Key takeaways

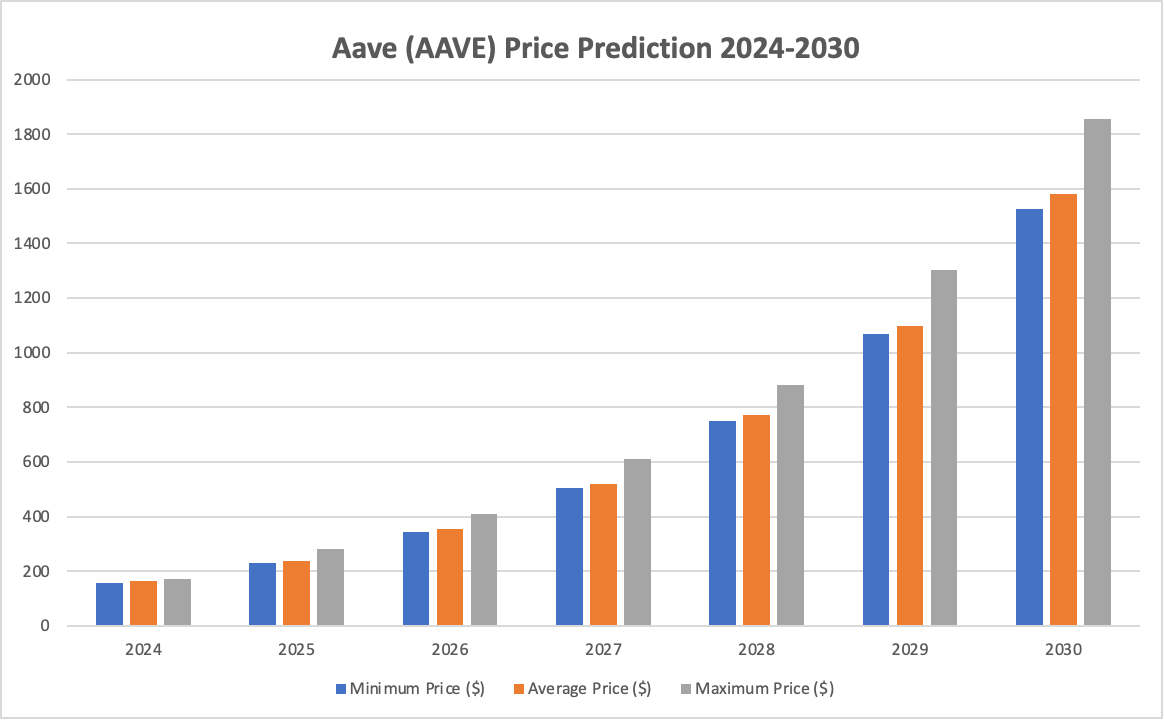

- AAVE price prediction for 2024 could reach a maximum value of $172.28.

- By 2027, AAVE could reach a maximum price of $611.58.

- In 2030, AAVE will range between $1,525 to $1,854.

Aave is a leading decentralized finance (DeFi) protocol on the Ethereum blockchain, known for its innovative financial solutions such as flash loans, which allow users to borrow instantly without collateral, and dynamic interest rates that adapt to market conditions. Participants in the Aave ecosystem can deposit their digital crypto assets back into liquidity pools to earn their interest payments or obtain loans by borrowing funds without providing collateral. Aave’s governance and fee distribution are significantly driven by its native token, AAVE, enhancing its utility and value within the platform.

Having touched its ATH at $666.86 in May 2021, will AAVE reach new heights despite the recent market downturn and consolidations? Let’s get into the Aave technical analysis and predictions.

Overview

Aave price prediction: Technical analysis

Aave price analysis 1-day chart: AAVE is consolidating, next stop $160.58 or bearish takeover?

TL;DR Breakdown

- Aave (AAVE) is currently consolidating.

- AAVE’s crucial support level is present at $149.73.

- A breakout above $160.58 could see AAVE retest $165.84.

The AAVE/USD price analysis for October 21 shows price consolidation, with potential downside if the bears take full control. With a 3.23% price loss in 24 hours, AAVE could push for lower highs.

Aave price analysis 1-day chart: AAVE could retest support at $149.73 if the bulls fail to push higher

The AAVE/USDT 1-day price chart shows the coin consolidating within the $150 – $160, with key support levels at $149.73, and $143.35. AAVE’s recent price action suggests it’s made an attempt at the $160.58 resistance. A bullish push above this level could see AAVE reach $165.

AAVE could retest support at $149.73 if the bulls fail to push higher

The Relative Strength Index (RSI) is at 51.36, indicating that AAVE is neither underbought nor oversold. This corroborates the current price consolidation, with the possibility of a price breakout in either direction. If AAVE fails to break above $160.58, we could see a pullback to the $149.73 support, where buying interest may re-emerge.

Aave price analysis 4-hour chart

The 4-hour AAVE/USD chart shows a clear head and shoulders pattern, signaling a possible bearish reversal. This pattern suggests that after reaching the high around $190 (the head), the price lost momentum and started declining.

AAVE/USD chart shows a clear head and shoulders pattern

The position of the right shoulder at a lower peak shows weakening market strength. The key support level for AAVE is around $140, as shown by the two bottoms formed. A further drop is likely if AAVE’s price fails to hold there.

The MACD indicator reflects negative momentum, with the MACD line below the signal line, hinting at a potential continuation of the bearish trend. Unless AAVE sees strong buying momentum, the outlook leans bearish.

Aave technical indicators: Levels and action

Daily simple moving average (SMA)

Daily exponential moving average (EMA)

What to expect from AAVE price analysis?

Our analysis shows that the AAVE is consolidating with potential for further bearish downturn if the coin fails to break past $160. A bearish continuation could see AAVE retest support around $140.

Is AAVE a good investment?

Aave provides essential infrastructure for lending and borrowing within DeFi, expanding beyond traditional applications into areas like gaming, NFTs, and dApps. Its AAVE token plays a vital role in powering the platform, making it a strong choice for investors due to its proven market success and continuous development.

Where to buy AAVE?

AAVE tokens can be traded on centralized crypto exchanges. The most popular exchange to buy and trade Aave is Binance, which is one of the largest cryptocurrency exchanges in the world, offering a wide range of cryptocurrencies, including AAVE. Coinbase and Bitfinex which offers a variety of trading pairs and support AAVE.

Will Aave recover?

Aave’s founder, Stani Kulechov, said in an August 5 post on X that the protocol successfully handled the overall stress across 14 active markets on various Layer 1 and Layer 2 blockchains, securing $21 billion in value. Stani noted that Aave’s revenue surge was mainly fueled by decentralized liquidations, a mechanism that helps maintain market stability by automatically selling off collateral when positions fall below required levels.

Will Aave reach $100?

Aave (AAVE) can potentially reach $100 if it breaks through the current resistance levels and gains momentum from positive, market sentiment and trends. Recent price movements suggest that a recovery to this level is feasible with increased trading activity and investor interest.

Does Aave have a good long-term future?

Aave shows potential for a good long-term future, given its ability to stabilize and recover after significant declines. The consistent support of around $79.8 indicates resilience and potential for future growth.

Recent news/opinion on AAVE

- Trump’s World Liberty Financial proposes Aave integration for his crypto venture

Donald Trump’s DeFi platform, World Liberty Financial, filed a governance proposal on October 9 to launch on Aave V3. The proposal describes how the platform will be introduced on the Ethereum (ETH) mainnet, with Aave serving as the protocol’s backend infrastructure.

- Grayscale Launches AAVE Trust

Grayscale has introduced its AAVE Trust, offering accredited investors indirect exposure to Aave’s decentralized finance platform through AAVE tokens.

Aave price prediction October 2024

Aave could experience an uptrend in October, reaching $161.59 at the end of the month. The minimum price projected for the coin is around $115.50, while the average is around $148.87.

Aave price prediction 2024

In Q4 of 2024, the value of AAVE might reach a maximum value of $172.28, a minimum price of $157.3 and an average price of about $164.69.

Aave price prediction 2025-2030

Aave (AAVE) Price Prediction 2025

The AAVE price prediction for 2025 anticipates a surge in price, resulting in a maximum price of $280.13. Based on expert analysis, investors can expect an average price of $236.98 and a minimum price of about $228.74.

Aave Price Forecast 2026

According to the AAVE price forecast for 2026, Aave is anticipated to trade at a minimum price of $342.65, a maximum price of $408.12, and an average price of $354.49.

Aave Price Prediction 2027

The AAVE price prediction for 2027 indicates a continued rise with minimum and maximum prices of $505.91 and $611.58, respectively, as well as an average price of $520.09.

Aave Price Prediction 2028

Aave price is expected to reach a minimum of $749.73 in 2028. The maximum expected AAVE price is $882.80, with an average price of $770.53.

Aave Price Prediction 2029

The AAVE price prediction for 2029 estimates a minimum price of $1,067, a maximum price of $1,302, and an average price of $1,098.

Aave Price Prediction 2030

The Aave price prediction for 2030 suggests a minimum price of $1,525 and an average price of $1,580. The maximum forecasted Aave price is set at $1,854.

AAVE/USD price prediction chart

AAVE market price prediction: Analysts’ AAVE price forecast

Cryptopolitan’s Aave (AAVE) price prediction

According to our AAVE price forecast, the coin’s market price might reach a maximum value of $170.89 by the end of 2024. Looking forward to 2026, the average Aave price could surge to $268.76.

AAVE’s historic price sentiment

AAVE/USD price history ⏐ Source: Coinmarketcap

- Launched as ETHLend in 2017, a peer-to-peer digital asset lending and borrowing platform; raised $16.2 million during the ICO. Rebranded to AAVE in 2018, with ETHLend becoming a subsidiary.

- In January 2020, the AAVE protocol went live on the Ethereum mainnet. By August, it became the second DeFi protocol to reach $1 billion in total value locked. The FCA awarded AAVE an EMI license, boosting LEND by 30%.

- Aave v3 launched on the Ethereum mainnet on 16 March 2022; AAVE surged 114% to $261.29 by 1 April. By mid-August, it recovered slightly to just over $100 but declined again towards the end of the year, trading between $50 and $60.

- From late January to March 2023, AAVE showed an uptrend, trading around $80 to $90. AAVE closed 2023 at about $109.

- Between January and April 2024, AAVE was on an upward trend, reaching a high of $142. Between May and June, it fluctuated between $77 and $113. In August, it opened at $95.07 and closed at $129.8, while in September, AAVE reached a peak price of $178.25. At the time of writing, AAVE is trading within the range of $159.64 – $159.82.

Leave a Reply