- Avalanche has been unable to break the $30 resistance zone for a month.

- The price action and the indicators showed that a short-term range formation is likely.

Avalanche [AVAX] has slowly trended higher since early August. It is up by close to 78% from the lows it set on the 5th of August nearly three months ago.

During this time, Bitcoin [BTC] and Ethereum [ETH] are up by 36.5% and 23.8% respectively.

This means Avalanche crypto has outperformed the largest, most popular assets, by a decent margin. Yet, the token is not ready for a long-term uptrend.

Avalanche is not in a strong trend

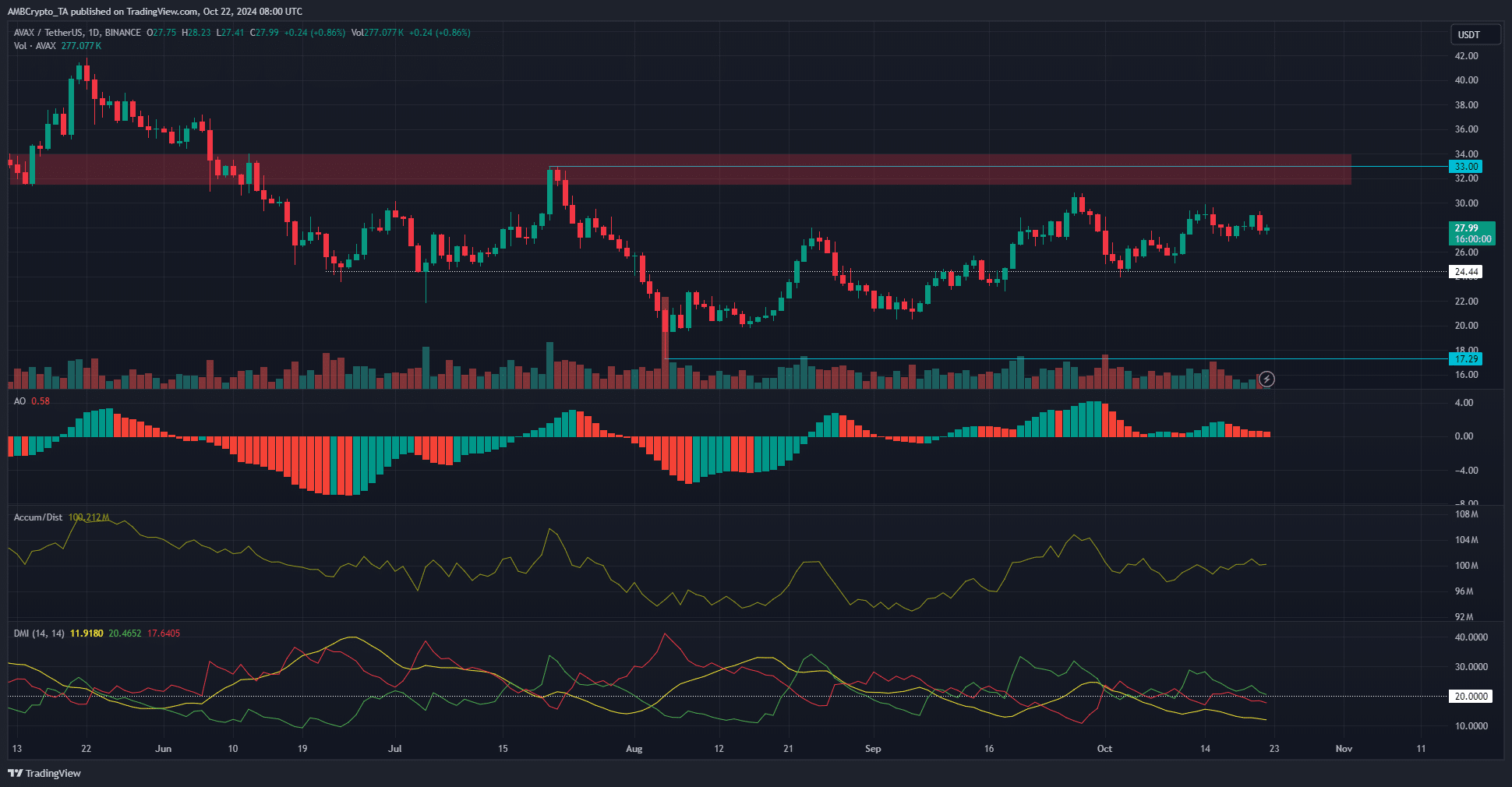

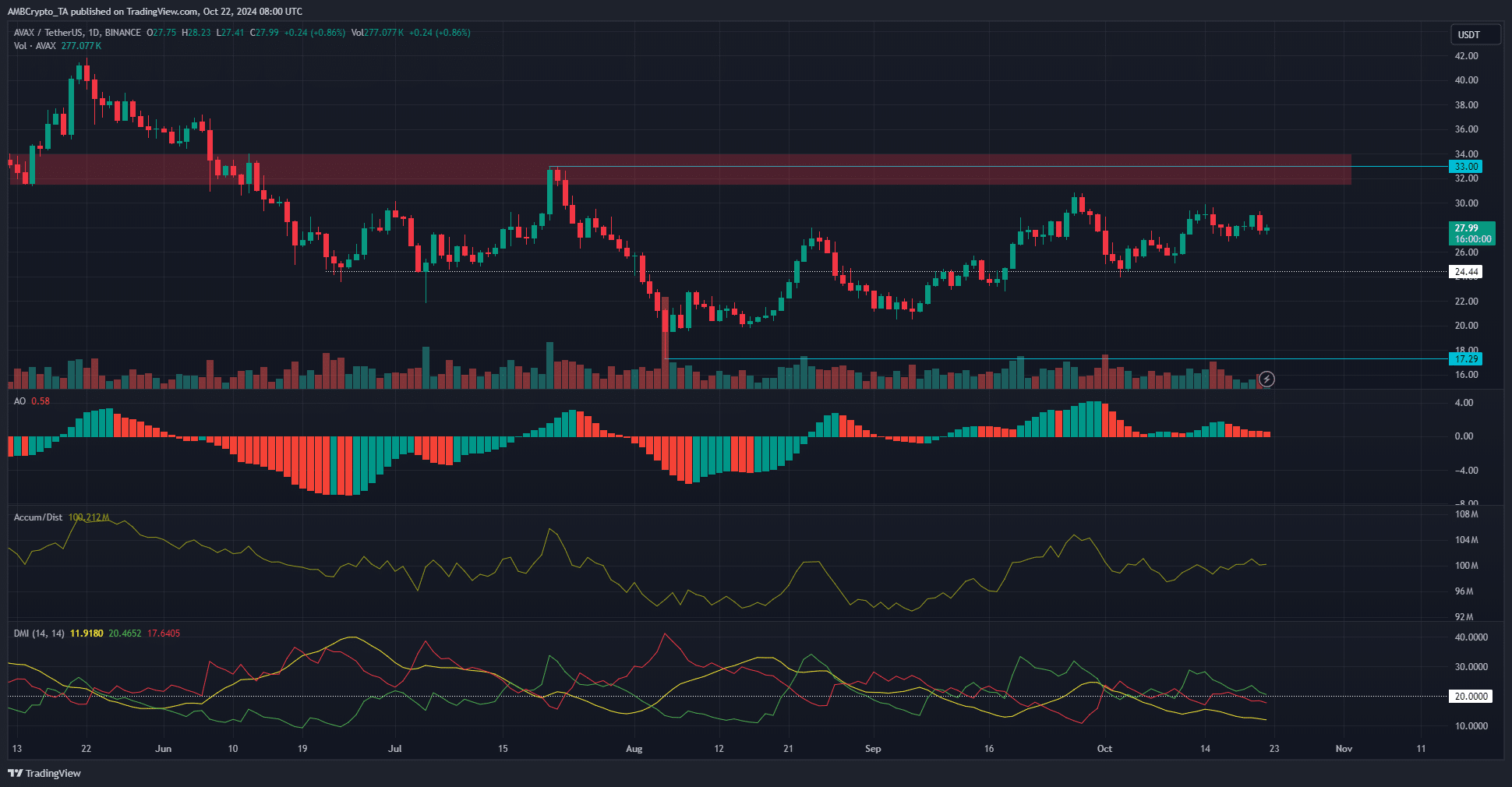

Source: AVAX/USDT on TradingView

The Awesome Oscillator histogram was nearing the zero mark, and the red bars showed that the bullish momentum was fading. The market structure was bullish, but the trend has slowed down in the past three weeks.

This was reflected in the DMI, with the ADX (yellow) below 20. This showed that a strong trend was not in progress. The A/D indicator was also flat in October, showing a lack of steady buy or sell pressure.

The indicators backed up the price action that demonstrated a lack of a trend. There were some bullish signs, but the $30 psychological level was standing strong.

Unless the volume picks up, traders can expect a small range formation between $27.2 and $29.8.

Magnetic zone at $30 is of interest

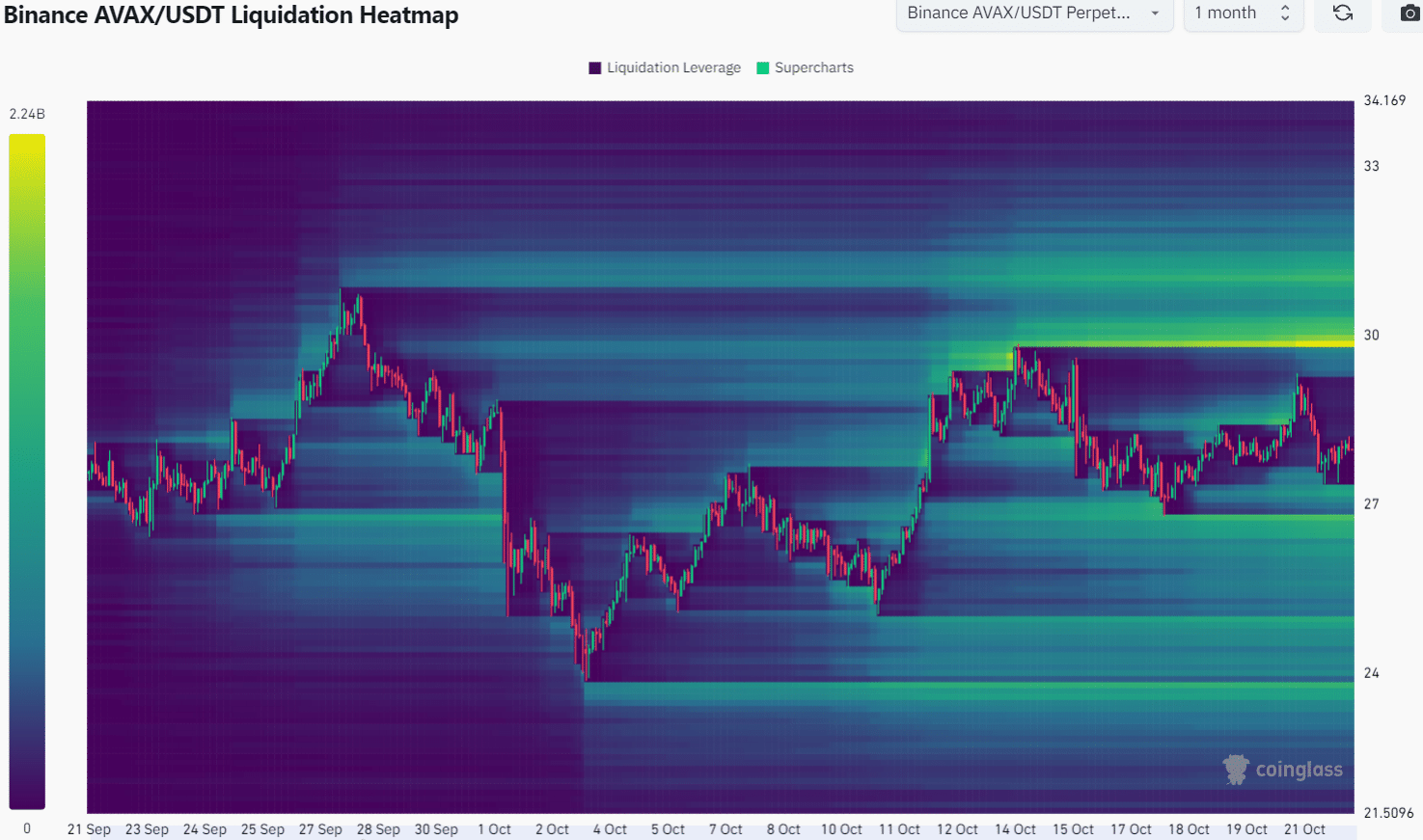

AMBCrypto found that the $30 zone had a cluster of liquidity around it. Similarly, the $27 region also saw a build-up of liquidation levels.

This finding supports the idea of a range formation in the coming days for Avalanche crypto.

Is your portfolio green? Check out the Avalanche Profit Calculator

It is unclear which of the two magnetic regions would be tested first. The $30 zone is a stronger magnet, but it is further away.

Therefore, traders should treat a retest of $27 as a buying opportunity and get ready to act in case of a positive reaction.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Leave a Reply