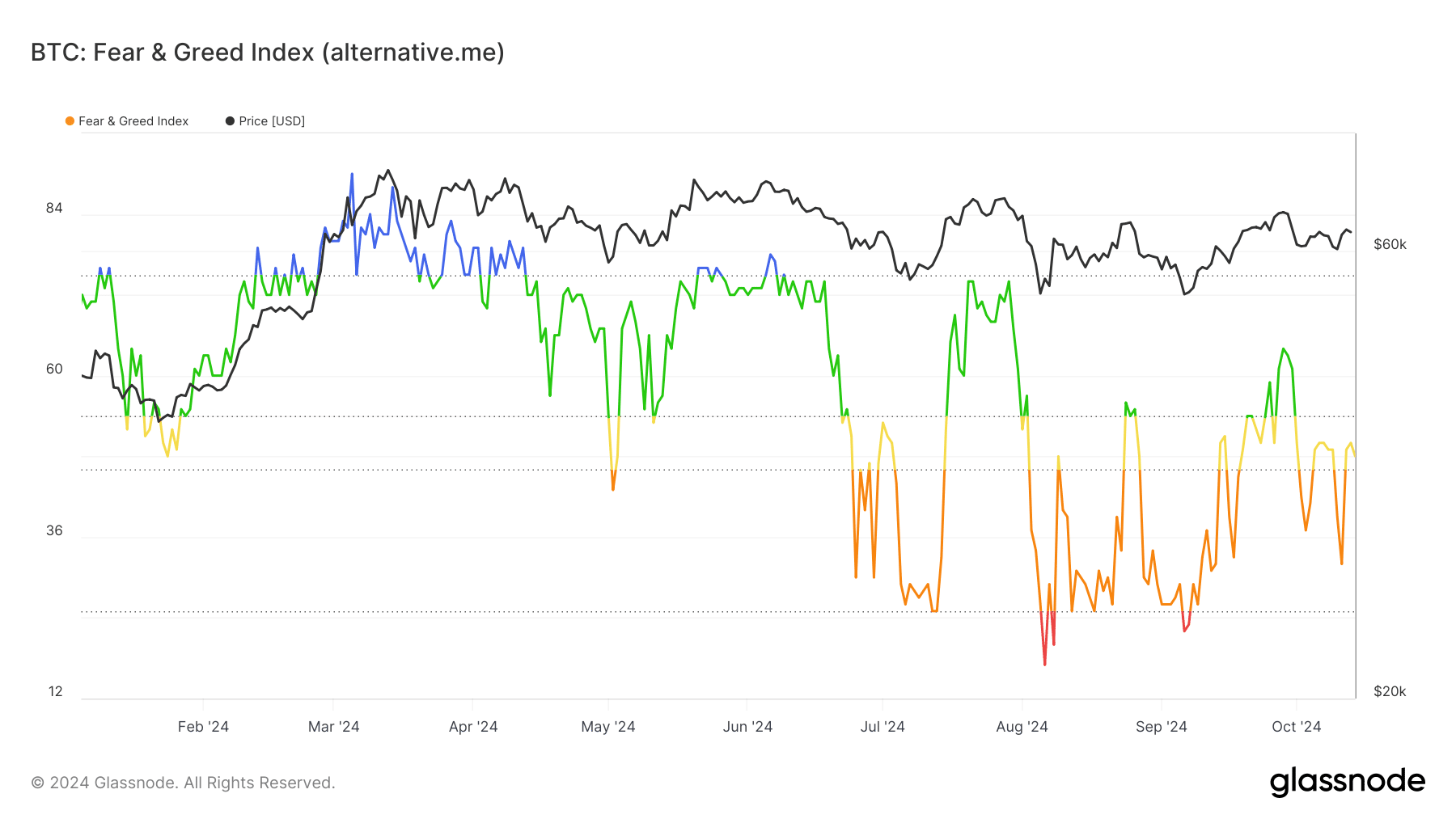

- The Bitcoin fear and greed index has shifted to a neutral score of 48, indicating balanced market sentiment.

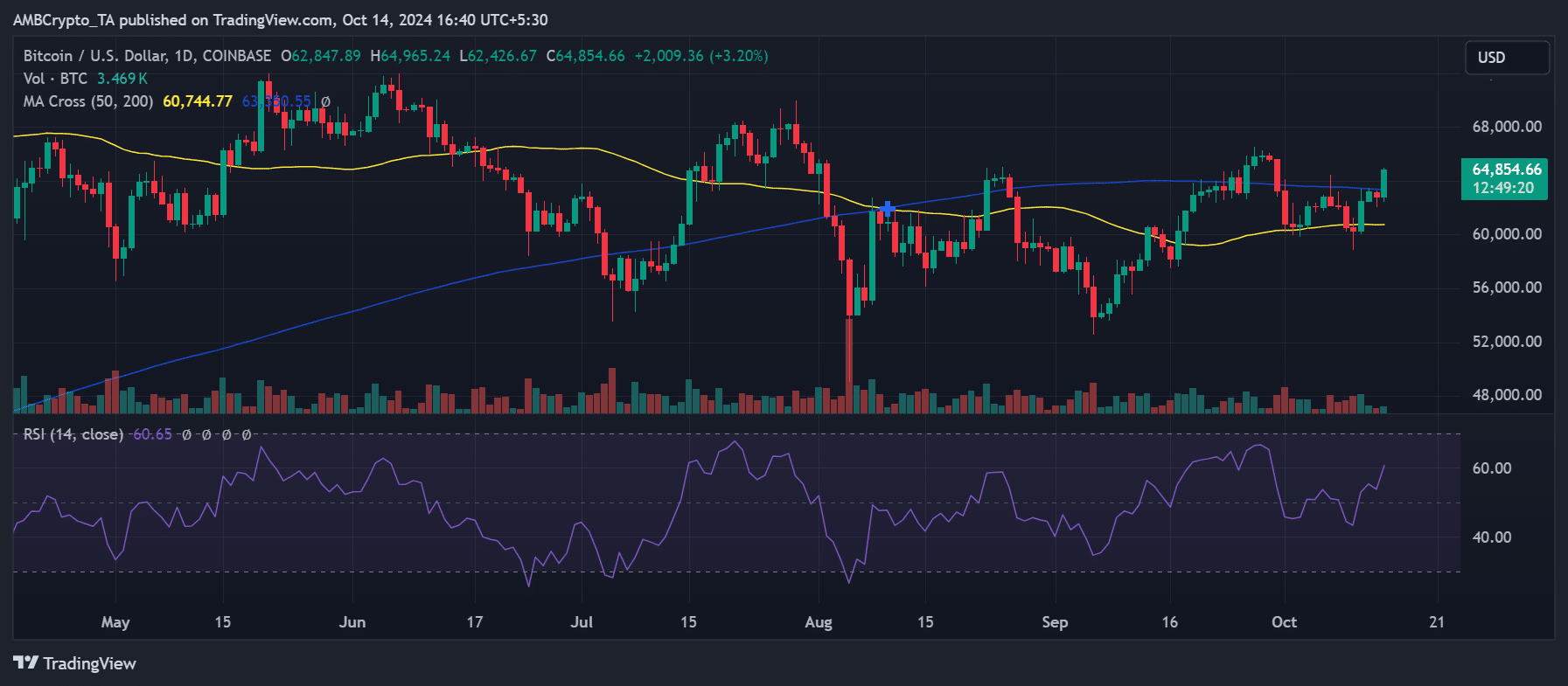

- Bitcoin has broken past its 200-day moving average, currently trading around $64,850 after a 3% increase.

The past few days have been a rollercoaster for Bitcoin [BTC], with its price moving through volatile trends. However, recent data suggests that the market sentiment is beginning to stabilize.

The Bitcoin fear and greed index shows that the emotional response of traders has shifted from extremes of fear and greed to a more neutral outlook.

Bitcoin fear and greed index turns neutral

According to Glassnode, the Bitcoin fear and greed index was 48 at press time, signaling a neutral sentiment in the market. This marks a shift from the heightened fear and greed that followed recent price fluctuations.

The index, which gauges market sentiment based on factors like volatility, volume, and social media trends, suggests that traders are adopting a wait-and-see approach after a period of intense market movements.

Source: Glassnode

Earlier in the week, on the 11th of October, the index dropped to 32, reflecting a state of fear among traders. Interestingly, this coincided with a Bitcoin price increase to approximately $62,000.

Despite this upward price movement, the sentiment at the time remained cautious, likely in reaction to earlier price declines.

BTC moves with fear and greed sentiment

AMBCrypto’s analysis of Bitcoin’s price trend revealed that the decline in the Bitcoin fear and greed index on the 11th of October was a reaction to prior price action.

Before the price increase, Bitcoin had faced a series of declines, dropping its value to around $60,000—a level below its 50-day moving average (yellow line), which acted as a key support level.

Source: TradingView

However, the market rebounded on the 11th of October. Bitcoin saw a 3% increase that brought its price back up to $62,500, pushing it above the 50-day moving average.

Despite this, the price remained under its 200-day moving average (blue line), a stronger resistance level.

As of this writing, Bitcoin is trading at approximately $64,850, gaining another 3%.

This upward trend has allowed BTC to break past the 200-day moving average, which had served as resistance around the $63,000 price mark.

The combination of these price movements and the neutral sentiment on the Bitcoin fear and greed index suggests that the market is in a state of cautious optimism.

Active addresses remain stable

Although the Bitcoin fear and greed index reflected a neutral sentiment, the number of active addresses has stayed remarkably stable.

Data from Santiment showed that the seven-day average of active addresses had remained consistent, with around 3.5 million active addresses.

As of this writing, there were approximately 3.52 million active addresses, reflecting sustained engagement with the network.

Source: Santiment

Read Bitcoin’s [BTC] Price Prediction 2024-25

This steady number of active addresses indicated ongoing interest from long-term holders, which could serve as a foundation for future price increases.

Despite the shifting sentiment, the stability in network activity may be a sign that Bitcoin’s long-term outlook remains positive.

Leave a Reply