- Solana was at the strong support level of $124 at press time.

- Trading volume surged by 36% signaling investors’ and traders’ participation.

In the last 24 hours, the cryptocurrency market experienced notable selling pressure, after the world’s biggest digital asset, Bitcoin [BTC] fell more than 8%.

Other cryptocurrencies including Ethereum [ETH], Solana [SOL], and Binance Coin [BNB] have also experienced significant 24-hour losses of over 10%, 7%, and 13%, respectively, in the last 24 hours, per CoinMarketCap.

At press time, the majority of cryptocurrencies were showing bearish trends amid this continued selling pressure. However, Solana had started showing a bullish pattern on its daily chart.

Solana: These are some key levels

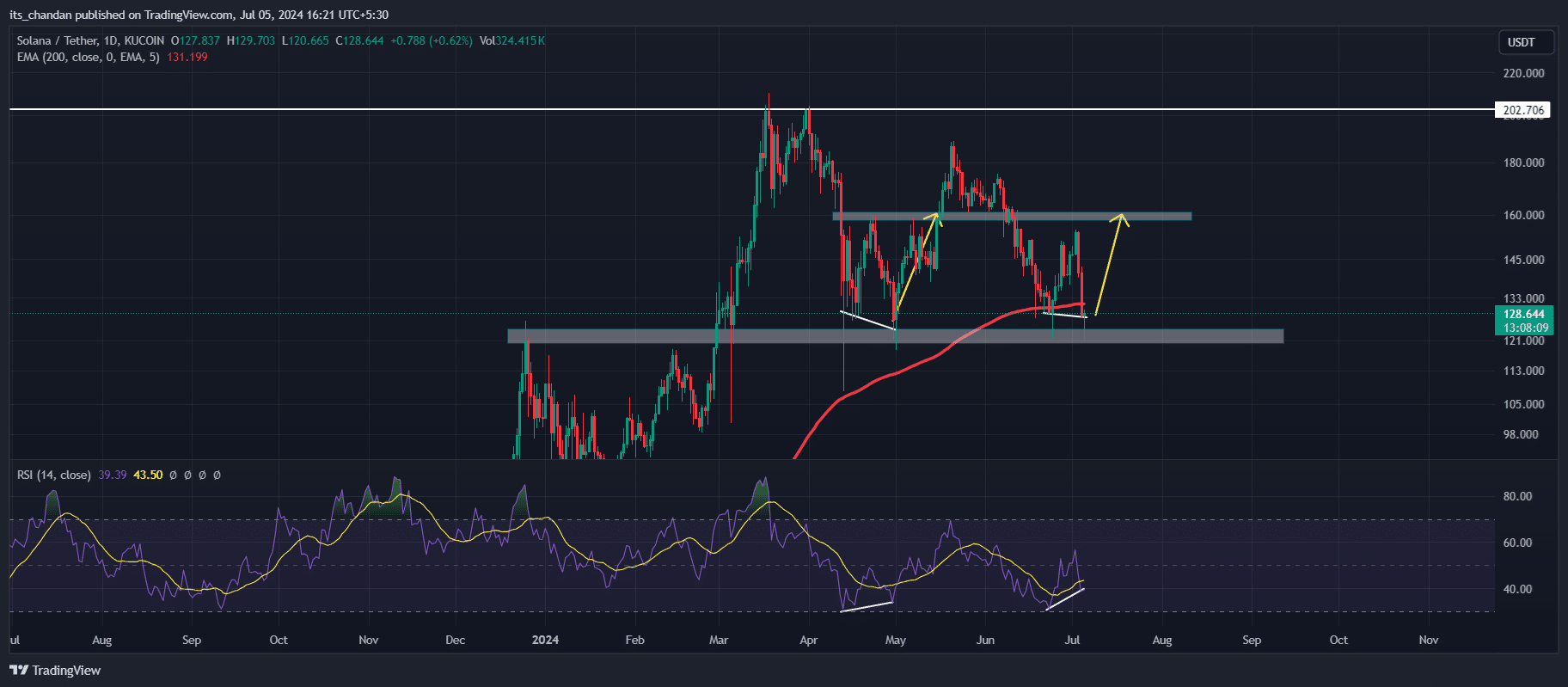

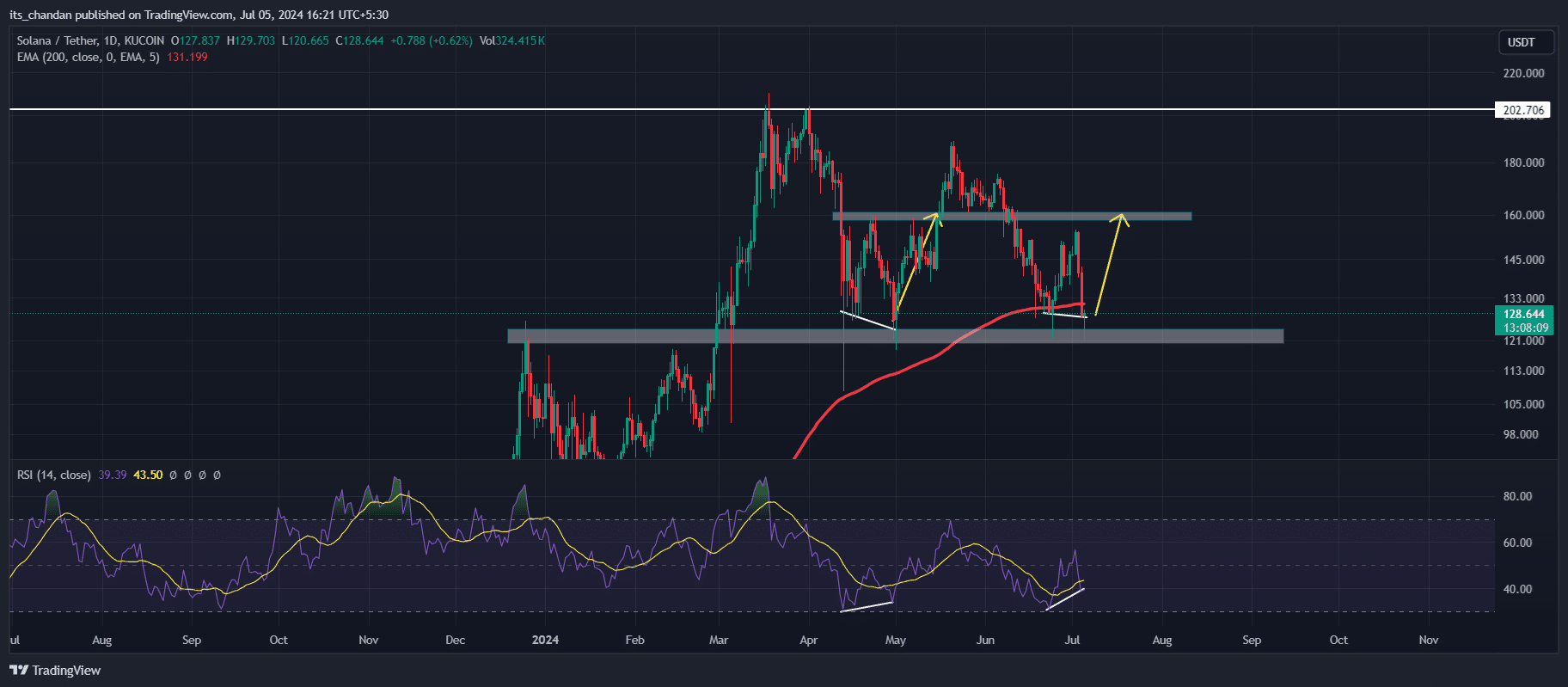

According to AMBCrypto’s analysis, SOL was currently at a strong support level of $124 at the time of writing and below the 200 EMA (Exponential Moving Average).

SOL’s daily chart showed the formation of two bullish price action patterns: a bullish double-bottom pattern and a bullish divergence in the oversold area of the Relative Strength Index (RSI).

Source: TradingView

However, this wasn’t the first time that SOL’s daily chart had shown this pattern. In May 2024, a similar bullish pattern occurred at the same level near $124.

There was thus a high possibility that SOL may copy the move that it made in May 2024. If history repeats itself, we could potentially witness a massive price surge of over 22%, reaching the $160 level in the coming days.

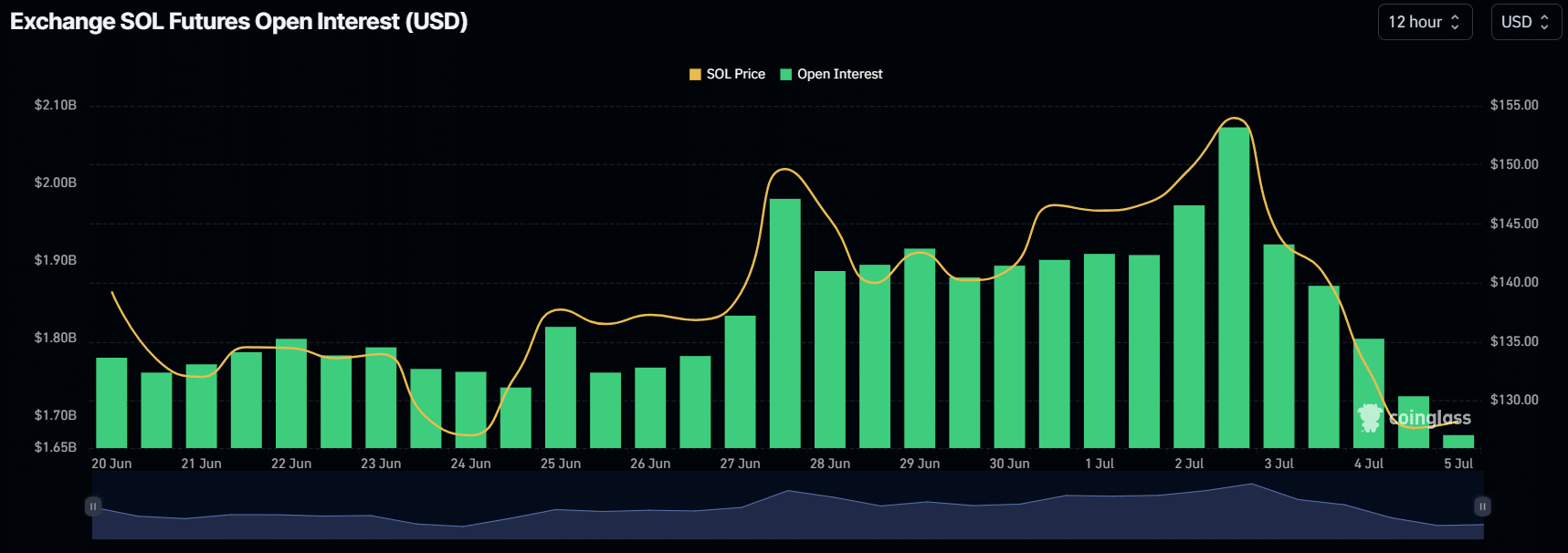

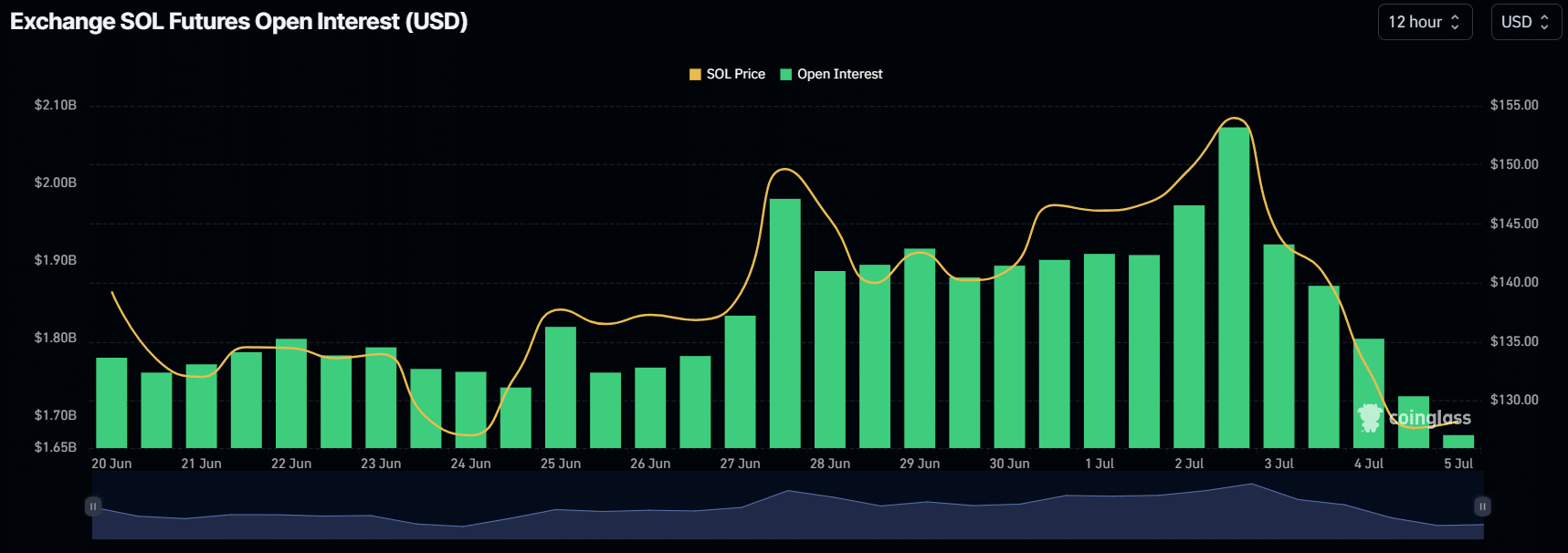

Despite this bullish outlook, the 24-hour Open Interest (OI) has dropped by 7% showing lower investors’ and traders’ interest in this challenging market, according to Coinglass.

Source: Coinglass

This drop in OI may be attributed to the liquidation of $25.5 million worth of traders’ positions, with SOL being the third-highest asset to experience this significant liquidation.

Whereas, the highest liquidation occurred in Bitcoin and Ethereum.

Price-performance analysis

As of this writing, SOL was trading near $126, and in the last 24 hours, it experienced a 7% price drop. The trading volume experienced a notable surge of 36% signaling investors’ and traders’ participation.

If we look at the performance of SOL over a longer period, in the last seven days it lost more than 11% of its value. Whereas, in the last 30 days, SOL has lost nearly 26% of its gain.

Besides SOL, Solana-based altcoins such as Render [RNDR], Bonk [BONK], and Pyth Network [PYTH] also witnessed similar price drops.

Is your portfolio green? Check out the SOL Profit Calculator

According to CoinMarketCap, RDNR, BONK, and PYTH saw price drops of 9%, 12%, and 13% respectively in the last 24 hours.

On the other hand, popular Solana-based meme coin dogwifhat [WIF], alongside The Graph [GRT] experienced surges of 12% and 2% respectively in the same period.

Leave a Reply