- BONK hit a familiar long-term roadblock.

- Demand was flat across spot and Futures markets

Memecoins attracted great market interest after Bitcoin’s [BTC] surge to $60k over the last 48 hours. In fact, on Saturday, the memecoin category was ranked second in terms of Open Interest (OI), with a 6% hike according to Coinglass. This can help the segment, including Bonk [BONK].

However, other memecoins like dogwifhat [WIF] and Pepe [PEPE] enjoyed higher volumes than BONK. This could delay a strong push for BONK, especially since it hit a long-term roadblock on the charts.

Can BONK clear this roadblock?

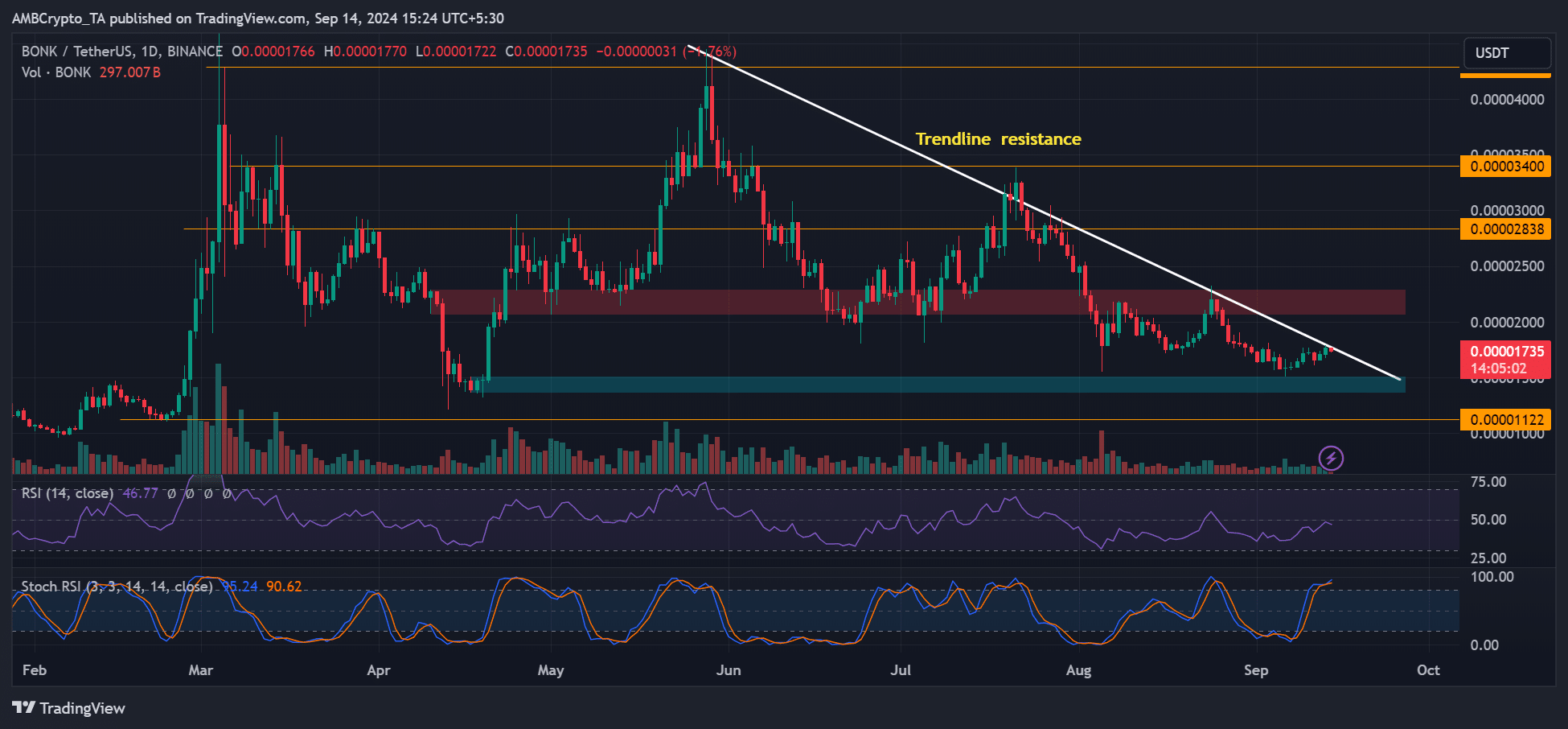

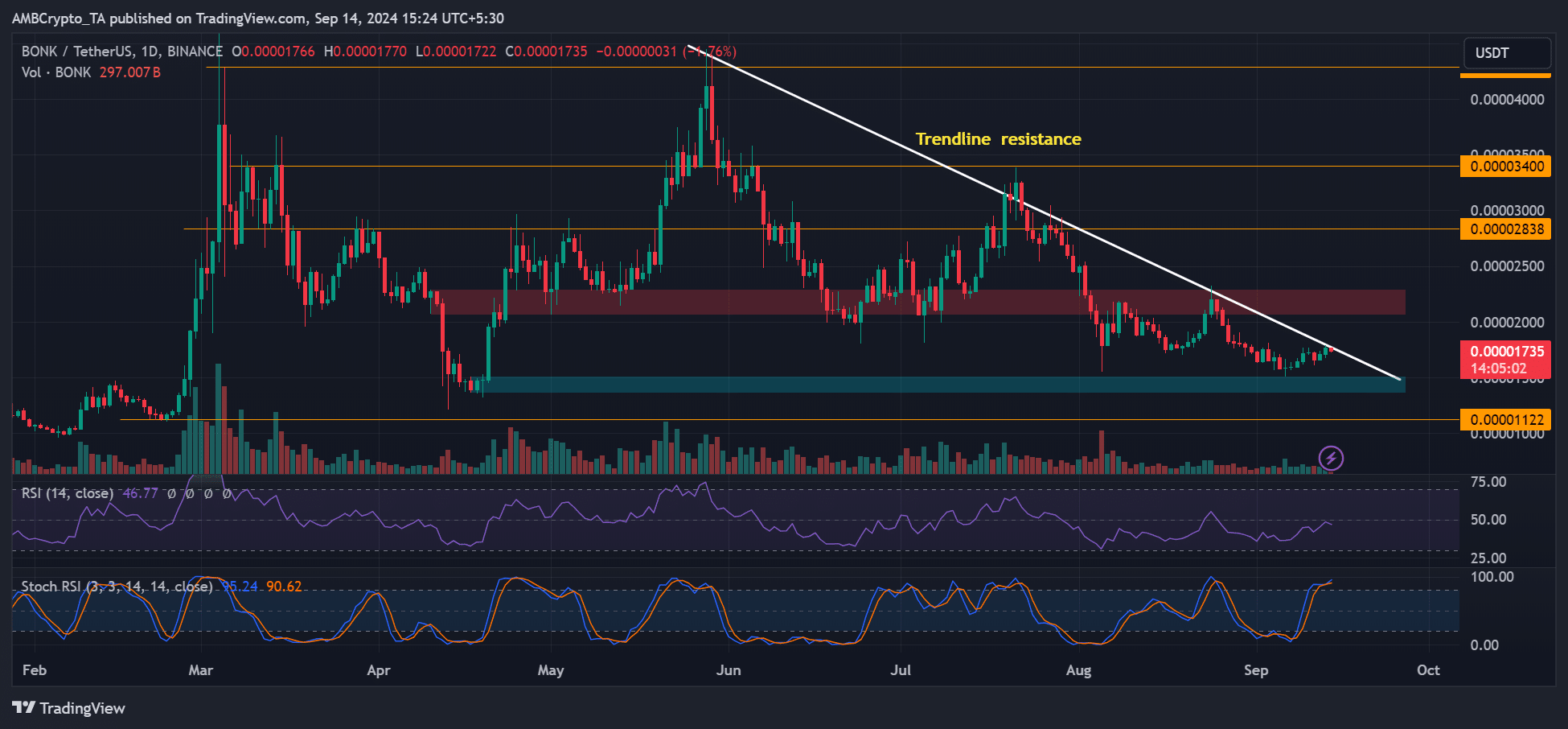

Source: BONK/USDT, TradingView

After BONK’s downtrend in Q2, the memecoin has struggled to clear its key long-term trendline support. The attempted recovery in July and August was reversed at the resistance. At press time, September’s relief rally re-encountered the roadblock at $0.000018.

BONK’s recovery uncertainty was further confirmed by the overbought conditions flashed by the stochastic RSI (Relative Strength Index) and neutral reading from the RSI. If BTC remains below $60k, the roadblock could trigger another BONK price rejection.

If so, a price rejection at the obstacle could drag the price to $0.000015 support (marked cyan).

However, BONK could see potential gains of 16% if it breaks above the trendline resistance and surges to the supply zone above $0.000020.

BONK demand stagnates

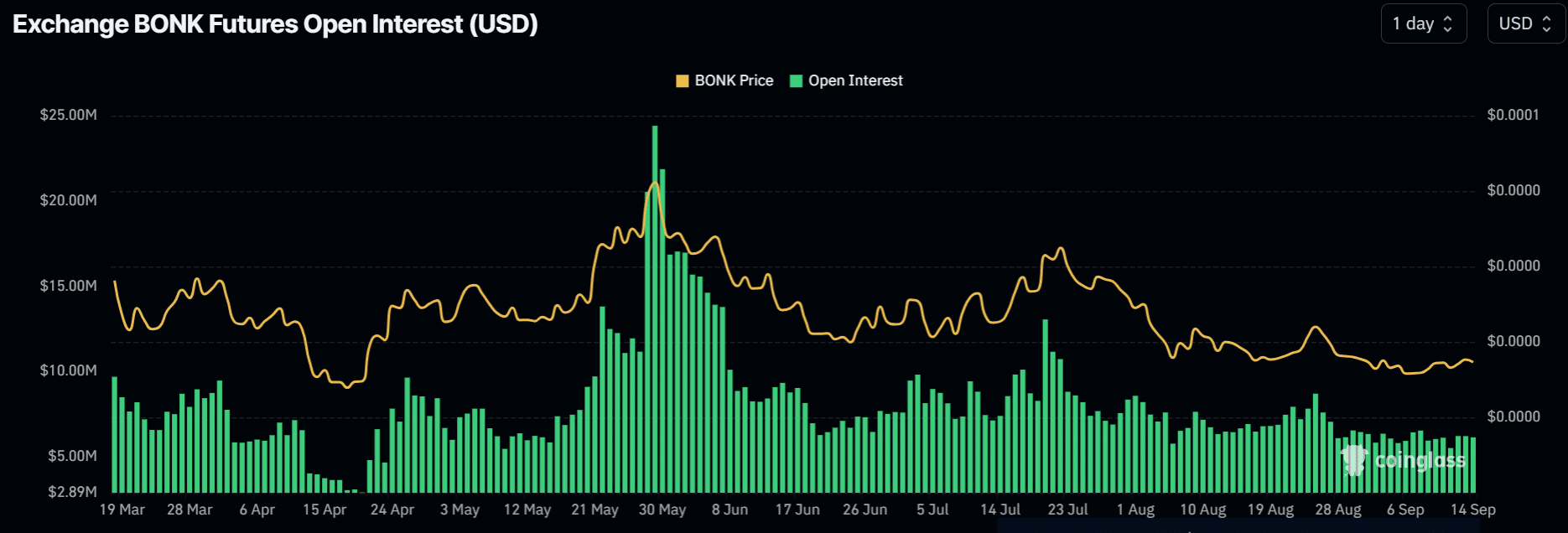

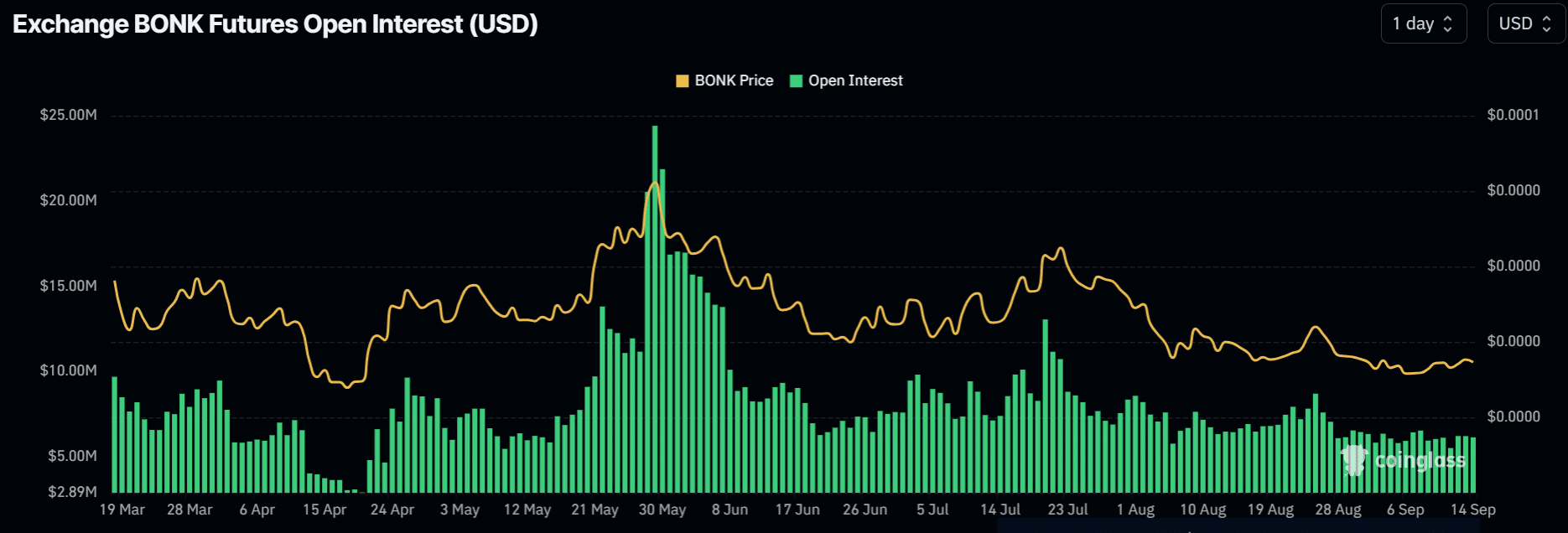

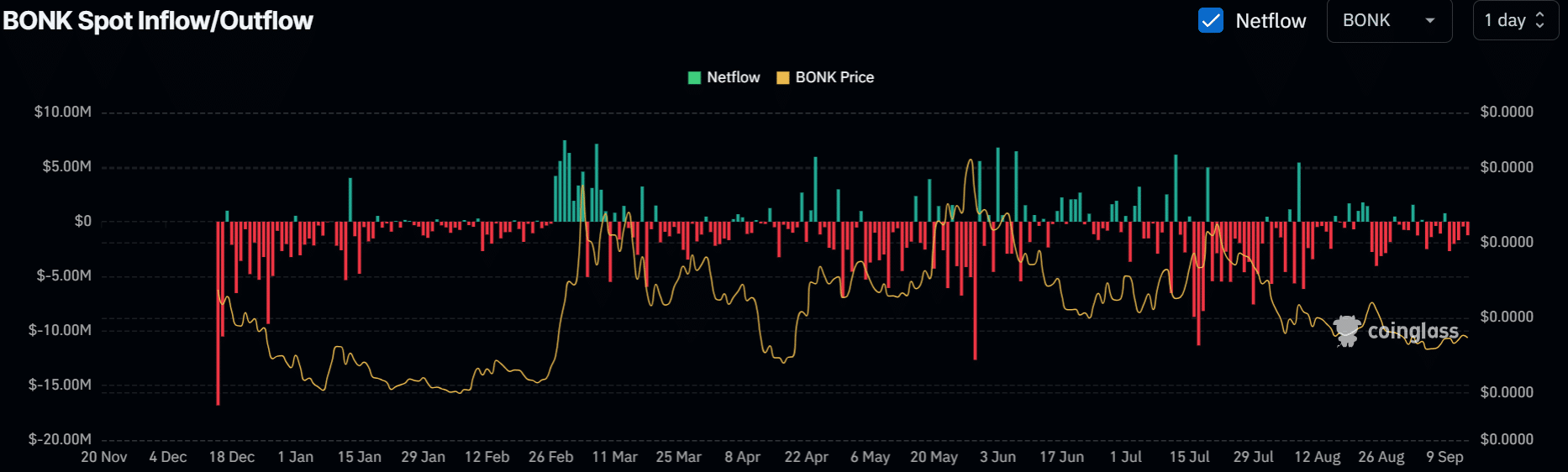

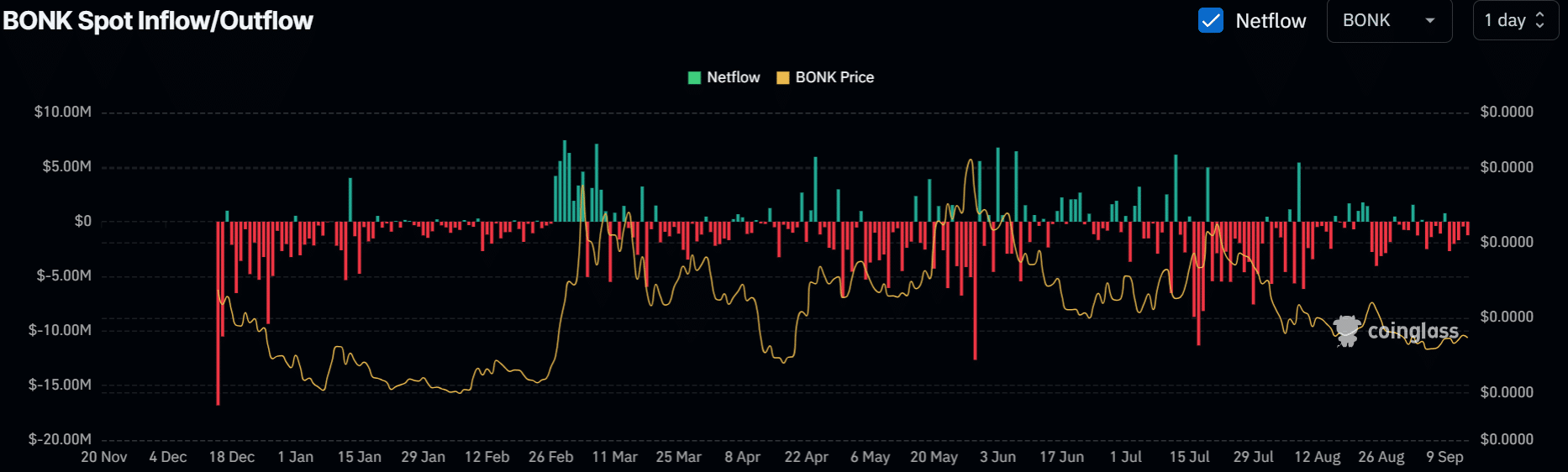

Source: Coinglass

BONK’s OI declined from July’s high of $13 million and has been hovering below $10 million in August and September. This illustrated a decline in interest, followed by flat demand from the Futures market.

Apart from the muted demand, the memecoin also saw massive outflows in August and September from spot markets. This further reinforced investors’ risk-off approach and lack of strong demand from spot buyers.

During the last seven trading days, the memecoin has seen nearly $8 million in outflows from centralized exchanges.

Source: Coinglass

The muted demand could weigh BONK and complicate bulls’ prospects of clearing the long-term hurdle.

If so, the immediate support area at $0.000015 could offer discounted buys for speculators eyeing a possible market rebound from October.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

Leave a Reply