In 2024, the NFT market faced an unexpected downturn, revealing challenging patterns as the once-booming sector struggled to maintain its momentum.

A recent study by NFTEvening and Storible agency, analyzing the performance of 29,079 new NFT collections, presents a stark reality. It shows that most NFT drops this year are failing to find lasting value or engagement.

Profit Elusive in 2024 NFT Market as Most Drops Decline

Using data from Dune Analytics and OpenSea, NFTEvening and Storible’s research focused on collections launched between January and August 2024. The study confirmed results Using OpenSea’s API and analyzed key metrics. Among them are minting and trading volumes, price movements, and trading activity to assess overall market health.

Per the research, nearly 98% of 2024’s NFT projects are effectively “dead.” This means they have experienced little or no trading activity since September. The high failure rate suggests that most new projects lose relevance shortly after launching, pointing to an oversaturation of the market.

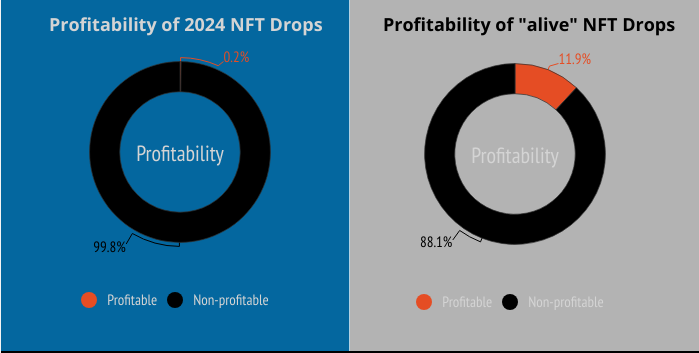

Further, only 0.2% of 2024 NFT drops have profited their investors. Even among “alive” NFTs that still see some trading activity, just 11.9% have been profitable. This reflects the challenges creators face in delivering investment returns in the current climate.

Despite the abundance of new collections, the report also notes that over 64% of 2024 NFT drops were recorded in fewer than 10 minutes. This turnout indicates difficulty in attracting initial buyers. Further compounding the problem, 98% of these projects saw fewer than 10 trades within their first week. This turnout suggests a severe lack of market interest and investor confidence.

Another finding in the research is that an overwhelming 98% of 2024 drops saw their prices fall by at least 50% within just three days of launch. This rapid devaluation highlights how quickly buyer enthusiasm wanes. It also suggests that the NFT market may no longer support speculative trading as it once did.

State of 2024 NFT Drops. Source NFTEvening

There is alsolimited value growth, with around 84% of these projects hitting an all-time high price equal to their mint price. This means they failed to appreciate in value. The lack of price growth reflects the broader cooling sentiment in a market that once thrived on speculation and high liquidity.

These findings reflect the market’s significant hurdles as it contends with an overflow of new collections, each vying for a limited pool of active buyers.

Oversaturation, Lack of Interest, and Future Directions for NFT Creators

One key takeaway from the report is the oversaturated nature of the 2024 NFT market. With an average of 3,635 NFT collections created monthly, supply has far outpaced demand. This makes it increasingly difficult for new projects to gain traction. The sharp decline in minting and trading activity signals a growing disconnect between creators and collectors, raising questions about the sustainability of an overcrowded marketplace.

In addition to the NFTEvening report, BeInCrypto recently published findings that echo the oversaturation issue. It noted a “dead project” phenomenon. This points to a similar trend, where an overwhelming number of NFTs fail to maintain relevance or trading volume after launch. It suggests that the market is flooded with projects that are unable to deliver lasting value.

The gap between successful and failing collections, as well as variations in project lifespan, reveal that the NFT market is no longer the golden goose it once appeared to be.

As the NFT market becomes more challenging, creators and project teams are at a crossroads. To survive, projects must offer more than simple collectibles. Building a sustainable, engaged community, providing genuine utility, and fostering long-term value has become essential for standing out. As rapid drops and “flip” culture lose their appeal, a shift toward community-oriented and utility-based NFTs may become the standard.

Meanwhile, investors must exercise caution and thoroughly vet projects to avoid losses in a market where profitability is increasingly elusive.

Leave a Reply