- SUI has outperformed SOL on key fronts.

- Some market commentators believe that its growth could derail SOL.

Sui [SUI] seems ready to eat into Solana’s [SOL] market share amid massive growth on key fronts.

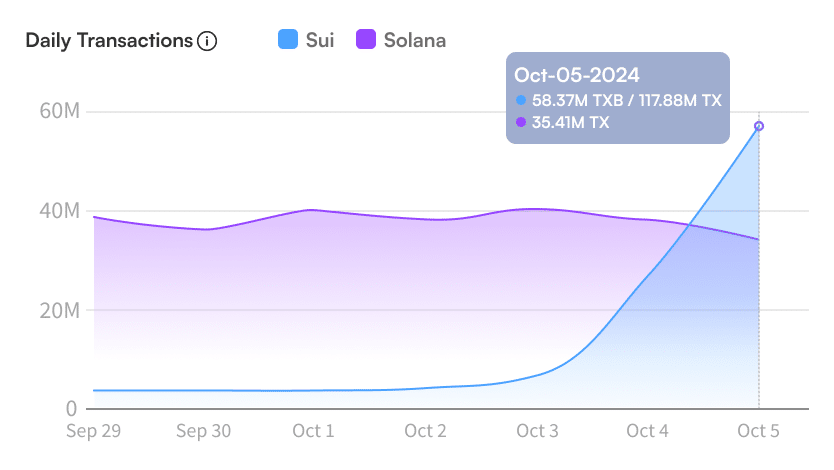

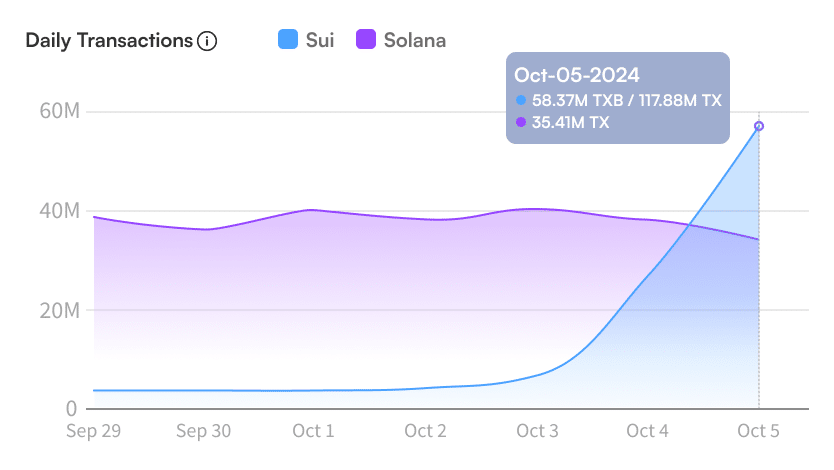

On 5th October, the Layer 1 platform outpaced Solana on transaction counts. It hit over 58 million transactions, while Solana executed 35 million on the same day.

Source: X

SUI’s aggressive growth

Reacting to the growth, Adeniyi Abiodun, one of the Sui insiders, said,

“With no failed transactions, no sandwich attack, and swaps still sub-second!”

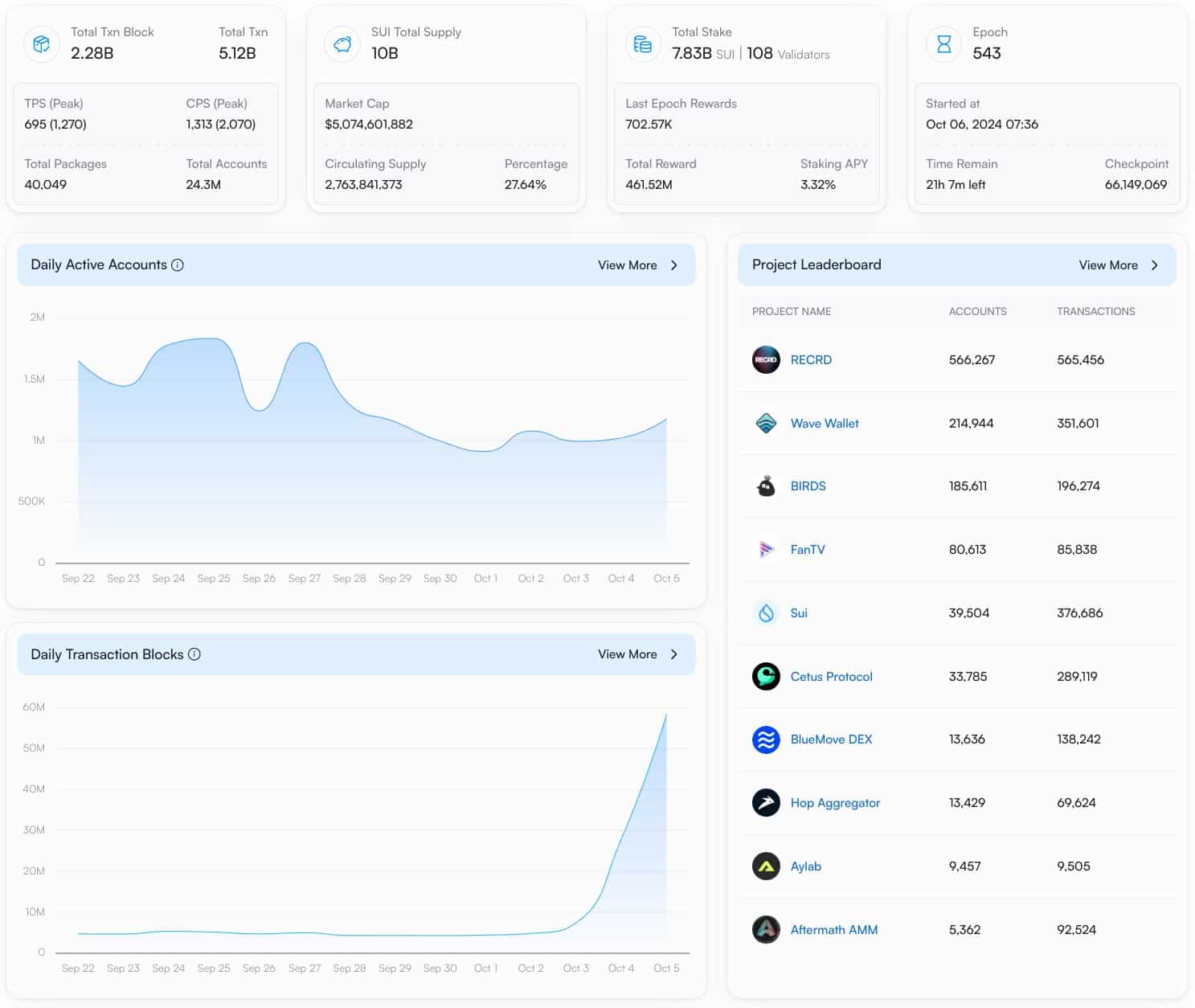

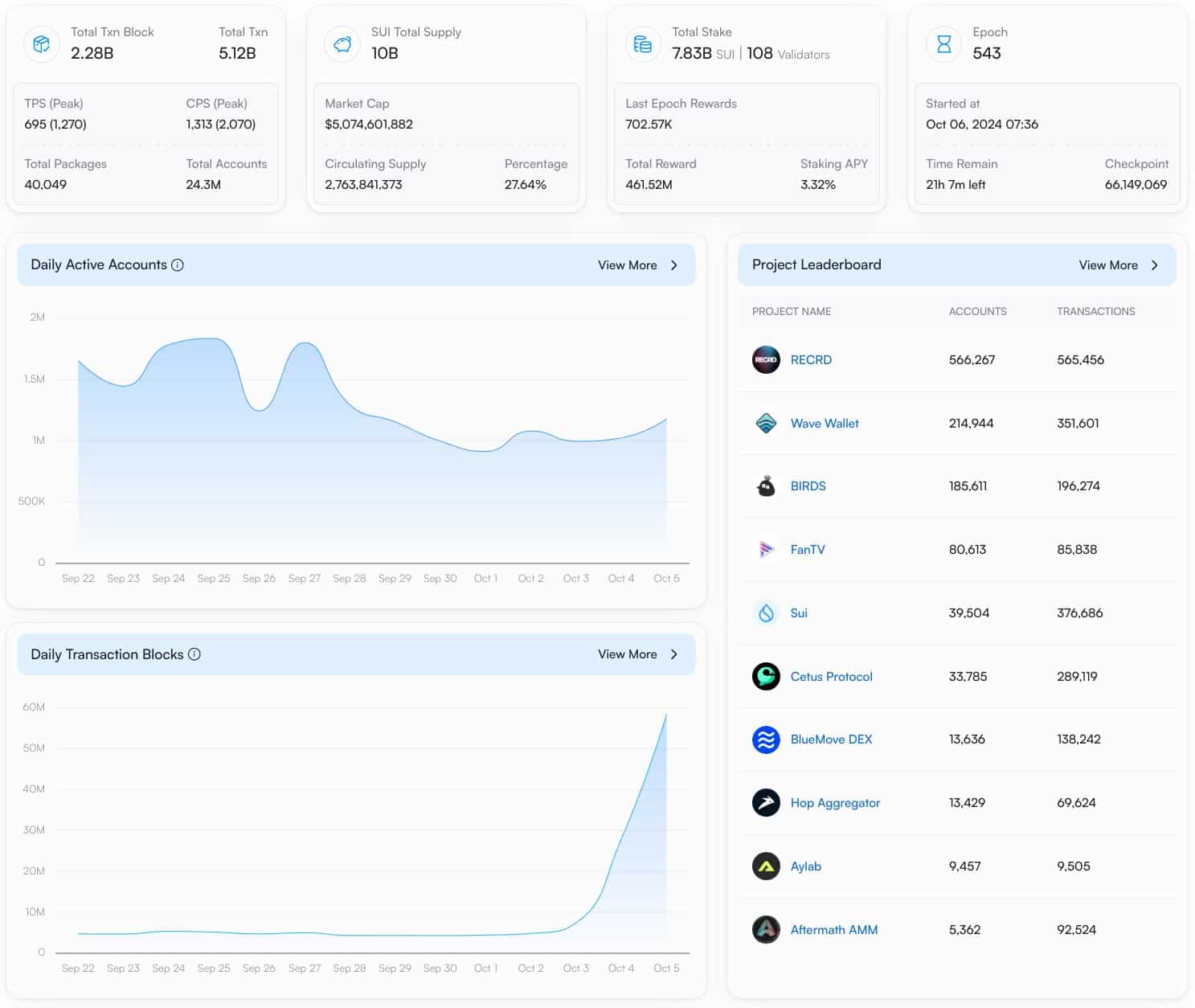

However, SUI has also experienced notable growth on other fronts. At press time, it also outpaced Solana’s throughput, knocking 756 transactions per second (tps) as SOL clocked 726 tps.

Source: Sui Vision

More notable traction was also noted across Ethereum-based outflows and average costs. SUI’s weekly Ethereum outflows stood at $55 million, while SOL bled $69 million over the same period.

Regarding user charges, SUI proved to be a cheaper alternative to Solana. Its average fee was $0.00018, against SOL’s $0.0044. In short, SUI checked all the boxes that made Solana a better alternative to Ethereum [ETH].

In a way, some market commentators have deemed its aggressive traction a threat to Solana’s dominance. Some even doubted whether SOL could hit $1000 amid Sui’s massive growth.

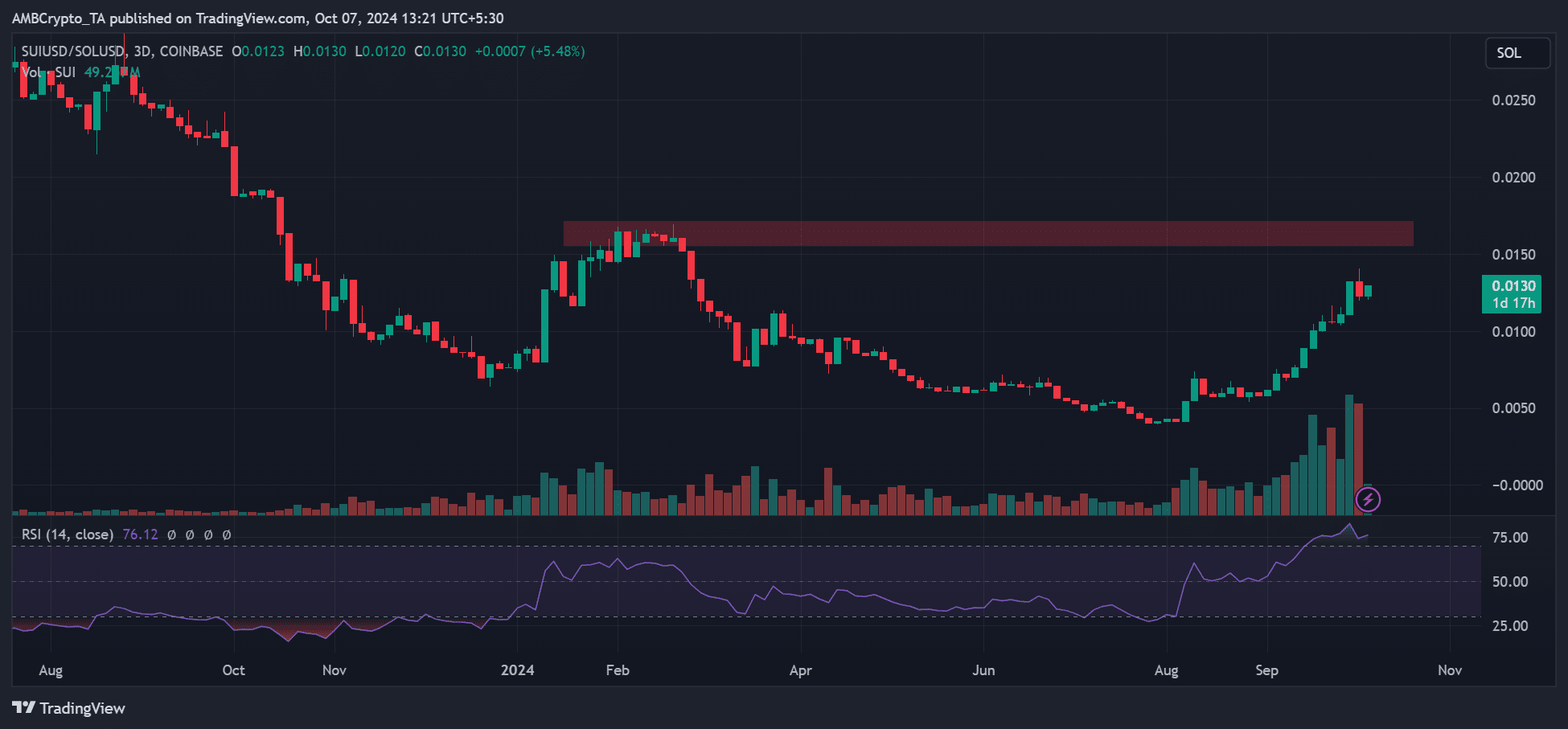

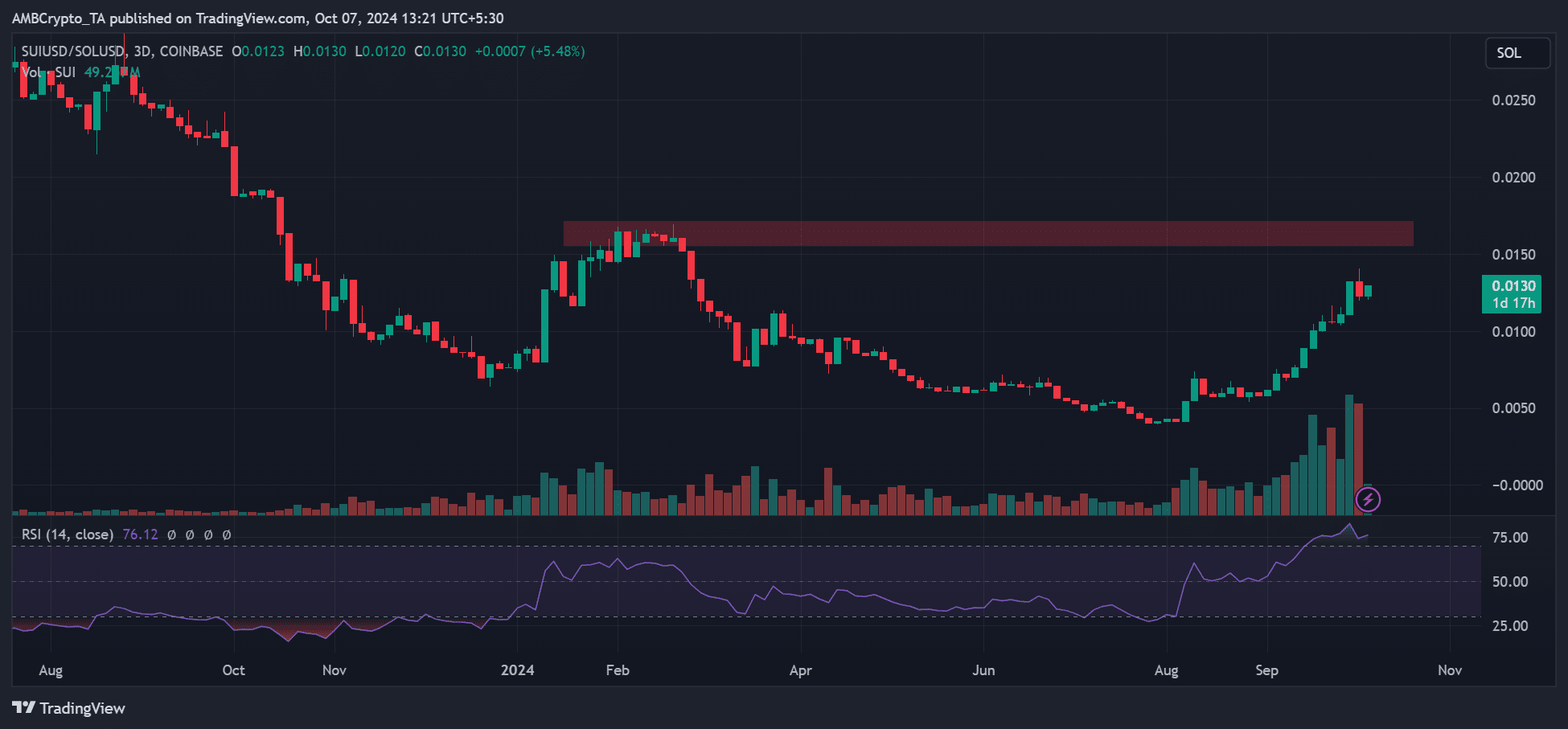

Source: SUI/SOL ratio

Interestingly, the traction was also visible on price charts. The SUI/SOL ratio, which tracks the relative performance of SUI against SOL, has been on a steady rise since August.

Is your portfolio green? Check the Sui Profit Calculator

It increased by +200% from 0.003 to 0.013, underscoring SUI’s price rally. At press time, SUI price consolidated below $2 and was close to hitting a price discovery.

However, SOL’s TVL (total value locked) eclipsed SUI’s. SOL boosted $5.5 billion in TVL against SUI’s $1 billion, underscoring that more investors were still parked in the Solana network.

Leave a Reply