- BTC bulls have managed to leverage the earlier dip to test the $61K ceiling.

- The critical task now is to maintain $64K; missing this level could lead to a likely retracement.

Bitcoin [BTC] is nearing its late-August high of $64K. Until it breaks this resistance, the breakout potential remains uncertain, as underlying factors could disrupt momentum, delaying a breakout if conditions falter.

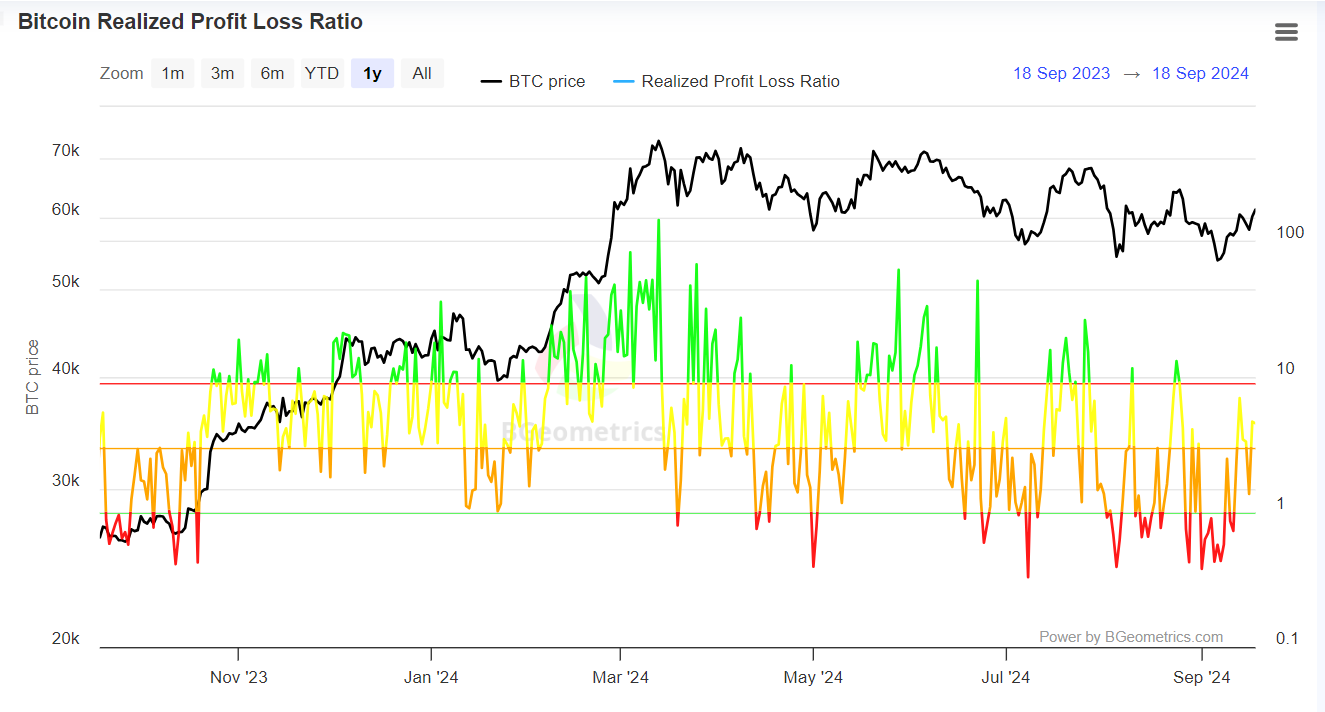

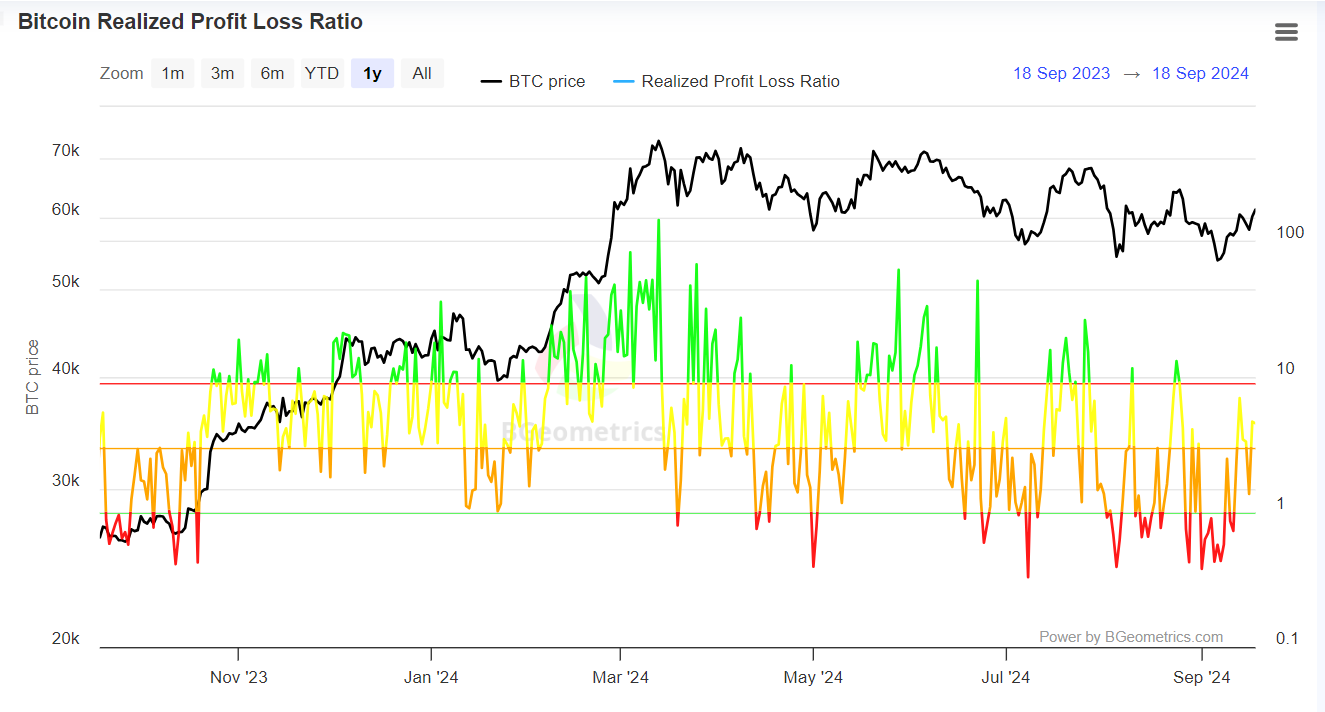

Bitcoin market is realizing profit

A year ago, Bitcoin participants were experiencing losses, as indicated by a net RPL ratio nearing zero. Put simply, the amount of BTC being sold at a loss was high.

This typically occurs during times of high volatility, when stakeholders lose confidence in the trend reversing.

Source : BGeometrics

A year later, the BTC market is now realizing substantial profits, encouraging stakeholders to hold for future gains. The Fed rate cut has certainly fueled this trend.

However, the market remains in a neutral phase. A significant push could turn the net RPL ratio green, potentially signaling a market top, according to AMBCrypto.

In summary, the market hasn’t peaked yet, indicating a bullish outlook and potential for future growth. The key question is whether bulls will capitalize on this trend or retreat for smaller gains.

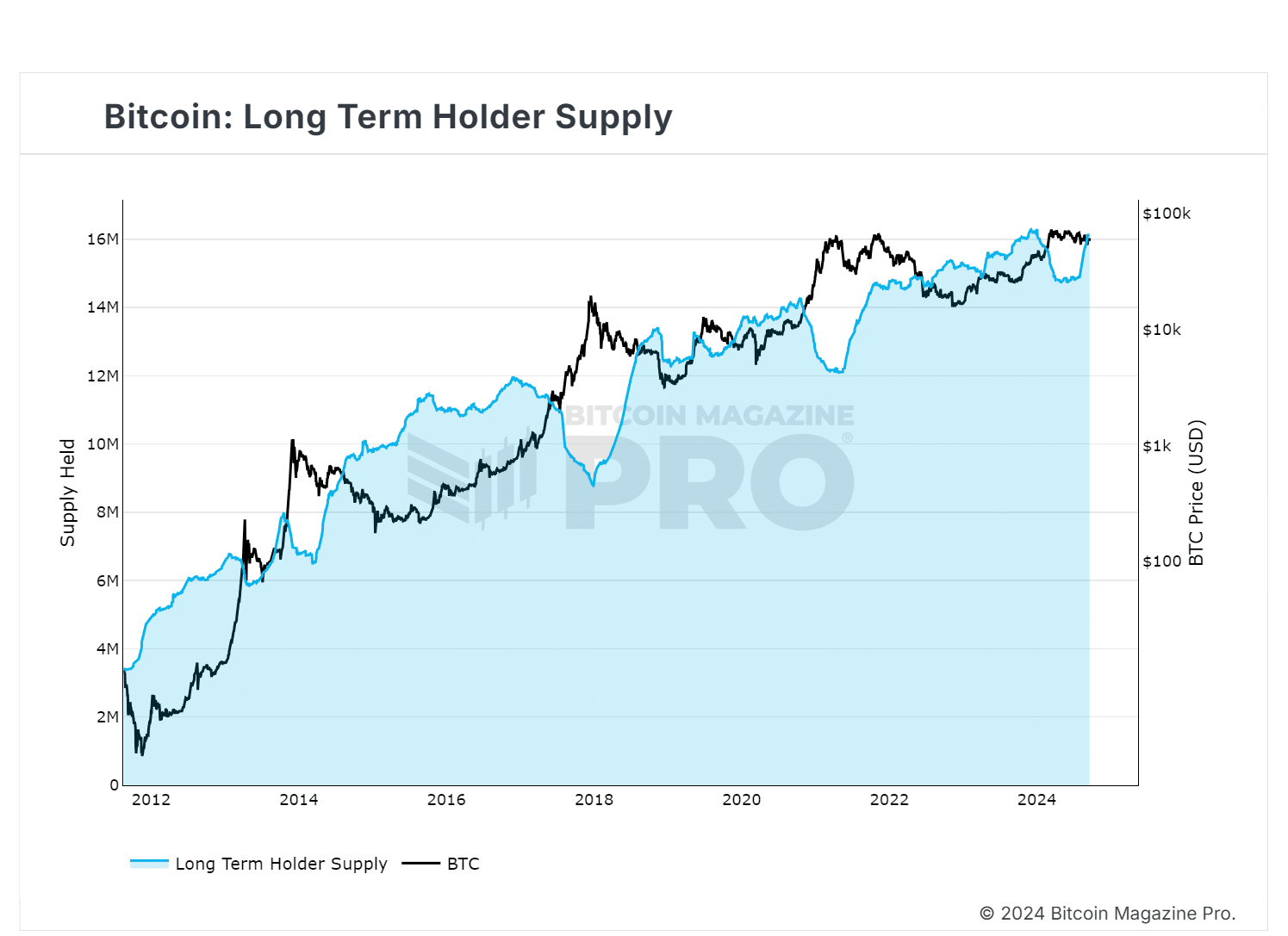

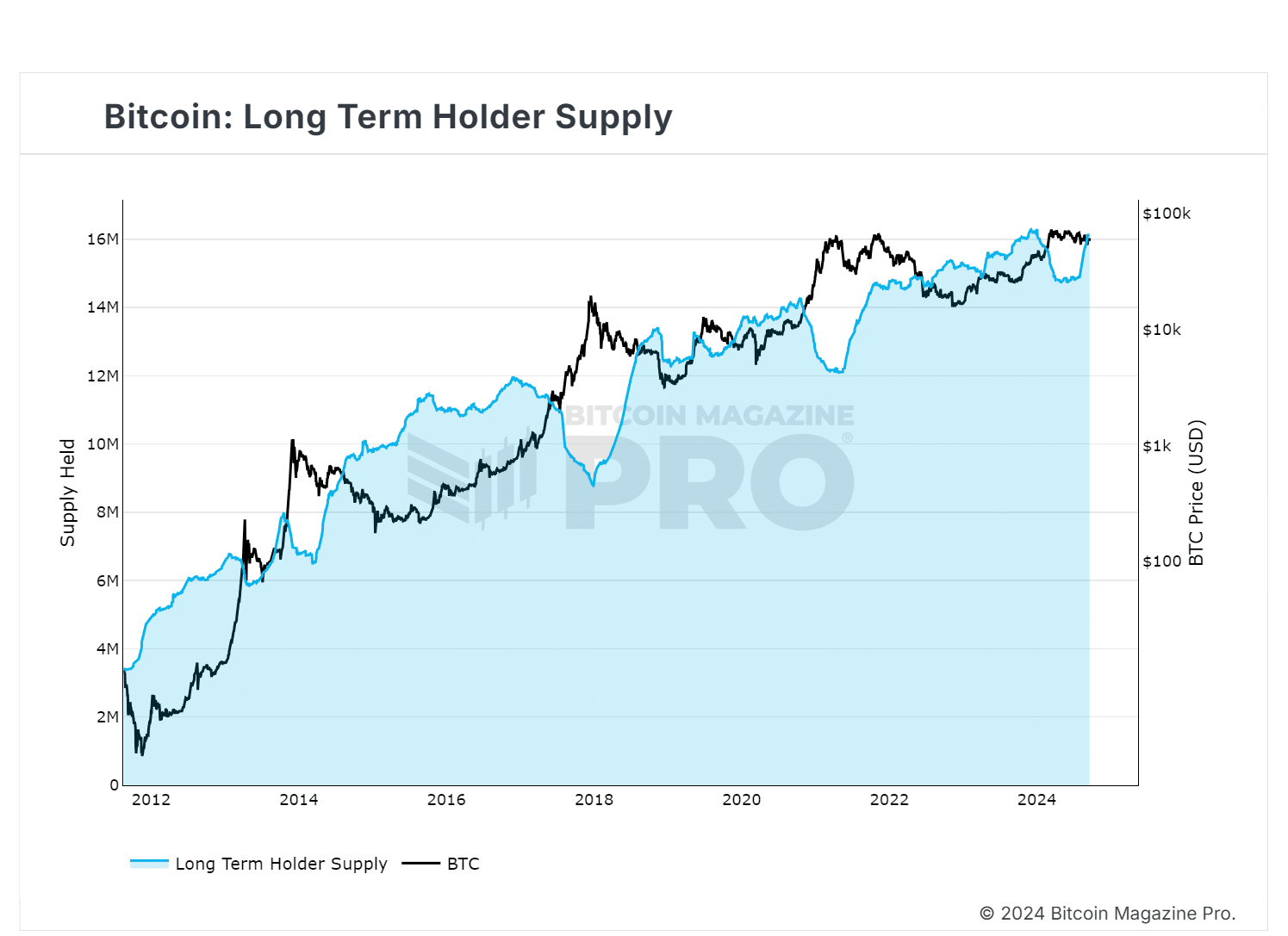

LTHs capitalize on BTC price bottom

Historically, sharp declines in the BTC supply held for over 155 days often signal market tops, as holders sell for profit, leading to price drops.

The last instance occurred at $71K, where BTC’s retrace below $55K saw a surge in supply volume, indicating long-term holders bought the dip.

Source : Bitcoin Magazine Pro

This added to the optimism, that large holders view $64K as a price bottom, accumulating for future gains and targeting the next resistance around $70K.

Overall, the rate cut has complemented this strategy, enhancing the likelihood of a rebound and reinforcing confidence in holding the asset. However,

Caution is advised

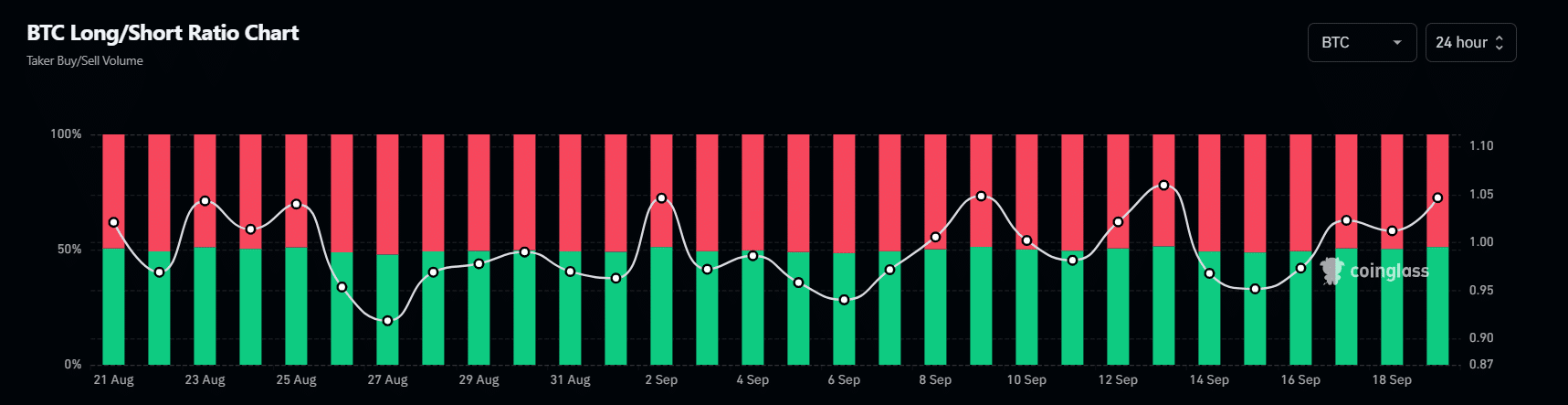

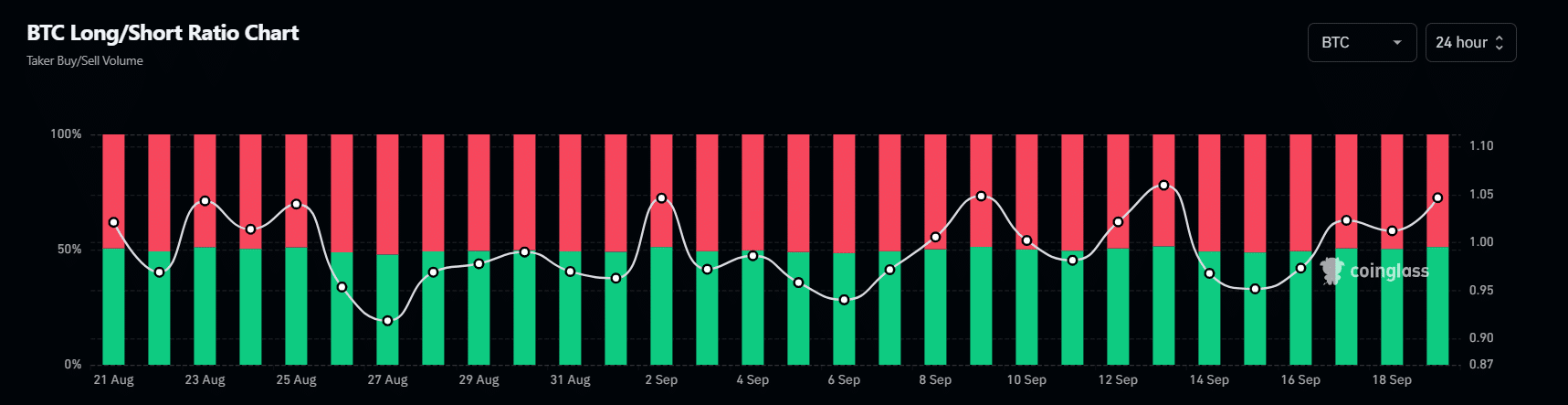

It is no surprise, BTC is vulnerable to swings in the perpetual market. Currently, longs dominate speculative trading, with institutions refraining from shorting Bitcoin.

Source : Coinglass

A similar pattern emerged at the start of the last August week, with longs outpacing shorts for three days, creating conditions ripe for a short squeeze.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Yet, BTC then plummeted from $64K to below $55K the next day, as shorts regained dominance. Overall, to avoid repeating this scenario, holding $64K is crucial.

While current charts favor the bulls, caution is advised. Otherwise, a retracement to $55K remains a possibility if bears regain control.

Leave a Reply