- Base recently hit a transaction count milestone.

- Its transaction count was around 4 million.

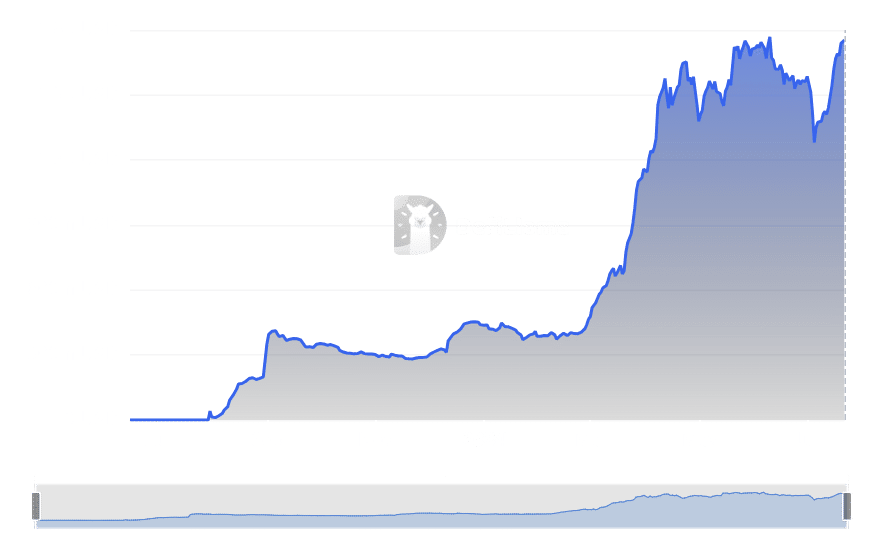

Base recently experienced a significant uptick in daily transaction count, reaching a notable milestone that suggested increased user engagement and adoption.

Additionally, Base’s Total Value Locked (TVL) also saw a spike, reaching another important milestone.

Base hits transaction milestone

Recent data from Coin98 Analytics revealed that Base has achieved a remarkable feat in network activity. The data showed it recorded the highest transaction count among both Layer 1 (L1) and Layer 2 (L2) networks.

This impressive volume, totaling over 4 million transactions, significantly outpaced its nearest competitor, which recorded around 2.2 million transactions.

Notably, this represents an all-time high for Base, highlighting a significant milestone in its operational history.

AMBCrypto’s analysis from Growthepie corroborated its leading position, indicating that it continued to dominate in terms of transaction count.

Additionally, there has been a notable increase in the number of active addresses on the network. This surge has propelled Base to the top spot in terms of active addresses among L2 networks.

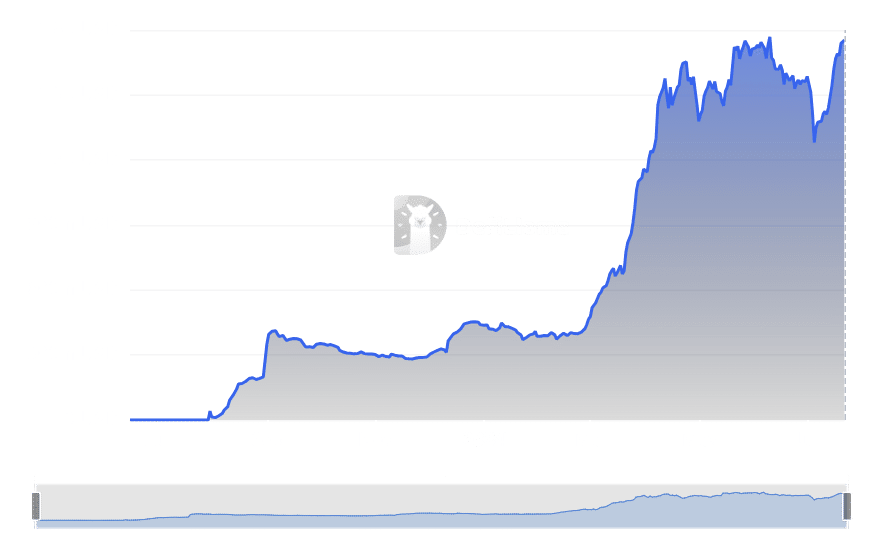

Base sees a spike in TVL

The Total Value Locked (TVL) in Base has shown a positive trajectory, marking a significant growth in the network’s engagement within the DeFi sector.

According to data from DeFiLlama, this uptrend in TVL began around the 6th of July, when it was approximately $1.3 billion. Since then, there has been a steady increase, with the TVL surpassing $1.7 billion.

Source: DefiLlama

This growth in TVL is noteworthy as it represents a milestone for Base—it’s the first time the network’s TVL has reached this level.

How it compares to other L2

According to the latest data from L2Beats, Base has achieved significant standing among Layer 2 (L2) networks. Its TVL has positioned itself as one of the top platforms in this space.

However, it ranked second at press time, following Arbitrum [ARB], which held the lead.

Arbitrum dominated with over 40% of the total TVL across Layer 2 solutions, underscoring its strong market presence and user trust. In comparison, Base held approximately 15% of the L2 market share in terms of TVL.

Leave a Reply