Binance broke above 240M registered users after the latest record crypto boom. Toward the end of 2024, Binance remained the top exchange both in terms of visits and liquidity.

Binance carried the boom of 2024, expanding both its volumes and user base. Richard Teng, CEO of Binance, announced the milestone, underscoring the size of the crypto market.

https://x.com/_RichardTeng/status/1857395323016032644

Binance remains a full KYC exchange, though in the past it has been accused of hosting bot accounts or spoofed identities. However, the recent user growth is corroborated by online trends, where Binance’s app and website also grow in popularity.

Binance also showed the market still needed a central settlement hub, as it carried a big part of the traffic during Bitcoin’s run up to $93,000. Binance was also instrumental to several meme token rallies, including PEPE, NEIRO, ACT, and PNUT. Interest in Binance also rose for its recent policy to add widely distributed meme assets with no signs of insider holdings.

In the short term, Binance is a way for tokens to go through a boom. As of November 15, some of the most actively trading pairs involved DOGE and PEPE, with high activity for ACT and PNUT as well.

Binance is the market share leader with inflows from Asia and Europe

Binance still carries more than 25.5% of all exchange volumes, based on data from Messari. The exchange handles more volumes than other top competitors, including Coinbase and Crypto.com. The exchange carries one of the biggest Bitcoin (BTC) wallets, holding more than $36B in deposits. The exchange carries more than $102B in its balances, spread across leading L1 and L2 chains. The exchange is seen as more transparent due to regular on-chain reports of current reseres.

Binance is a worldwide market, with a special division for US traders. The exchange has moved its registration to the Kayman Islands for a global presence, wary of previous problems with regulations.

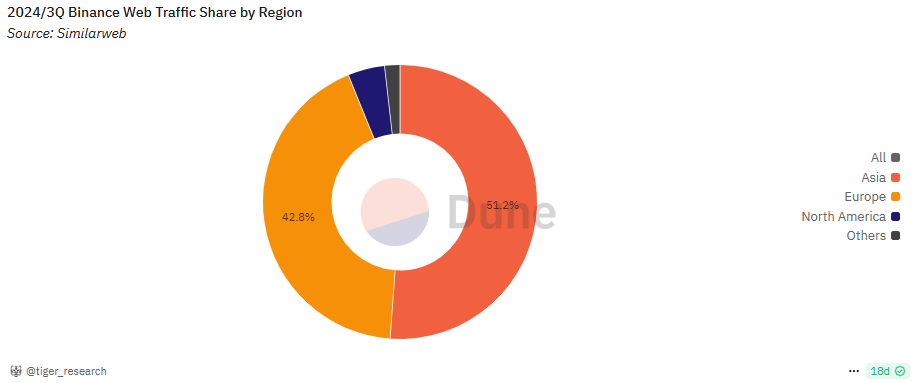

Binance also derives a big part of its volumes from Asia and Europe, based on site visit data. BinanceUS works as a separate entity, unrelated to the worldwide exchange and facing some limitations for US-based traders. Close to 35% of Binance web traffic comes from Asian countries, with 42.8% from Europe, where the exchange sees no limitations in the SEPA area.

Binance derives most of its traffic from the booming Asian and European crypto markets. | Source: Dune Analytics

For the European markets, Binance is also adapting to local regulations, swapping out products using Tether (USDT) for USDC, a more transparent stablecoin with bank-based fiat reserves. Binance will also comply with the second stage of EU requirements from 2025 onward, and is not threatened for its presence on the European market. Binance is both a retail hub and a settlement platform for larger deals, recently seeing whale inflows for profit-taking.

The top centralized DEX also reinvented its influence after swapping its leadership. Former CEO and co-founder Changpeng ‘CZ’ Zhao moved on to the technical side, recently discussing crypto tech with Vitalik Buterin.

Binance ecosystem remains less active

Binance has proven its value as a CEX, but its decentralized ecosystem lags behind other networks. Binance Smart Chain and its DEX, PancakeSwap, retain fewer users and lag behind Uniswap and Raydium.

Additionally, BNB, the native asset, hovers just over $600, with no significant breakouts to a higher tier. The Binance ecosystem also phased out Binance USD (BUSD), replacing it with the centralized FDUSD.

BNB Smart Chain is one of the busiest in terms of projects. However, those startups were added during the Web3 gaming boom and the NFT craze. Some of the projects lost their users and their value, hardly contributing to the Binance brand.

So far, the leading crypto brand seems to derive its biggest value from centralized activity. At the same time, Binance retains its incubator programs, educational hub and various models of DeFi, staking and passive income programs.

In the past years, some of the assets listed on Binance did not fare better, especially when it came to VC-backed tokens. In the recent case of Binance listings, meme tokens actually benefitted, entering a stage of price discovery.

Leave a Reply