- Stacks has a short-term bullish outlook.

- Increased demand is necessary to break the token out of the three-month range formation.

Stacks [STX] has made rapid bullish progress recently. Since the lows posted on the 16th of September, the token rose by 22%. This followed the bullish market-wide belief of the past two weeks.

From the second week of September, Bitcoin [BTC] has rallied from $54k to $64.5k. This 20% move for the king of crypto has rejuvenated bullish belief, including the sentiment behind Stacks.

STX headed toward the range highs again

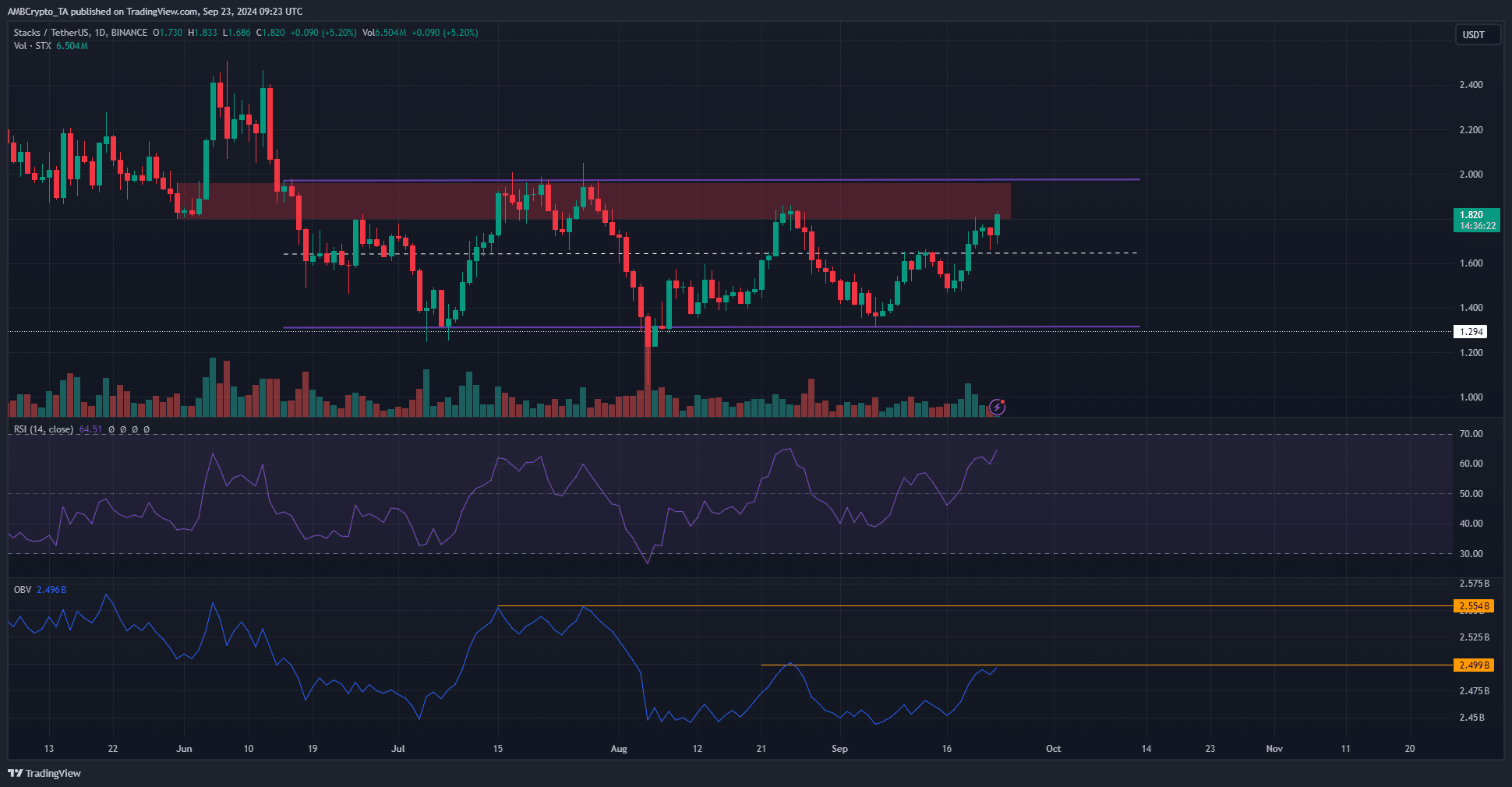

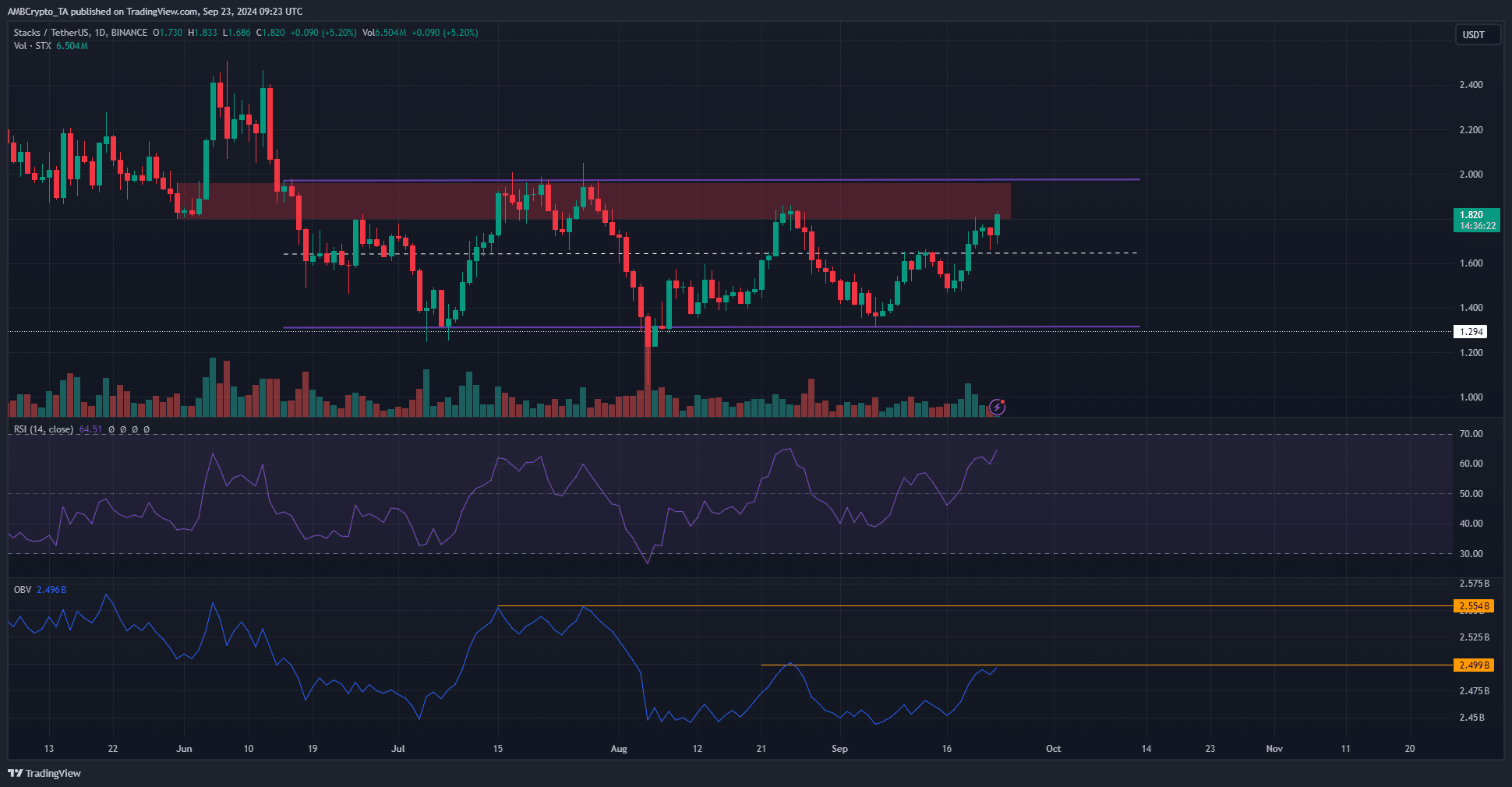

Source: STX/USDT on TradingView

Since the first week of July, Stacks has traded within a range that extended from $1.32 to $1.97. The mid-range level at $1.645 has served as both support and resistance in the past three months.

Earlier in September, STX bulls were rebuffed from the $1.645 resistance before the rally of the past week flipped this level to support.

Alongside the range highs, a bearish breaker block on the daily chart was present below the $2 region. This posed substantial opposition to bullish growth.

A retest of this resistance might not yield a breakout on this attempt either.

The daily RSI was bullish and showed upward momentum. The OBV was at a local high that acted as a resistance over the past month.

Even if the buyers can break this, there’s a local high that the OBV formed in July, which was insufficient to break the range.

As things stand, a large influx of capital is necessary to push Stacks prices past $2. Until this happens, traders can use the range extremes as their targets.

Social sentiment witnessed a massive positive swing

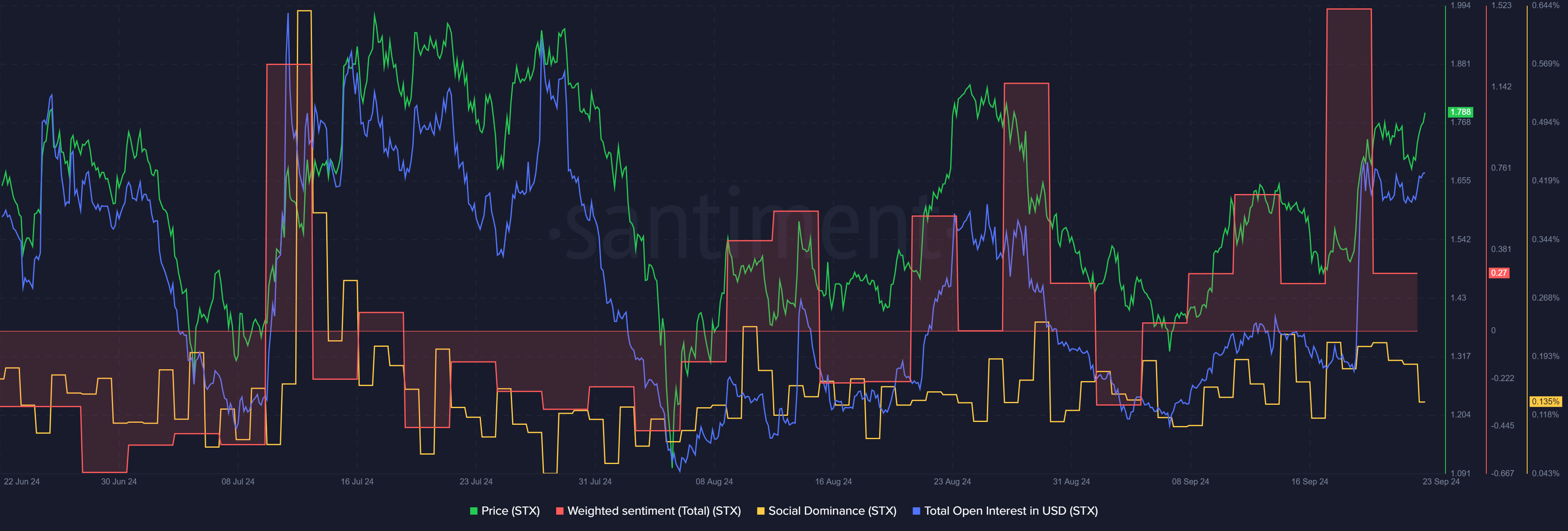

AMBCrypto looked at the data from Santiment and noted that the weighted sentiment on social media has been positive throughout September. This saw a spike last week as prices also breached the mid-range resistance.

Realistic or not, here’s STX’s market cap in BTC’s terms

This could be due to the news that Stacks was integrating with the Aptos [APT] network, allowing BTC use in the APT network’s decentralized applications (dApps).

The rise in Open Interest also indicated bullish sentiment was rising in recent days.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Leave a Reply