Sergey Nazarov, co-founder of Chainlink, confirmed today that the integration of Swift’s traditional payment system with blockchain technology has reached a production-ready stage.

Nazarov made this crucial revelation at the Sibos 2024 conference currently holding at the China National Convention Centre in Beijing. This year’s Sibos brings together financial services leaders from around the world. Nazarov’s announcement marks an important milestone for digital asset transactions in traditional finance.

Chainlink Swift Blockchain Payment Integration for TradFi

Chainlink has been collaborating with Swift for several years to enable the use of Swift messages and standards to seamlessly interact with blockchains. Nazarov highlighted that the once-conceptual blockchain integration has now moved to a pre-production stage, allowing institutions to begin real-world testing.

“We’re now at a point where this system is ready to be integrated with your existing institutional systems,” he said during his keynote address.

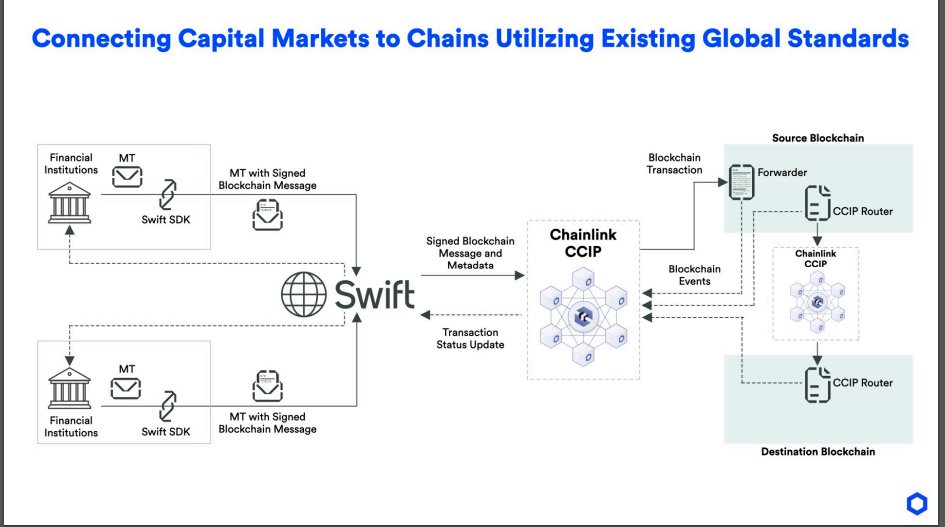

The system operates through a pre-settlement phase, where traditional Swift messages communicate transaction details such as settlement status and intent. Following this, the process shifts to the blockchain, where Chainlink facilitates the conversion of Swift messages into on-chain events.

Nazarov explained that this integration allows financial institutions to use Swift’s existing infrastructure for blockchain transactions, whether for tokenized funds, real-world assets, or Central Bank Digital Currencies.

The innovation lies in the ability to reuse Swift’s off-chain payment system to settle digital asset transactions, making it easier for institutions to adopt blockchain technology without overhauling their current operations.

Financial Institutions Can Test Chainlink-Swift Payment Integration

As a major part of this new process, Chainlink converts payment confirmation messages from Swift into on-chain events, enabling traditional payments to settle digital assets. The system also ensures that assets are unlocked and transferred on-chain after payment confirmation.

Slide from Chainlink co founder presentation

“This is not just a concept or a plan — it’s a product you can start integrating today,” Nazarov emphasized. The demo system is available at Chainlink’s booth at Sibos, giving financial institutions a firsthand look at how Swift messages can be used for blockchain interactions at minimal cost.

Chainlink (LINK) Price Action

However, this pivotal announcement from Chainlink has yet to positively impact the market value of its native asset, LINK. At press time, LINK is trading at $11.37, down by 7% over the last 24 hours.

Leave a Reply