- Wormhole had a bearish trajectory until recently.

- The bullish belief was gaining momentum.

Wormhole [W] has bounced in price in the past couple of days. Earlier this week, Bitcoin [BTC] bounced higher from the $58k level to trade at $62k at press time. This 7.8% bounce was surpassed by Wormhole.

W has gained 19.39% in the past three days, outperforming BTC. However, its long-term trend remained bearish.

The market structure and trends weren’t encouraging

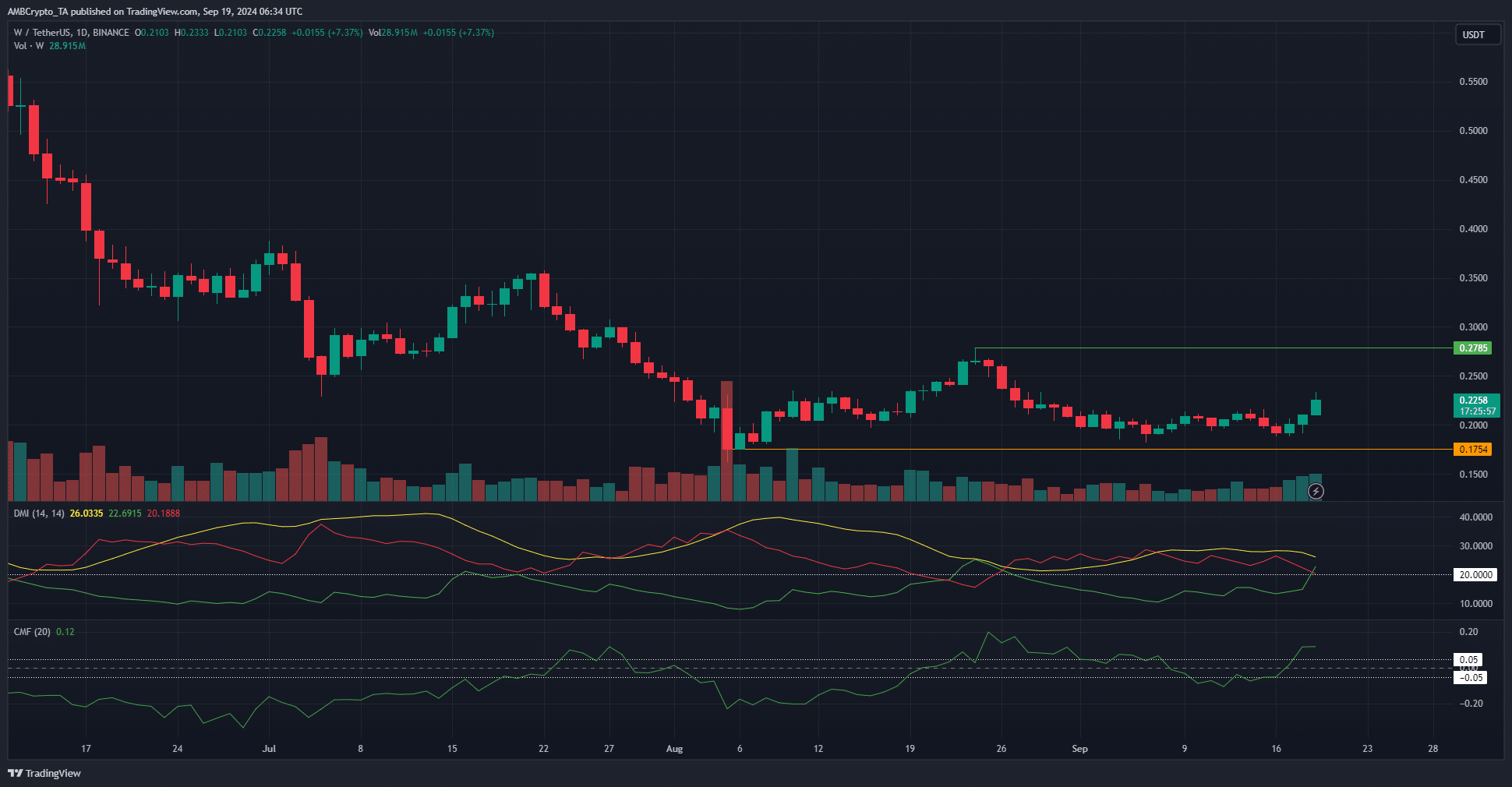

Source: W/USDT on TradingView

Since August, W has not set a new lower low on the daily chart, which was a slight encouragement for the bulls. The price appeared to form a range between $0.175 and $0.2785, with the local $0.2145 level serving as resistance in recent weeks.

This level was broken during the recent price surge. The Directional Movement Index, which had been signaling a strong downtrend in progress, began to shift. The readings were now more neutral.

The CMF also climbed higher. The +0.12 value reflected a significant influx of capital to the Wormhole market. Overall, a move toward the local highs at $0.278 appeared likely.

Sentiment was picking up

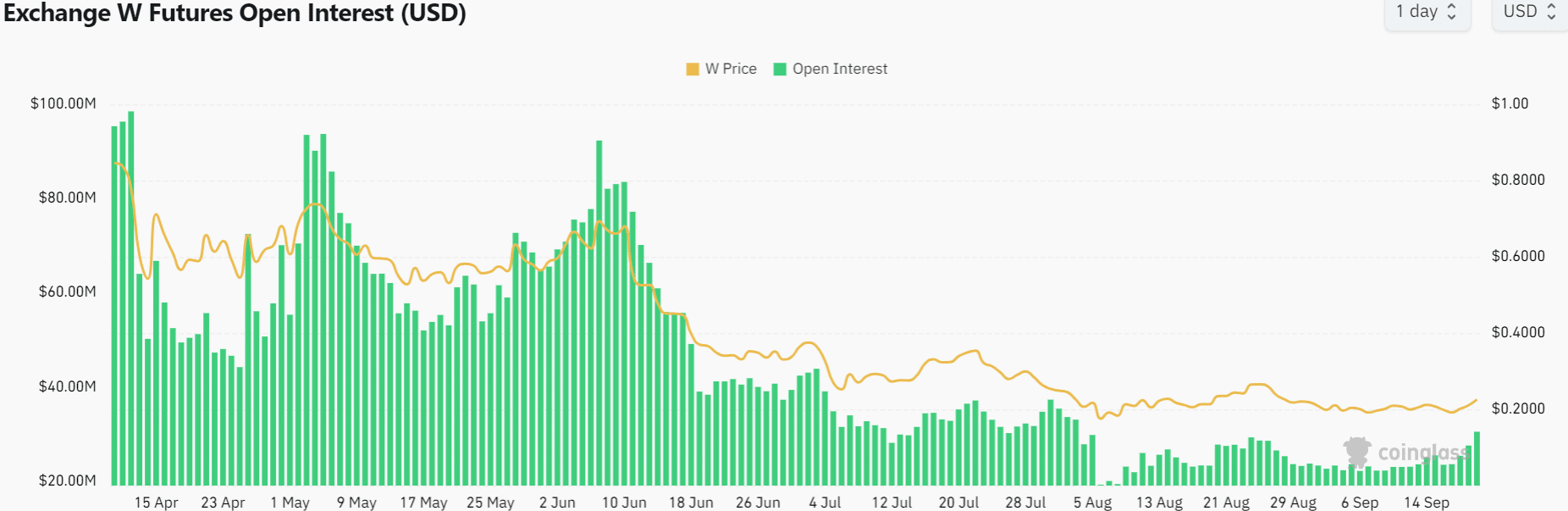

Source: Coinglass

The bearish trend in the daily chart during August and the first half of September saw muted values on the Open Interest chart. Speculators preferred to remain sidelined, but this was slowly changing.

The price spike of the past few days encouraged bulls to enter the futures market, and the Open Interest has increased by $5 million over the past two days.

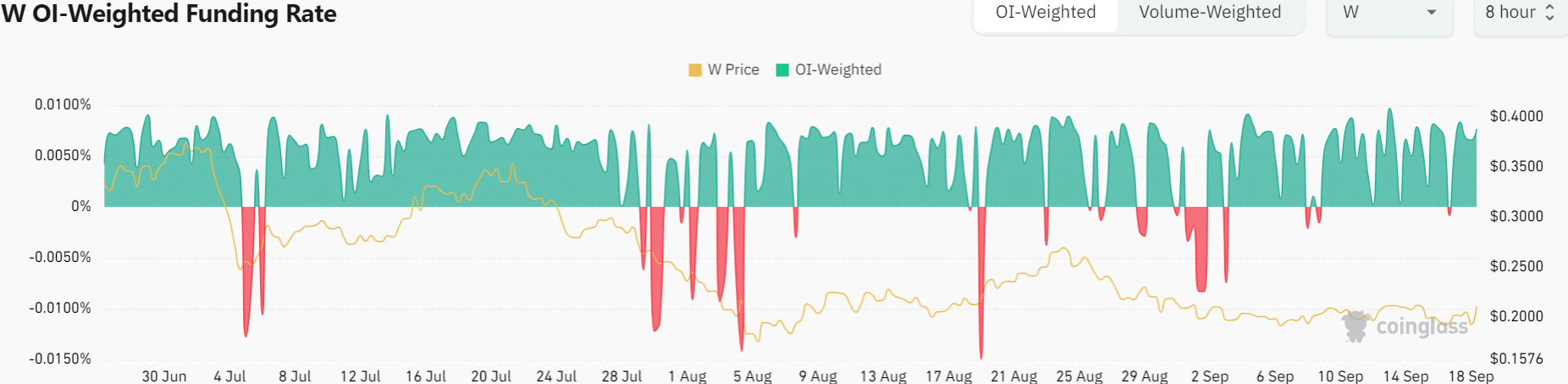

Source: Coinglass

Read Wormhole’s [W] Price Prediction 2024-25

The OI-weighted funding rate was also positive after a minor dip to negative territory on the 17th of September. This was another sign that participants were going long in the futures markets.

Overall, the next few days is likely to be bullish for Wormhole, provided Bitcoin does not see a sharp price drop.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Leave a Reply