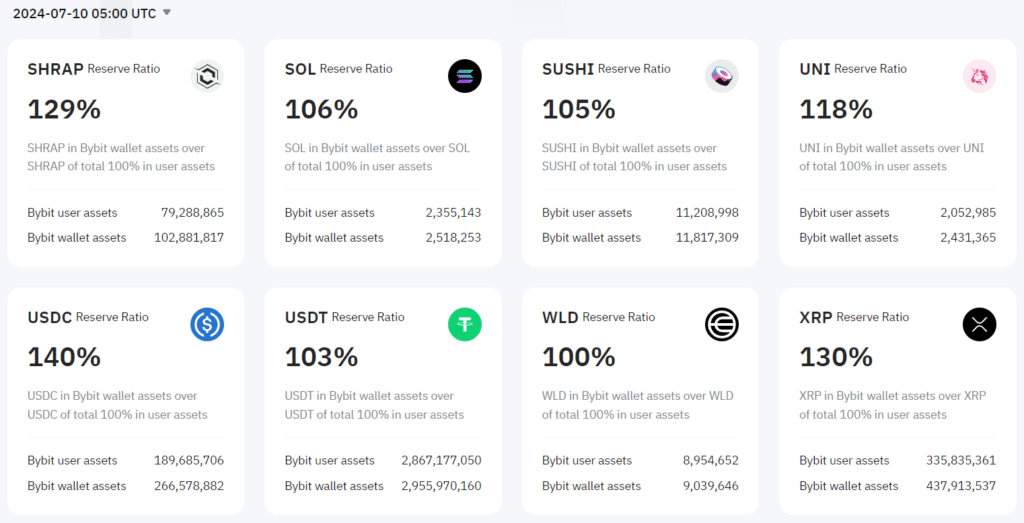

Cryptocurrency exchange Bybit has released the twelfth proof of reserve, featuring a 17.8% increase in USDT holdings.

Crypto investors are showing an increased appetite for stablecoins as the Bybit crypto exchange revealed in its latest proof of reserve nearly an 18% increase of customers’ holdings in Tether (USDT). According to the exchange’s report, users’ USDT balances grew by 433 million USDT as of Jul. 10, marking a 17.8% rise from Jun. 6.

The report also noted a dramatic increase in Circle’s USD Coin (USDC), with deposits surging by over 150 million USDC, a nearly 400% jump from June. In contrast, the algorithmic stablecoin DAI, issued by MakerDAO, experienced a decline, with holdings decreasing by 33% over the same period.

Bybit user reserves in stablecoins as of Jul. 10 | Source: Bybit

You might also like: Arthur Hayes foresees market bottom, predicts gradual uptrend

Meanwhile, holdings of traditional cryptocurrencies Bitcoin (BTC) and Ethereum (ETH) saw modest gains of 5.62% and 0.46%, respectively, suggesting that traders might be reallocating their liquidity from stablecoins into more volatile crypto assets.

The uptick in stablecoin holdings coincides with rising market capitalization in the sector, as Bitcoin appears to have reached a local price bottom. CryptoQuant CEO Ki Young Ju noted in a Jul. 17 post on X that the stablecoin market cap hit an all-time high earlier in July, with USDT comprising 70% of the total market.

While Ju acknowledged that current liquidity levels might not significantly impact price movements, he deemed the upward trend as “noteworthy” given the prevailing market conditions.

Read more: Bitcoin’s hashrate reached post-halving bottom, analysts say

Leave a Reply