- Pepe has surged by 39.07% over the past week.

- Pepe’s fundamentals indicated that it has reached overbought levels, with the RSI hitting 76.5.

Over the past two weeks, crypto markets have experienced significant gains. Amidst this growth, memecoins are leading the way with substantial gains.

One such memecoin is Pepe [PEPE], which experienced a sustained uptrend over the past two weeks.

In fact, as of this writing, PEPE was trading at $0. 0000114. This marked a 44.8% increase on monthly charts, with an extension to the bullish trend by 39.07% over the past week.

Despite these gains, the memecoin remained relatively low from its recent high of $0.0001314. Equally, it was approximately 32% below its ATH of $0.000017.

Therefore, the prevailing market conditions raise questions about whether PEPE’s recent uptrend will hold or if the memecoin will experience a correction.

Pepe’s RSI reaches overbought levels

According to AMBCrypto’s analysis, PEPE was experiencing a strong upward momentum, with bulls dominating the market.

Source: TradingView

However, its RSI has reached overbought at 76.5 territory, which usually signals a potential reversal of the current trend.

In context, an overbought condition often indicates that the upward momentum may be running out of steam and a price reversal or a period of consolidation might occur.

However, although the overbought conditions suggest potential for a pullback, it does not guarantee a reversal.

Therefore, while RSI is in an overbought condition, our analysis indicates that PEPE is under a strong uptrend. In such a scenario, a reversal is unlikely in the short term.

Implications on PEPE’s charts?

Although RSI suggests a potential reversal, it’s essential to determine what other fundamentals suggest.

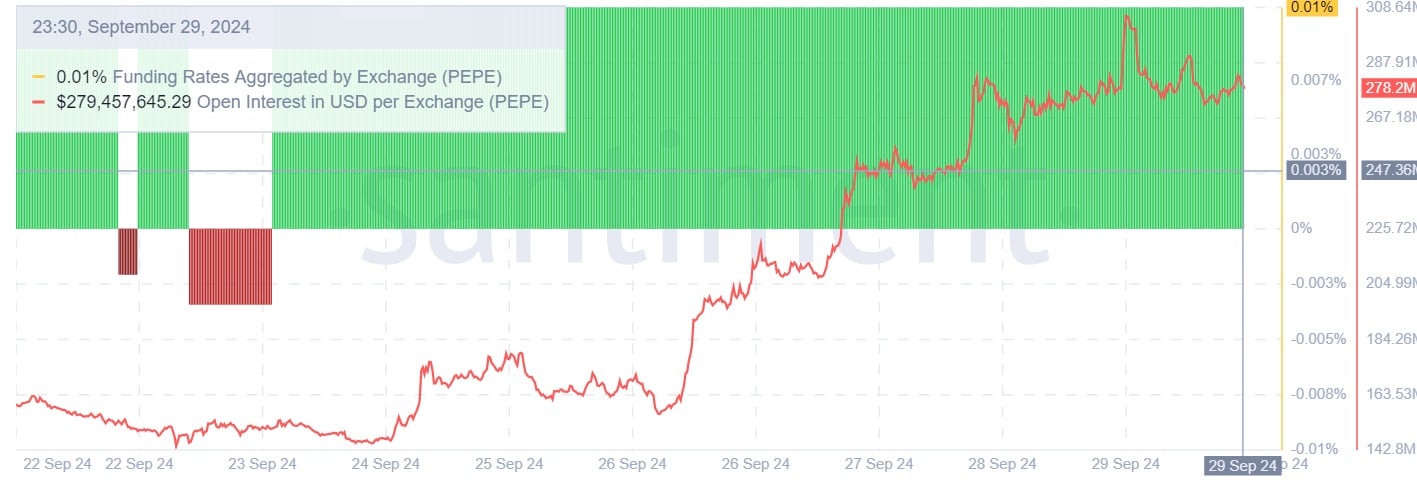

Source: Santiment

For starters, Pepe’s adjusted price DAA divergence has remained positive throughout the past week.

This implies that Pepe’s active addresses are increasing, suggesting a growing user activity and interest, even though the price does not reflect it. Thus, PEPE was gaining adoption and could see further price increases.

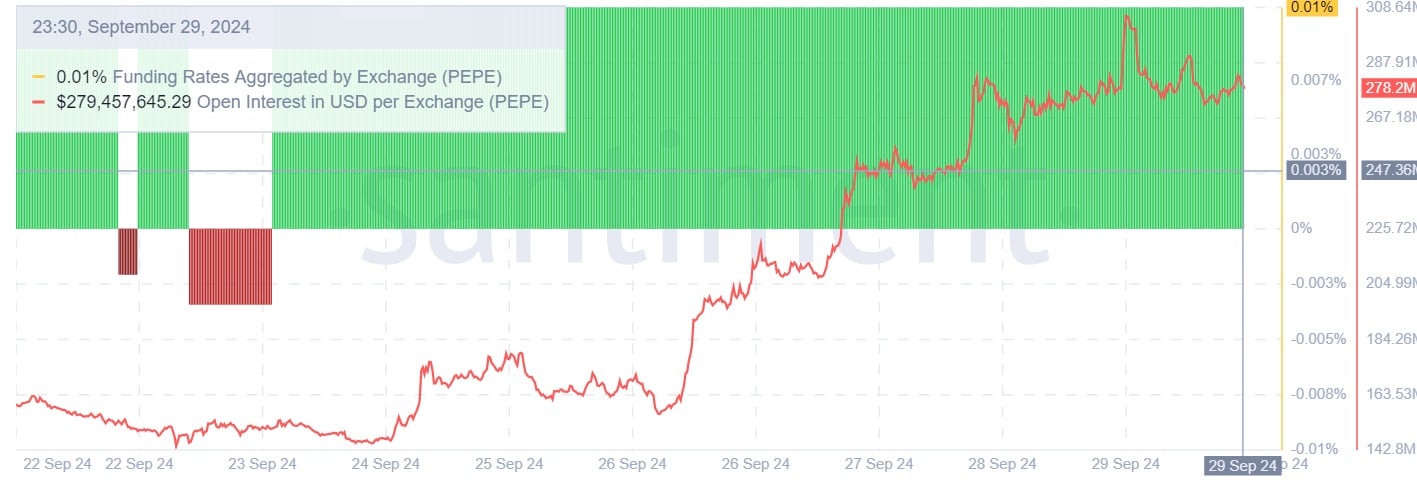

Source: Santiment

Additionally, Pepe’s Funding Rate Aggregated by Exchange has been positive for the last seven days. This suggests long position holders are paying those taking shorts.

The fact that investors are willing to pay a premium to hold their position reflects their confidence in memecoin’s future value.

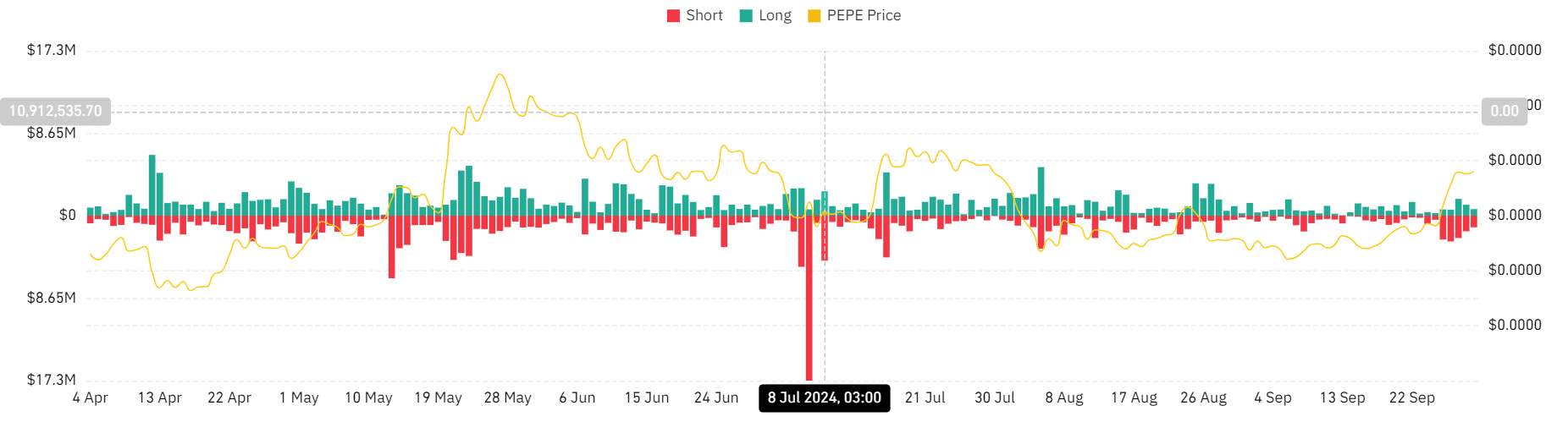

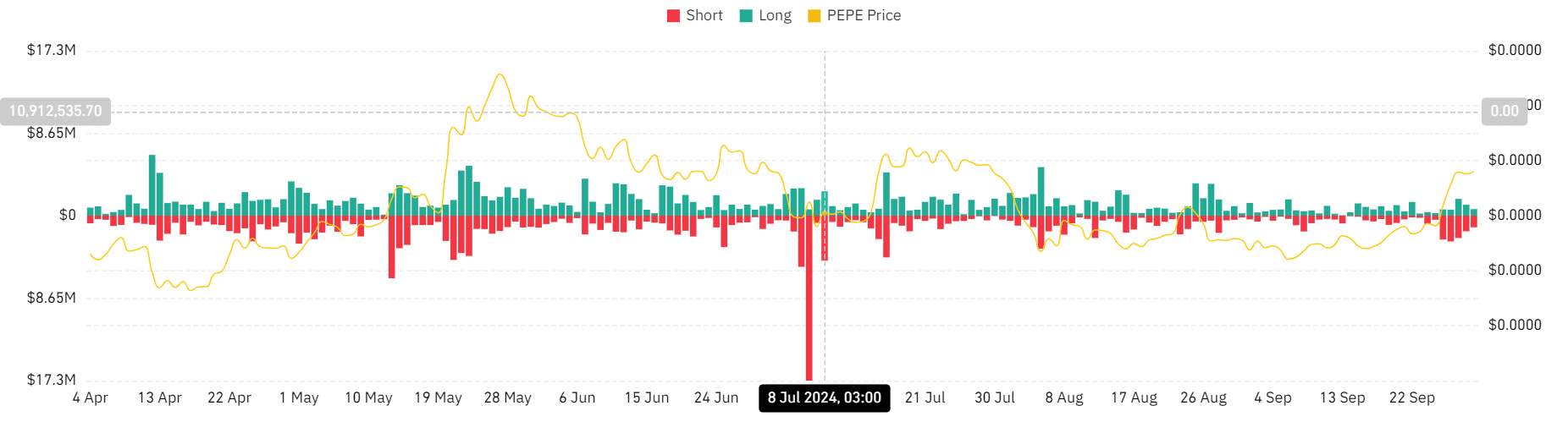

Source Coinglass

Finally, this positive market sentiment is reflected by higher liquidations for those taking shorts compared to those taking longs. Short position holders have faced extreme liquidation for the past four days.

Read Pepe’s [PEPE] Price Prediction 2024–2025

Therefore, based on our analysis, although Pepe’s RSI has reached overbought territory, the memecoins uptrend remains strong. This means that it will remain there for a period before the price starts to decline.

As such, if the prevailing conditions hold, Pepe will attempt the next significant resistance level at $0.0000119. Consequently, a correction will see the memecoin decline to $0.000009847.

Leave a Reply