- A decline below the $0.34 support can confirm a patterned breakout.

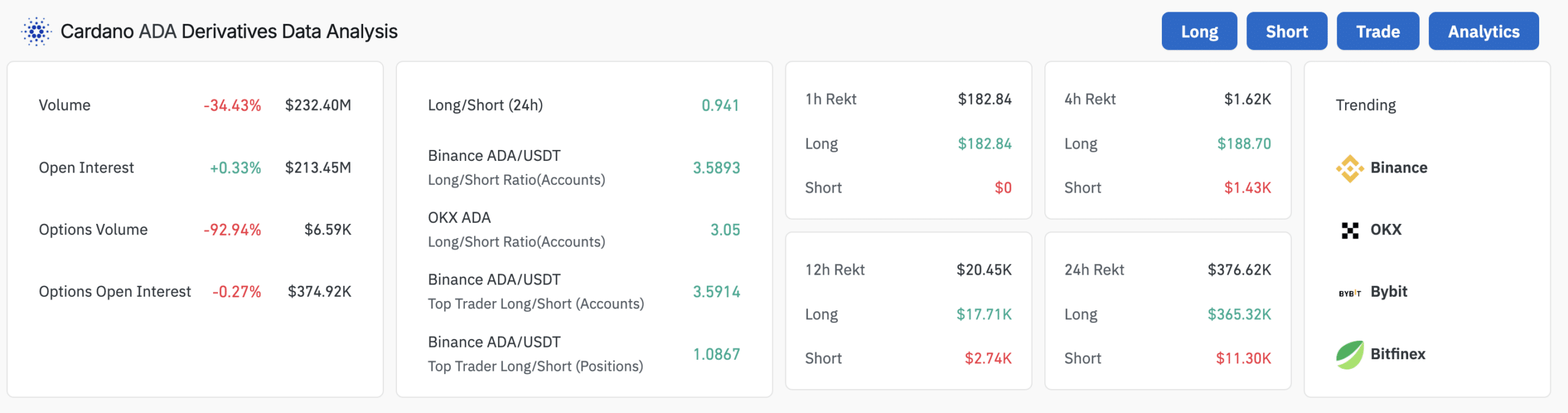

- Derivates data for ADA showed mixed sentiment.

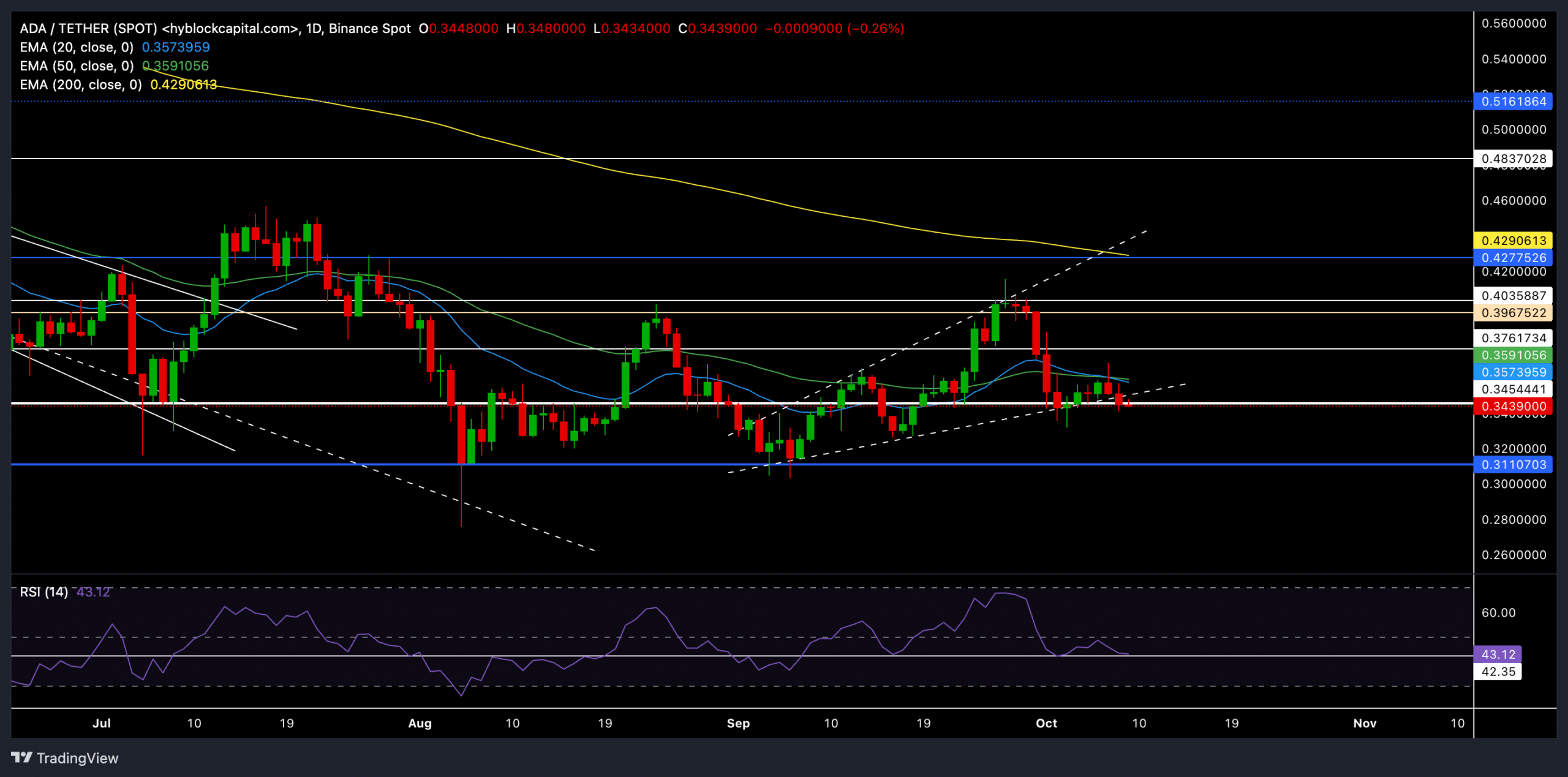

Cardano’s [ADA] continued its ongoing bearish trend and recently fell below the 20-day and 50-day exponential moving averages (EMAs) to affirm a bearish edge.

After its recent decline, ADA was struggling to maintain a foothold above crucial support levels. It traded at around $0.3439 at press time, down 2.5% in the last 24 hours.

Is a rebound for Cardano in sight?

Source: TradingView, ADA/USDT

ADA’s recent bounce from the $0.30 support region chalked out a classic broadening wedge pattern on the daily chart.

The altcoin attempted to position itself above the 20-day and 50-day EMAs, only to be rejected at the $0.40 resistance level.

This rejection led to a nearly 14% depreciation over the last two weeks, and the price action slid back below the EMAs.

The descending trend in ADA now positions the $0.34 mark as a vital threshold.

If ADA sustains a close below this level, it could confirm a breakdown from the broadening wedge pattern, increasing the likelihood of further losses.

The immediate target for Cardano bears could be around $0.31, where buyers might reenter to defend the psychological support zone.

Adding to the downward pressure, the 20-day EMA fell below the 50-day EMA, suggesting increased bearish strength in the market.

This crossover could further propel more bearish pressure, bringing ADA to retest the $0.31 support level before a possible bullish rebound.

The Relative Strength Index (RSI) formed relatively flatter lows, while the price action marked lower lows.

This divergence can indicate that the selling pressure is weakening, hinting at a potential reversal in the coming sessions.

A rebound of the $0.3 level, paired with RSI climbing above 50, could signal a buying opportunity for traders aiming to capitalize on short-term rebounds.

Derivatives data reveals…

Source: Coinglass

The derivatives data provided a mixed outlook for ADA. The 24-hour long/short ratio was 0.941, indicating a somewhat balanced sentiment.

However, the Long/Short Ratio on Binance and OKX were notably skewed in favor of longs, at 3.5893 and 3.05.

Read Cardano’s [ADA] Price Prediction 2024–2025

Despite this optimism, trading volume fell by 34.43%, indicating reduced market activity and a possible lack of conviction among Cardano market participants.

The liquidation data revealed that long positions were more prominent, with minimal short liquidations, hinting that profit-taking might drive the current downward movement more than aggressive shorting.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Leave a Reply