- FLOKI has a strong bearish outlook in the near term

- Buying pressure seemed non-existent, with market participants fearing more volatility

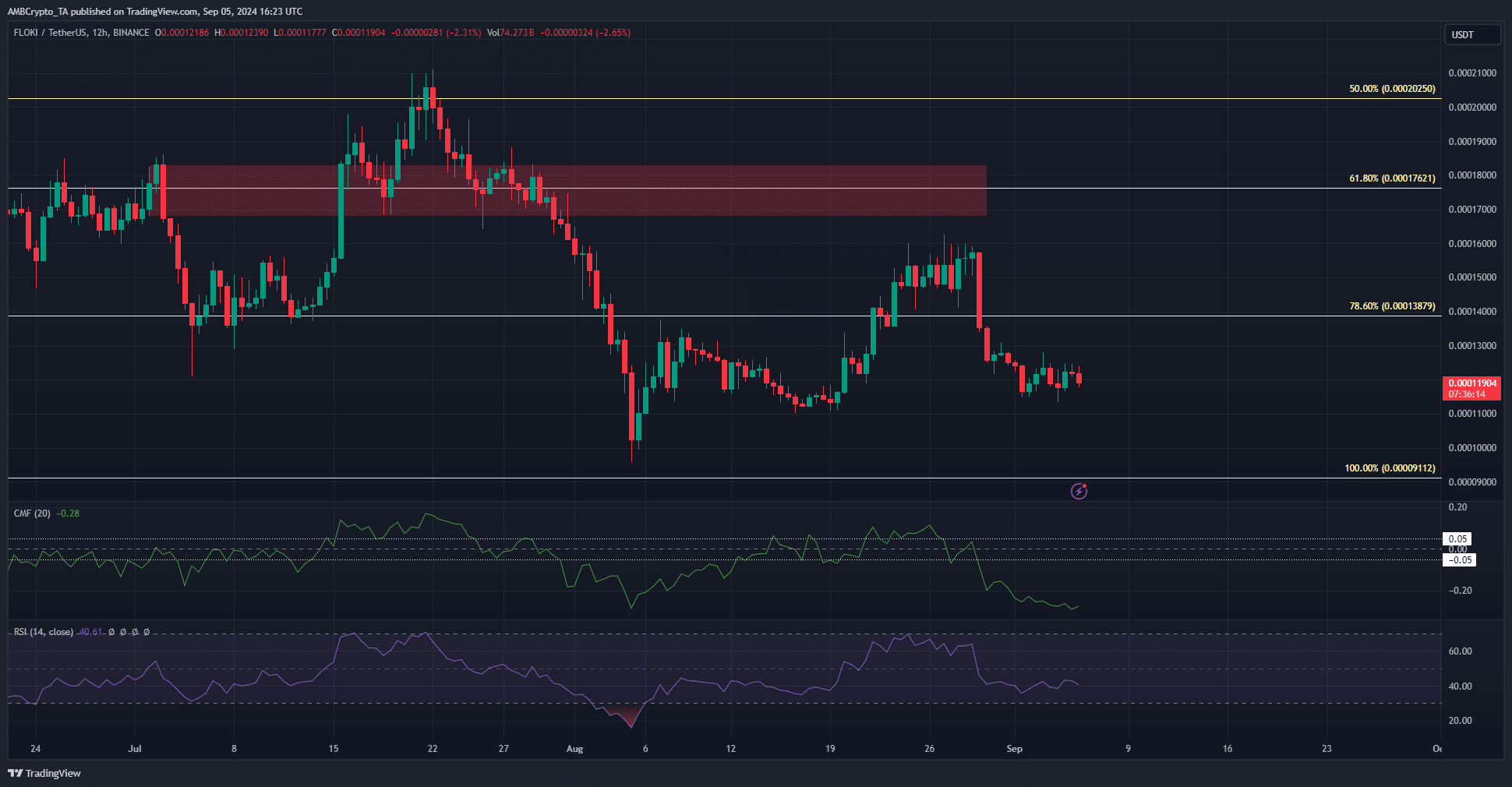

FLOKI bulls were not successful in reclaiming the $0.000176 zone. They were not strong enough to retest the resistance zone, falling short of their target at the $0.00016-level.

Source: FLOKI/USDT on TradingView

The CMF fell well below -0.05 to indicate significant capital flows out of the market in recent days. The RSI on the 4-hour chart was also in bearish territory, and more losses appeared likely for the memecoin.

Hence, the question – Do the on-chain metrics agree with these findings?

Signals were bearish, but there was some hope for holders

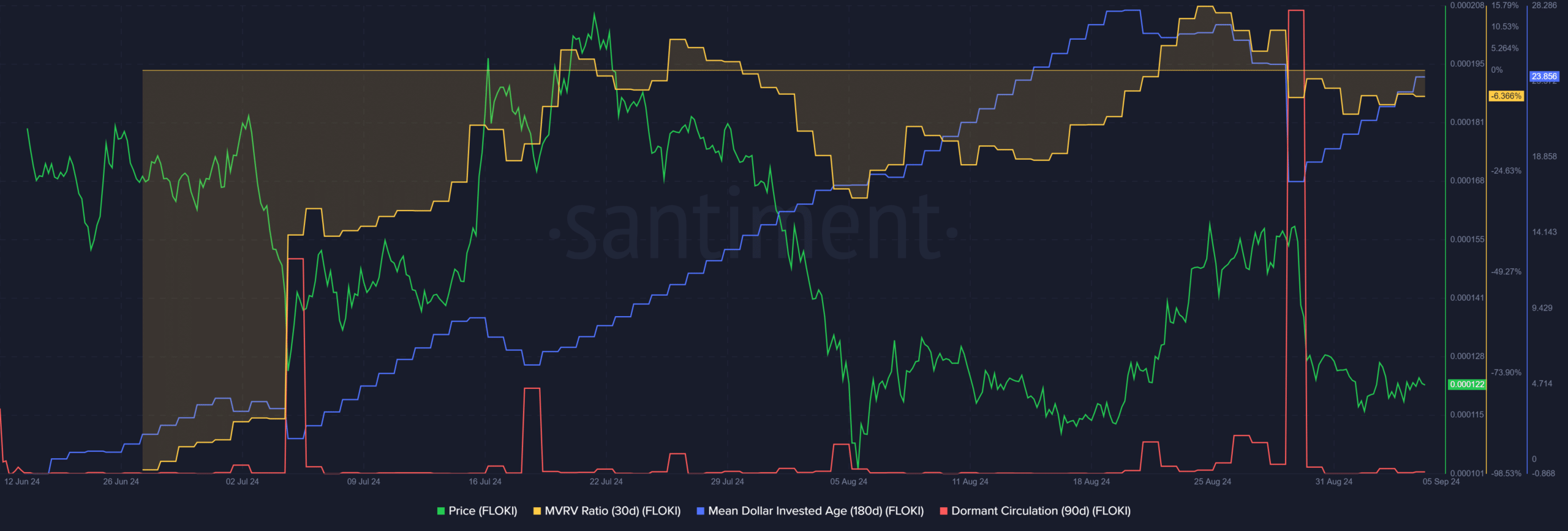

On 29 August, the dormant circulation saw a giant surge. This was a sign of a flurry of token movements that were likely for selling purposes. At the same time, the price dropped from $0.000157 to $0.000135.

The short-term MVRV, which had been in positive territory, was also forced to pull back. This showed that holders were at a minor loss, with the recent price uptick running into a large wave of selling.

The mean dollar invested age also saw a pullback to signal old coins re-entering circulation. After trending higher for nearly three months, this was a good sign. There was room for FLOKI to make gains after the recent reset. As things stand, the buying pressure was not yet in favor of the bulls.

FLOKI sentiment worsened after the retracement

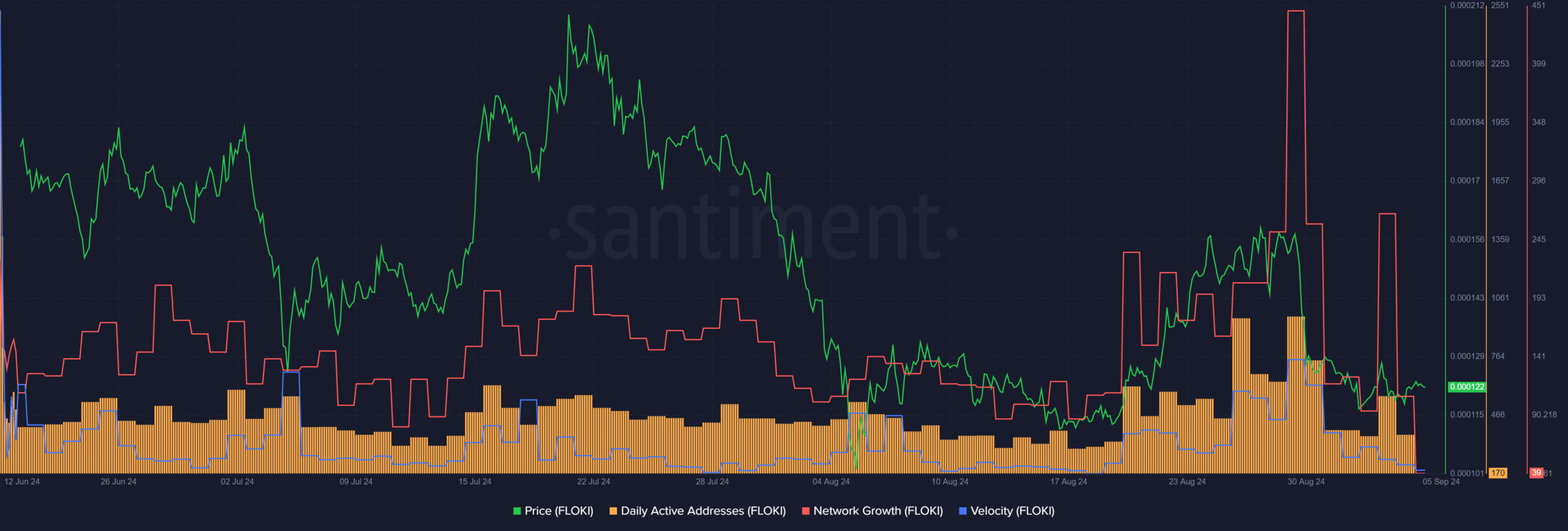

In the last week of August, when FLOKI was making strong short-term gains, the daily active addresses metric steadily increased. This signaled greater usage and potential demand. Additionally, the token velocity also climbed to show increased usage in transactions.

This uptick vanished within the span of a few days as bearish sentiment seized the market and drove away participants. The network growth was not affected as badly.

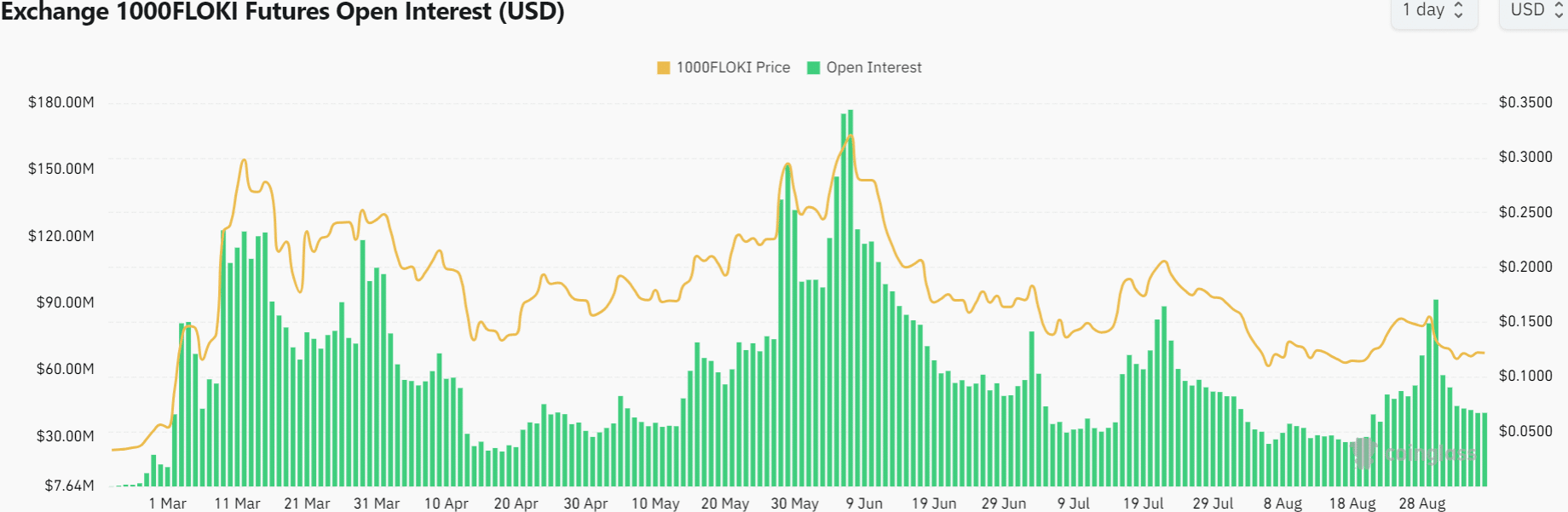

The Open Interest saw a sharp hike even after FLOKI made a local high and began to pull back. This was a sign of heavy short-selling in the markets.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

Since then, the OI has been falling, showing that bearish sentiment was prevalent.

Overall, in the short term, the metrics and indicators favored the sellers. The fall in the mean dollar invested age seemed to be only a small positive.

Leave a Reply