- The number of Dogecoin long-term investors have increased.

- Metrics hinted at a DOGE price rise soon.

New data has revealed that short-term Dogecoin [DOGE] traders, those who have traded in the past 30 days, have seen only modest gains averaging +1.7%.

In contrast, long-term traders, who have held positions for a year, are down nearly 20.8% compared to their status a year ago.

Let’s have a closer look at DOGE’s state to find out whether long-term investors will also enjoy profits this year.

Dogecoin LTHs are suffering

Santiment recently posted an analysis revealing the states of different types of DOGE holders. As per the analysis, DOGE did benefit last month because of the memecoin frenzy that happened after Tron’s SunPump launch. However, the trend has changed.

As per CoinMarketCap, DOGE’s price dropped by more than 3% in the last 24 hours. At the time of writing. Dogecoin was trading at $0.09956 with a market capitalization of over $14.5 billion.

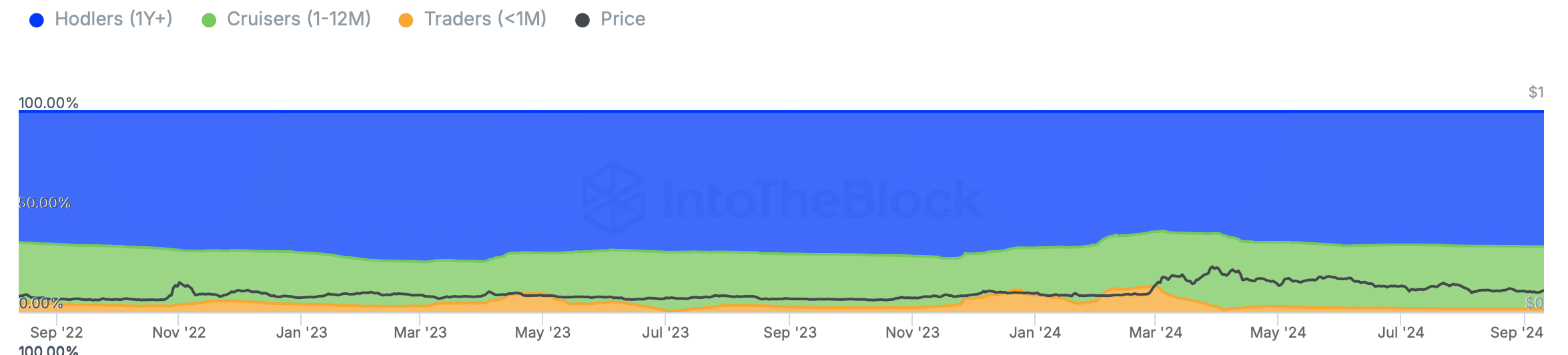

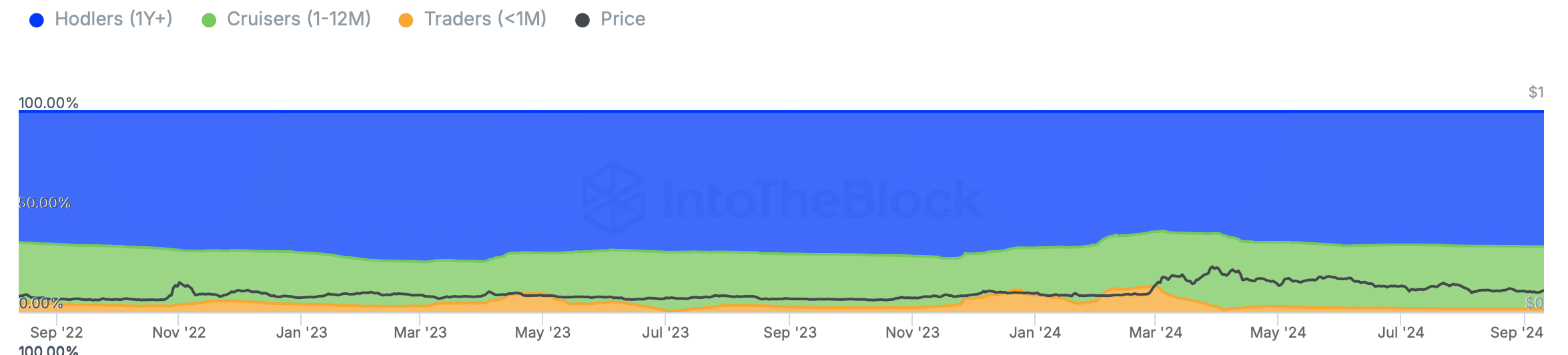

AMBCrypto then checked IntoTheBlock’s data to find out the concentration of long-term holders. We found that despite this latest setback, the number of holders (addresses holding DOGE for more than 1 year) actually increased over the last several months.

This clearly indicated how long-term holders were confident in the world’s largest memecoin.

Source: IntoTheBlock

Will investors see profit?

AMBCrypto then checked the world’s largest memecoin’s on-chain data to see whether long term investors’ belief in the coin will actually benefit them.

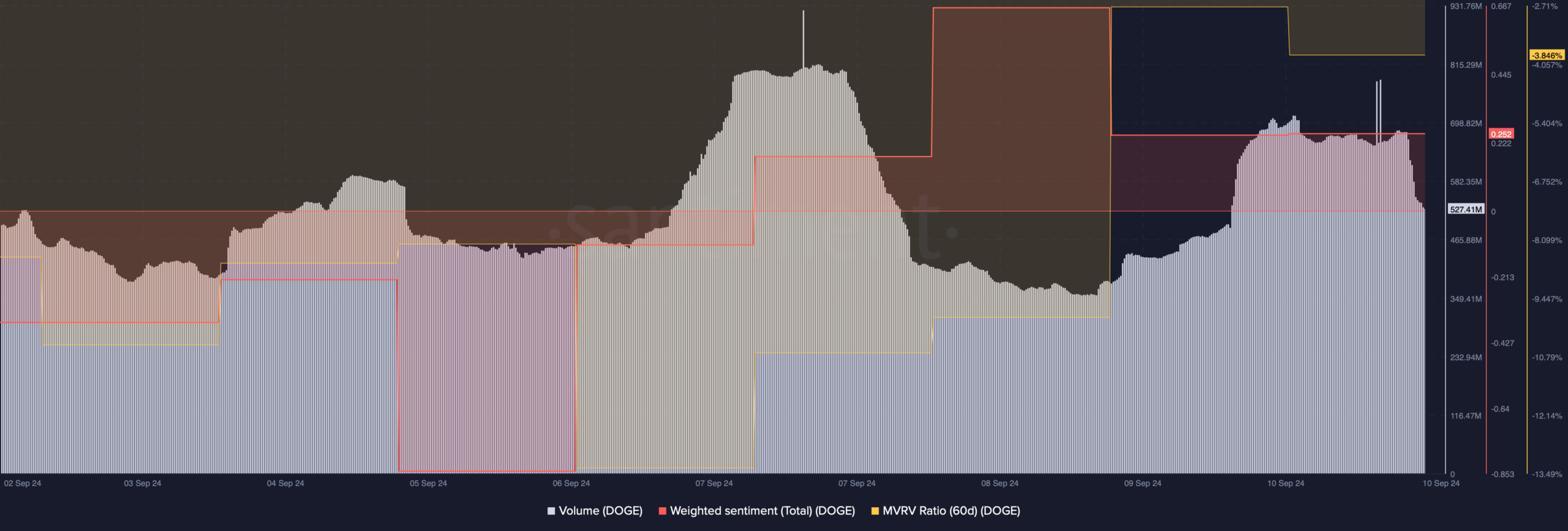

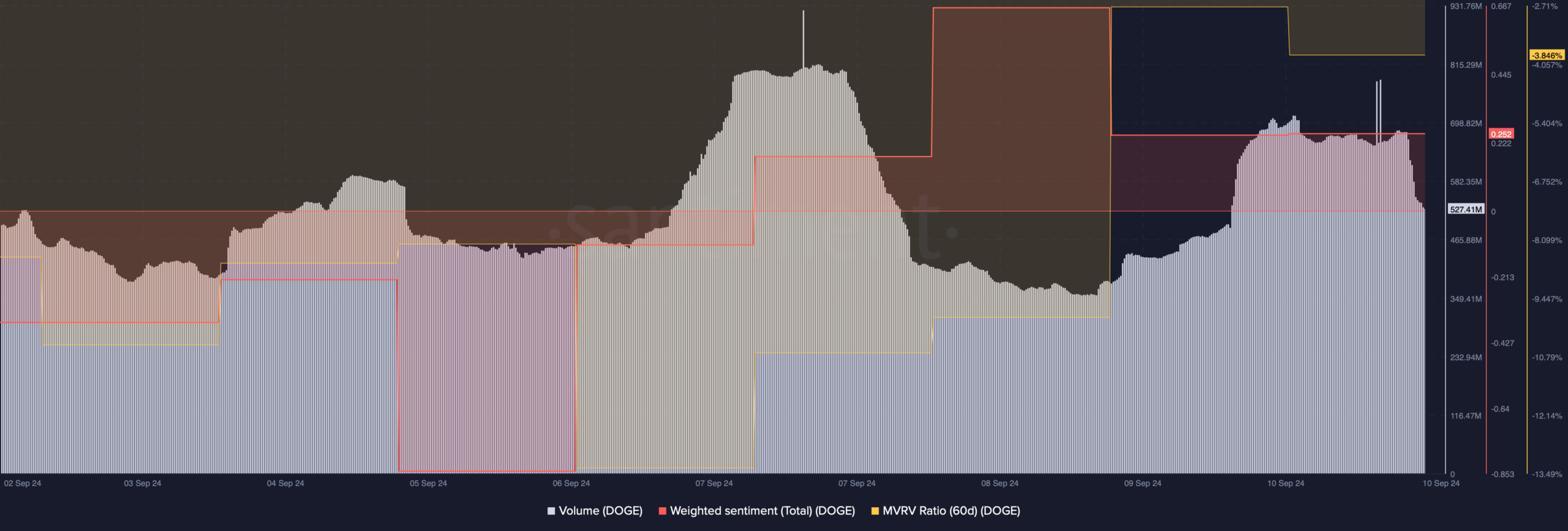

As per our analysis of Santiment’s data, DOGE’s volume increased while its price dropped, which can be inferred as a bearish signal.

However, Dogecoin’s weighted sentiment increased, reflecting a rise in bullish sentiment. Additionally, the MVRV ratio also increased, indicating a possible rise in the coin’s price.

Source: Santiment

As per Glassnode’s data, DOGE’s long/short ratio registered an uptick. Whenever the metric increases, it suggests that there are more long positions in the market than short positions, indicating a hike in bullish sentiment.

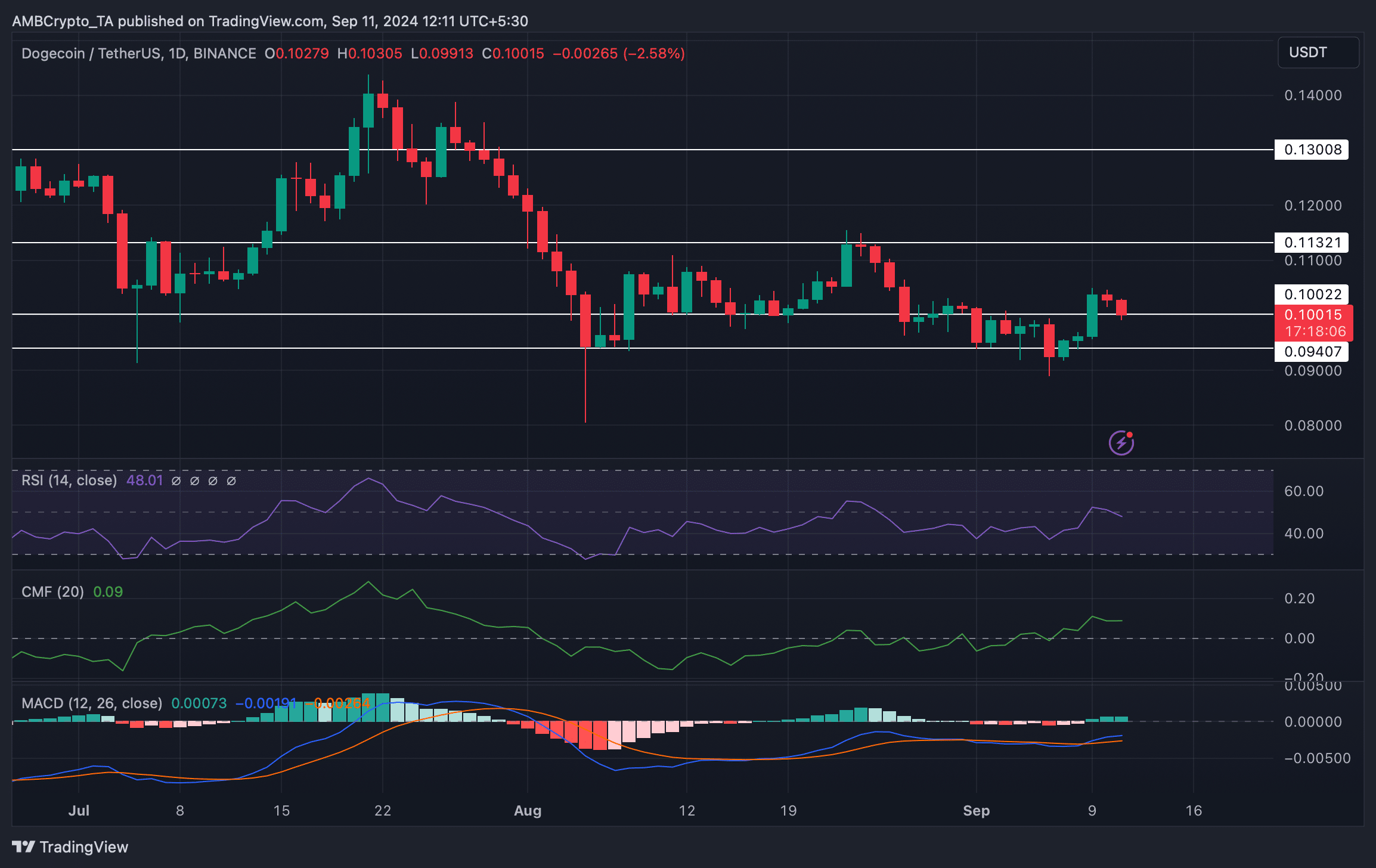

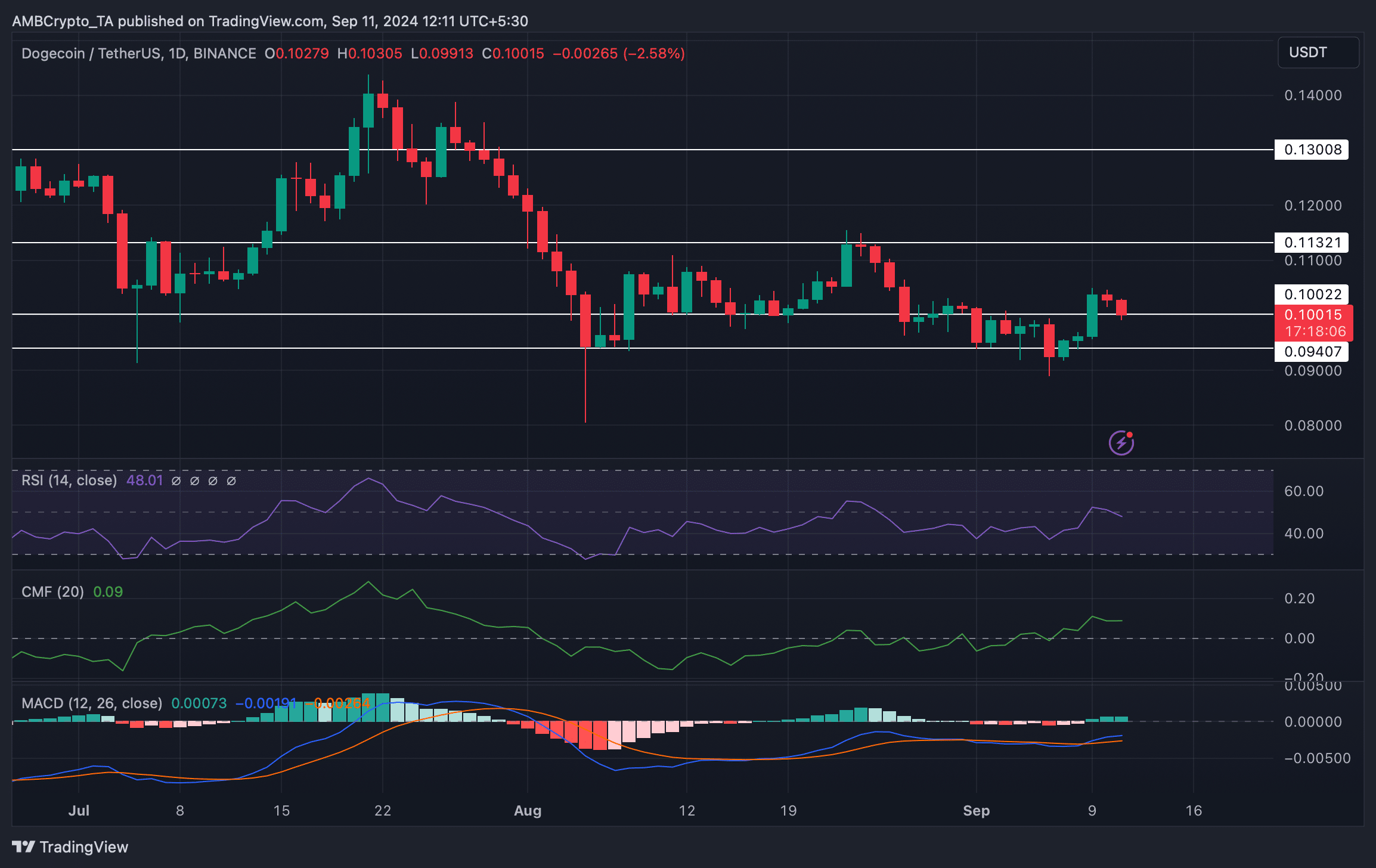

We then took a look at the token’s daily chart. We found that DOGE was testing as a crucial support zone.

Is your portfolio green? Check out the DOGE Profit Calculator

The Chaikin Money Flow (CMF) indicated that DOGE might have failed to test the support as it moved sideways. The Money Flow Index (MFI) also followed a similar trend.

However, the MACD looked in the investors’ favor. This was the case as the indicator displayed a bullish crossover.

Source: TradingView

Leave a Reply