- Ethereum saw a surge in deposits over withdrawals.

- ETH’s price patterns showed a potential breakout.

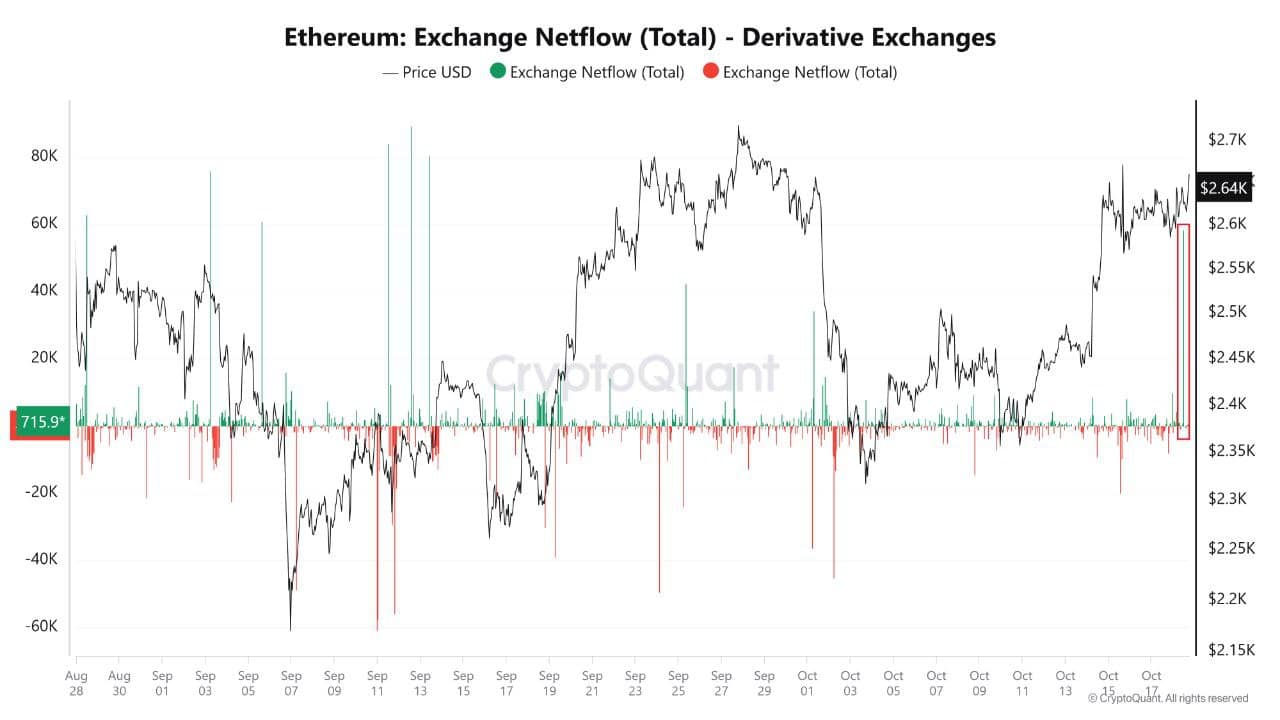

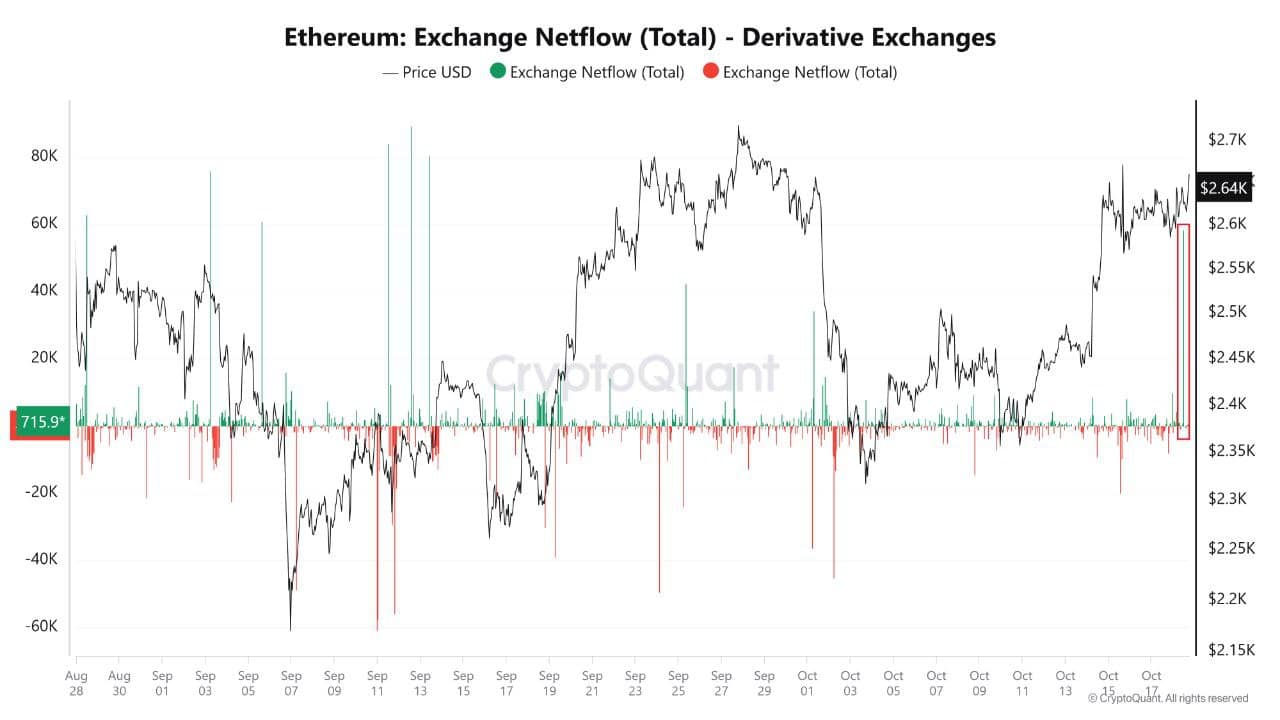

Ethereum’s [ETH] netflows on derivative exchanges recently surpassed 50,000 ETH per day, indicating a significant surge in deposits over withdrawals.

This trend has traders speculating about the potential impact on ETH price movements.

A spike in deposits may signal either impending selling pressure or increased borrowing to fuel long positions, suggesting volatility is on the horizon.

With market participants anticipating major price swings, Ethereum’s outlook for the coming months could be a key focus for investors.

Source: CryptoQuant

ETH price and inflation rate

Ethereum’s price action has remained in the spotlight. Over the past week, ETH has risen by 8.53%, and as of press time price stood at $2605.63.

ETH/USDT is currently positioned within an ascending triangle, and a breakout from this pattern could push the price higher. The next key target for ETH is $2800, which could be surpassed if the bullish momentum continues.

On the ETH/BTC pair, it is trading near a critical support level at $0.039 on the weekly chart. Despite bearish sentiment in the market, this support level has held firm, indicating the possibility of a bounce.

Such a rebound could not only benefit ETH but also spark a broader rally in the top 100 altcoins.

Source: TradingView

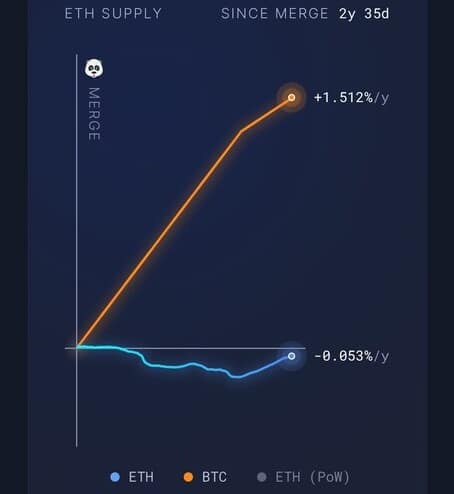

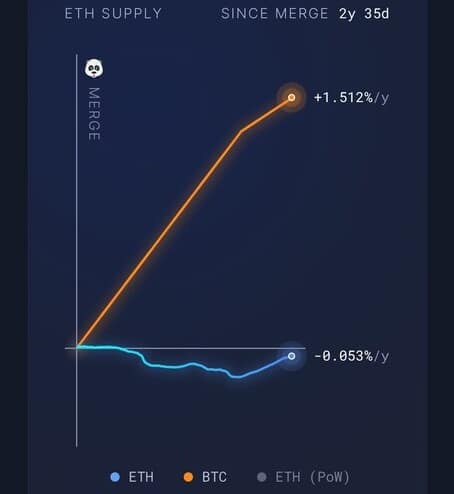

Inflation remains a crucial factor in Ethereum’s overall market performance. Currently, Ethereum’s inflation rate stands at +0.31% per year, a figure lower than both Bitcoin and gold.

Since the Merge, which transitioned Ethereum to Proof-of-Stake, over 135,000 ETH have been burned, reducing supply. This burn mechanism has continued to enhance its deflationary aspect.

Despite the subdued price movement in recent months, the network’s growing demand and deflationary characteristics are setting the stage for potential long-term price increases.

The combination of Ethereum’s supply reduction and increasing network usage is likely to drive ETH prices higher in the future.

Source: X

Leading smart contract platform

Ethereum’s dominance as the leading smart contract platform remains unchallenged. Since its inception in 2015, Ethereum has been the foundation for innovation in the DeFi and NFT sectors.

With ETH 2.0 now live, the network is more scalable, secure, and energy-efficient than ever before. These advancements are contributing to Ethereum’s continued growth in the blockchain space.

Read Ethereum’s [ETH] Price Prediction 2024–2025

The ongoing development and use of Ethereum’s blockchain, coupled with its reduced inflation and deflationary mechanisms, are key drivers behind the expectation of higher prices.

Ethereum is well-positioned for strong performance in the near term. Keeping a close eye on Ethereum’s next moves is needed, especially with the potential for gains as 2025 approaches.

Leave a Reply