- XRP nears resistance with bullish support from RSI and Bollinger Bands.

- Open interest and on-chain activity boost momentum, but NVT raises caution.

Ripple [XRP] is currently drawing bullish attention from both retail and institutional investors. At press time, XRP was trading at $0.5421, up 1.93% in the last 24 hours. With crowd sentiment sitting at 0.07 and smart money at 0.74, optimism is building around the possibility of the altcoin breaking through key resistance levels and continuing its upward trend.

However, market conditions remain complex, and several factors could impact this trajectory.

XRP chart shows potential

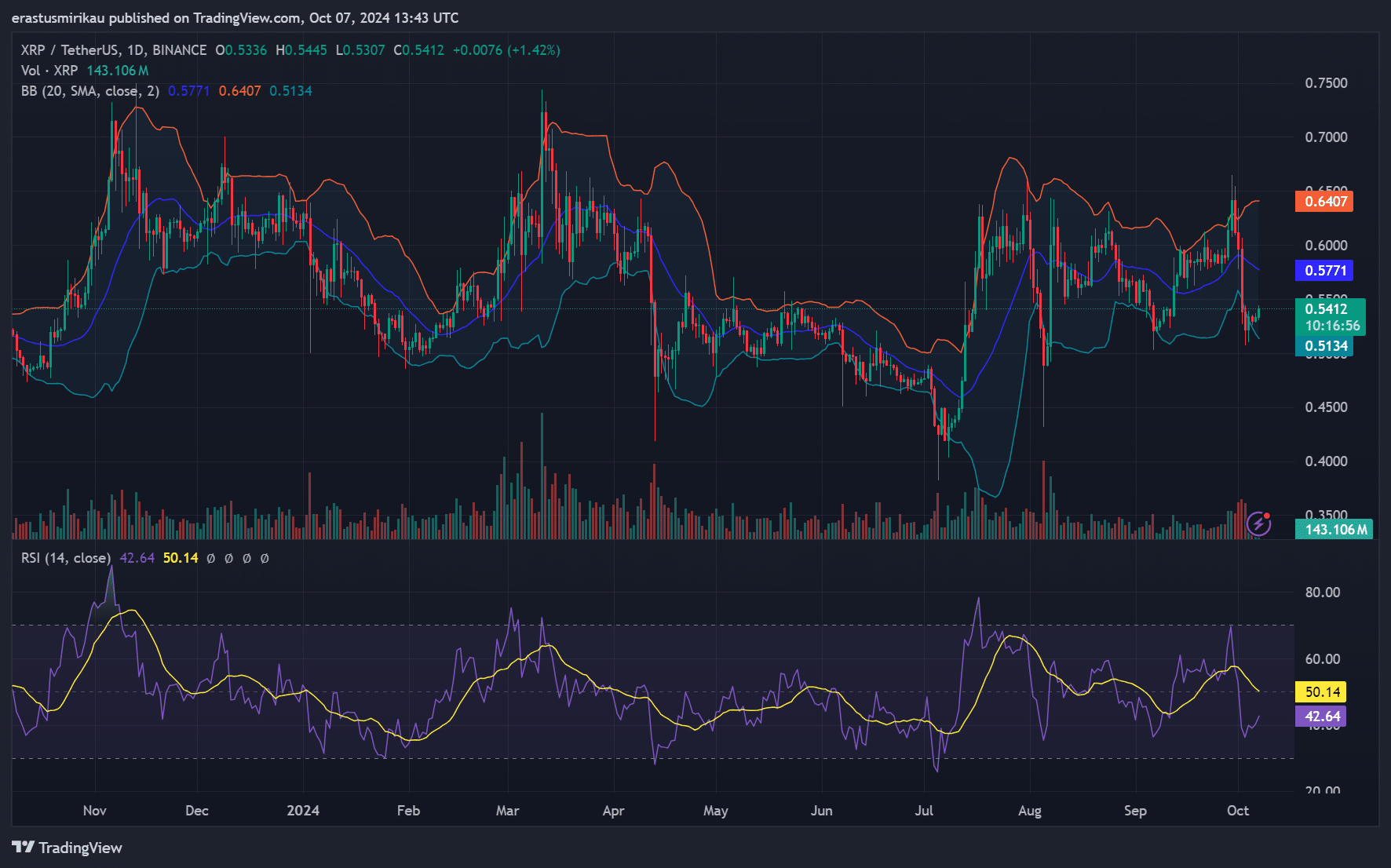

XRP’s price movement is contained within its Bollinger Bands, ranging between $0.5336 and $0.5445. The Relative Strength Index (RSI) sits at 50.14, reflecting a neutral stance in the market.

Therefore, the market is neither overbought nor oversold. Consequently, traders could see this as a setup for a breakout. If bullish momentum holds, a rise above $0.5445 could propel XRP further.

However, failure to breach this level could see the price consolidate or even retrace.

Source: TradingView

While XRP’s price action and sentiment are pointing toward a bullish outlook, the NVT (Network Value to Transaction) ratio paints a more cautious picture. Currently, the NVT ratio stands at 388.20, down 4.89% in the past 24 hours at press time, according to CryptoQuant.

A high NVT ratio typically indicates an overvalued network compared to transaction volume, suggesting that the price might not be fully supported by underlying network activity. Therefore, despite the positive sentiment, traders should be wary of potential overvaluation.

Rising on-chain activity: A positive signal

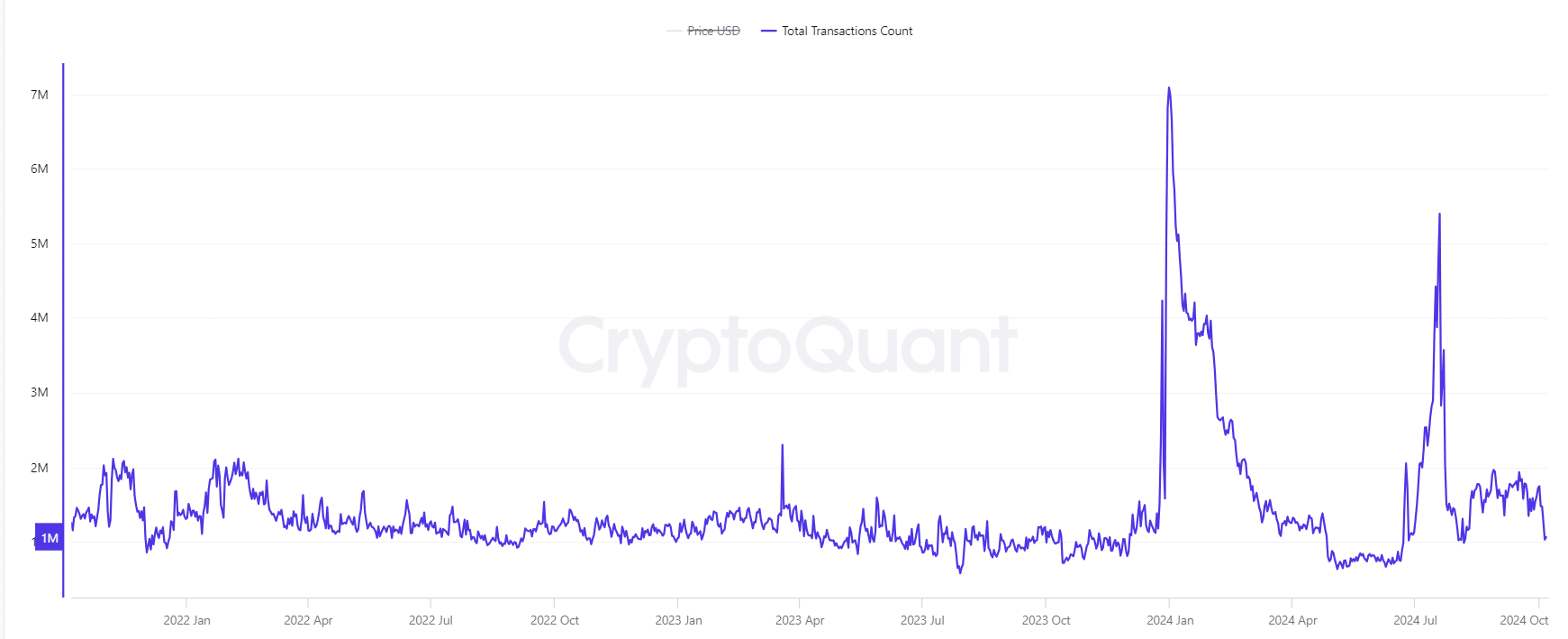

In contrast, on-chain metrics provide more encouraging data. XRP’s transaction count rose by 1.17% to 1.1804M in the last 24 hours, while active addresses climbed by 1.11%, reaching 9.329K. These increases in transaction and user activity reinforce the bullish narrative.

Additionally, growing network engagement often correlates with stronger price action, making this a positive sign for near-term prospects.

Source: CryptoQuant

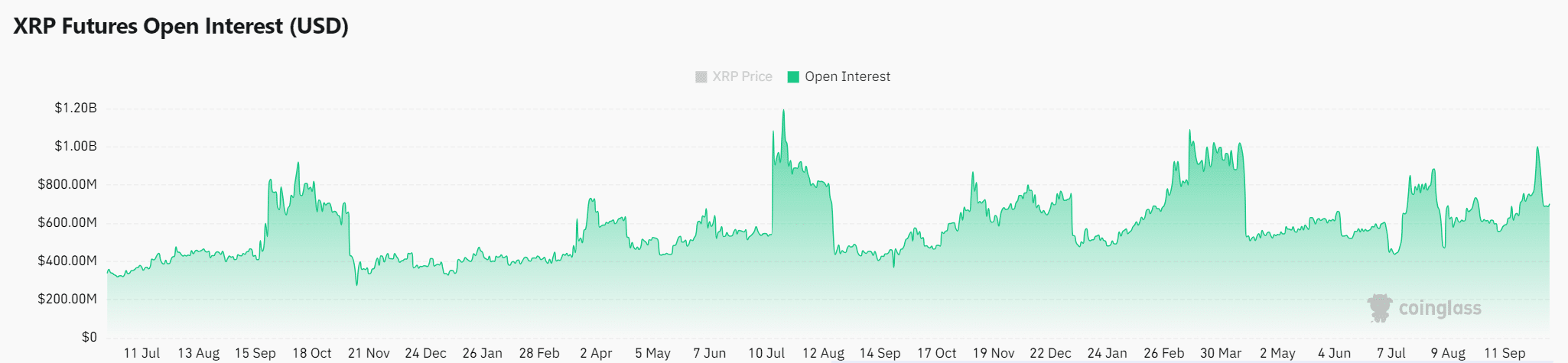

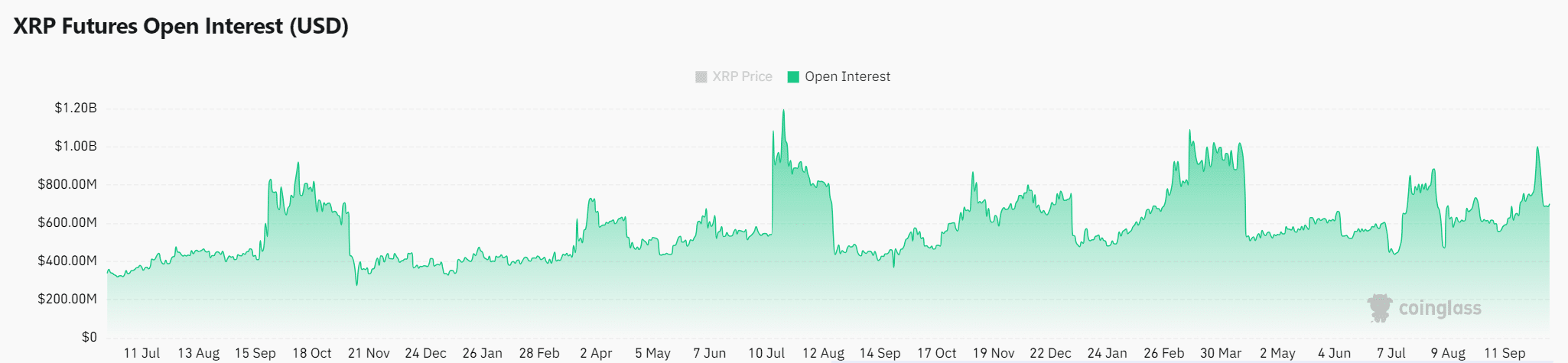

Open interest gaining momentum

Additionally, XRP’s open interest has risen by 1.95% in 24 hours, reaching $714.94M at press time. Rising open interest suggests increased trader participation and market confidence.

Consequently, this could signal growing momentum for XRP, as more traders are taking positions, anticipating a price breakout.

Source: Coinglass

Read XRP’s Price Prediction 2024–2025

Conclusively, XRP’s bullish sentiment, rising open interest, and increasing on-chain activity all suggest that the momentum could push prices higher. However, the elevated NVT ratio serves as a cautionary note.

If XRP breaks through its immediate resistance, it could trigger a sustained rally. Therefore, investors should watch for a breakout above $0.5445.

Leave a Reply