- Ethereum mirrors its 2019 pattern.

- Largest holders of ETH have steadily accumulated more since 2019.

Ethereum [ETH] remained the second-largest cryptocurrency, with market sentiment shifting from bearish to bullish as 2024 nears its end.

The price action of Ethereum was mirroring the 2019 pattern on the ETH/USD pair, where an ascending wedge was formed.

The higher lows of this cycle’s wedge were ten times larger than those seen in 2019.

Back in 2019, Ethereum’s price dropped below its ascending wedge before the first Federal Reserve rate cut, a situation similar to what is happening in 2024.

Source: TradingView

After the rate cut in 2019, ETH/USD and ETH/BTC both bottomed, forming a strong confluence.

The current pattern is expected to replicate this success, with the price likely to break below the wedge, capturing liquidity before reversing to the upside in late Q4 2024 or early Q1 2025.

However, if the price stays below the ascending wedge for an extended period, further analysis may be necessary to adjust strategies or minimize potential losses.

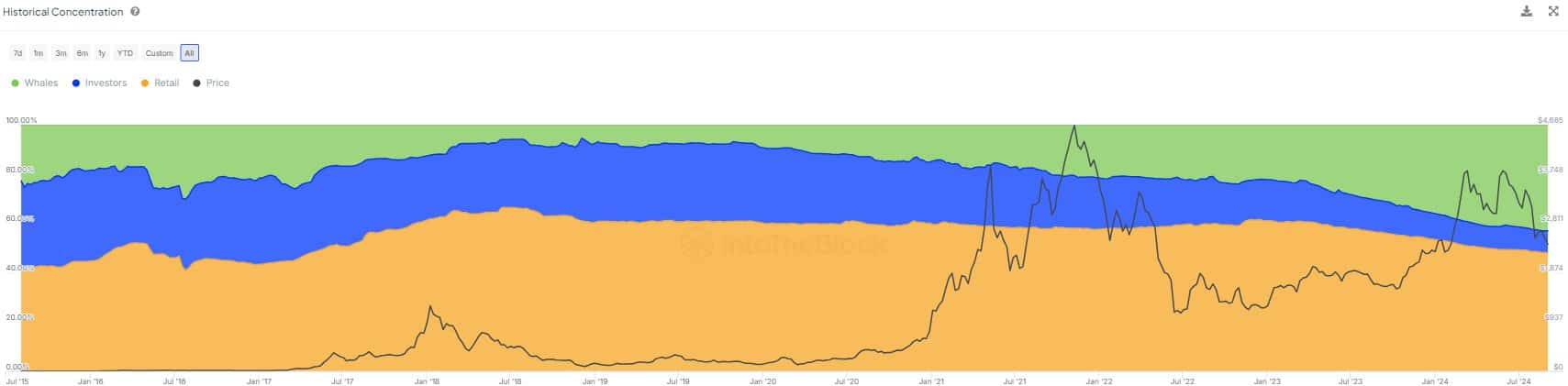

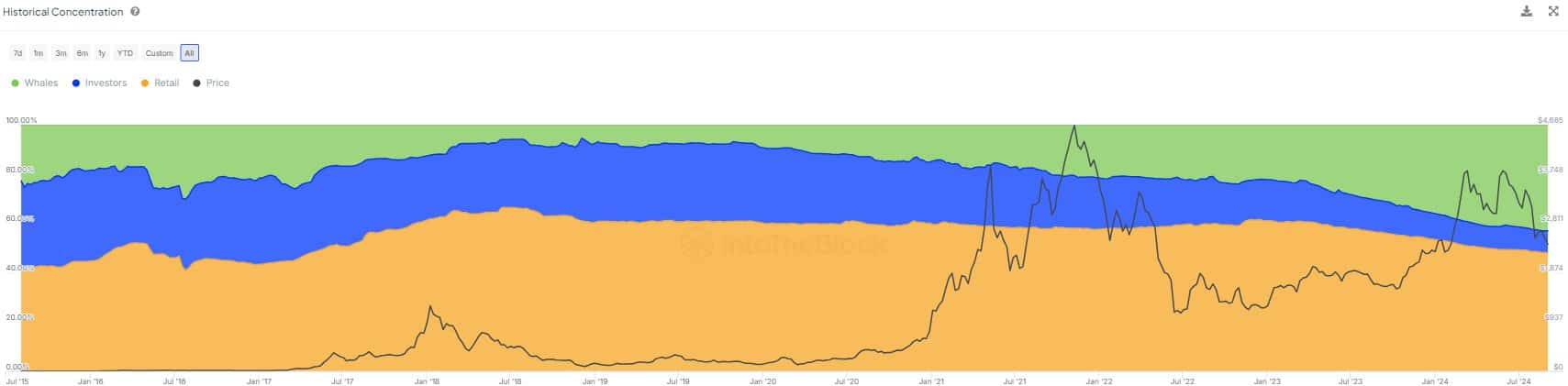

Whales continue to accumulate

Whales are playing a significant role in supporting this expected upward movement. Ethereum’s largest holders have been steadily accumulating more ETH since 2019, and this trend intensified after the Shanghai upgrade in early 2023.

As of press time, whales controlled over 43% of Ethereum’s circulating supply, closing in on the 48% held by retail investors.

This accumulation indicates that these major players expect Ethereum’s price to move higher over time.

Source: IntoTheBlock

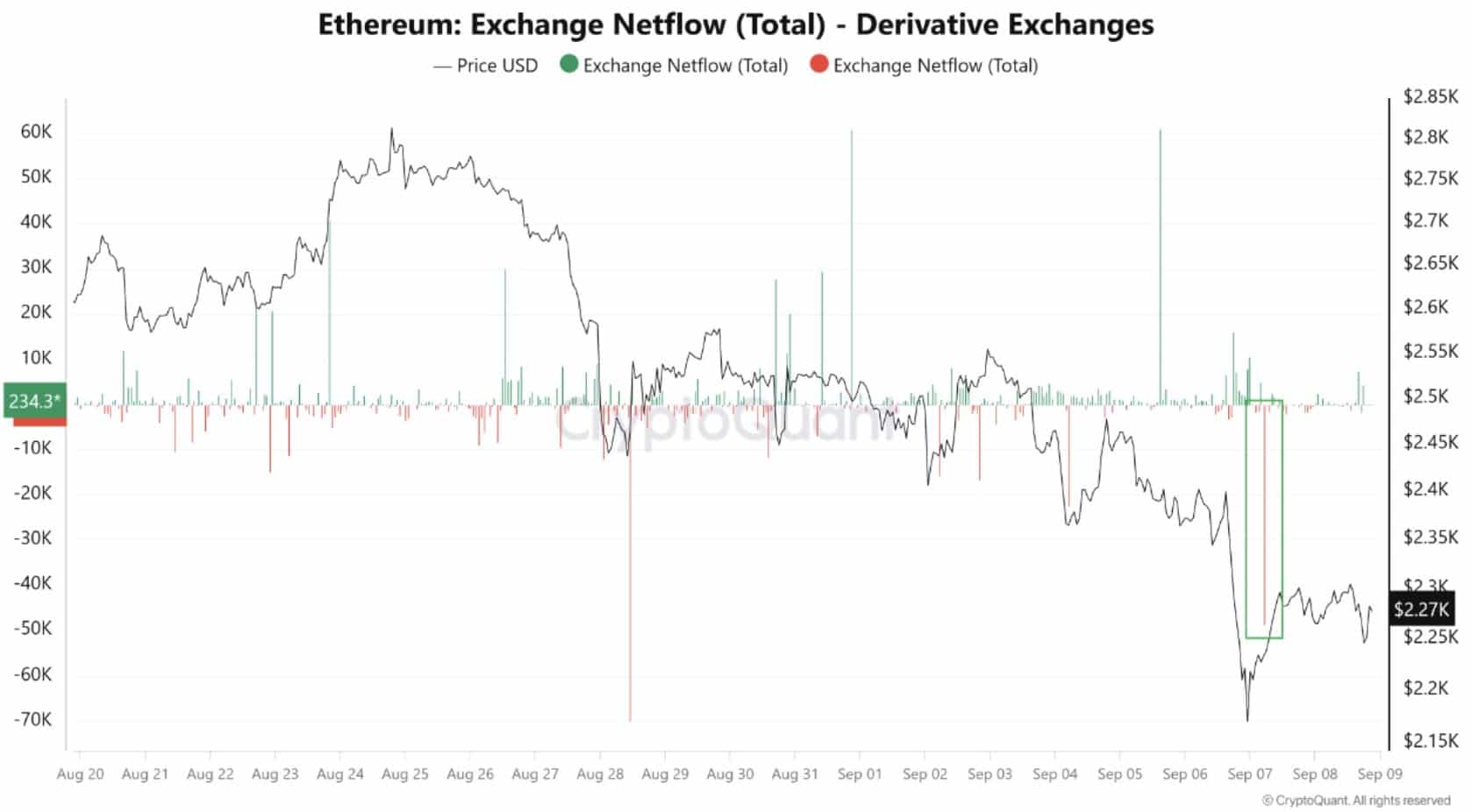

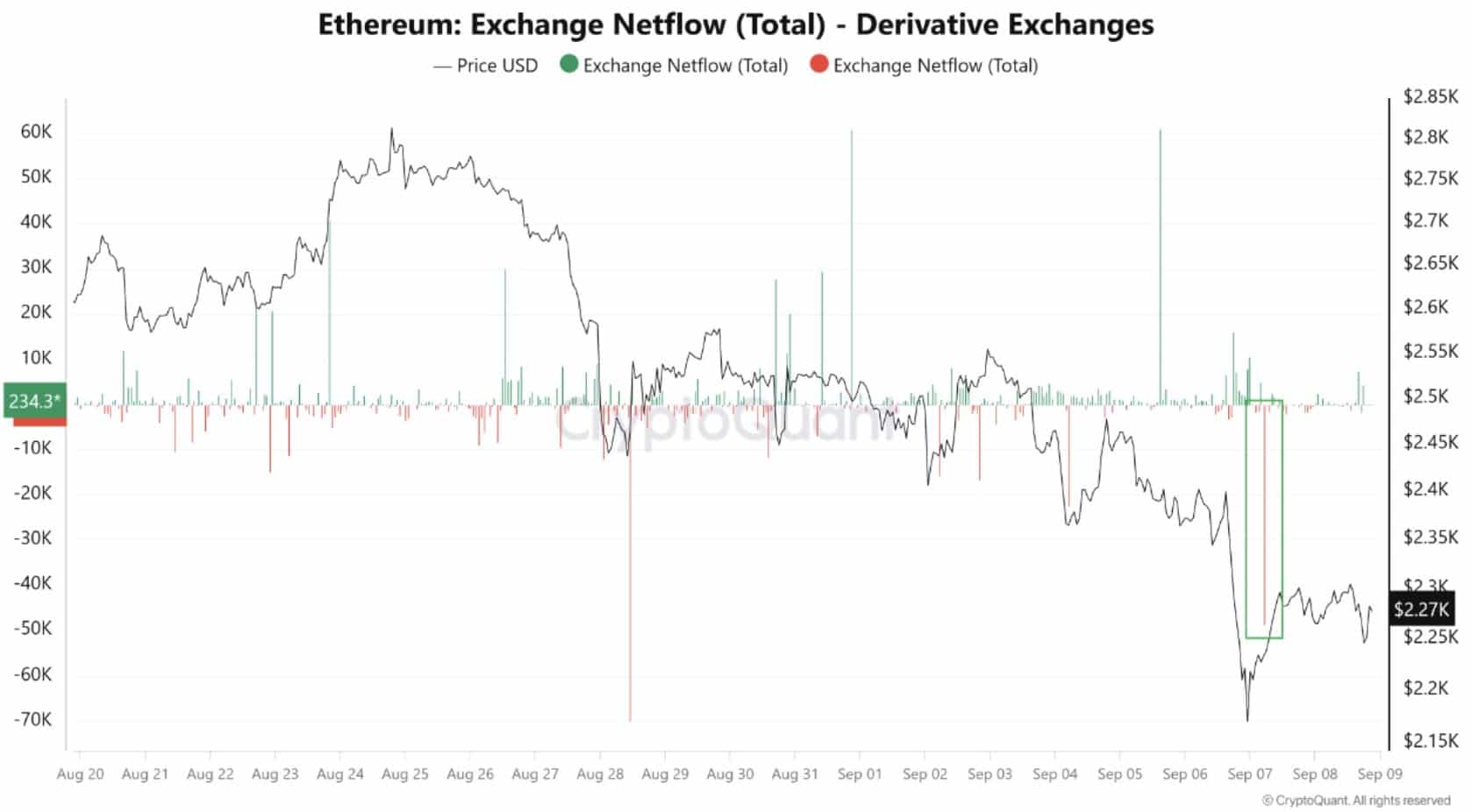

ETH exchange netflows

Looking at Ethereum’s exchange netflows, data showed that the negative netflow on derivative exchanges have surpassed 40,000 ETH.

This suggested that more ETH was being withdrawn from these exchanges and transferred to cold wallets, indicating reduced selling pressure.

Traders may be preparing for long-term gains, suggesting that the current decline in Ethereum’s price is a temporary correction, potentially setting the stage for a significant upward movement.

Source: CryptoQuant

Read Ethereum’s [ETH] Price Prediction 2024–2025

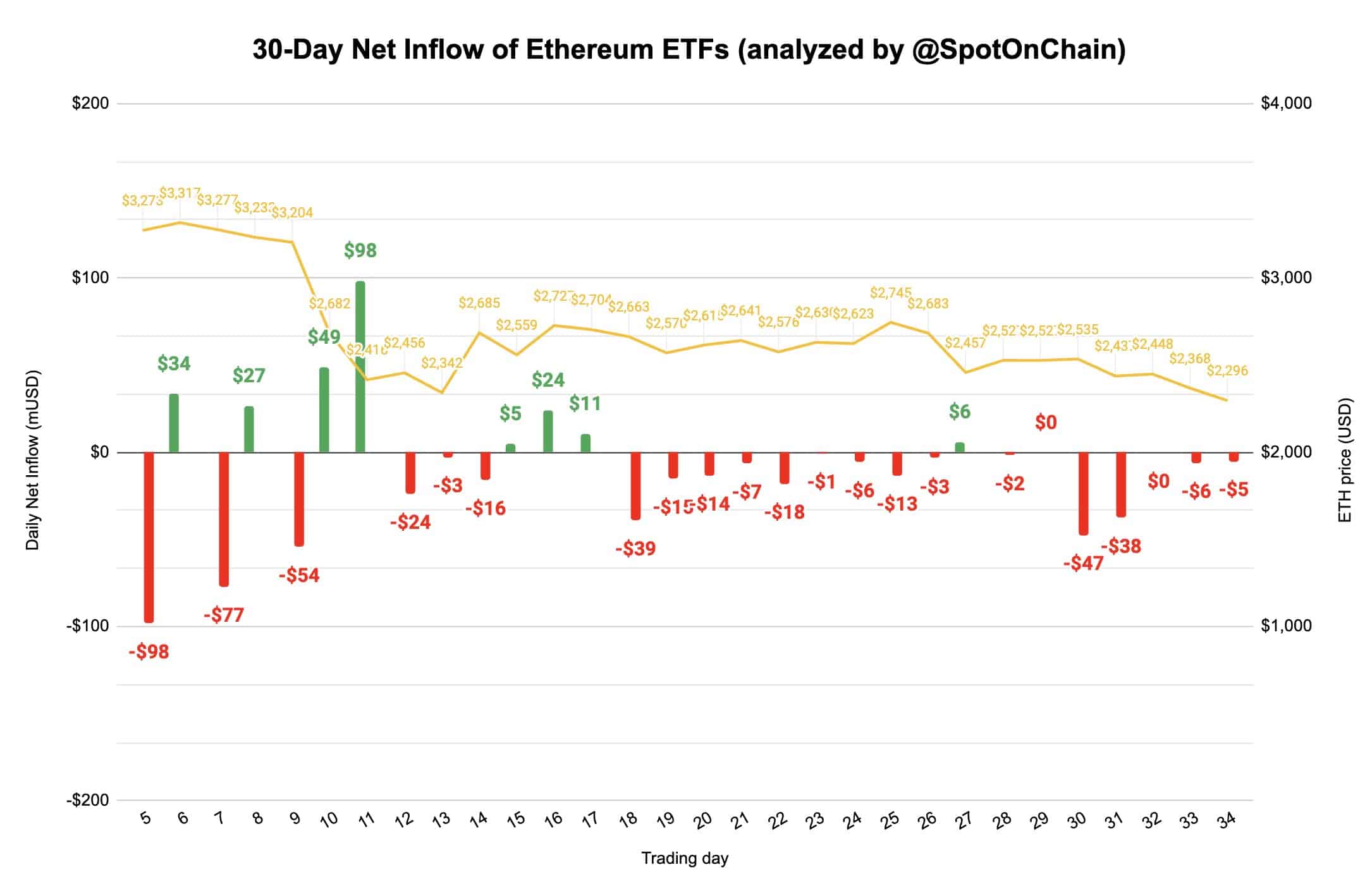

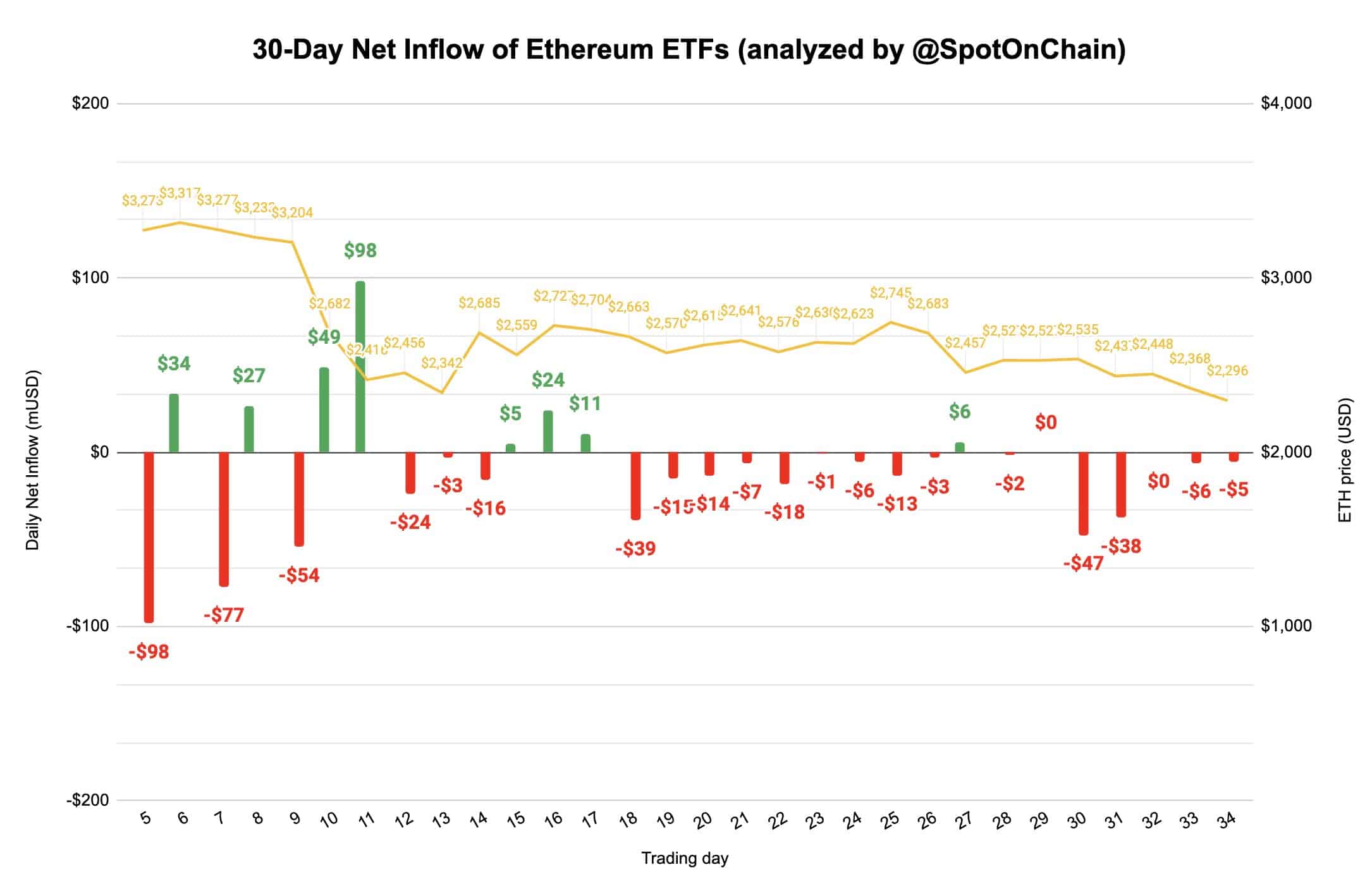

Ethereum ETF update

Despite some negative net-flows in Ethereum ETFs, there are positive signs. ETH ETFs, including Fidelity’s saw inflows over the past 24 hours. Grayscale’s ETHE experienced the largest and the only outflow.

However, the overall positive sentiment surrounding ETFs may eventually support Ethereum’s future price growth.

Source: Spot On Chain

Leave a Reply