- Shiba Inu’s price target could be $0.000081, if the falling wedge breakout is confirmed

- On-chain activity has remained strong, but high exchange netflows could signal near-term selling pressure

A recent analysis seemed to highlight a confirmed falling wedge breakout for Shiba Inu [SHIB]. This pattern, historically seen as a bullish reversal, usually suggests a possible long-term recovery for the token in question.

With the price target set at $0.000081, popular crypto analyst Javon Mark predicted a massive 480% upside potential. However, it’s worth asking a very important question – Is the breakout alone enough to spark a significant rally?

Source: X

Are Shiba Inu’s technical indicators aligning for a breakout?

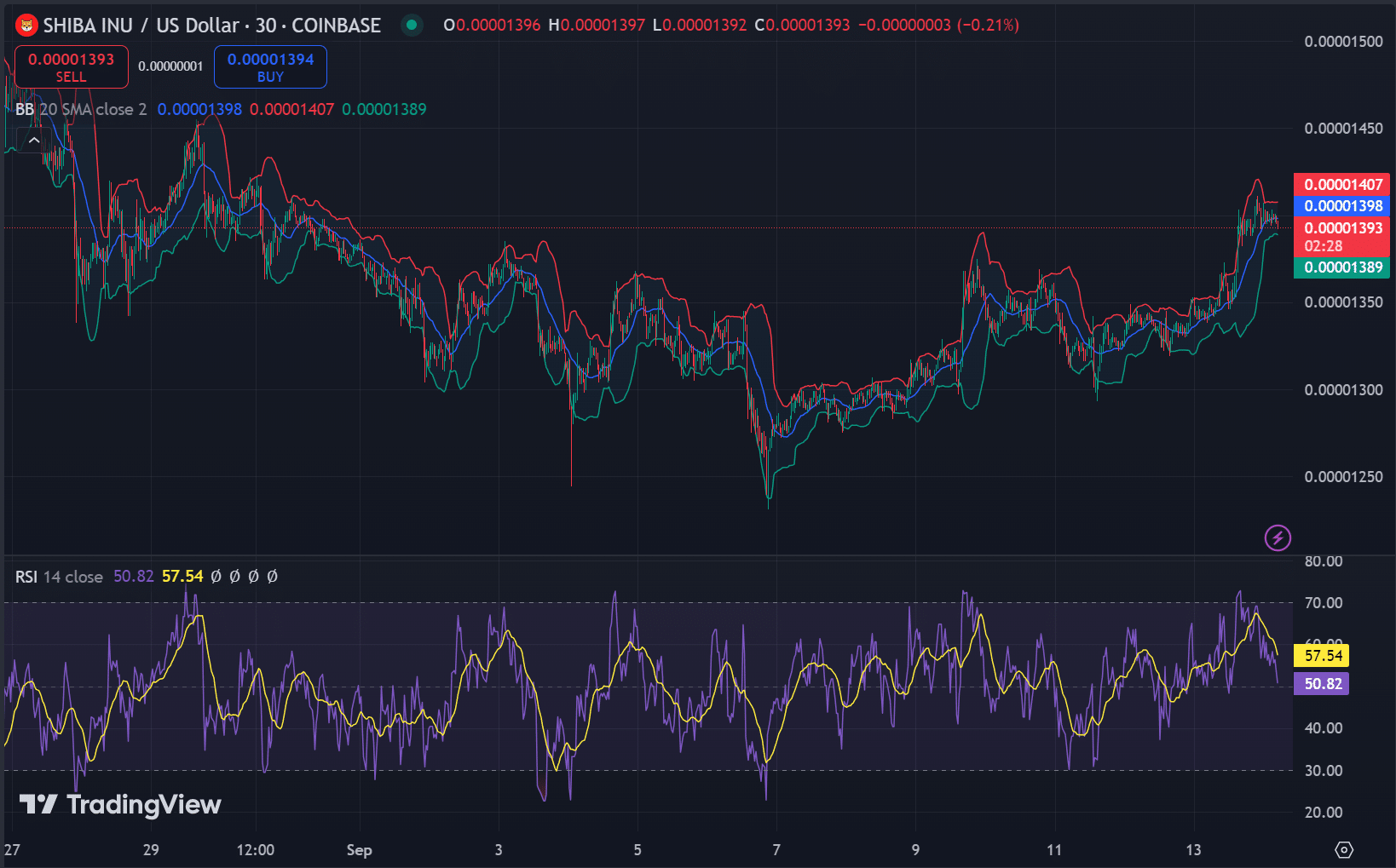

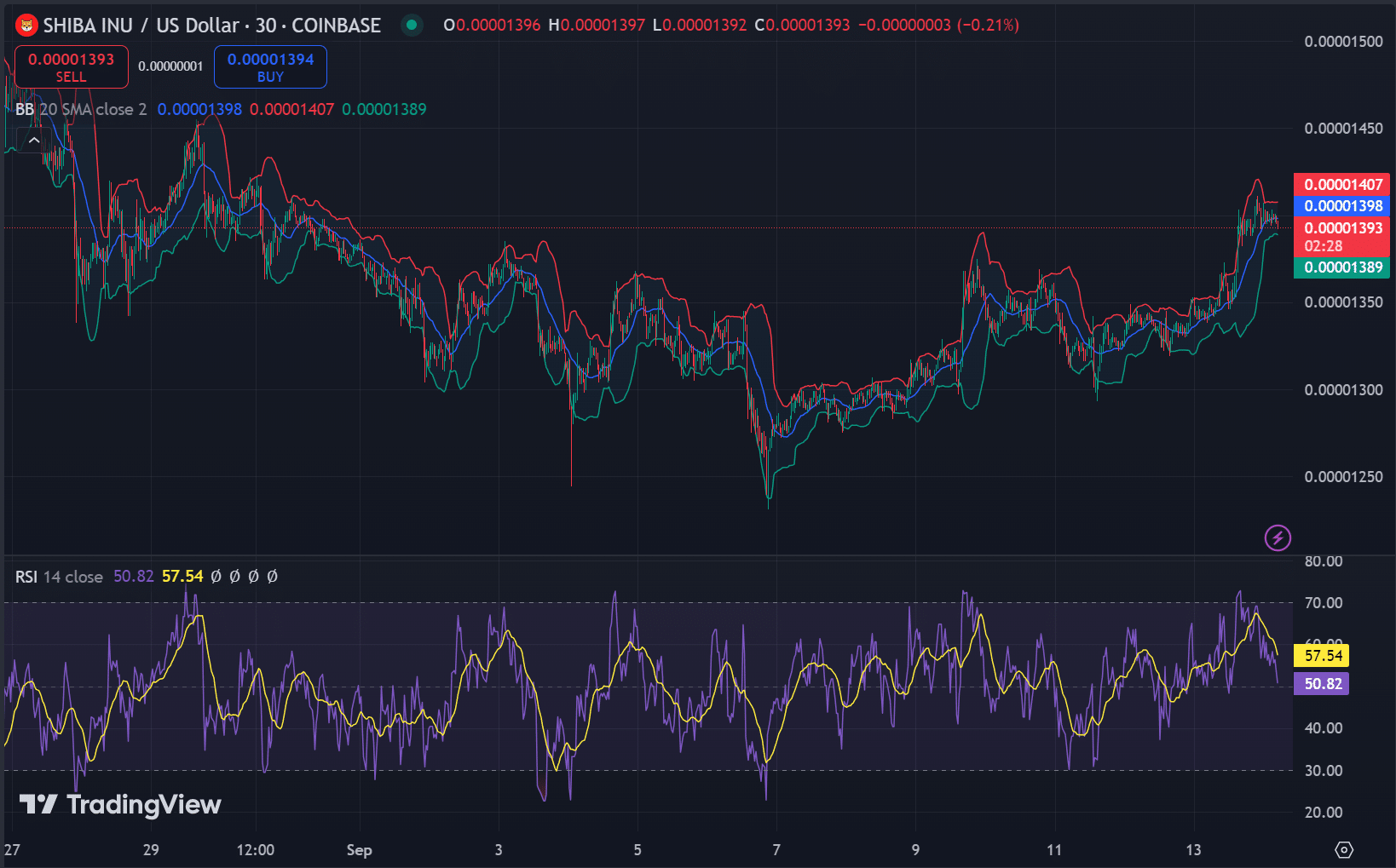

At the time of press, SHIB was priced at $0.00001393, following a 3.50% hike in the last 24 hours. Its RSI (Relative Strength Index) seemed to be sitting at 57.54, indicating that there is still room for northbound momentum before hitting overbought conditions.

The RSI had not yet crossed the critical 70 threshold, suggesting the rally could continue without an immediate pullback.

Additionally, the Bollinger Bands revealed a price range between $0.00001389 and $0.00001407, reflecting tightening price action. This constriction, coupled with the falling wedge breakout, aligns with a potential bullish move – Confirmation of the likelihood of a breakout.

Source: TradingView

Is on-chain activity supporting the bullish outlook?

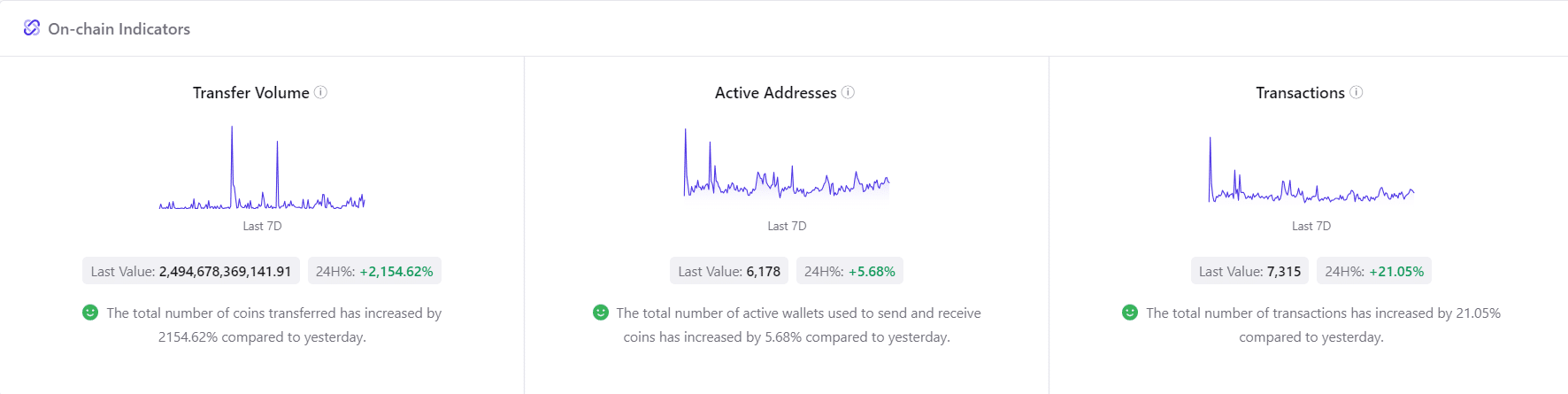

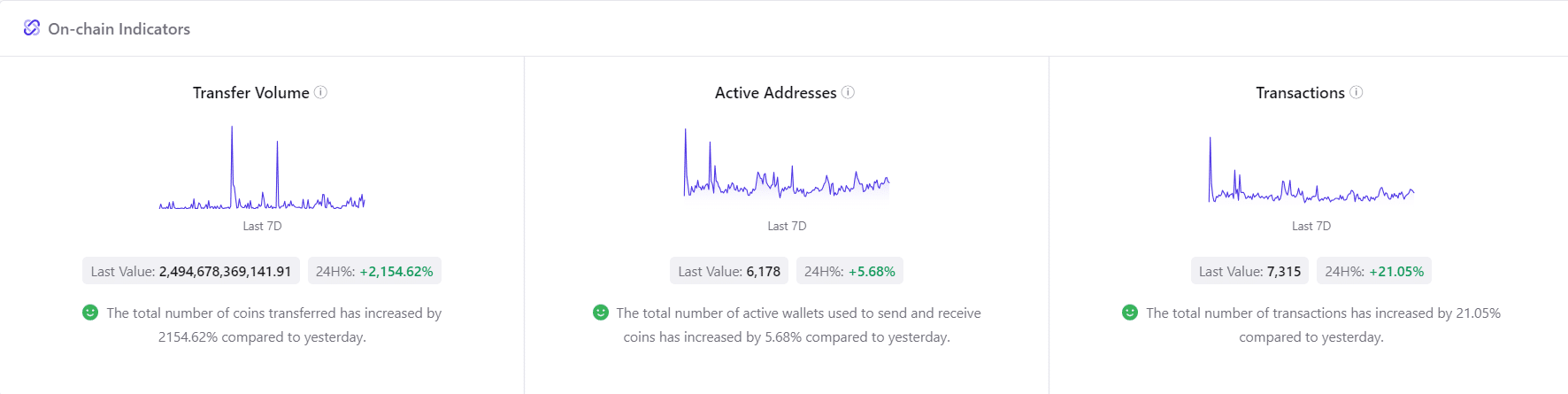

Shiba Inu’s on-chain metrics highlighted increasing engagement from investors. Over the last 24 hours alone, the transfer volume surged by a massive 2,154.62%, hitting 2.49 trillion SHIB at press time. This dramatic rise indicated heightened interest and participation from the Shiba Inu community.

In terms of wallet activity, 6,178 active addresses represented a 5.68% hike – A sign that more wallets are transacting with SHIB. Similarly, the number of transactions grew by 21.05%, totaling 7,315. These on-chain activities can be interpreted as growing investor confidence in the token, possibly validating the bullish setup.

Source: CryptoQuant

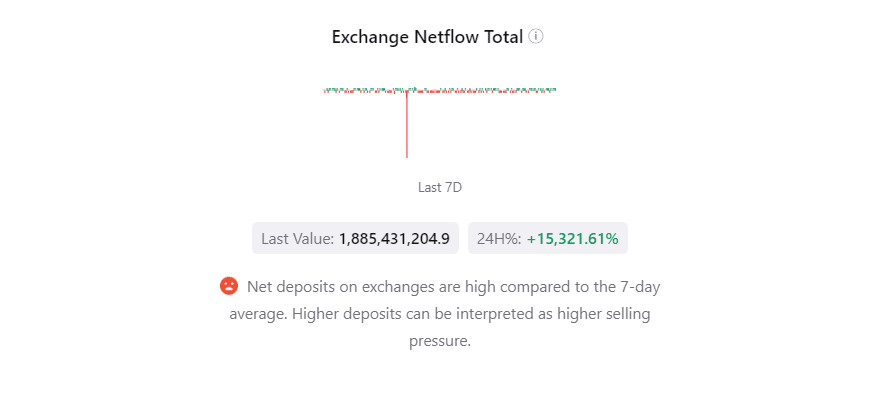

Should investors be cautious about exchange netflows?

While the metrics underlined strong momentum, one cautionary signal seemed to be the exchange netflows.

Over the last 7 days, over 1.88 billion SHIB has been deposited into exchanges – A 15,321.61% spike in the last 24 hours. This could indicate that some investors are preparing to sell, potentially introducing selling pressure into the market.

Source: CryptoQuant

Exchange inflows typically suggest short-term volatility. Hence, traders should be aware of this factor when making decisions, especially in a highly speculative market like SHIB’s.

What does the future hold for Shiba Inu?

With a market cap of $8.21 billion and a daily trading volume of $166.87 million at press time, Shiba Inu has positioned itself for a potential breakout.

However, while the technical setup is promising, the recent spike in exchange deposits calls for cautious optimism.

Leave a Reply