Despite declining crypto prices last month, centralized exchange volumes saw an uptick in activity.

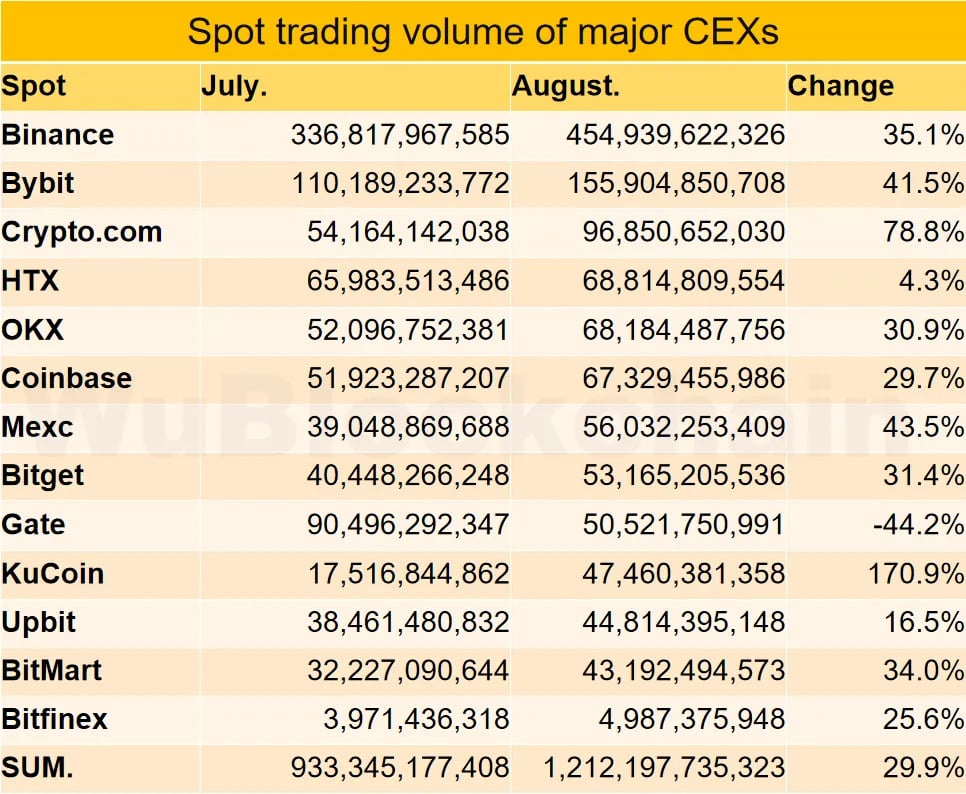

Data from centralized crypto exchanges showed a 30% month-on-month increase in August, even as Bitcoin (BTC) and other digital assets experienced a historical downtrend. August and September are typically bearish months for crypto, but lower prices do not necessarily mean reduced trading activity, as the data confirms.

Binance and Bybit led the major centralized exchange (CEX) pack, with increases of 35% and 41%, respectively. However, KuCoin, Crypto.com, and MEXC outperformed the larger platforms. Crypto spot trading volumes on these three platforms increased by 171%, 79%, and 44%, respectively, as investors shuffled assets and blockchain-based value.

Meanwhile, Gate saw a 44% decline in activity, while Justin Sun-backed HTX and South Korean giant Upbit had the smallest increases in trading volume.

CEX exchange volume increase 30% MoM in August | Source: WuBlockchain

You might also like: Bitcoin whale accumulation heats up ahead of US CPI report

Why CEX volume jumped when price slumped

As crypto.news reported, some of August’s CEX activity included billions in Bitcoin outflows from platforms like Binance and Coinbase. Investors withdrawing from crypto exchanges may be regarded as a bullish sign.

The jump in CEX spot trading volume likely signals optimism among digital asset investors. Officials at the U.S. Federal Reserve were poised to introduce interest rate cuts before the end of this month, barring any drastic changes or hawkish economic data.

Reduced rates could incentivize investors to borrow more money and allocate capital to assets as risk appetite increases.

CoinBureau CEO Nic Puckrin told crypto.news via email that the increased liquidity could lead to price progression for Bitcoin and other cryptocurrencies. Puckrin added that Bitcoin will likely lead the way, while altcoins like Ethereum (ETH) continue to underperform relative to BTC. Bitcoin whales entered an accumulation spree ahead of the expected Fed rate cuts.

I would say that the current market is positioned for a soft September. I expect Bitcoin to continue trading in a range bound fashion for the coming few weeks. Altcoins are likely to fall relative to Bitcoin therefore leading to an increase in Bitcoin dominance.

Read more: Spot Bitcoin ETFs end 8-day outflows streak, Ether ETFs lose $5.2m

Leave a Reply