- Litecoin has been accumulating bullish momentum in the short term.

- Metrics indicated mixed signals.

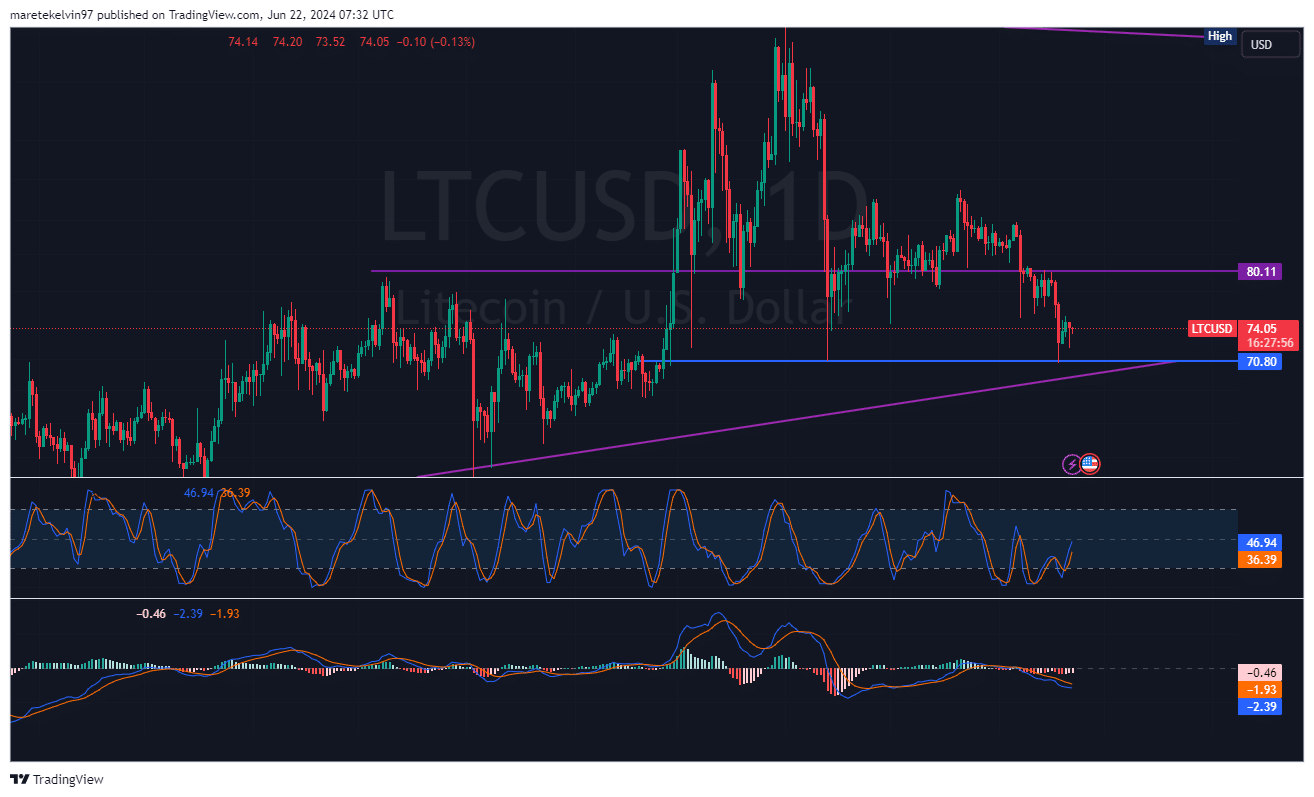

Litecoin [LTC] has been hovering in between two support levels since the 6th of June. The price then plummeted by 11% to the $71 support level, where it retested and reversed.

LTC has been accumulating bullish momentum since the 18th of June.

As of this writing, CoinMarketCap has Litecoin at $74.05, which is a 1.81% increase in the last 24 hours and a 5.86% drop in the last seven days.

Its market capitalization stood at $5.55 billion, while the trading volume dipped by 23.20% to $272.5 million in the last 24 hours.

This indicated that LTC is bearish in the long term, but bullish pressure is accumulating in the short term.

Source: TradingView

The stochastic RSI (46.94) had crossed from an oversold zone to a neutral zone. This could suggest that after a reversal, the price may surge, though with diminishing bullish momentum.

The moving average divergence convergence showed a number of bearish histograms. Unlike the stochastic RSI, the MACD indicates a bearish signal.

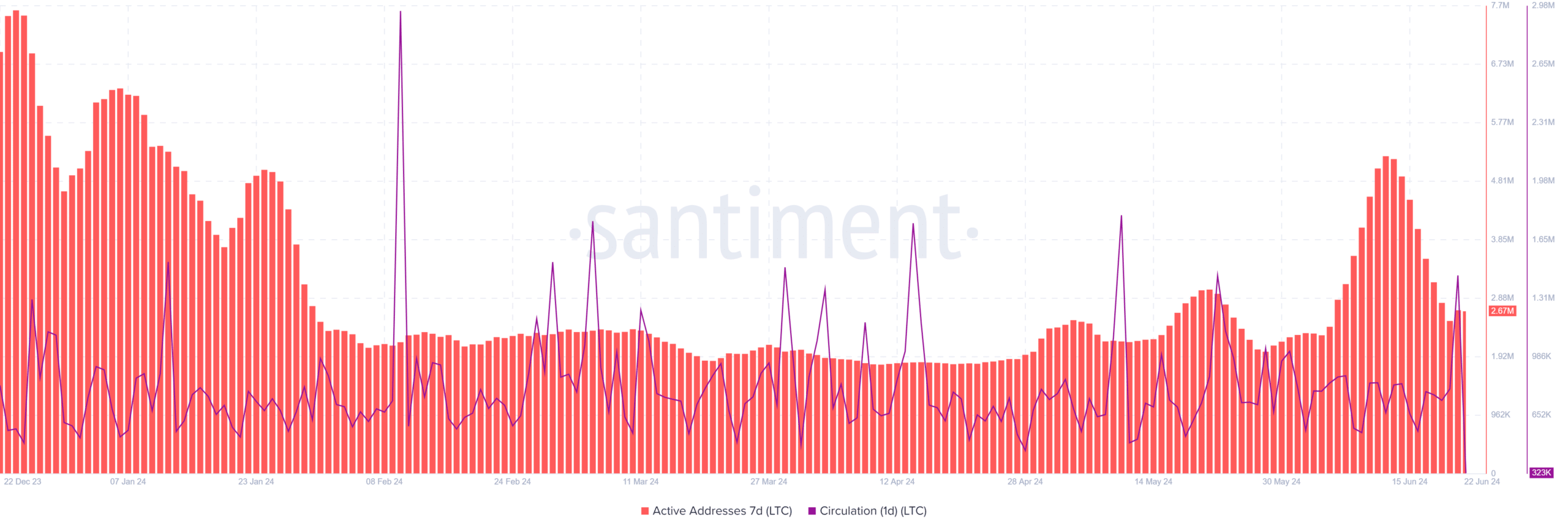

A tale of two trends

AMBCrypto analysis of the Santiment’s data indicated a fascinating interplay between active addresses and circulation. The Active Addresses had several spikes, while the Circulation showed periodic spikes.

This divergence hinted at a complex market dynamic, where increased user activity doesn’t necessarily translate to higher trading volumes

Source: Santiment

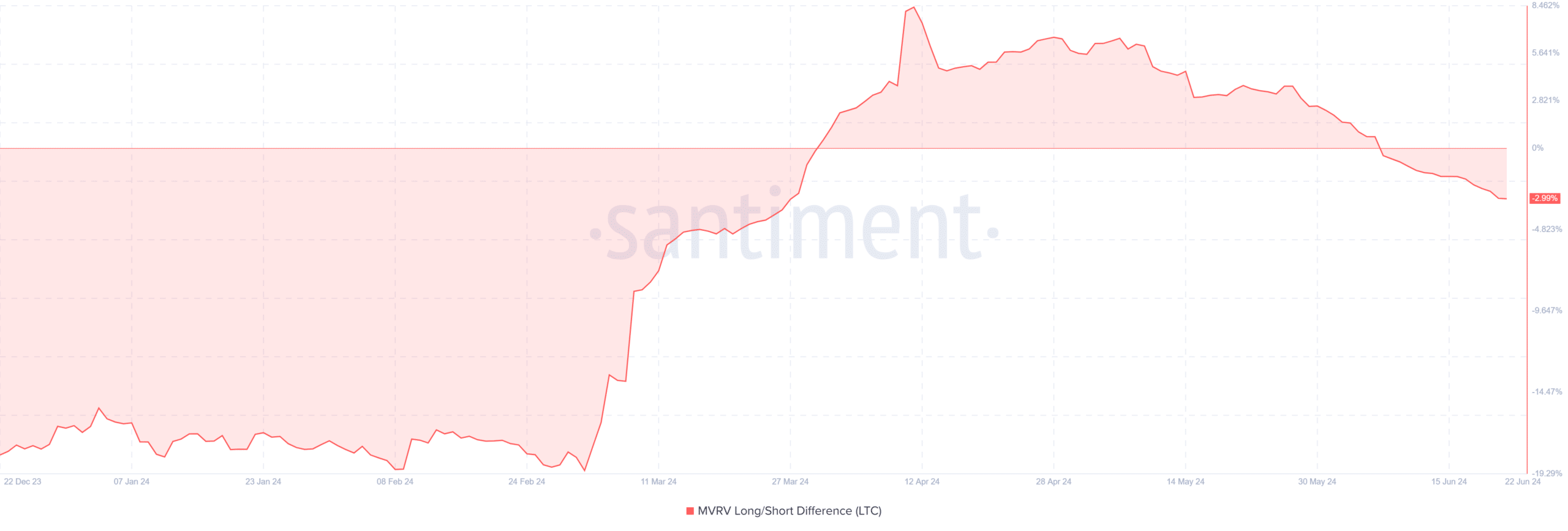

The MVRV (Market Value to Realized Value) Long/Short Difference indicated an upward trend since March. After a sharp ascent in March, the MVRV has been on a steady decline.

This decline in MRVT suggested a potential cool-down in long-term holder sentiment. The bearish signal could lead to further price pressure on Litecoin.

Source: Santiment

Realistic or not, here’s LTC’s market cap in BTC terms

What’s ahead for Litecoin?

The fluctuating active addresses, MVRV ratio, and technical indicators all showed mixed signal. This suggested that Litecoin was at a critical point, where investors were indecisive on whether to take long or short positions.

LTC will thus be stagnating around the levels before the market takes a side, and the “wait and see phase” will be determined by the winner between the bears and bulls.

Leave a Reply