- Whale accumulation of SUNDOG suggests increasing confidence, with recent purchases totaling over $2.5 million.

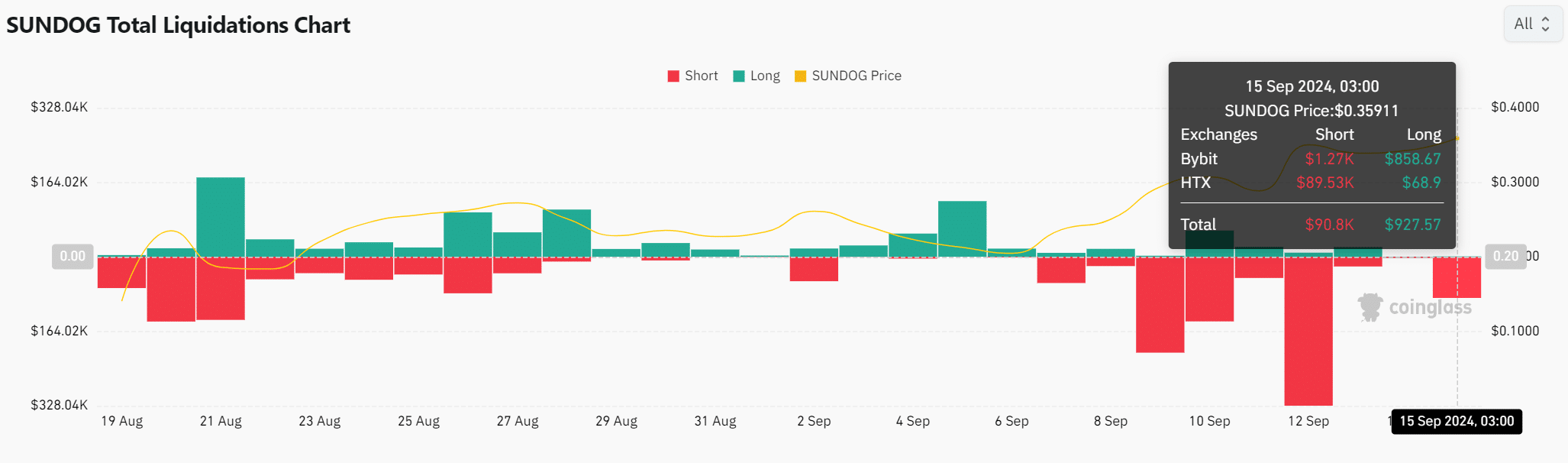

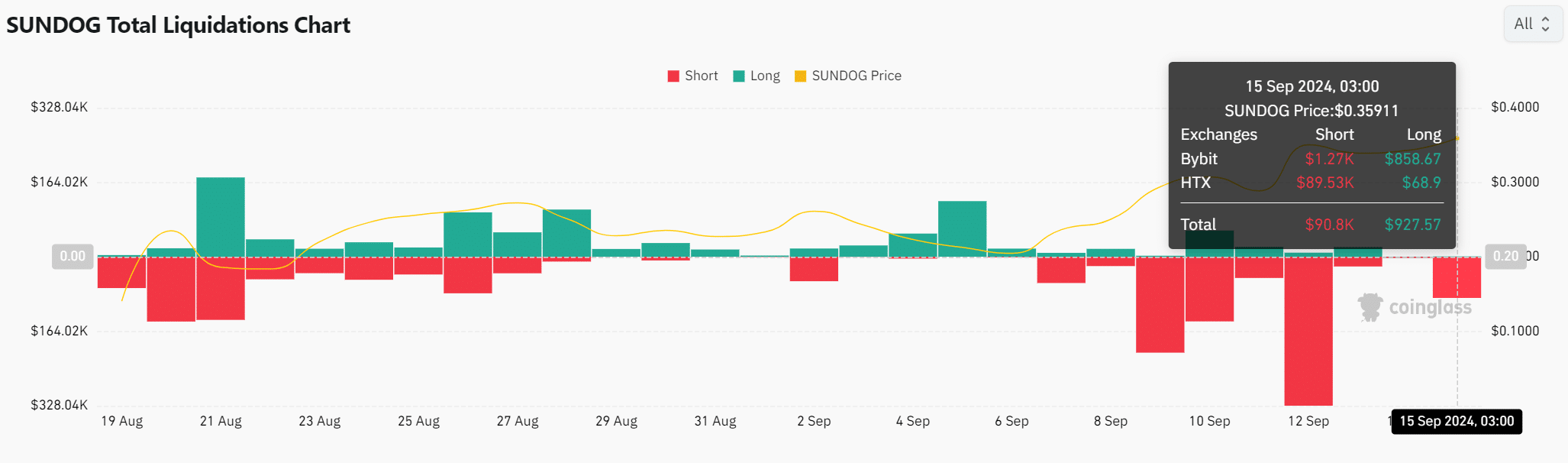

- On-chain data supported the bullish sentiment, with short positions being liquidated amid rising price momentum.

Recent whale activity in Sundog [SUNDOG] has caught the attention of market watchers, with two substantial transactions fueling speculation about the token’s future.

One whale spent $2 million to acquire a large amount of SUNDOG in a single transaction, followed by another whale purchasing $500,000 worth, equating to 1.16 million tokens.

These significant buys could reflect increasing confidence in the asset’s potential. A deeper look at market sentiment, technical indicators, and on-chain data will provide insight into whether this momentum is sustainable.

Are whale purchases signaling long-term confidence in SUNDOG?

The sudden accumulation of SUNDOG tokens by whales suggests growing belief in the token’s upward trajectory. At press time, the price was trading at $0.3597, with a 5.01% increase over the past 24 hours.

This rise has coincided with these large purchases, potentially indicating that whales are positioning themselves ahead of a significant price move.

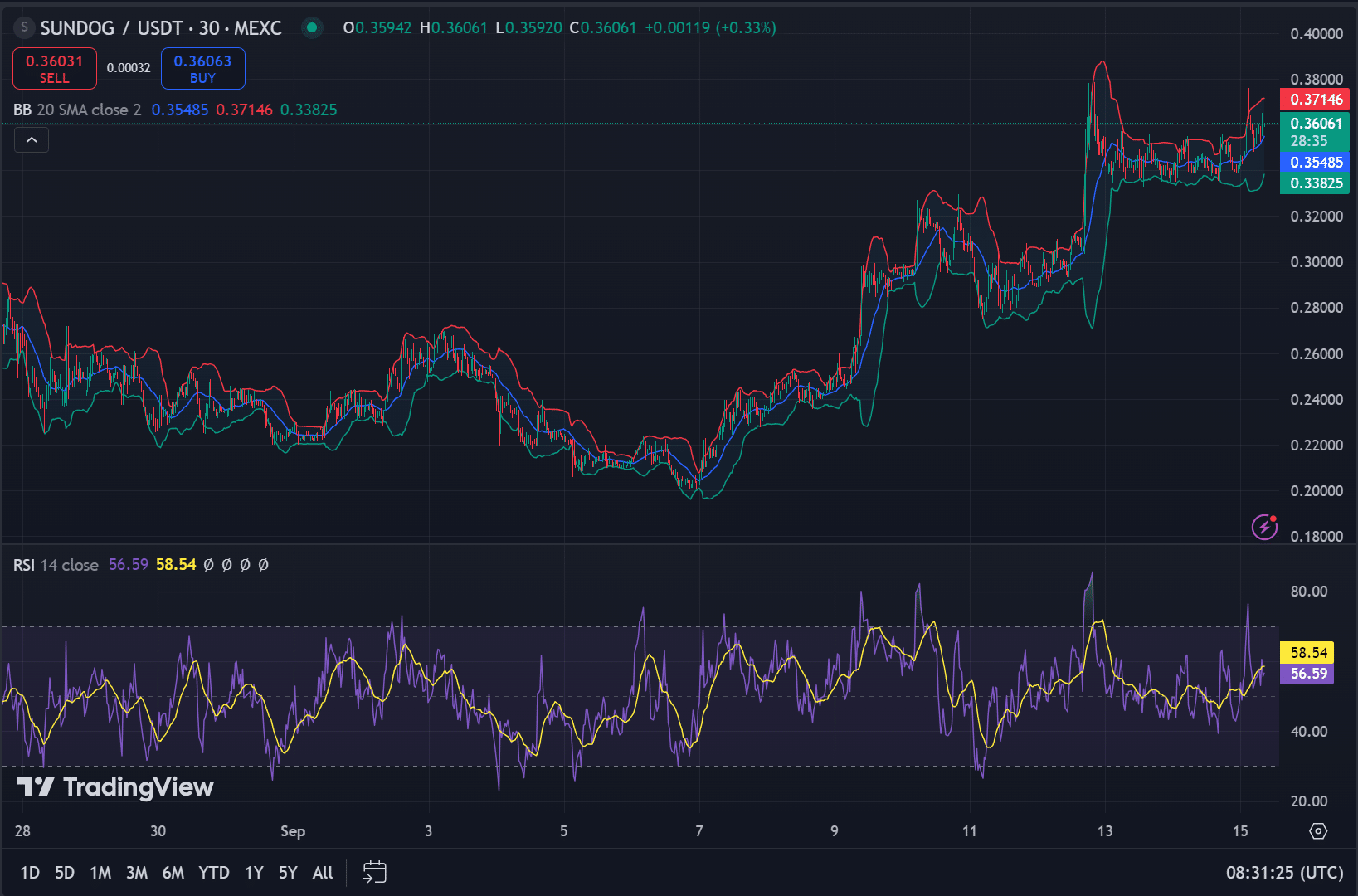

The Bollinger Bands show increased volatility, with the price testing the upper band at $0.37146, suggesting bullish momentum may continue. The lower band, at $0.33825, serves as key support.

Meanwhile, the RSI is at 58.54, just below the overbought zone, implying there is room for further upward movement before the token hits overbought conditions.

Source: TradingView

What role does on-chain data play in this rally?

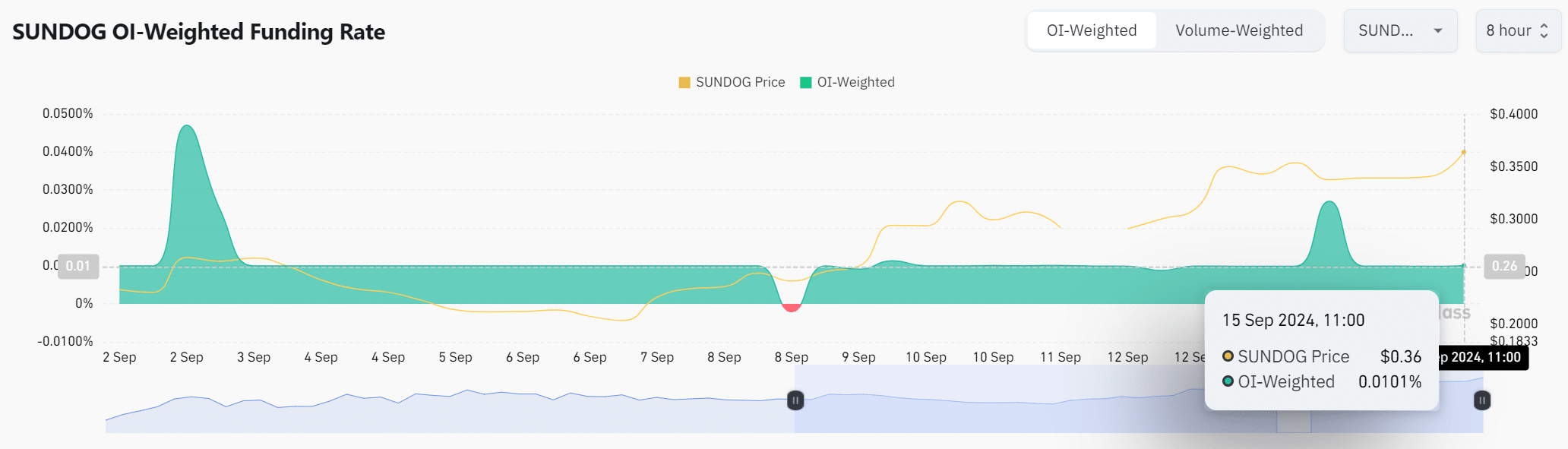

On-chain metrics offer further insight into SUNDOG’s recent surge. The open interest (OI)-weighted funding rate stands at 0.0101%, signaling positive sentiment as traders are paying a premium to maintain long positions.

Source: Coinglass

In addition, the total liquidations chart reveals that $90.8K in short positions were wiped out, indicating that bearish traders are being squeezed as the price continues to rise.

By contrast, only $927.57 in long positions have been liquidated, reinforcing the bullish sentiment driving SUNDOG’s current uptrend.

Source: Coinglass

Will SUNDOG’s price continue to rally?

SUNDOG’s recent price movement and whale accumulation suggest the token could maintain its bullish momentum in the short term. However, investors should monitor the RSI as it approaches overbought levels and watch for potential volatility in the Bollinger Bands.

While whale purchases indicate long-term confidence, the market’s response to sudden shifts in whale activity will be essential in determining whether the rally sustains.

The outlook remains positive for now, but traders should stay cautious and vigilant for any sudden market changes.

Leave a Reply