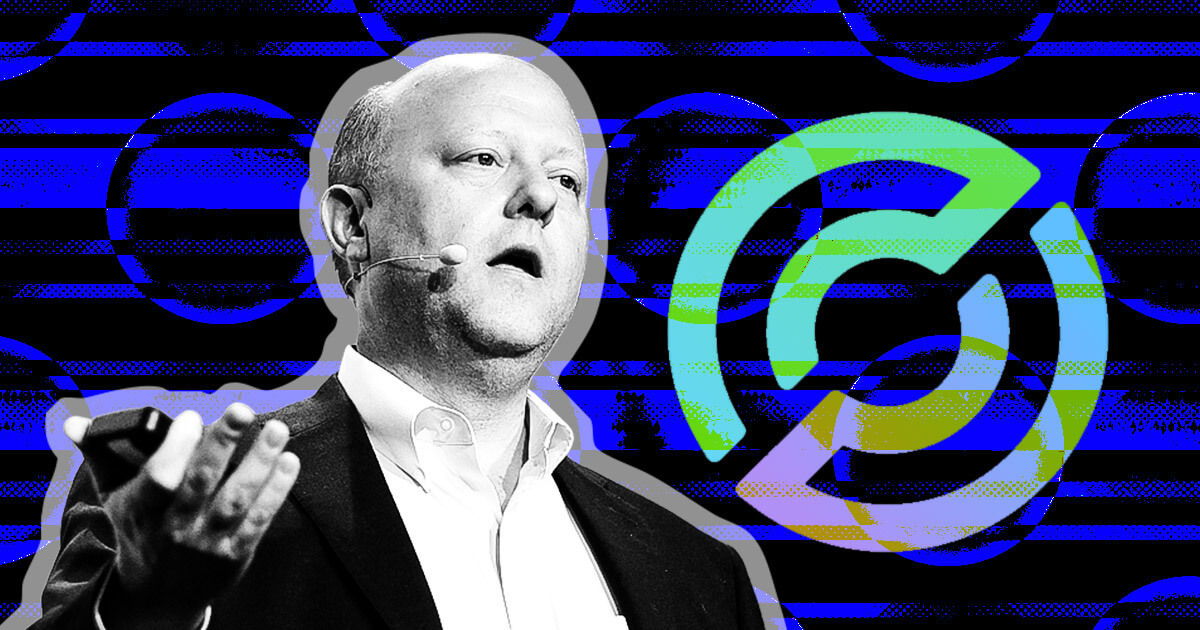

Circle CEO Jeremy Allaire said stablecoins are poised to become essential financial instruments globally due to their potential to streamline cross-border trading and drive efficiency in emerging markets, South China Morning Post reported.

Speaking at Hong Kong FinTech Week 2024 on November 5, Allaire positioned stablecoins, specifically USDC, as a key component in modernizing global trade agreements, seeing them as the foundation for “better, faster, cheaper” financial transactions.

Testing ground

Allaire highlighted that many importers in developing regions already rely on Hong Kong to manage trade flows, making the city a critical testing ground for stablecoin solutions.

He said:

“Stablecoins are reshaping the financial infrastructure, enabling trade deals that reduce friction and costs.”

Circle, which is hosting its inaugural Circle Forum in Hong Kong, marked the occasion by announcing two key partnerships: an agreement with Hong Kong Telecom (HKT) to explore blockchain-based loyalty programs and a collaboration with Thunes to use USDC for cross-border transactions.

The initiatives are part of Circle’s commitment to leverage stablecoins for practical applications in commerce.

While this year’s FinTech Week focused on artificial intelligence and tokenization, stablecoins and central bank digital currencies (CBDCs) emerged as dominant themes shaping Hong Kong’s Web3 strategy.

With the Hong Kong Monetary Authority planning to issue new stablecoin regulations by the end of the year, Circle’s approach reflects its willingness to comply with regulatory frameworks globally.

Allaire emphasized the company’s position as a responsible, compliant entity in the evolving digital financial landscape, stating:

“We have been a regulated player from the start and expect stablecoins to become an integral financial infrastructure worldwide.”

Stablecoin adoption

According to Allaire, Hong Kong’s role as a global trading hub has made it an ideal environment for stablecoin adoption. The city’s unique regulatory environment and international financial connections place it at the forefront of stablecoin experimentation and implementation.

However, Circle’s CEO acknowledged that the company’s operations in mainland China would remain limited due to strict regulations banning commercial crypto activities. Instead, he predicted a robust “offshore stablecoin” market that would support seamless currency exchange and improve the efficiency of cross-border transactions.

Allaire also suggested that major tech companies such as Ant Group or Tencent Holdings entering the stablecoin market could further strengthen stablecoin use. He said such developments would likely complement Circle’s efforts and create a diverse, interoperable landscape that supports digital commerce across borders.

He stated:

“A broader stablecoin ecosystem involving these companies would advance our shared goal of building a global financial infrastructure that can meet the demands of today’s trading and digital economies.”

Leave a Reply