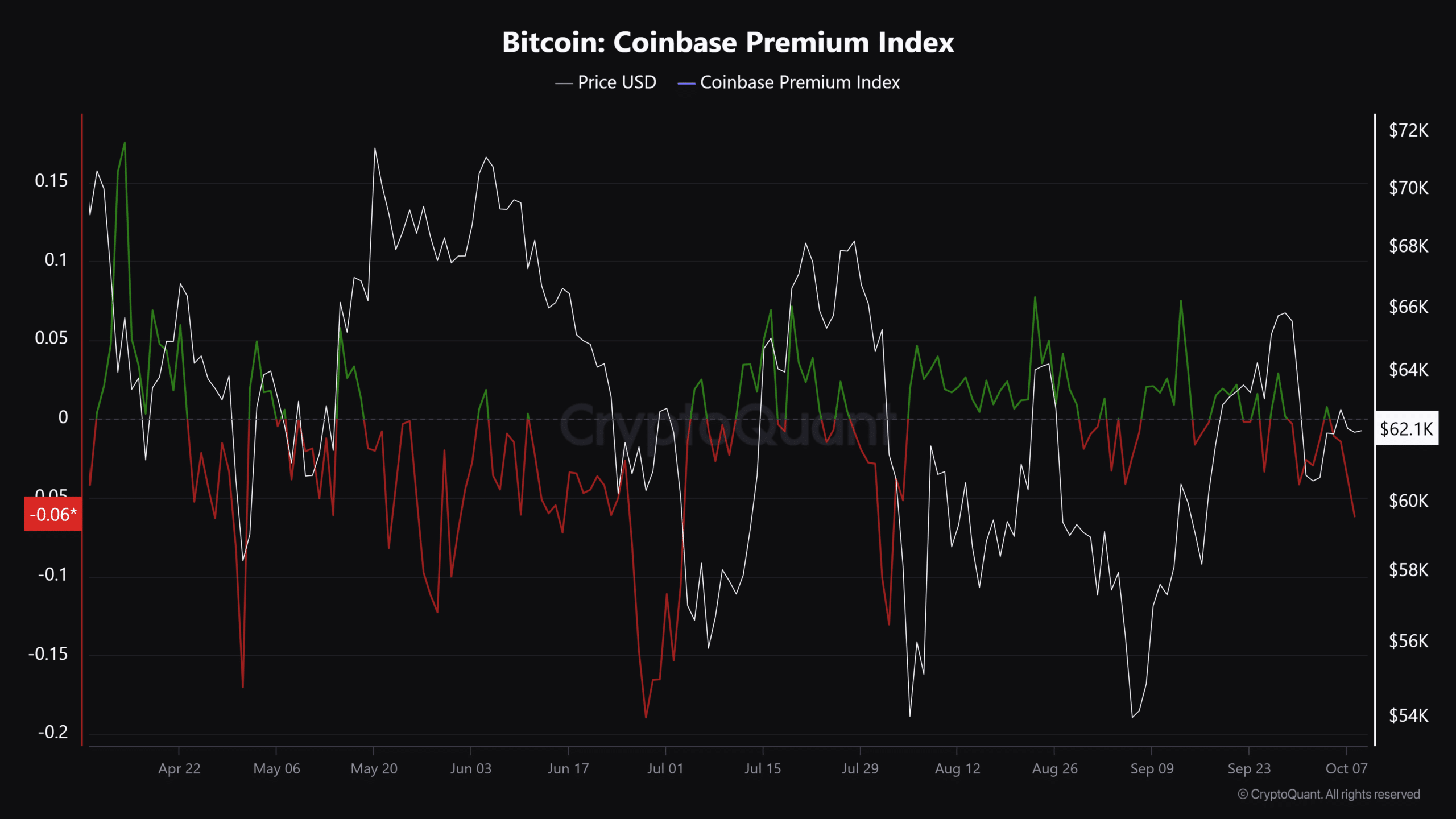

The short-term weak demand in October, especially from U.S. investors, also concurred with the above observation.

The Coinbase Premium Index, which gauges U.S. investors’ demand, has been red for the past few days.

Source: CryptoQuant

However, the short-term holder cost basis point of around $63K was crucial support that could determine whether BTC will face a recovery in the short term.

Leave a Reply