- Dogecoin was testing key resistance at $0.12 after breaking a 6-month downtrend.

- On-chain data showed rising network activity and accumulation as traders eye a breakout past $0.12.

Dogecoin [DOGE] has finally broken free from a 6-month downtrend, sparking optimism among traders. DOGE traded at $0.1025 at press time, showing a 5.37% increase over the past seven days despite a minor 24-hour decline of -2.88%.

With a market cap of nearly $15 billion and a 24-hour trading volume of $553 million, Dogecoin was testing key resistance levels as traders focus on the $0.12 mark to trigger a significant upward move.

A falling wedge pattern, along with a reverse head and shoulders formation, suggests a potential bullish reversal for DOGE.

Both patterns indicate that a breakout could be on the horizon, particularly if the price surpasses the critical $0.1200 resistance level, which has previously acted as both support and resistance.

Critical levels for Dogecoin: $0.1050 support and $0.1200 resistance

As Dogecoin approaches key technical levels, traders are closely monitoring the $0.1200 resistance level. A breakout above this price could trigger a strong rally, potentially pushing DOGE toward $0.20.

The area between $0.1050 and $0.1200 is seen as a crucial range, and a sustained move above $0.1200 may indicate a shift in market sentiment from bearish to bullish.

Source: TradingView

However, DOGE must also hold above the $0.1050 support level to maintain its upward trajectory. A drop below this level could lead to further declines, forcing the price back into a consolidation phase.

Analysts are emphasizing the importance of momentum in these levels, with the next few trading sessions likely to be critical in determining DOGE’s short-term direction.

Technical indicators point to potential breakout

Dogecoin’s technical indicators are showing mixed signals, with room for both caution and optimism. The Relative Strength Index (RSI) is currently neutral at 47.45, suggesting that DOGE is neither overbought nor oversold.

If the RSI moves above 50, it could indicate renewed bullish momentum.

Source: TradingView

Meanwhile, the Moving Average Convergence Divergence (MACD) is on the verge of a bullish crossover, though the signal remains weak at this point.

If the price breaks above the $0.1200 resistance level, it could confirm the MACD crossover and provide additional momentum for a rally.

Critical levels to watch include support at $0.1050 and resistance at $0.1200, with a potential target of $0.2000 if a breakout occurs.

On-chain metrics show growing interest in Dogecoin

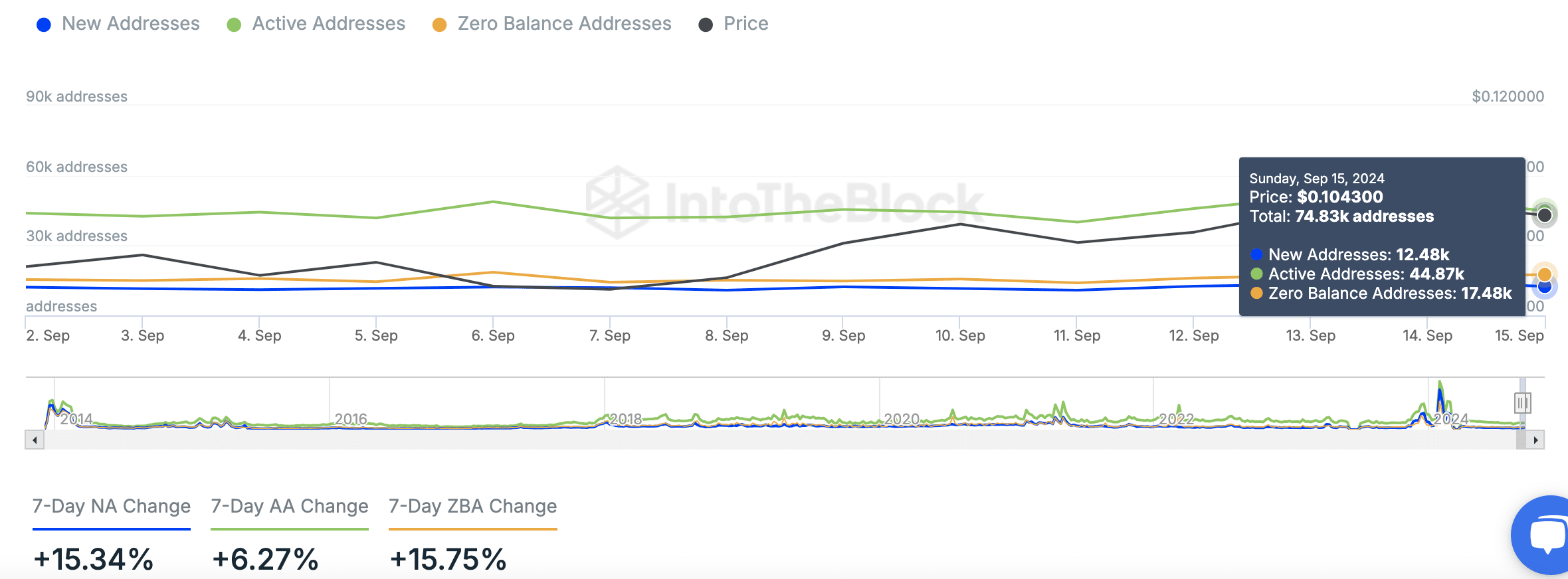

According to IntoTheBlock, On-chain data for Dogecoin reveals increasing network engagement, which may support the current price movement. On September 15, Dogecoin had 74,830 total addresses, with 12,480 new addresses added that day.

Active addresses stood at 44,870, indicating rising participation within the network.

Source: IntoTheBlock

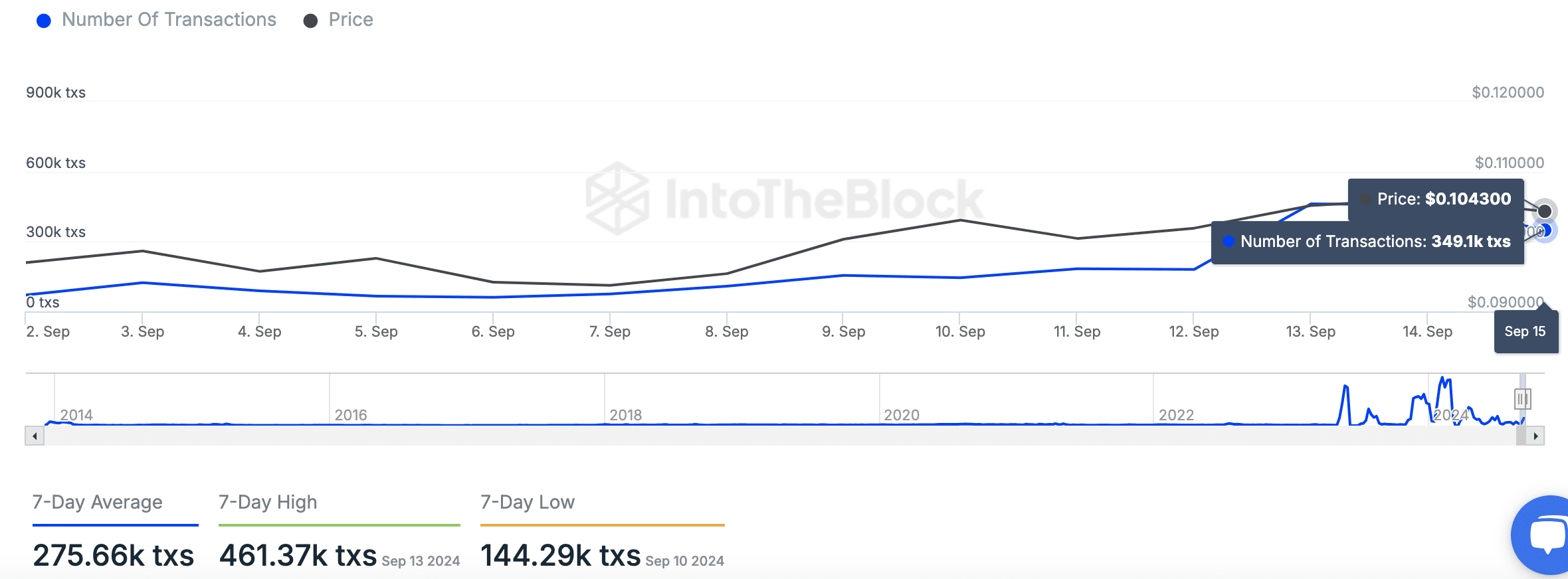

Additionally, Dogecoin saw 349,100 transactions, with a 7-day transaction average of 275,660. The highest transaction count in the past week occurred on 13th September, with 461,370 transactions.

This consistent network activity points to steady user interest, even as the price fluctuates.

Source: IntoTheBlock

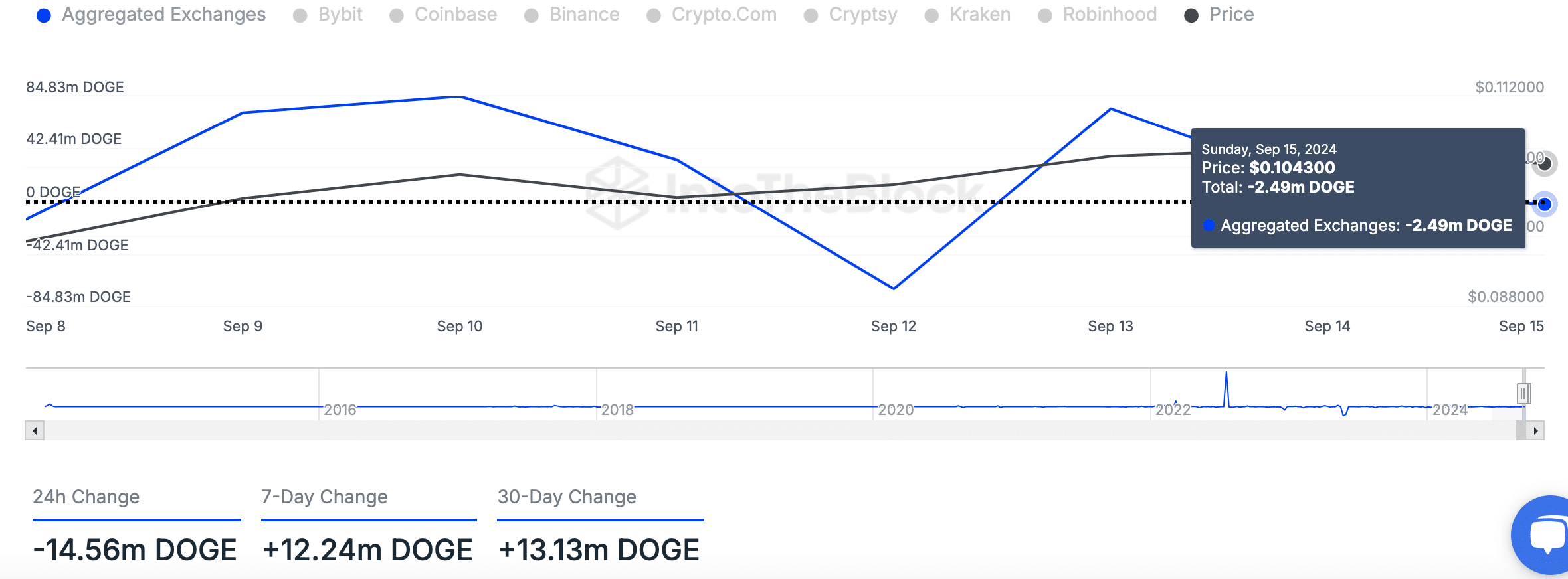

Moreover, Dogecoin experienced a net outflow of 2.49 million DOGE from aggregated exchanges, signaling potential accumulation. Over the past 24 hours, the outflow reached 14.56 million DOGE, while the 7-day net flow showed an inflow of 12.24 million DOGE.

Source: IntoTheBlock

Read Dogecoin’s [DOGE] Price Prediction 2024–2025

Despite recent price volatility, this data suggests that large holders may be moving Dogecoin off exchanges, possibly in anticipation of future gains.

With the $0.1200 level in sight, Dogecoin’s price movement remains critical.

Leave a Reply