Currently, the crypto market stands at a valuation of $2.33 trillion. This has witnessed a massive surge in the past two months, with Bitcoin momentarily crossing over the $73,000 mark.

However, over the past few days, the correction in Bitcoin has dropped its market value to $69,674. Currently, it has registered a 0.61% surge in the past 24 hours and a 3.88% jump in 7 days.

Despite the short-term setback, dropping the weekly return gains, the 30-day Bitcoin registers a 13.60% jump in the last 30 days. With the upcoming U.S. presidential elections, the growing institutional demand, and the hype of a bullish end to 2024, will the Bitcoin price surge to a new all-time high? Let’s find out.

Bitcoin Price Prediction Amid U.S. Presidential Elections

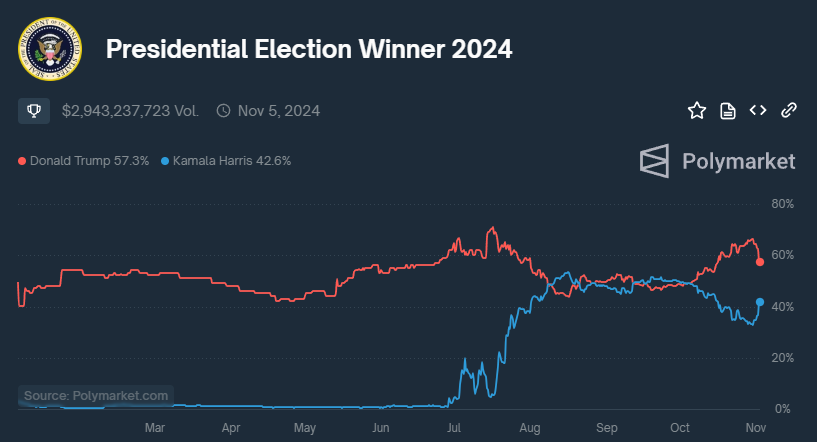

U.S. presidential elections remain a key catalyst in driving the current Bitcoin prices. Over Polymarket, users anticipate Donald Trump winning the elections by 57.5%. This is remarkably supported by $1.15 billion of trading volume. Meanwhile, Kamala Harris stands at 42.5% of chances.

The pro-stance of Donald Trump towards Bitcoin and other cryptocurrencies makes his possible winning a potential bullish catalyst for Bitcoin.

Per the daily chart, the BTC price is struggling to surpass its all-time high level of nearly $73,600. If Donald Trump wins the U.S. elections, BTC prices are expected to surge.

Furthermore, if either candidate wins, the broader market anticipates a 0.25 basis point cut in interest rates. Hence, the BTC price will likely surge higher to the 1.272 Fibonacci level at $79,000.

Institutional Support Grows For Bitcoin

The growing institutional demand for Bitcoin has been a crucial driving force. Over the past four weeks, U.S. spot Bitcoin ETFs have registered a net positive inflow.

Leading the trend, BlackRock’s IBIT now has a total net asset of $29.95 billion, followed by Grayscale’s GBTC of $15.22 billion.

What If Trump Loses?

In case Donald Trump loses the elections, the growing positive stance from Kamala Harris might play a positive role for Bitcoin. However, the general market sentiment anticipates a minor setback for the crypto market if Donald Trump loses.

In such a case, the BTC price is likely to find support near the $65,000 support level. However, the potential rate cuts following the US presidential elections will reignite the bullish trend. Hence, the loss of Donald Trump might be a bittersweet situation for Bitcoin holders.

Curious to know if Bitcoin will hit $100,000 in 2024? Find a technically and logically driven answer in Coinpedia’s BTC price prediction, and subscribe to us for the latest crypto updates!

Leave a Reply