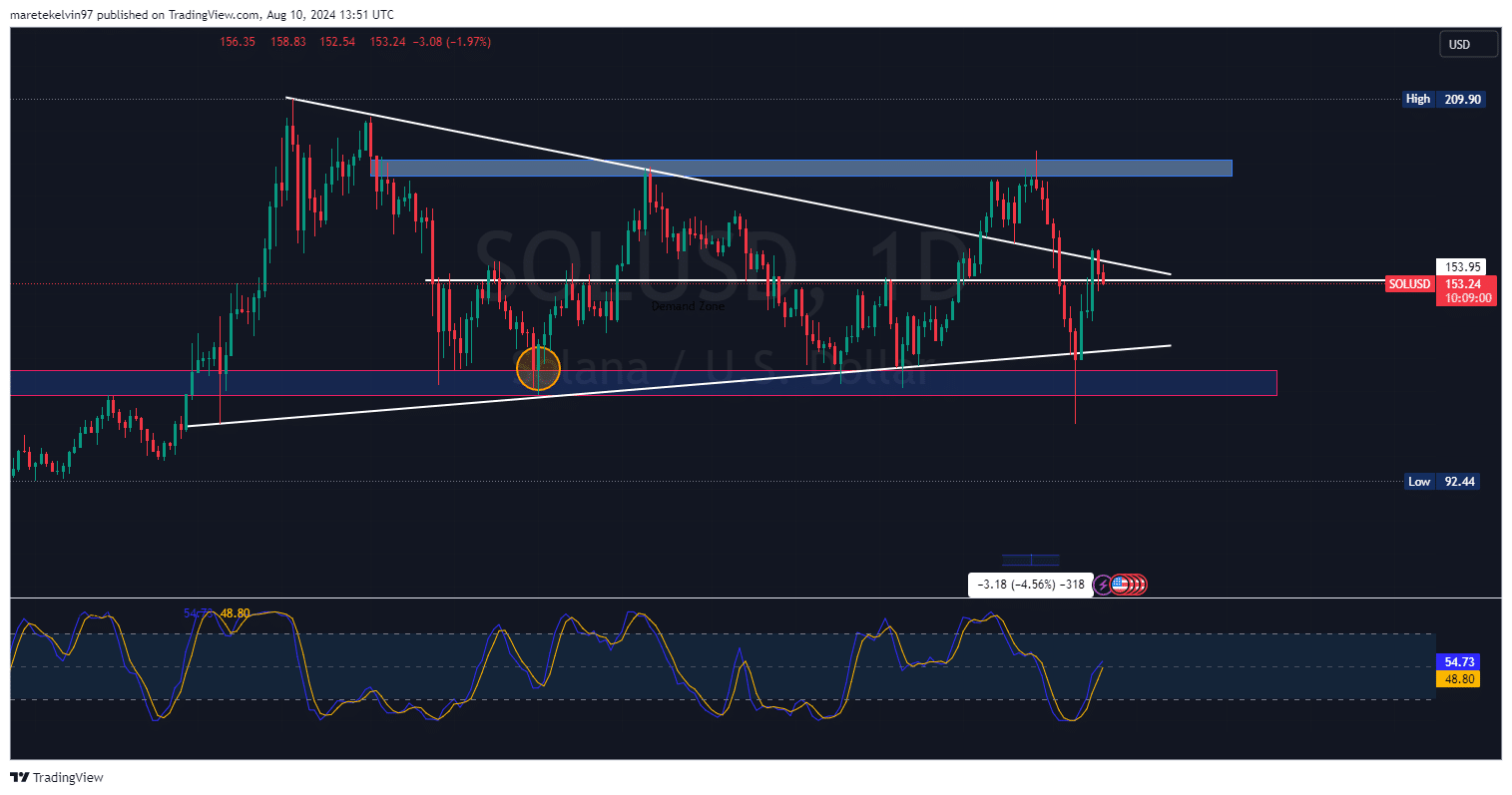

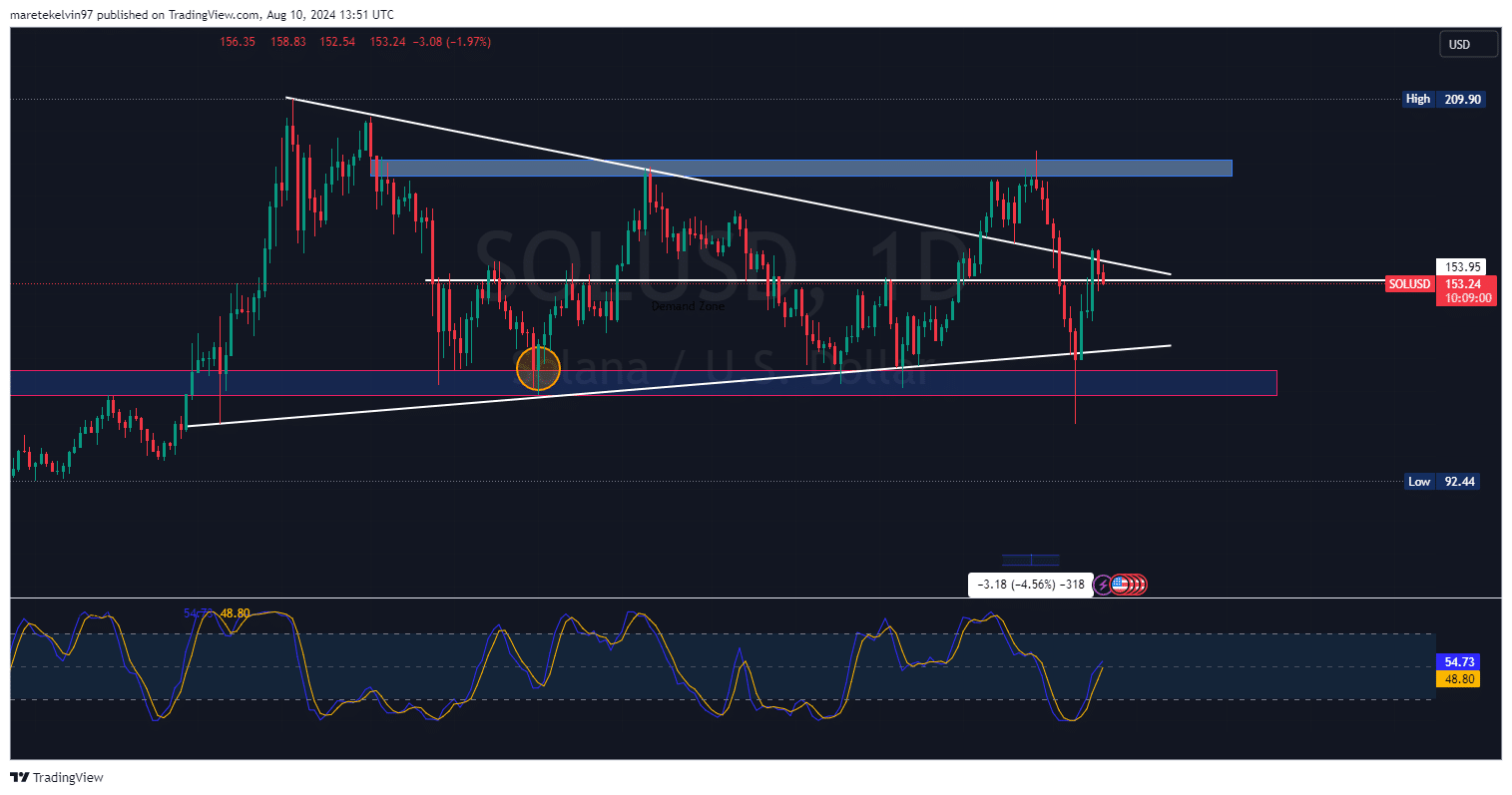

- Solana was testing key support at $153.95 after a sharp 6% pullback.

- Metrics indicate a potential bullish reversal.

Solana [SOL] was facing a crucial moment as it tests the support level of $153.95. Market participants are closely watching to see if this support holds after a 6% pullback or if bearish pressure will push Solana prices lower.

Source: Tradingview

The stochastic RSI is approaching a neutral zone from overbought region. This further adds more weight to Solana’s current accumulating bullish momentum. This give green lights for further price rallies

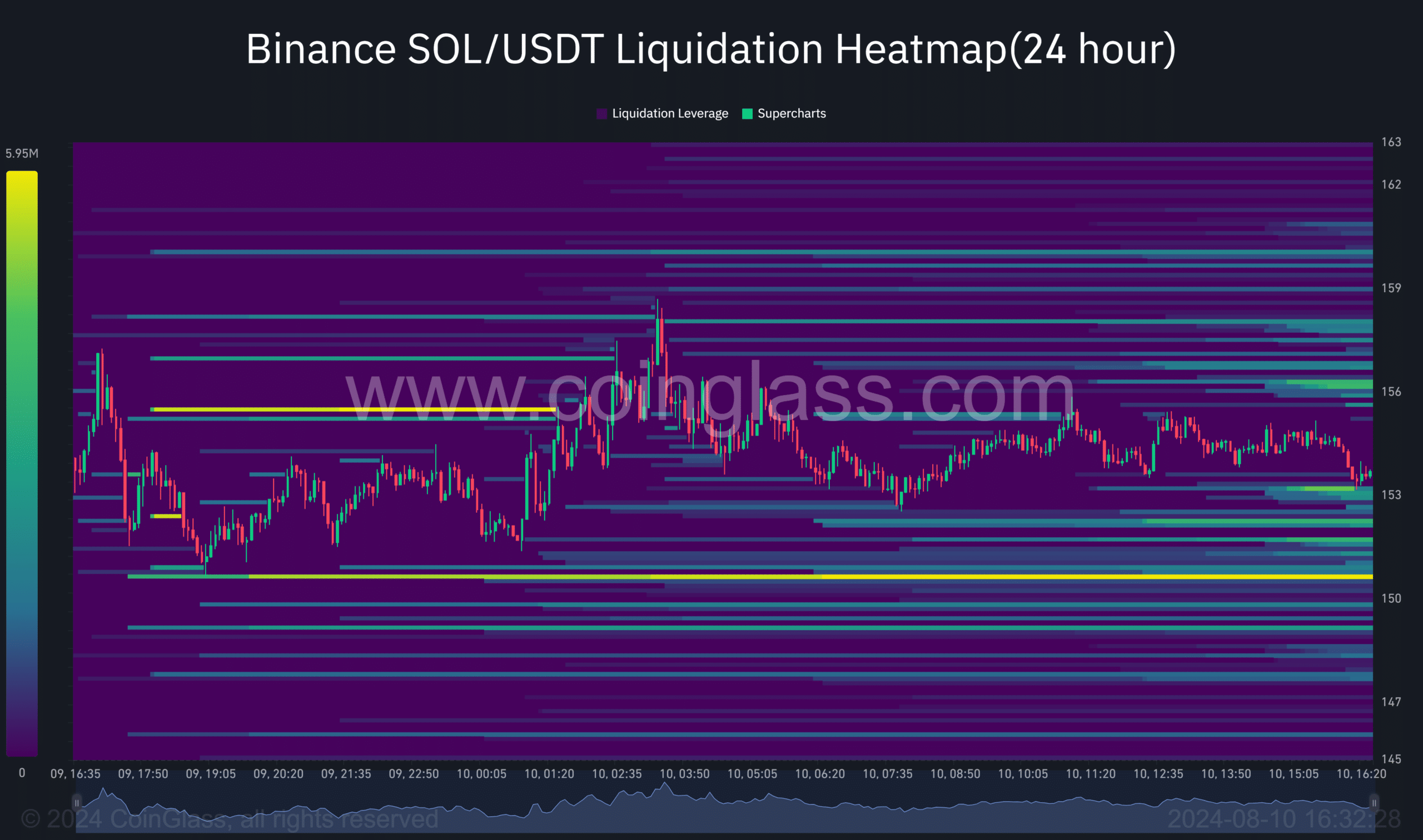

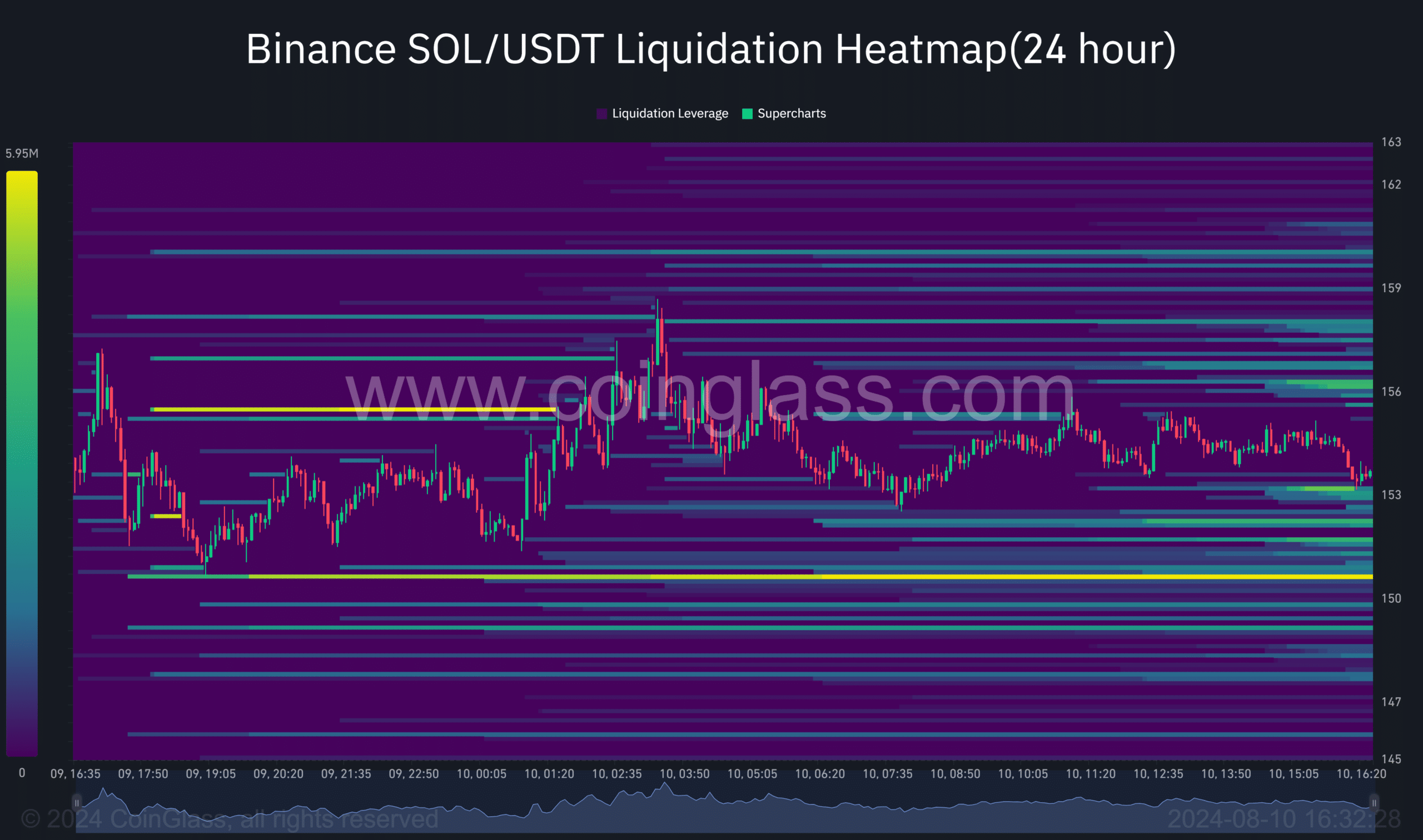

Solana liquidations hint at further downside run

According to Coinglass’ liquidation heatmap data, there is a huge Solana pool of liquidation worth $5.96 million just below the $153.95 support, specifically around the $150 price level.

This increases the probability of breaching $153.95 in support. The huge pool may tend to cause additional forced selling by aiming to trigger some stops, thereby pushing Solana prices further down.

It also has noteworthy liquidation pools above level 153.95, which can offer support and even cause upward momentum if SOL bulls gain control.

Source: Coinglass

Solana bulls fighting back

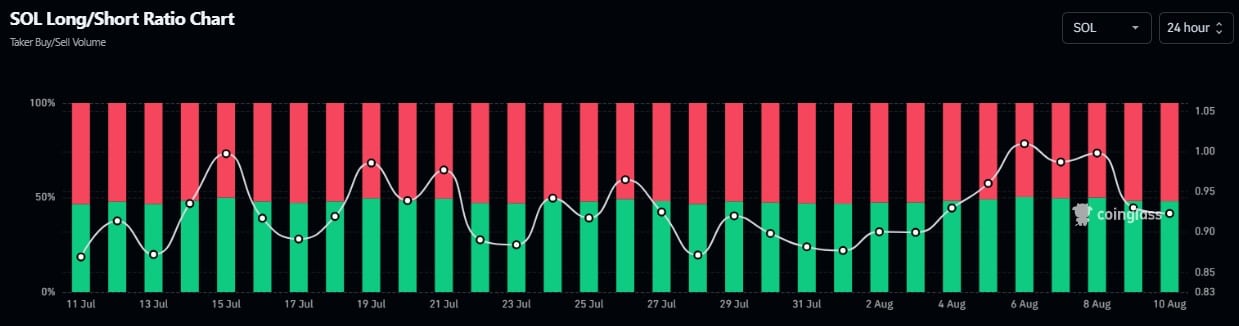

AMBCrypto further analyzed the short-to-long ratio data. Despite being inclined toward bears, the ratio has indicated some resilience.

Although the ratio has decreased slightly in the short run, recent oscillations suggest that bulls are slowly getting stronger. If buyers maintain the momentum, a bullish reversal may be in store.

This tug-of-war between Solana bears and bulls could lead to a consolidation phase before a decisive move in either direction.

Source: Coinglass

Is your portfolio green? Check out the SOL Profit Calculator

If this level is broken, the price will likely plummet to around $150, where there is strong support. But if bulls can save their ground here, it may lead to a mild rally and even a retest of higher resistance zones.

The role of liquidation pools and the long/short ratio will be important in deciding Solana’s next direction.

Leave a Reply