- Toncoin’s weekly and daily price charts remained green.

- TON might drop to $7.2 before gaining bullish momentum.

While most crypots struggled last week to paint their charts green, Toncoin [TON] acted differently. Things might get even better in the coming weeks as TON prepares for a rally.

However, investors should be patient, as the token might first witness a correction before turning bullish.

Toncoin’s bullish future

CoinMarketCap’s data revealed that TON’s price increased by more than 1.7% in the last seven days. In fact, in the last 24 hours alone, its value surged by nearly $2.

At the time of writing, TON was trading at $7.79 with a market capitalization of over $18.9 billion, making it the ninth largest crypto.

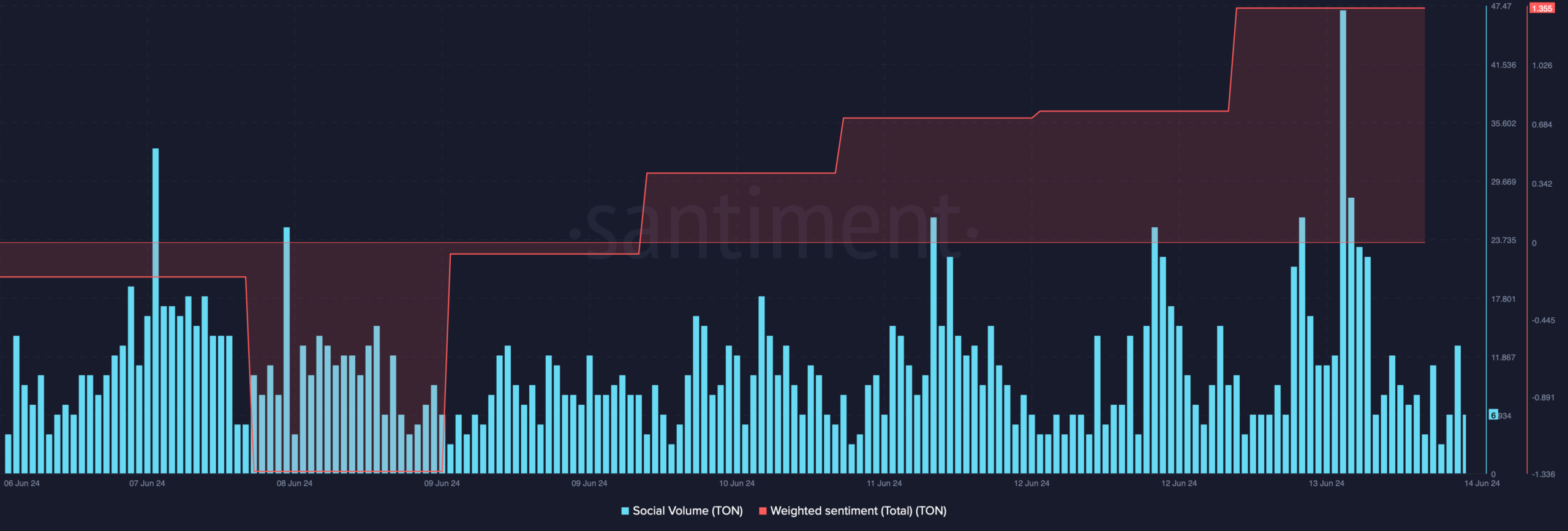

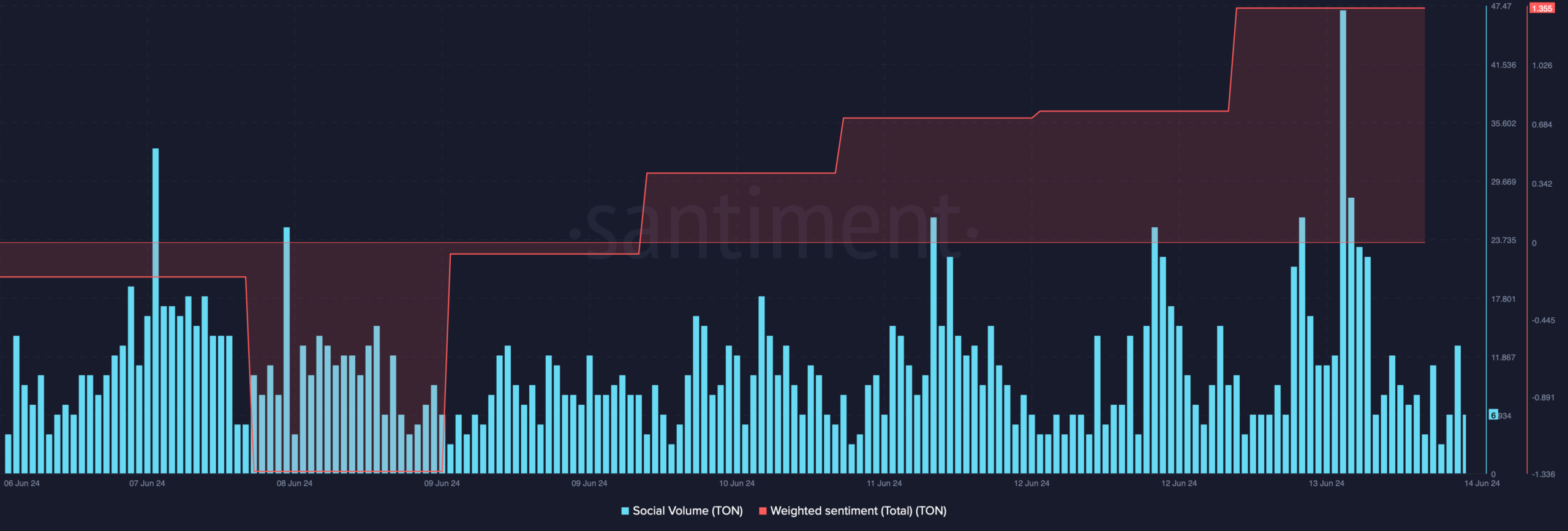

Thanks to the price uptick, TON’s weighted sentiment graph went up, meaning that bullish sentiment around the token was dominant in the market. Its social volume also spiked, reflecting a rise in its popularity.

Source: Santiment

Apart from this, AMBCrypto reported earlier how Toncoin outshined Ethereum [ETH].

Our analysis revealed that the number of unique addresses that have completed at least one transaction on Toncoin has exceeded that of Ethereum for ten out of the last 12 days.

There was better news for Toncoin, as Ali, a popular crypto analyst, recently posted a tweet pointing out an interesting development.

As per the tweet, TON was getting ready for a bullish breakout, which might allow it to touch $11 in the coming days.

However, investors might have to wait a bit in order for TON to complete its consolidation phase. Therefore, investors might witness TON dropping $7.2 to gather enough liquidity for its upcoming bull rally.

Will TON drop to $7.2?

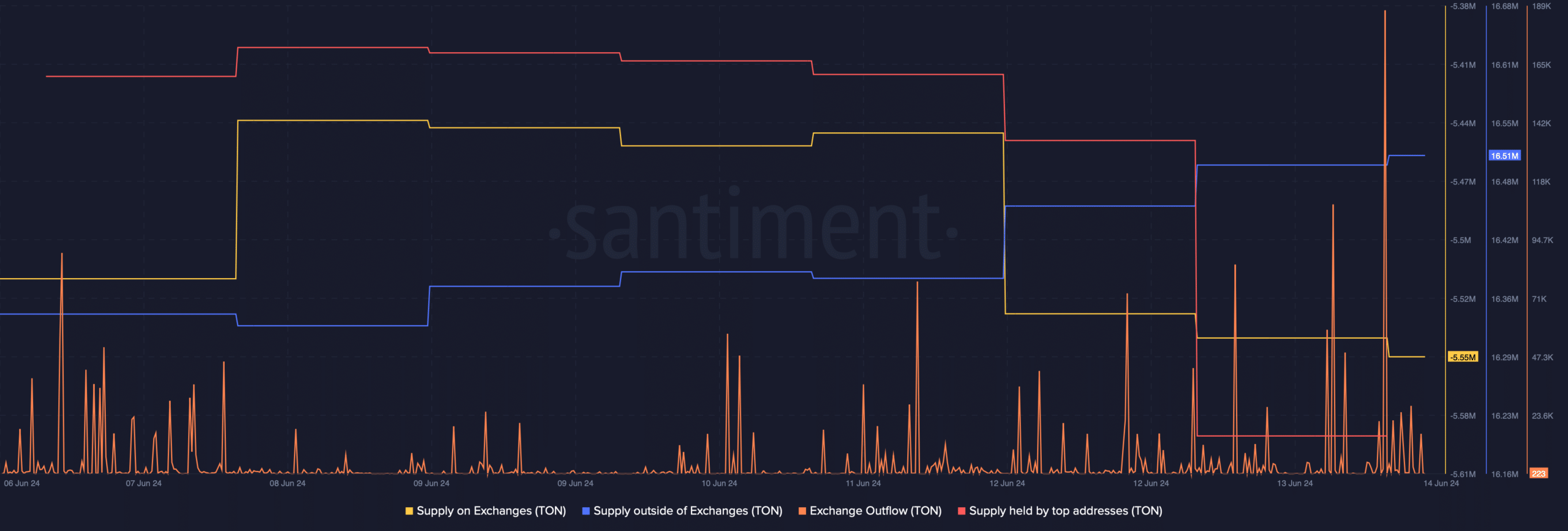

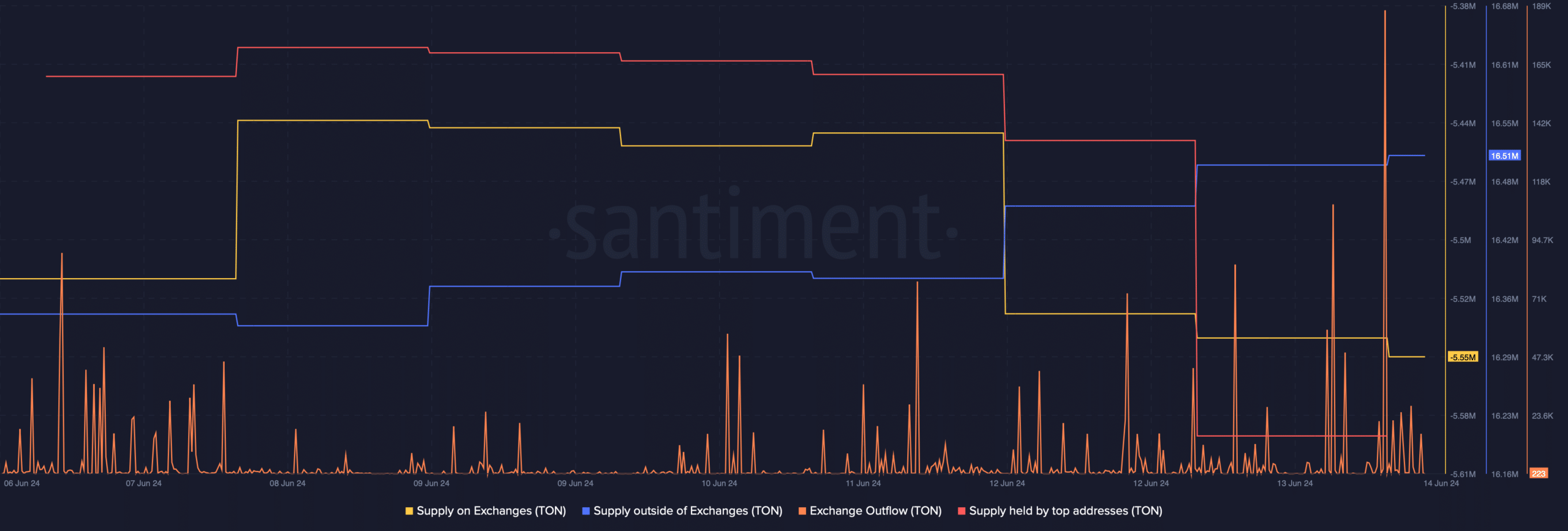

AMBCrypto then analyzed Santiment’s data to see the possibility of TON dropping to $7.2. As per our analysis, buying pressure on TON remained high, which was evident from its rise in its exchange outflow.

Its supply on exchanges dropped while its supply outside of exchange increased, further indicating high buying pressure.

However, whales chose to sell Toncoin as the supply held by top addresses dropped sharply. This selling pressure from whales might result in TON dropping to $7.2.

Source: Santiment

Read Toncoin’s [TON] Price Prediction 2024-25

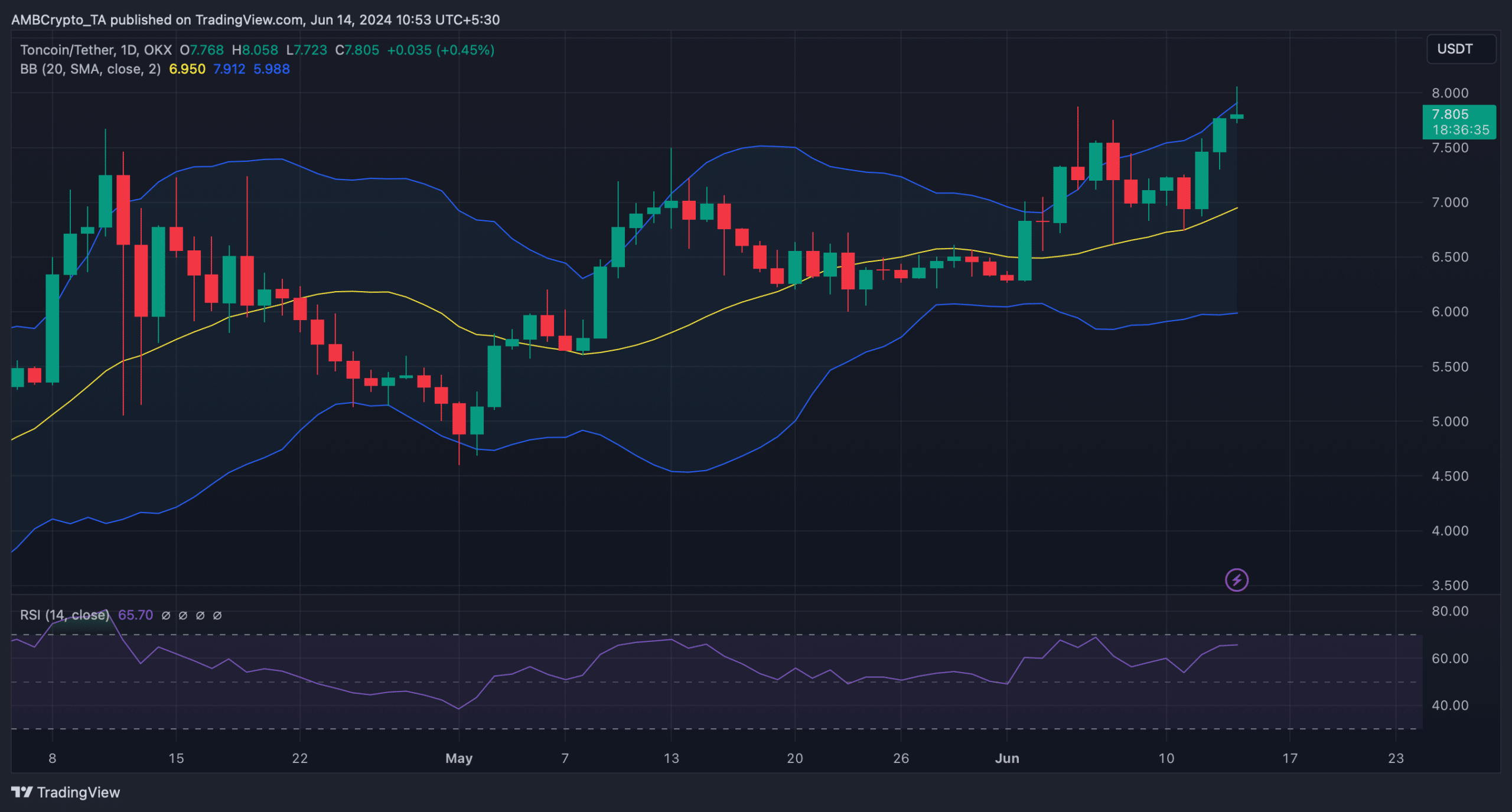

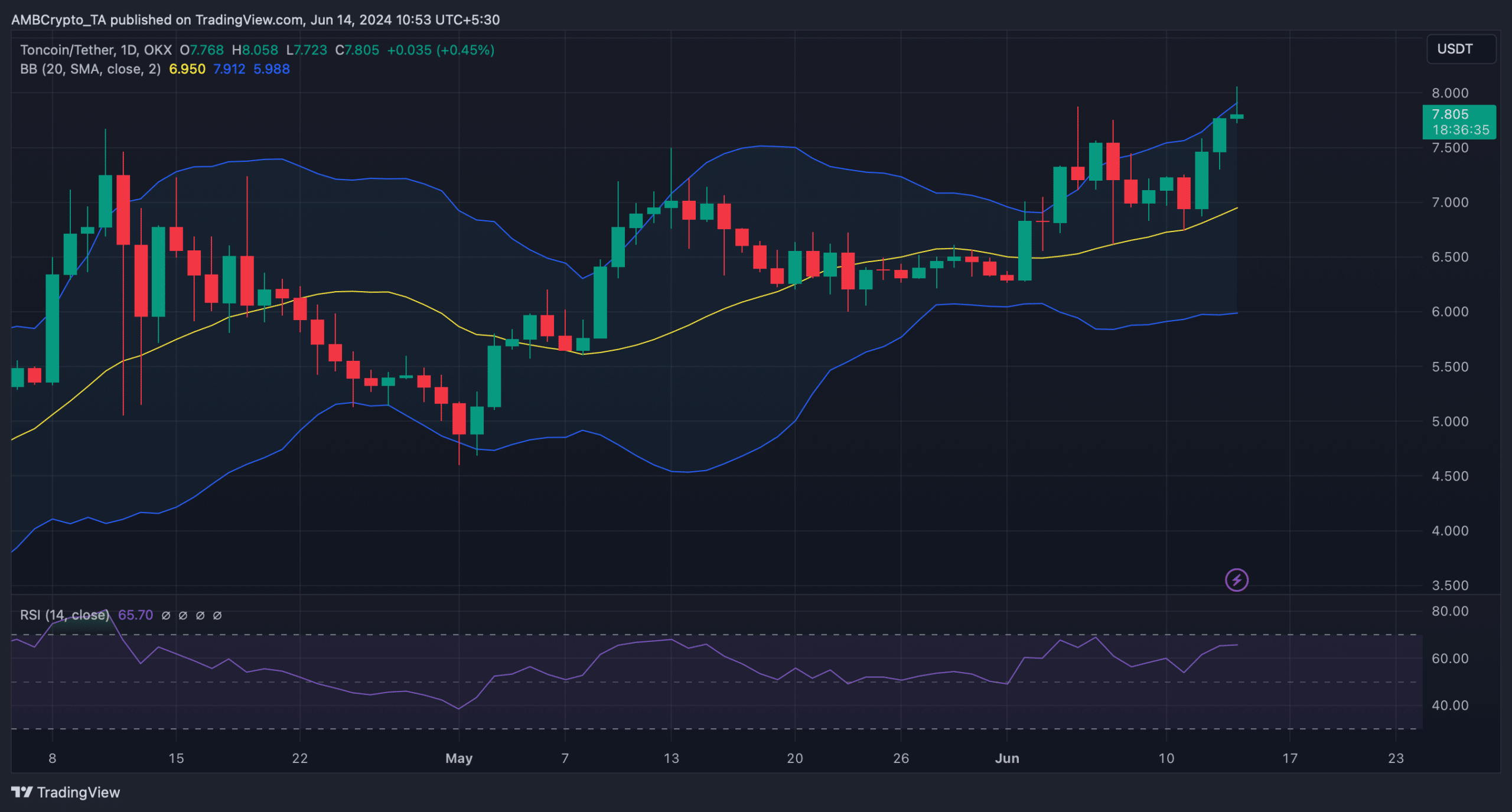

We then took a look at TON’s daily chart to better understand whether a slight price correction was on its way. As per our analysis, TON’s price touched the upper limit of the Bollinger Bands, which often results in price corrections.

Additionally, TON’s Relative Strength Index (RSI) was also near the overbought zone. If the indicator enters that territory, selling pressure might rise, which in turn might push the token’s price down.

Source: TradingView

Leave a Reply