- Bitcoin’s Open Interest soared while its supply on exchanges dropped sharply

- A price correction could push BTC down to $66k or even $62k

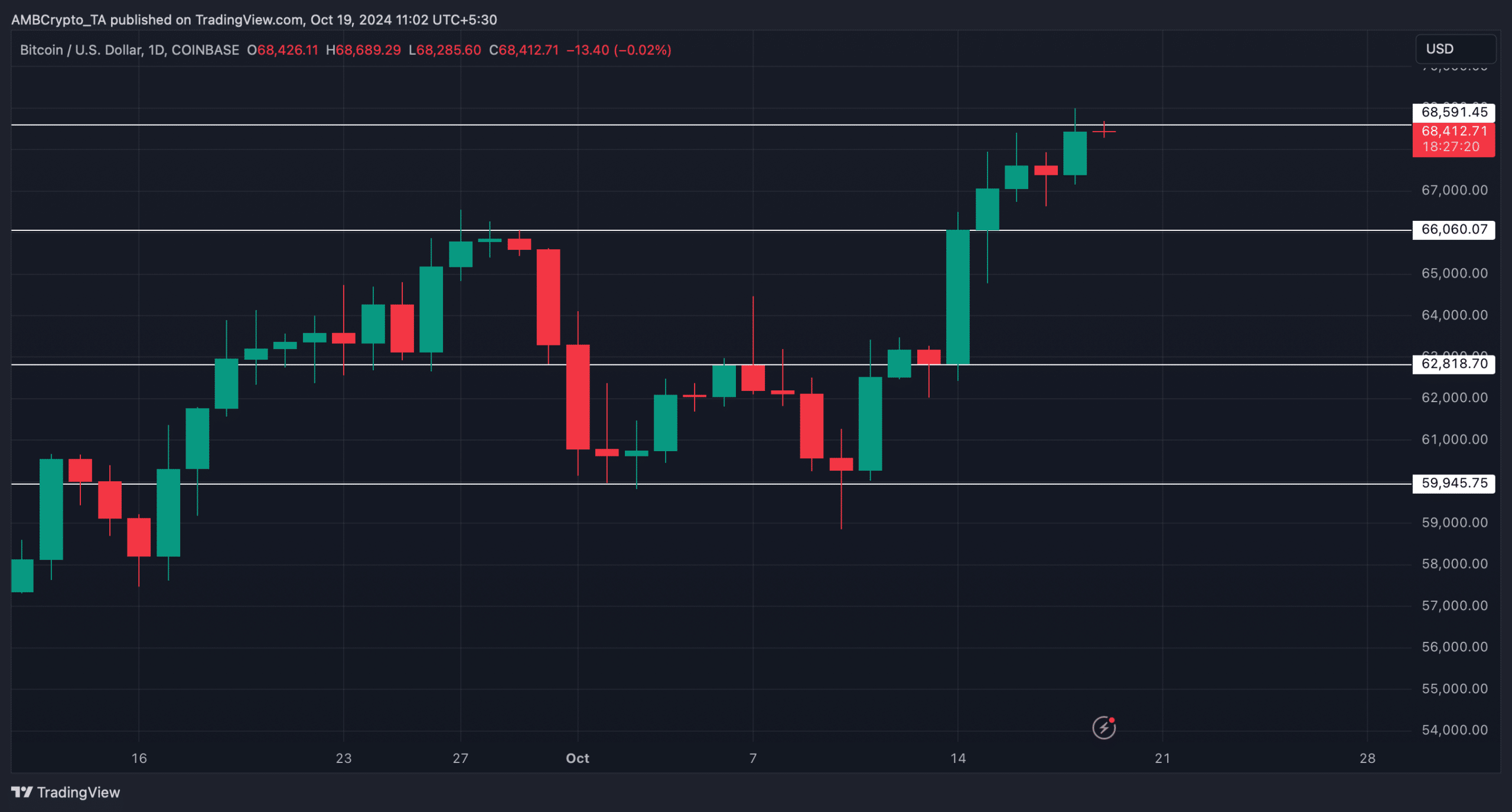

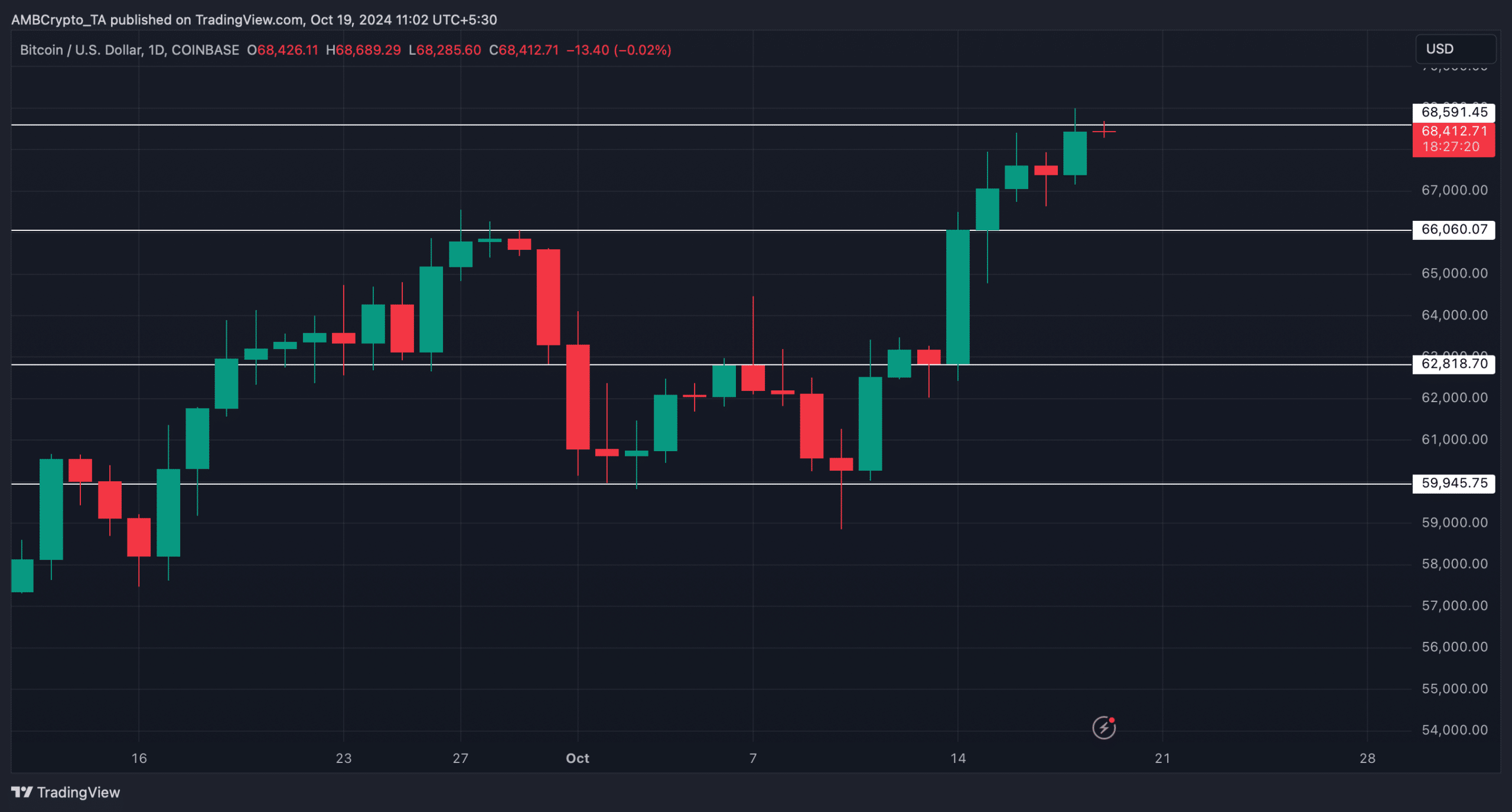

Bitcoin [BTC] has been on steady hike over the past week. In fact, its latest bull trend allowed the king coin to cross $68k on the price charts. However, the prevailing trend might change soon, albeit for a short while.

This seemed to be the case, especially as a bearish divergence appeared on Bitcoin’s price chart.

Bitcoin’s major strengths

According to CoinMarketCap, the crypto’s price appreciated by over 9% last week, allowing it to jump above $68k. AMBCrypto reported previously a few developments that could have played a major role in BTC’s most-recent rally.

For instance, Bitcoin’s supply held on exchanges dropped to a 5-year low. This clearly meant that buying sentiment was dominant in the market – Hinting at a price hike.

Apart from that, AMBCrypto also reported how BTC’s Open Interest soared. To be precise, Bitcoin’s Open Interest hit a record $20 billion, just 8% below its ATH. Whenever the metric rises, it means that the chances of the ongoing price trend continuing are high.

Satoshi Club, a popular X handle that shares updates related to cryptos, recently posted a tweet highlighting yet another major development. According to the same, BTC’s supply held by addresses that bought in the last 12 months is now at a 2-year high. This trend has accelerated recently on the back of ETFs seeing inflows of $2.1 billion over the last five days.

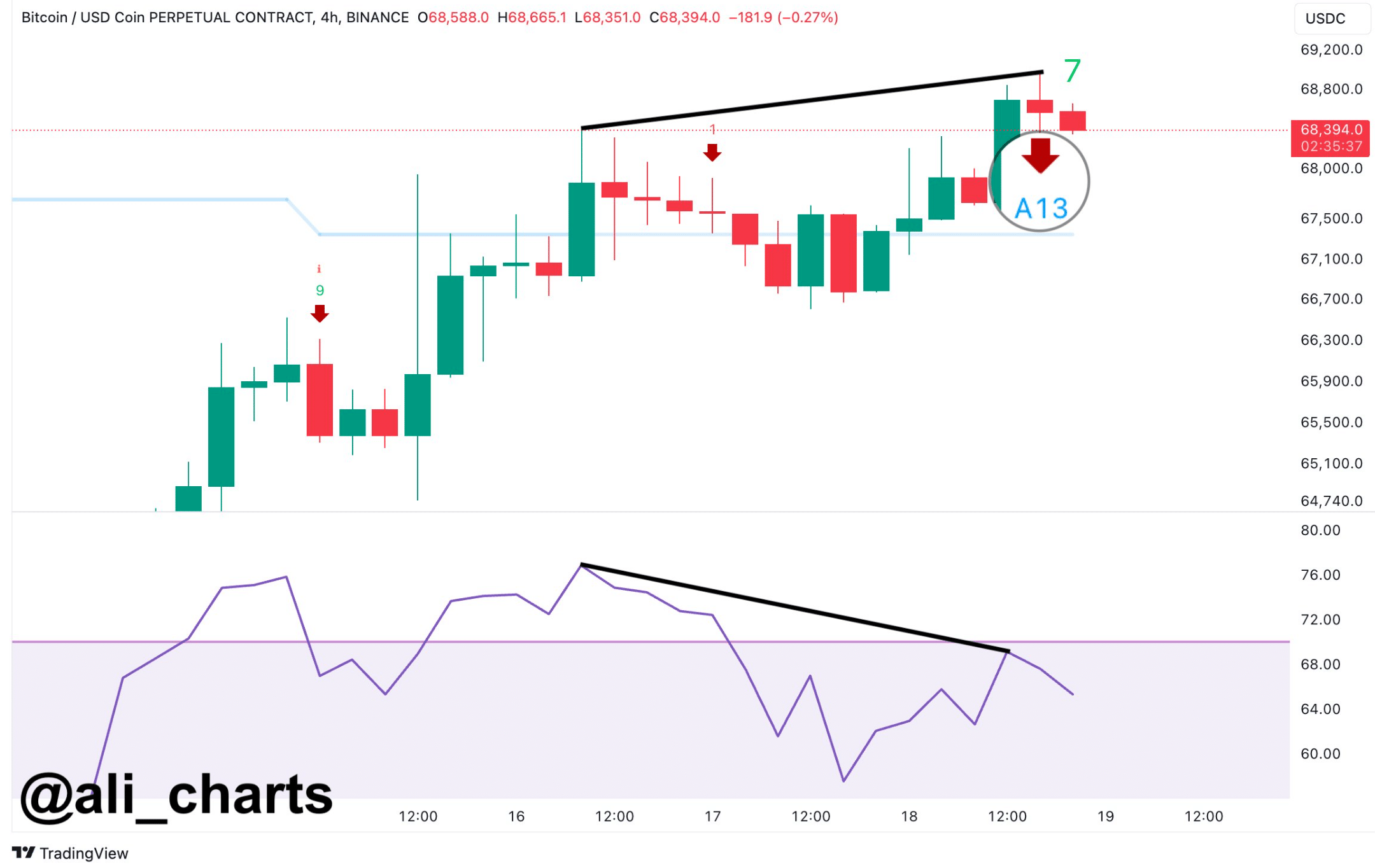

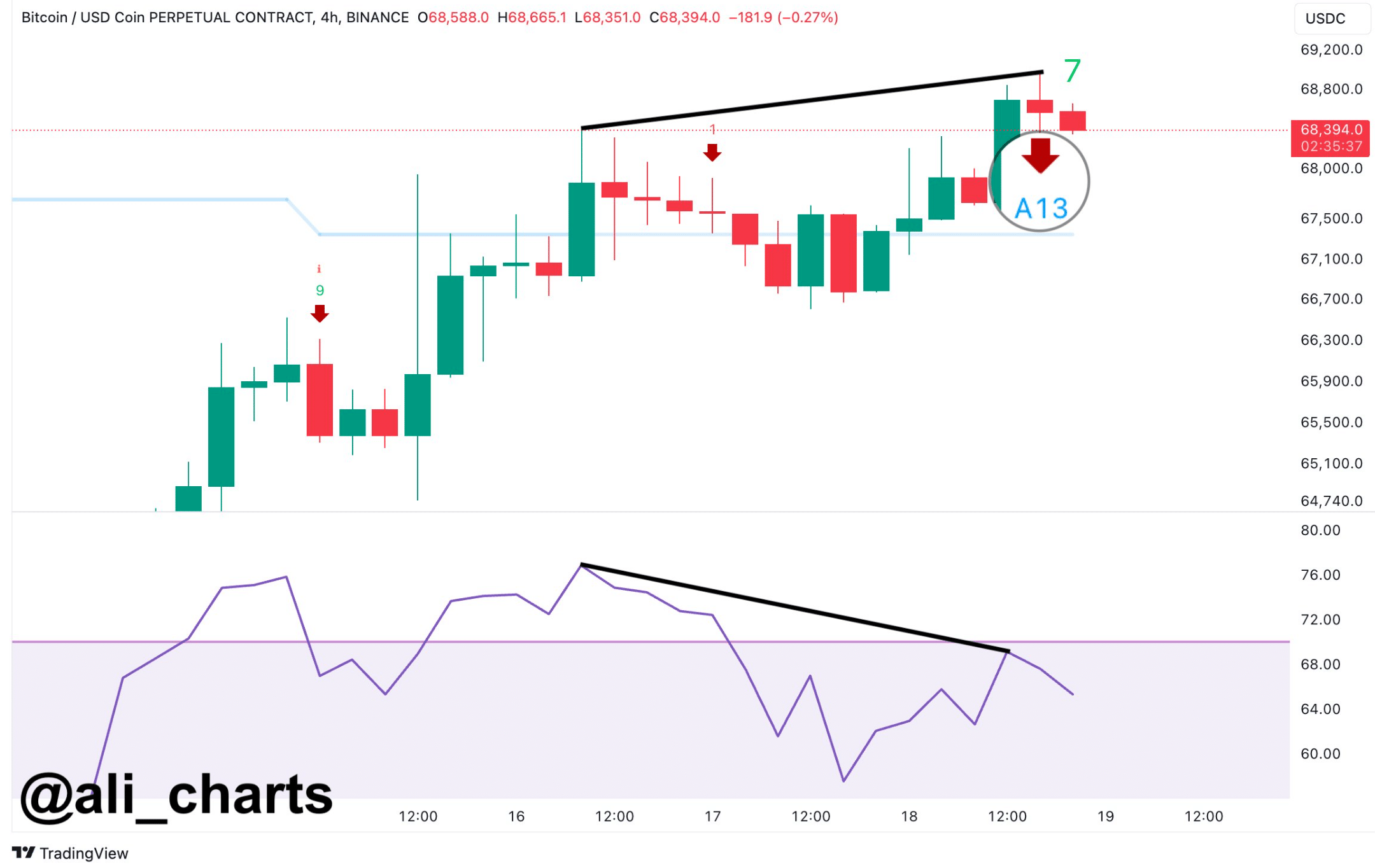

Nonetheless, not everything has been working in the king coin’s favor. Ali, a popular crypto analyst, shared a tweet, mentioning a bearish divergence. This indicated that there were chances of a short-term price correction here. Hence, it’s worth taking a closer look at the current state of Bitcoin.

Source: X

Is a price correction inevitable?

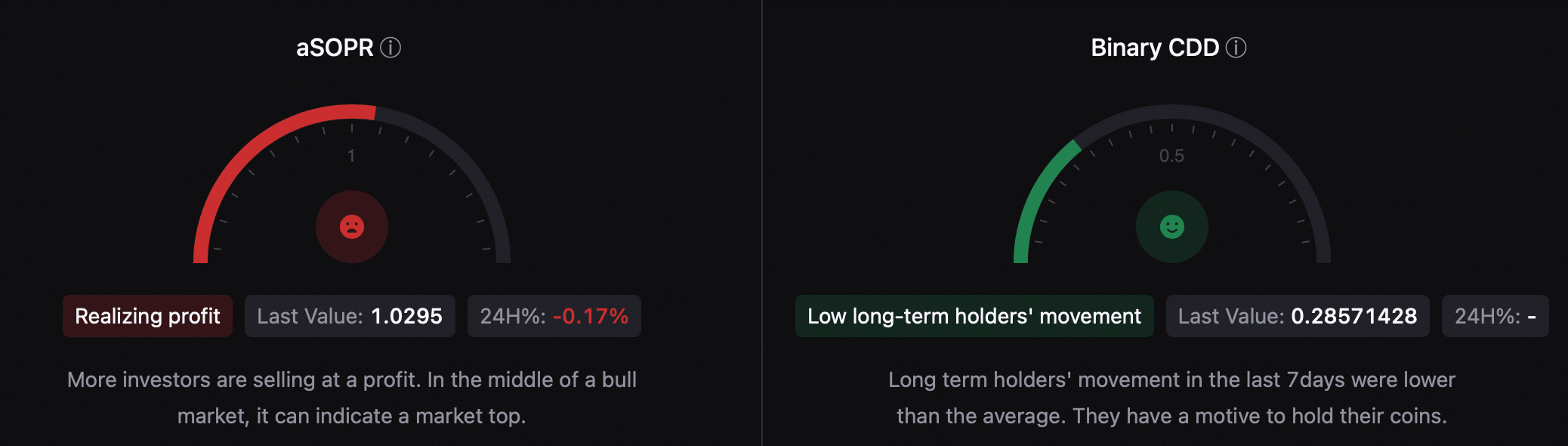

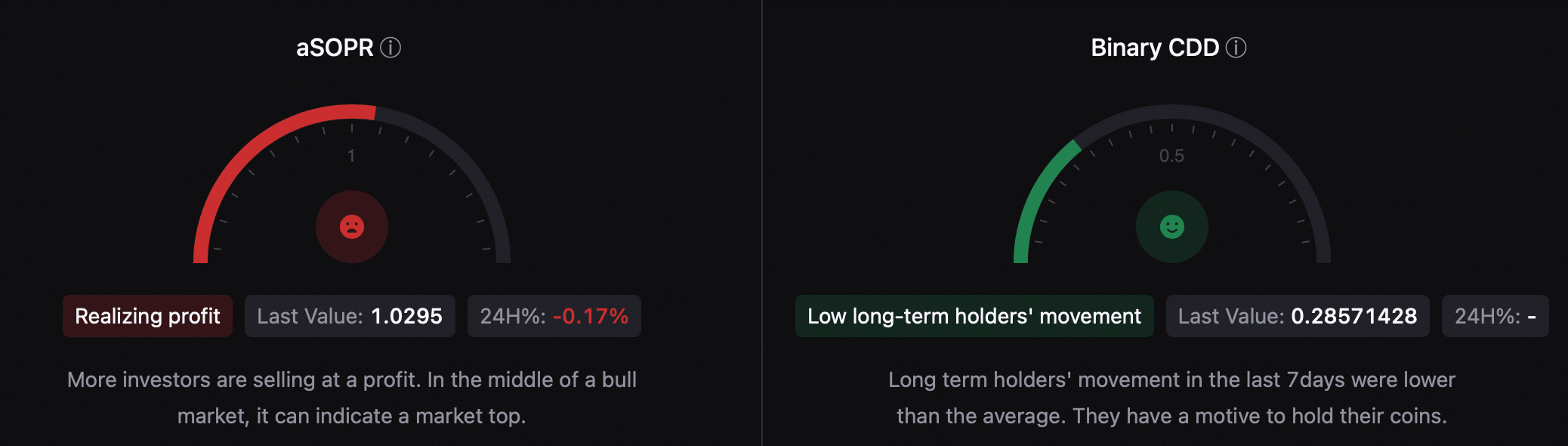

AMBCrypto’s analysis of CryptoQuant’s data revealed quite a few interesting metrics. For instance, the king coin’s binary CDD was green, meaning that long-term holders’ movement in the last 7 days was lower than the average. They have a motive to hold their coins.

However, the aSORP suggested that more investors have been selling at a profit. In the middle of a bull market, it can indicate a market top.

Moreover, the NULP was also bearish, as it indicated that investors were in a belief phase where they were in a state of high unrealized profits.

Source: CryptoQuant

Finally, we then took a look at Bitcoin’s daily chart to find the possible support the coin might drop to in case of a price correction.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

According to our analysis, a price correction might result in BTC once again dropping to $66k. A slip under that level could push the coin further down to $62.8k.

Source: TradingView

Leave a Reply