Japanese investment firm Metaplanet has made the largest number of Bitcoin purchases to date, after acquiring 107,913 BTC for approximately 1 billion yen (equivalent to $6.9 million), according to an October 1 statement.

This marks Metaplanet’s eleventh Bitcoin acquisition since the initial purchase on April 23 facts of Bitcoin Treasuries.

With this latest purchase, the company’s total Bitcoin holdings now stand at 506,745 BTC, worth approximately $32.2 million. The company’s recent disclosure shows that it spent 4.75 billion yen (about $31.9 million) on its Bitcoin purchases, with an average purchase cost of 9.37 million yen (about $64,931) per BTC.

Meanwhile, Metaplanet CEO Simon Gerovich hinted at further Bitcoin acquisitions and revealed that the company’s next goal is to accumulate 1,000 BTC. He said:

“As we enter the second week of exercising rights, please help us move up the list of Bitcoin’s top business owners. The next goal is to own more than 1000 Bitcoin.”

Currently, Metaplanet is the second largest institutional Bitcoin holder in Asia, behind only Meitu Inc. from Hong Kong, which holds 940.9 BTC, according to Bitcoin Treasuries.

Meanwhile, Michael Saylor-led MicroStrategy remains the largest corporate Bitcoin holder globally, with 252,220 BTC.

Metaplanet shares are outperforming

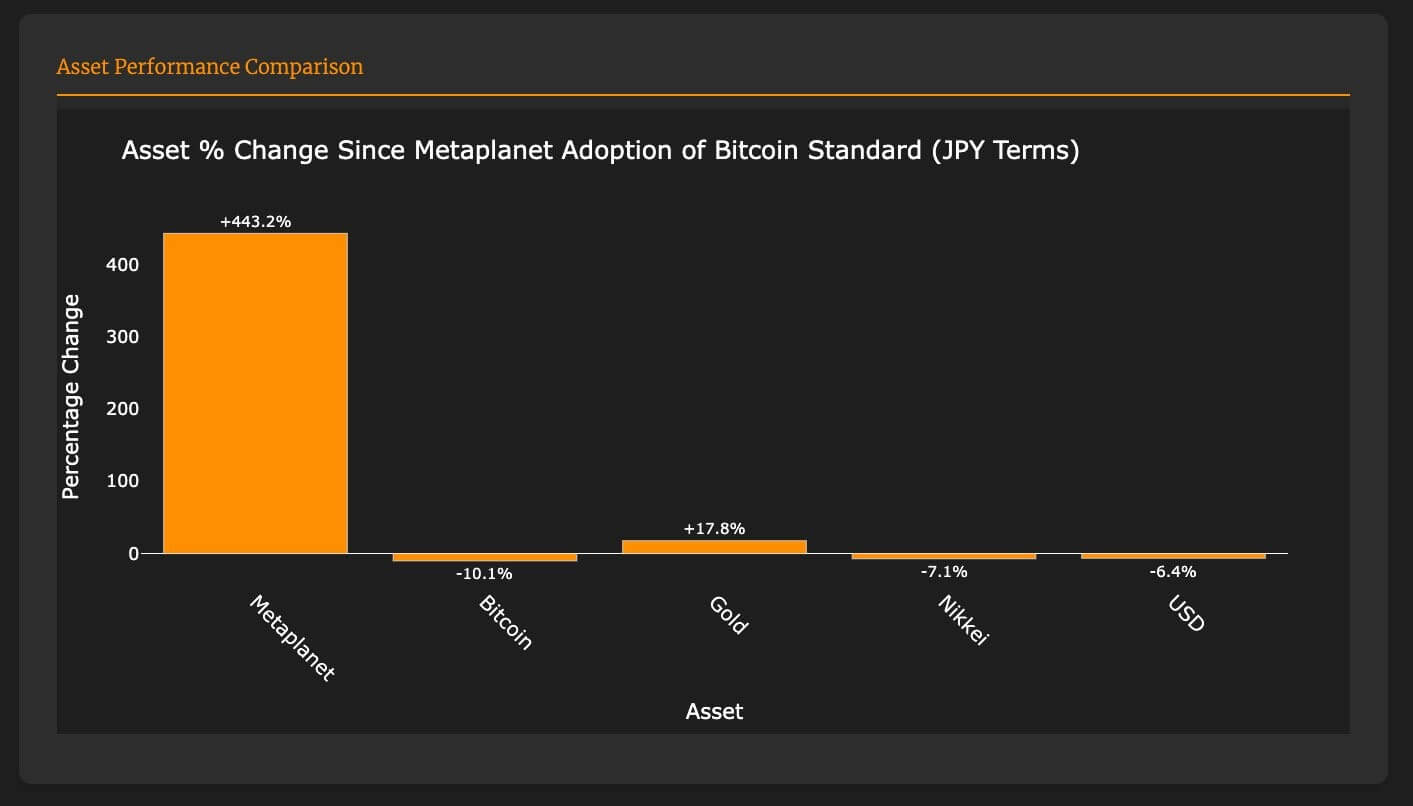

Metaplanet’s Bitcoin push has proven largely successful, helping the company’s shares outperform traditional financial assets such as the US dollar, gold and Japan’s Nikkei stock index.

On September 19, Gerovich said the company’s shares have risen 443% since the introduction of the Bitcoin standard. By comparison, the Nikkei index, the US dollar and Bitcoin itself have all seen declines of 7.1%, 6.4% and 10.1% respectively. However, gold has risen 17% during this period.

Market observers have linked this strong performance to the company’s Bitcoin-only treasury strategy, which the company adopted in May to hedge against Japanese yen volatility. Since then, Metaplanet has made regular Bitcoin purchases, positioning itself among the top 25 institutional Bitcoin holders globally.

Leave a Reply