MicroStrategy acquired approximately 18,300 Bitcoin for $1.1 billion at an average price of $60,408 per BTC between August 6 and September 12, according to a September 13 report submit with the US Securities and Exchange Commission (SEC).

Coinflip data shows The company’s latest purchase has already resulted in a paper loss of $2.2 million due to the current volatility of its key digital assets.

Financing

The company stated that the purchase was financed by selling more than 8 million shares of company stock through a sales agreement with several financial institutions, including TD Securities, The Benchmark Company, BTIG, Canaccord Genuity, Maxim Group and SG Americas Securities.

The capital raised from these sales was used directly to expand his Bitcoin holdings.

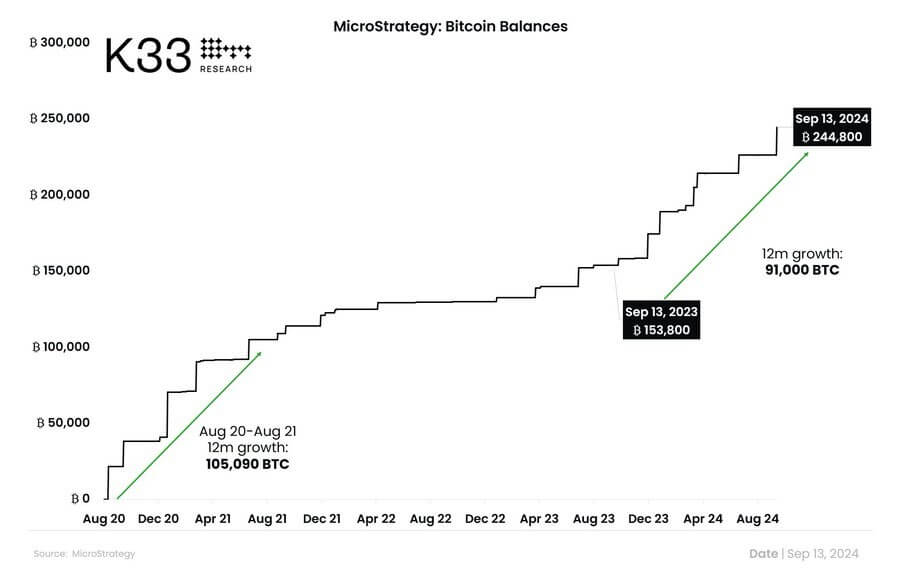

Notably, the company has aggressively pursued this financing strategy over the past year to amass key digital assets. K33 Research stated that the company purchased approximately 91,000 BTC between September 2023 and today.

It added:

“August 2020-21 is the only period with higher year-on-year growth of MSTR’s BTC exposure of 105,090 BTC.”

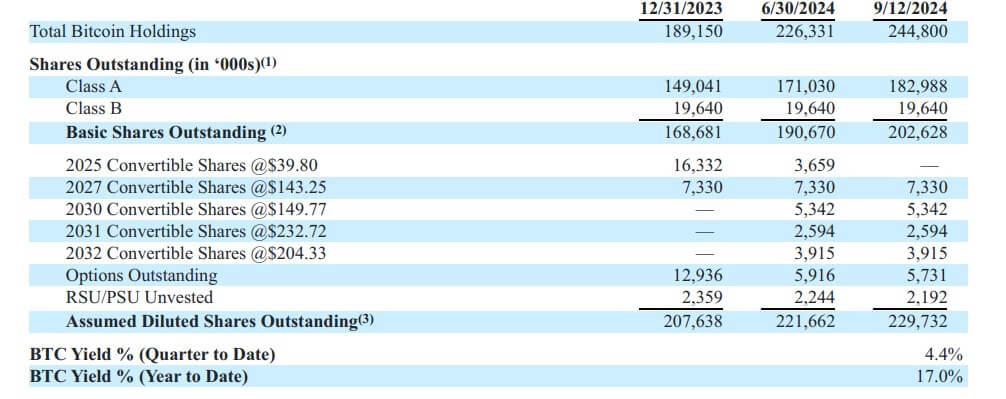

Meanwhile, this latest acquisition brought MicroStrategy’s total Bitcoin holdings to 244,800 BTC, valued at over $14 billion at current prices. The company’s total investment in Bitcoin amounts to $9.45 billion, with an average purchase price of $38,585 per Bitcoin.

Saylortracker facts indicates that the company has unrealized profits of more than $4 billion.

Bitcoin yield

Michael Saylor, executive chairman of MicroStrategy, reported a Bitcoin return of 4.4% for the quarter and 17% for the current year on his investments.

According to the SEC filing, this Key Performance Indicator (KPI) helps assess the company’s strategy for acquiring Bitcoin. The BTC return metric tracks the percentage change over time in the ratio of MicroStrategy Bitcoin ownership to diluted shares.

The company believes that this measure can increase investors’ understanding of its decision to finance Bitcoin purchases through the issuance of additional shares or convertible instruments.

Despite news of the latest purchase, MicroStrategy shares are flat in premarket trading. However, it is up 91% this year.

Leave a Reply