- Analyst believes the crypto market will “bounce” as soon as Bitcoin sees a major breakout

- Altcoins expected to profit significantly whenever this breakout happens

The global crypto market cap has been in a state of flux over the past few weeks, experiencing both gains and declines. After climbing to as high as $2.7 billion in March, the market has since struggled to maintain its momentum, with intermittent hikes failing to recover from the broader downtrend.

At the time of writing, the global crypto market cap had dipped by 1.4% to stand with a figure of $2.122 trillion. This, following a brief rise to $2.140 trillion earlier in the day. This volatility has largely been driven by Bitcoin, the dominant player in the cryptocurrency market.

Bitcoin itself has shown a mix of bullish and bearish trends. After briefly surpassing $58,000 yesterday, Bitcoin again slipped below this threshold. In fact, at a point, it even traded at as low as $57,292 following a 0.5% decline.

Despite this uncertainty, however, analysts continue to share insights into the future of the crypto market, with many predicting key movements ahead.

Popular crypto analyst CrediBull has offered a particularly compelling outlook. According to him, Bitcoin’s breakout from its current consolidation phase will trigger a broader market rally.

Analyst’s outlook on the upcoming crypto bull run

CrediBull’s insights on X emphasized the critical role Bitcoin plays in influencing the entire crypto market. He believes that Bitcoin’s upcoming breakout from its five-month consolidation phase will likely lift the entire crypto market.

However, CrediBull warned that not all altcoins will benefit equally. Some, especially those forming multi-month distribution tops, may see temporary “dead cat bounces,” before facing a further downward phase known as a crypto market “markdown.”

The analyst advised investors to be cautious, suggesting that these temporary rebounds could be the last chance to exit certain altcoins before deeper declines.

Looking at Dogecoin (DOGE) as an example of altcoin performance, the memecoin has mirrored the Bitcoin market’s volatility. DOGE briefly traded above $0.104 on Monday, but the gains were short-lived, with the asset correcting to $0.098 by midweek.

However, DOGE has since registered some recovery, trading at $0.1031 at press time after a 0.4% hike in 24 hours. Despite these fluctuations, the memecoin’s resilience is a sign that some altcoins may still have room for growth amidst uncertainty.

DOGE fundamentals point to potential market stability

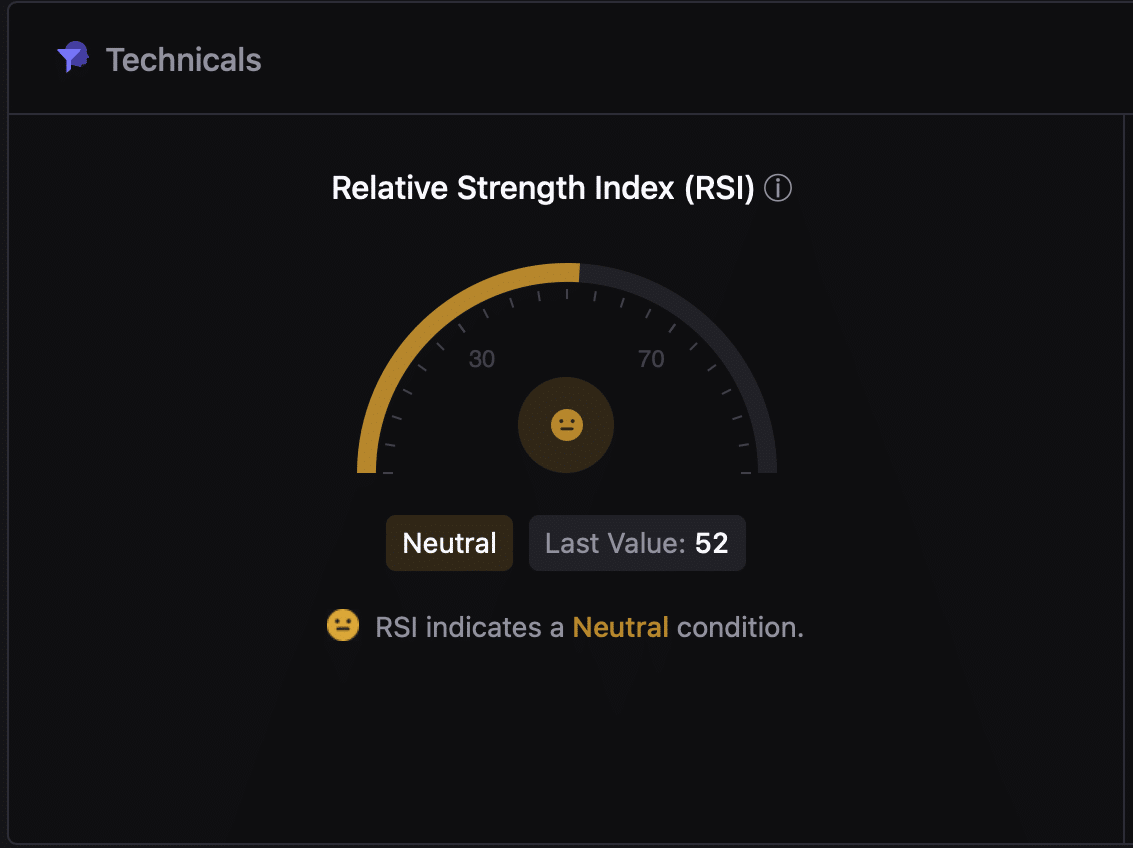

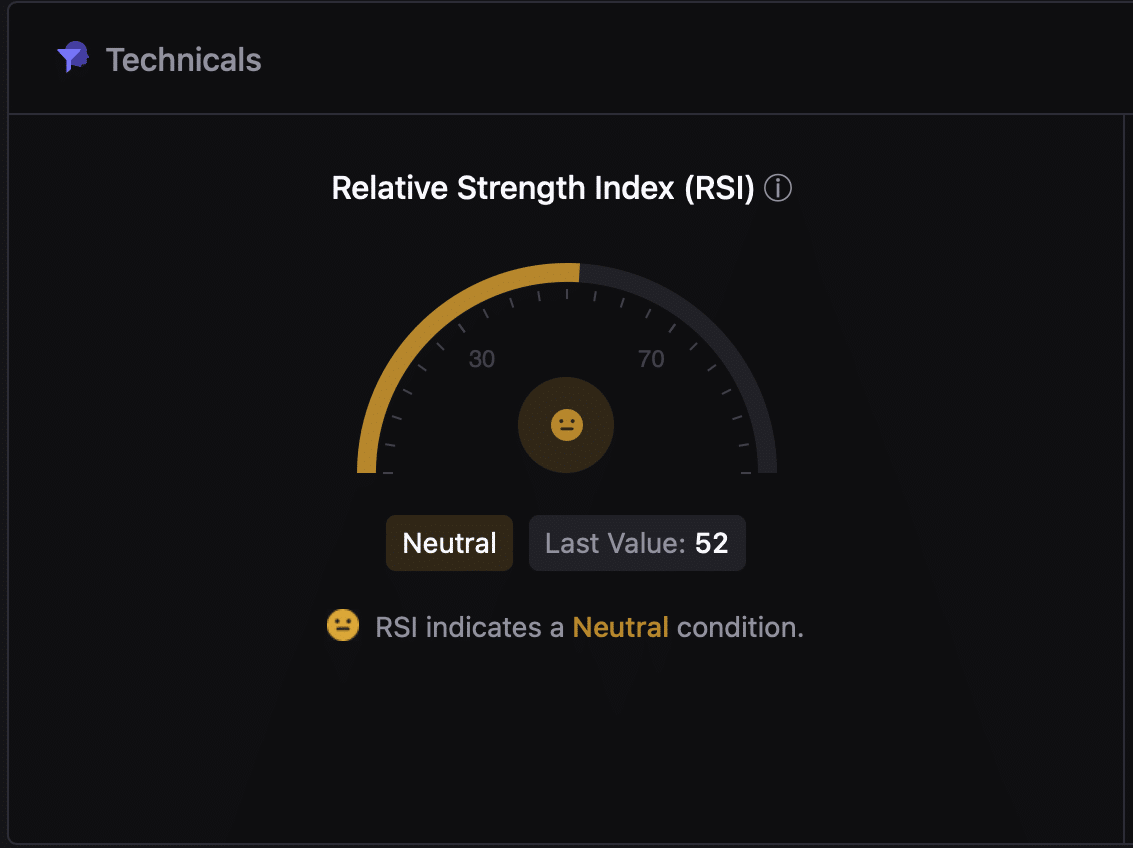

Beyond its price action, assessing DOGE’s fundamentals gives us additional insights into its market potential. For example – According to data from CryptoQuant, DOGE’s Relative Strength Index (RSI) had a reading of 52, indicating neutral market conditions.

Source: CryptoQuant

An RSI reading between 30 and 70 means that the asset is neither overbought nor oversold – A sign of potential price stability in the near term.

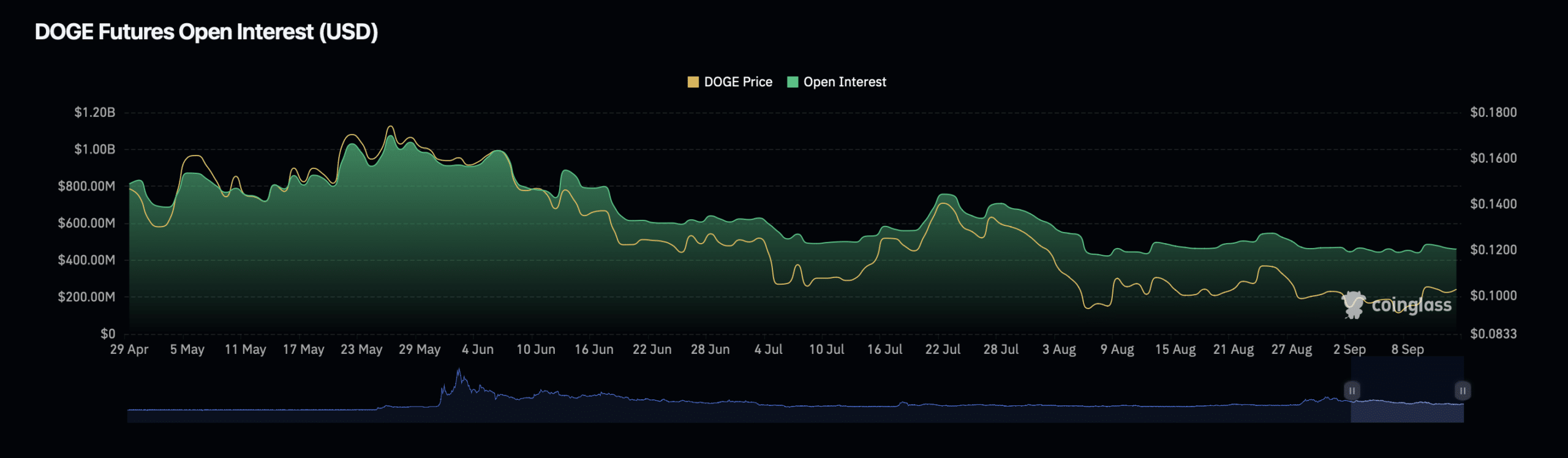

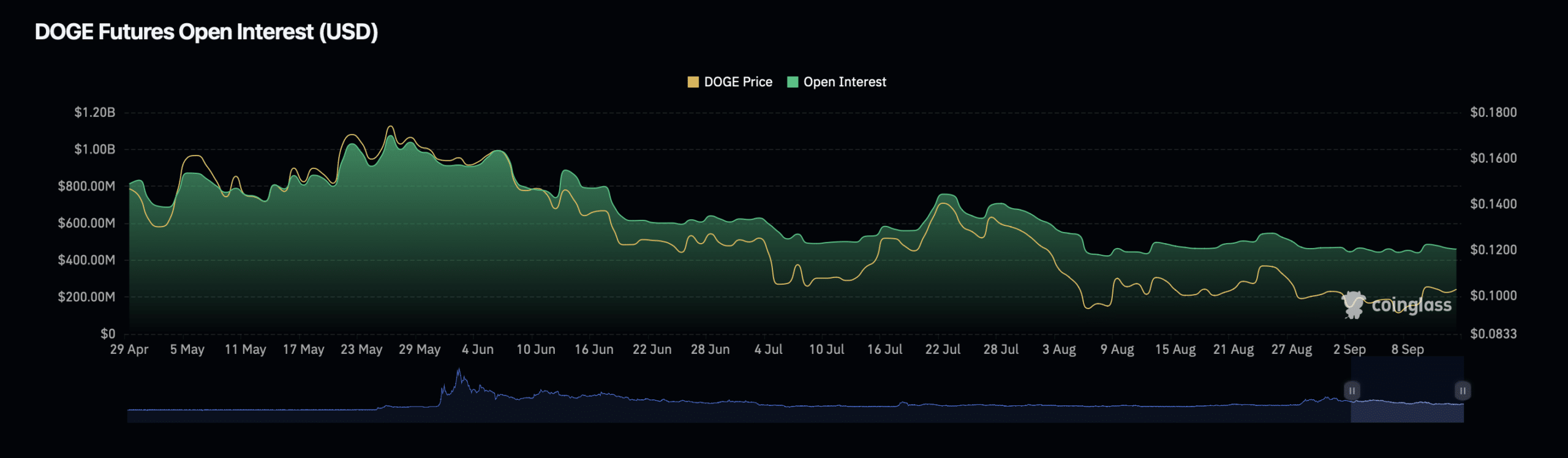

Additionally, data from Coinglass suggested that DOGE’s Open Interest has seen a 1.46% hike, reaching a valuation of $476.12 million. On the contrary, the asset’s Open Interest volume also declined by 13.46%, dropping to $670.33 million.

Source: Coinglass

The uptick in Open Interest, despite the drop in volume, may imply that investors are cautiously positioning themselves in the market. They might be doing so while anticipating future price movements on DOGE’s charts.

Leave a Reply