- TRX has been stuck in a range-bound market for nearly two weeks amid a lack of market participation.

- Tron’s Open Interest has dropped to significantly low levels, showing fading market interest.

Tron [TRX] was the only token among the top tegn largest cryptocurrencies by market capitalization that was not trading in the red at press time after a slight 1% gain. These gains have seen TRX trade at $0.156.

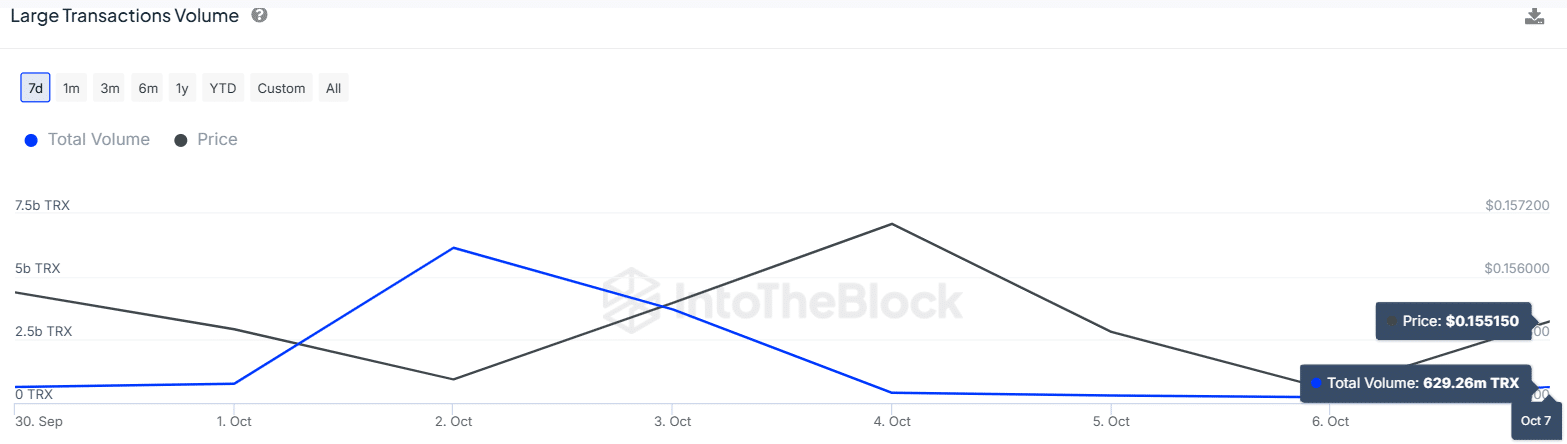

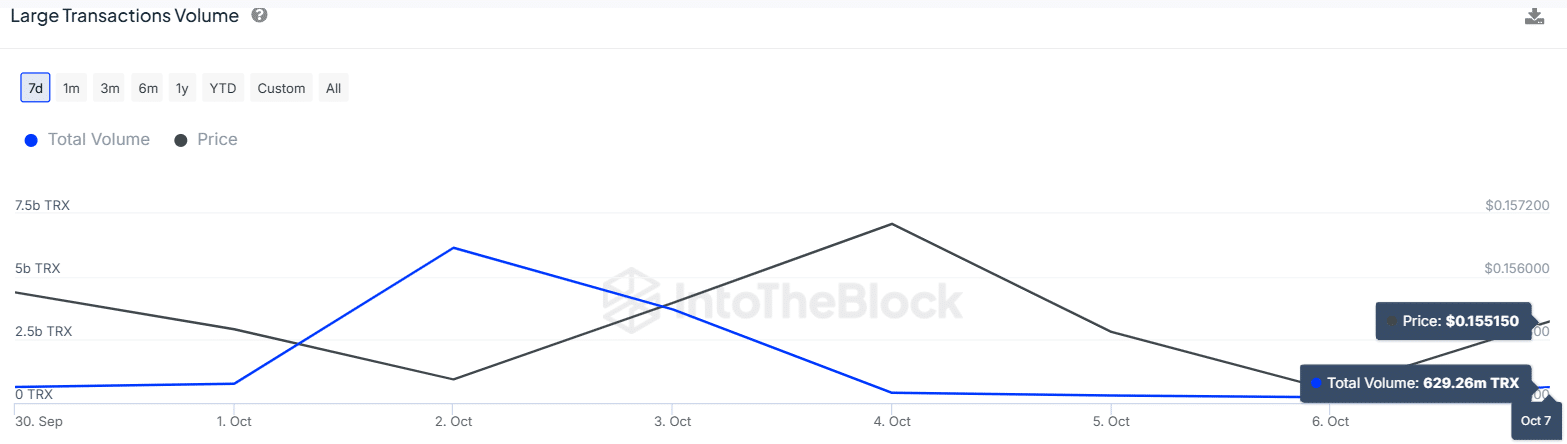

One of the factors that might have triggered the slight gains is a rise in large transaction volumes.

Data from IntoTheBlock showed that on the 7th of October, large transaction volumes for TRX increased from 224 million to 629 million. This represented a 180% gain.

Source: IntoTheBlock

This spike in large transactions worth over $100,000 shows that whales are gaining interest in TRX. However, will these volumes be enough to break TRX out of its consolidation zone?

Tron price outlook

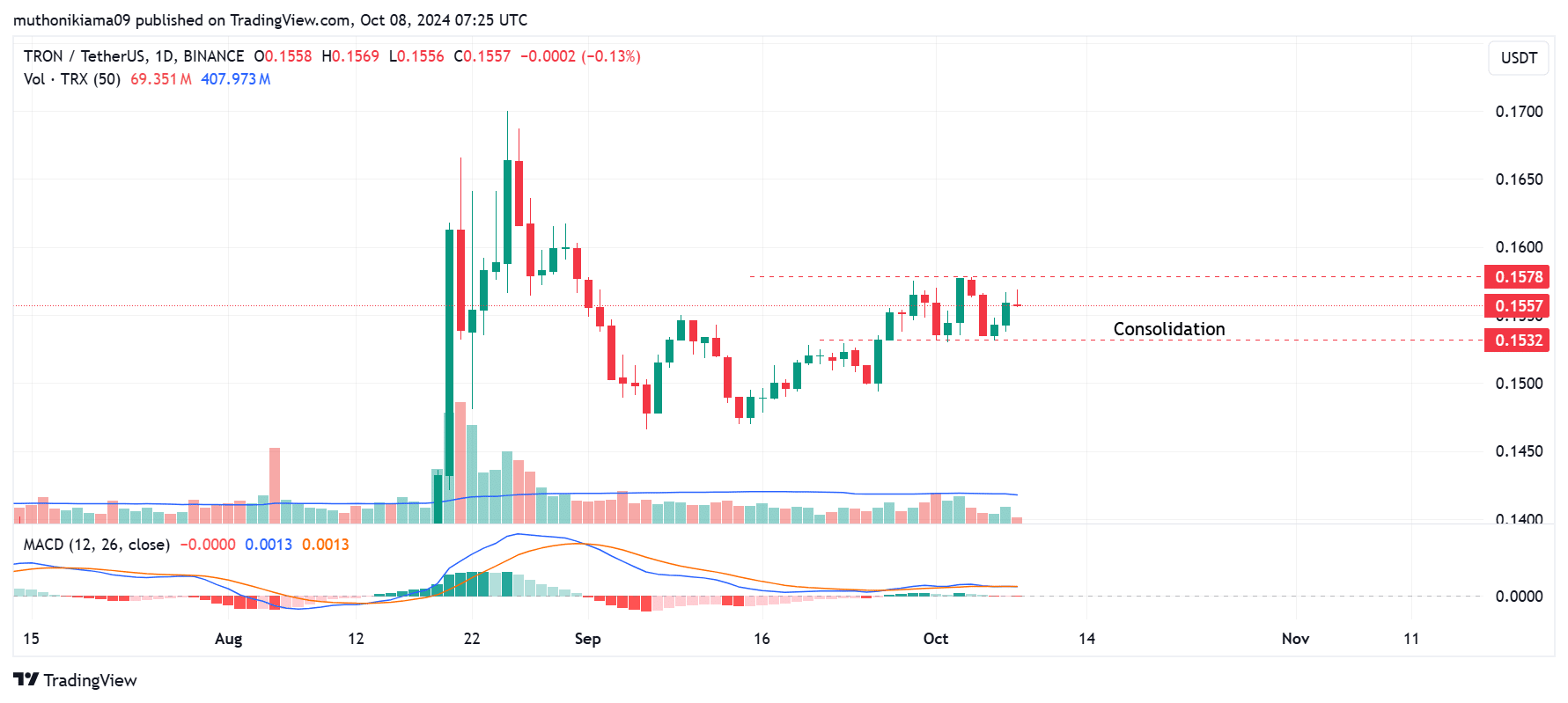

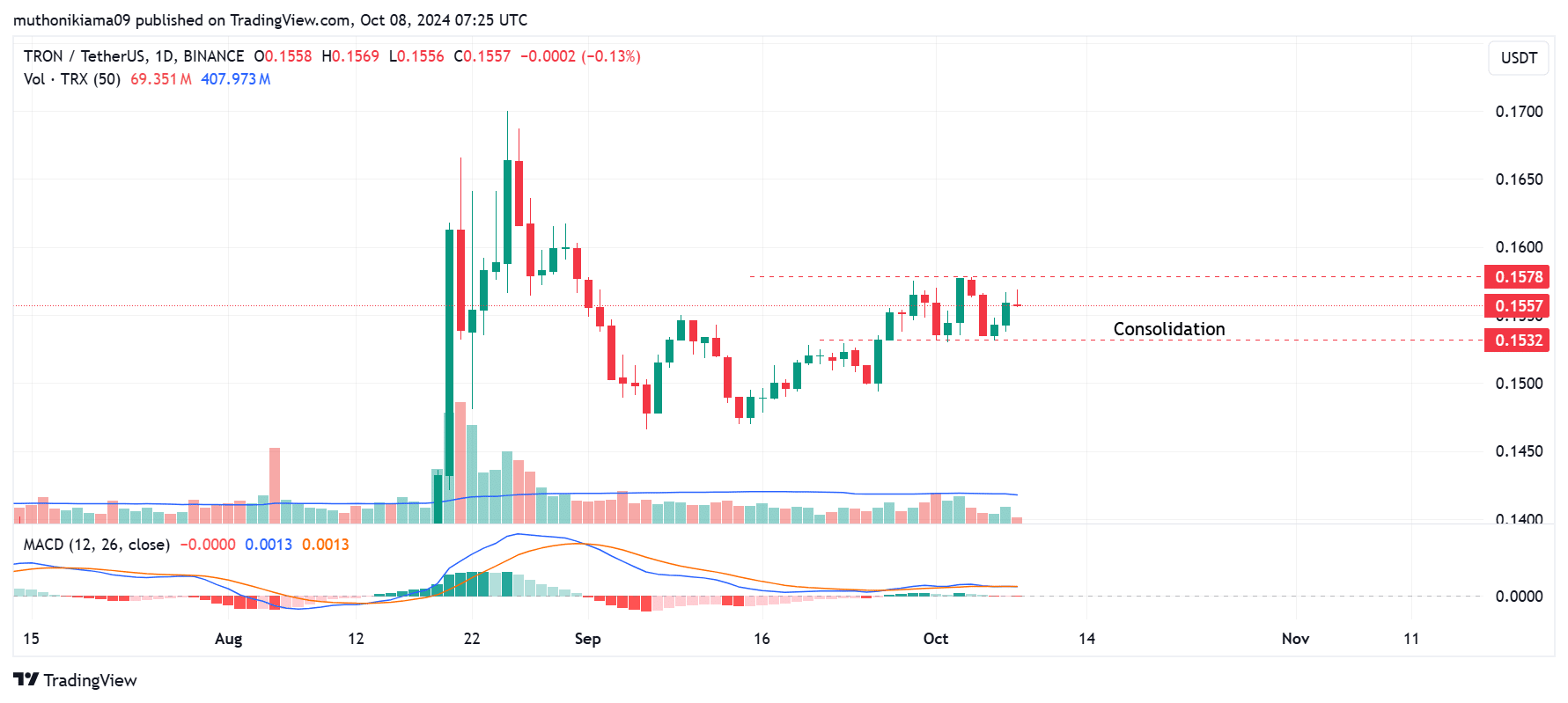

Since late September, TRX has traded within a consolidation phase, with the price oscillating between a low of $0.153 and a high of $0.157.

The volume histogram bars suggest that the price has failed to break out from this consolidation phase due to reduced buyer and seller interest.

The histogram bars have also been below the 50-day moving average since early September, showing that the market remains inactive.

Source: TradingView

The flattening Moving Average Convergence Divergence (MACD) line against the signal line also shows a lack of momentum.

Traders might be waiting for a signal before entering new trading positions, whether on the buy side or the sell side.

If there is no significant change in trading volumes, TRX might continue trading within a range-bound market, with an uptrend facing resistance at $0.157.

Open Interest and Funding Rates show THIS

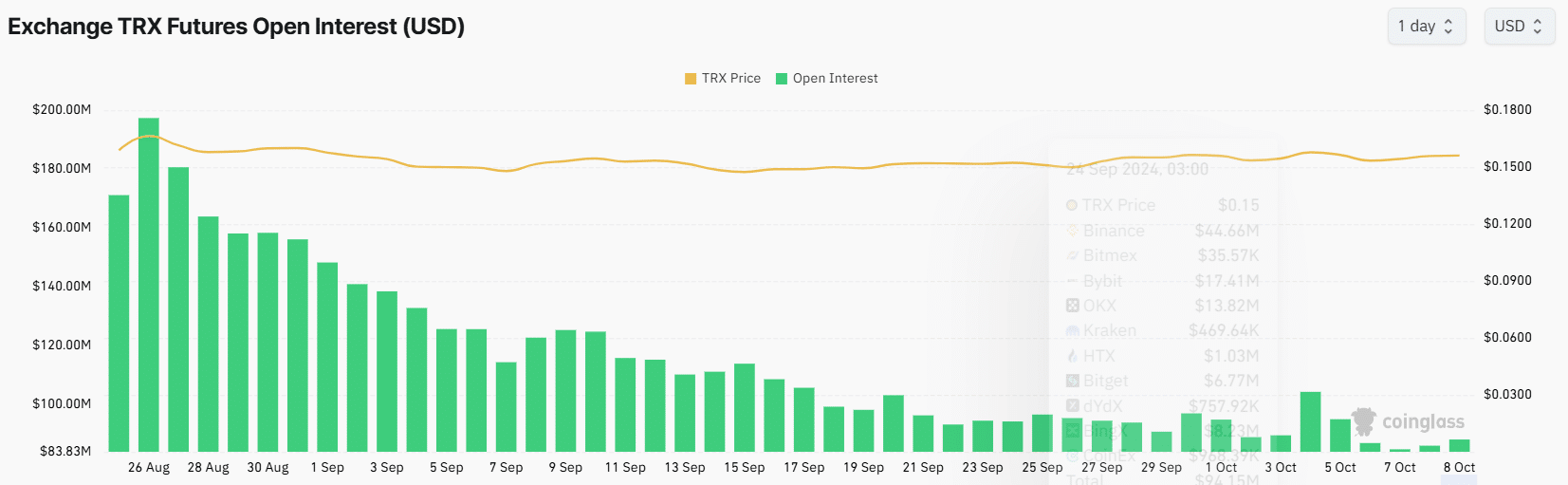

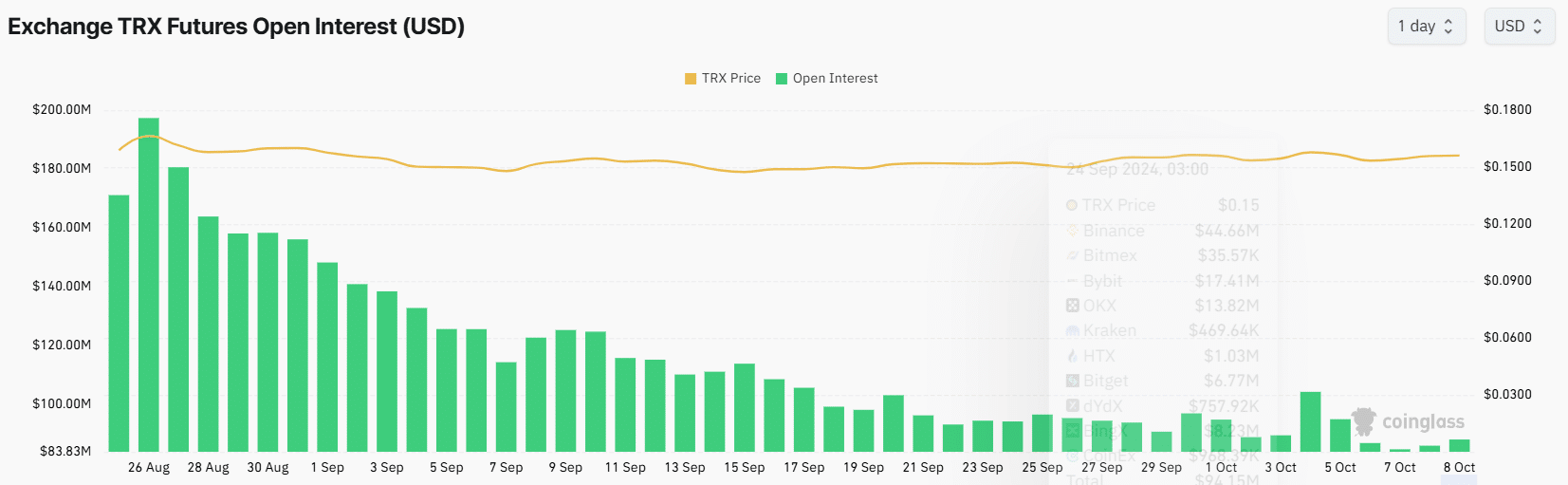

Tron’s Open Interest has dropped to significantly low levels, as data from Coinglass shows. At press time, TRX’s Open Interest stood at $86M, a nearly 50% decline since late August.

Source: Coinglass

Low Open Interest showed declining market interest, where fewer traders were opening and holding positions on TRX. It also shows that both bulls and bears were undecided and exhausted after the August uptrend.

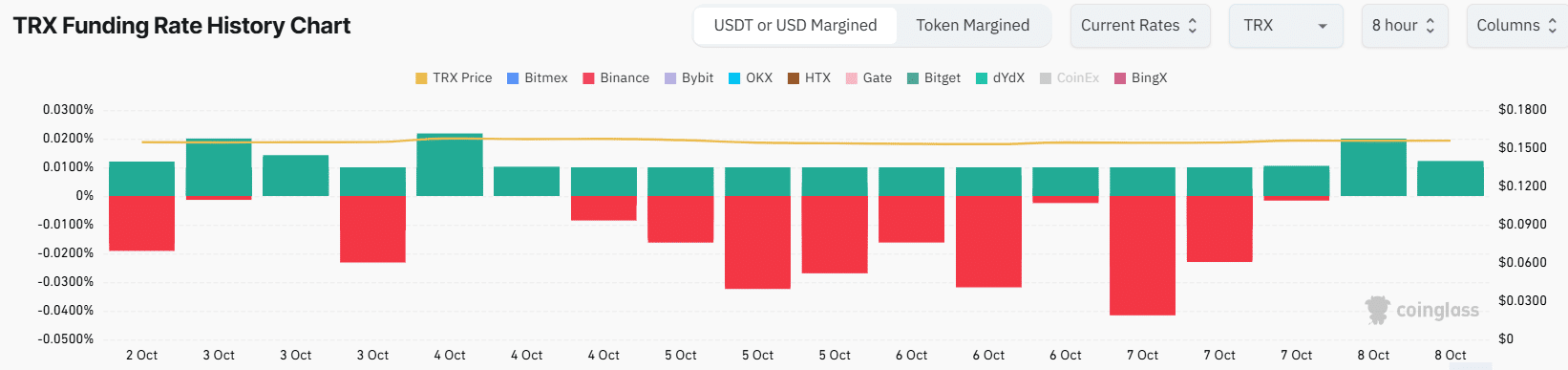

However, a look at Funding Rates suggests that if TRX fails to make a bullish breakout from the consolidation phase, bears could take control of the price action.

In the last seven days, there has been an increase in short positions on TRX.

Source: Coinglass

This data shows that traders are betting on a bearish breakout from the range-bound market.

One of the factors that could have triggered the negative funding rates is a slight dip in the TRX wallets that are in profits.

Read Tron’s [TRX] Price Prediction 2024–2025

According to IntoTheBlock, the wallets that are In the Money have declined from 97% to 95% in the last seven days.

While this is a small decrease, if more wallets fall into losses, it might cause the price to drop further if traders choose to sell to minimize losses.

Leave a Reply