Soneium, layer-2 di Ethereum pre-announced on August 23 by the tech giant Sony, has revealed that it will launch in the future a stablecoin pegged to the yen thanks to the subsidiary Sony Bank.

The new blockchain, currently in the testnet phase under the name “Minato“, will likely be introduced in mainnet in Q1 2025.

The debut of a Japanese stablecoin could push several other web3 providers to invest in the enhancement of this specific market niche, in a context where the US dollar predominantly reigns.

Let’s see all the details below.

Sony and the scheduled launch of Ethereum layer-2 Soneium: airdrop coming?

On August 23, the Japanese multinational Sony announced the imminent launch of the Ethereum layer-2 Soneium, anticipating a program that sees the development of a stablecoin that reflects the value of the yen. The Japanese technology giant, whose core business is focused on videogames and entertainment, has suddenly decided to dive into the blockchain market.

In a detailed blog post, it introduced the new scalable next-generation solution, which aims to integrate developers, creators, community, and end users together.

Introducing #Soneium by #Sony Block Solutions Labs building a public Ethereum layer 2 next-generation blockchain ecosystem designed to invoke emotion and empower creativity.

Soneium aims to connect Web3 with everyday internet services, making blockchain technology more… pic.twitter.com/I7zAIbB5Td

— Soneium 💿 (@soneium) August 23, 2024

The mission of Soneium is to unite more people with different backgrounds around a single interoperable infrastructure with the broad Web3 sector. In addition to maximum compatibility with external applications, the network could aim to create new types of decentralized services, still publicly unknown.

The partners accompanying Sony on this journey are Astar Network, Chainlink, Alchemy, Circle, and The Graph. In particular, Astar will offer its bridging technology for transferring funds from Polkadot to Ethereum, while Chainlink will act as an oracle. Circle is committed to supporting the new stablecoin, Alchemy provides RPC support, and The Graph lends its data indexing service.

The final launch date is not yet clear, but it is believed that the mainnet will be presented by Q1 2025. Many are already starting to talk about a significant crypto airdrop on the way, but at the moment only the “Minato” testnet is available to interact with Sony’s project.

There is also an incubation program for new projects, called “Soneium Spark”, but no airdrop campaign has been announced.

Ready to turn 5 minutes into thousands of dollars?

Dive into the Soneium Minato Testnet with this simple guide 🚀

Cost: $0

Time: 5 minutesDon’t miss out! A thread 🧵👇 pic.twitter.com/9VDoZKEZTR

— andrewwwww (✍️,🧵) (@andrewtalksdefi) September 10, 2024

Sony: the new stablecoin pegged to the yen in collaboration with Sony Bank

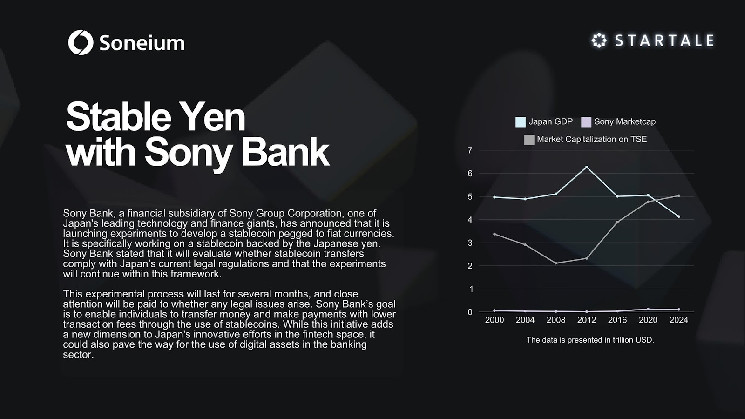

According to unofficial sources, Sony is reportedly considering a new stablecoin pegged to the yen, in collaboration with its subsidiary Sony Bank.

In the last few hours on X, this image has been circulating, explaining how the subsidiary of the Japanese giant will commit to developing a stable cryptocurrency. The choice to open the Japanese market to stablecoins is presumably motivated by the already confirmed presence of the American company Circle (with USDC) in Soneium’s plans.

By doing so, Sony’s layer-2 will have support both for the onboarding of Western USD based clients and for Eastern YEN based clients.For the moment it is just an experiment (among other things not officially confirmed) that will need to integrate with the regulatory framework of the country.

The development of a cryptocurrency dedicated to the yen in Japan will first need to obtain the green light from the regulatory authorities before it can land on the blockchain.

Currently, there is no clear regulation on the topic of stablecoin in the country, so the timelines could be longer than expected. Sony Bank’s goal seems to be to allow its users to exchange money through its own convenient, secure, and economical infrastructure.

The presence of a stablecoin is therefore fundamental in the company’s plans, which strongly focuses on the fintech development of Tokyo. It is also evident how the attention of institutions towards the world of digital assets is growing significantly in Japan.

Source: https://x.com/delzennejc/status/1833243834563650038

The non-USD stablecoin market

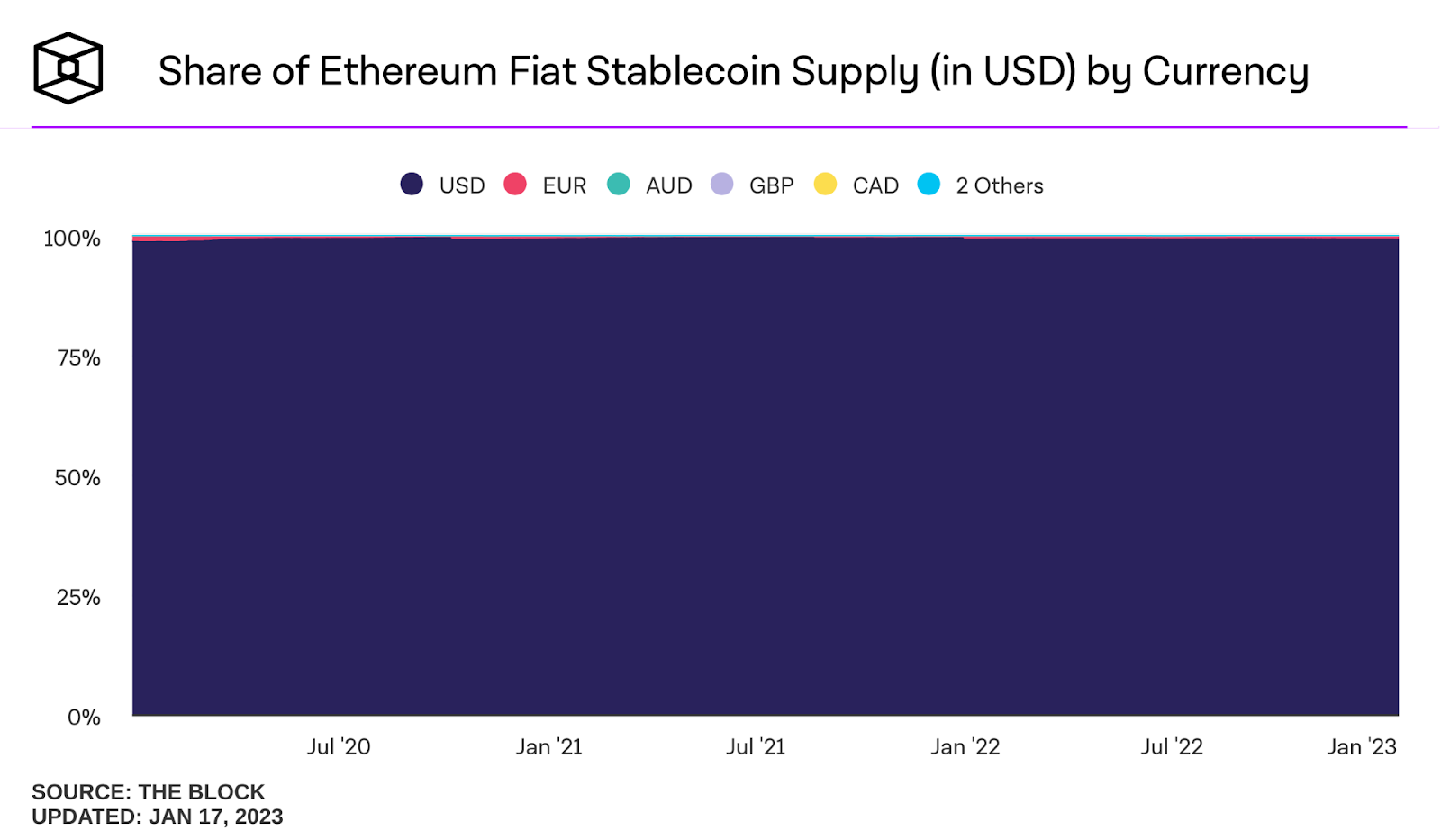

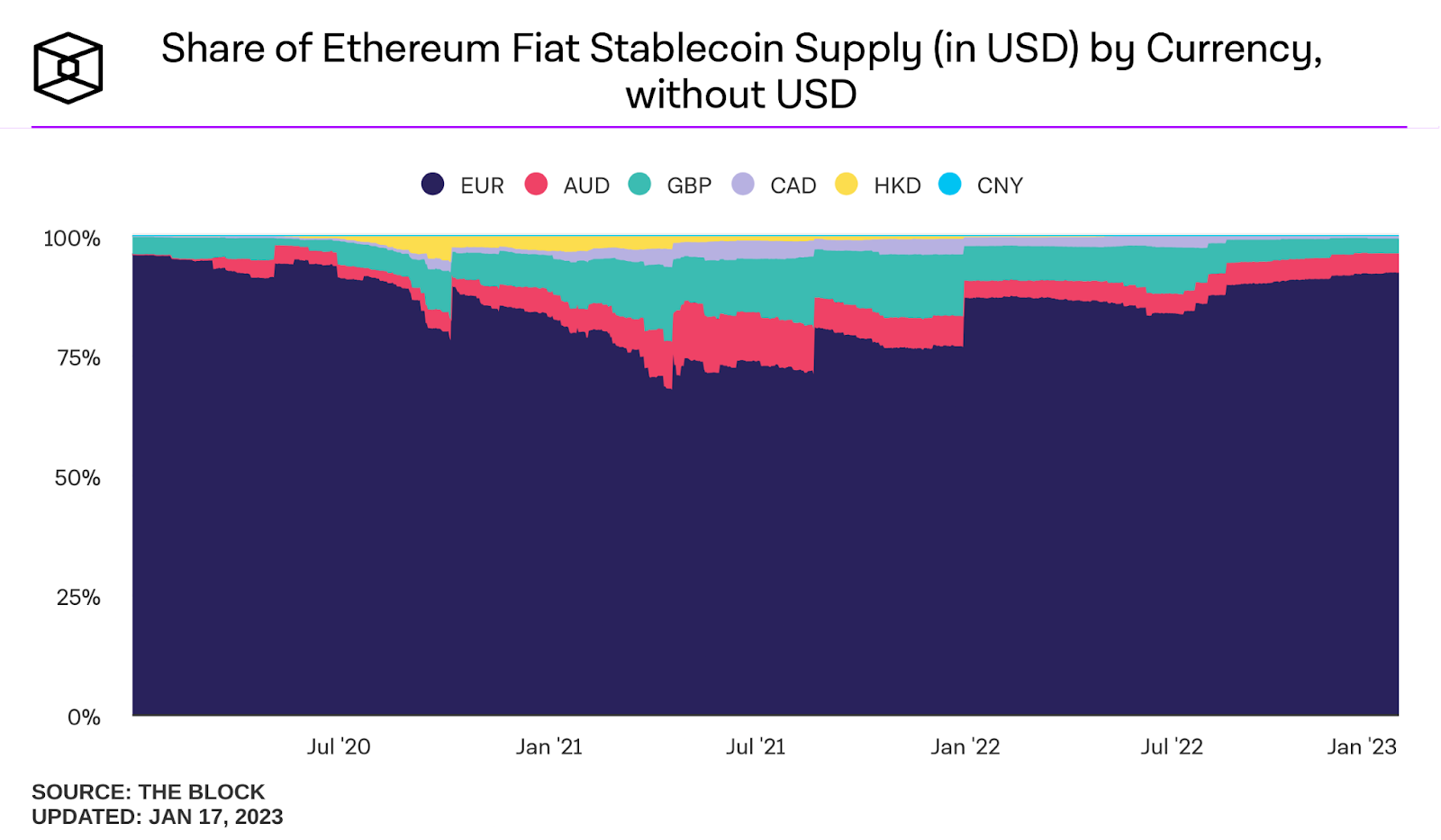

Sony, by launching a new yen-based stablecoin for its own blockchain Soneium, would enter a market niche totally dominated by the US presence. In fact, according to data from The Block, the fiat stablecoin market on Ethereum is governed by 99.32% by the US dollar.

The remaining 0.68% of the slice, with a total value of over 600 million dollars, is then monopolized in turn by the euro which controls a substantial 92% of it. Australian dollar (AUD) and British pound (GBP) play marginal roles with respectively 4.04% and 3.09% of the stablecoin market in which USD is excluded.

For the yen, at the moment, there is really little space in the panorama of cryptographic stablecoins, in which first the Americans, then the Europeans, have plunged headlong.

Ciononostante, il crescente impegno di molte società Web3 nel voler mettere un piede nell’ambiente crittografico giapponese, highlights a potential for this industry. In this regard, a few days ago Brad Garlinghouse, CEO of Ripple, stated that he is convinced that Japan will face a strong demand for a yen stablecoin.

According to what was said in an interview:

“People will want to hold stablecoins in yen, and I think it’s only a matter of time.”

The cryptocurrency exchange Binance, already for several months with its own branch Binance Japan, is considering a stablecoin just like Sony Bank is doing at the moment. The main problem at the moment is related to the regulation of digital assets, where the lack of a clear framework limits large investments from individuals and institutions.

However, after Sony, a giant with an annual revenue exceeding 3 billion dollars, made its intentions in the crypto world public. It is likely that many others will follow in its footsteps.

Leave a Reply