- AVAX has experienced a decline over the past 30 days, dropping by 11.89%

- Analysts expect massive sell-offs if prices decline below the $22.84 support level.

Over the last 30 days, Avalanche [AVAX] experienced a considerable decline of over 11.89%. However, there was a slight recovery over the last seven days, reporting a 1.61% gain on the weekly charts.

Despite these developments, AVAX’s price remained relatively low from the recent high of $33.02 and 85% below ATH recorded three years ago.

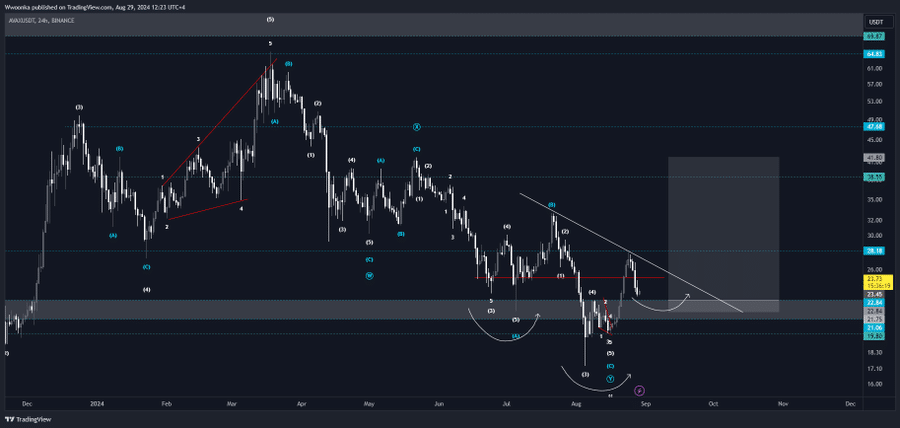

The current market conditions have left analysts eyeing further gains. Inasmuch, Crypto analyst Trade Devils saw a rally after the altcoin formed a bullish pattern.

Source: X

In his analysis, Trade Devils pointed to the inverse head and shoulder patterns that recurred across the altcoin market. If the prices break out of the stubborn resistance level of $22.84, the altcoin will rally.

However, the analyst sees massive sell off if it fails to hold above $22.84 support level.

Based on this analysis, the AVAX will make further gains since it has already passed its point of possible selling pressure.

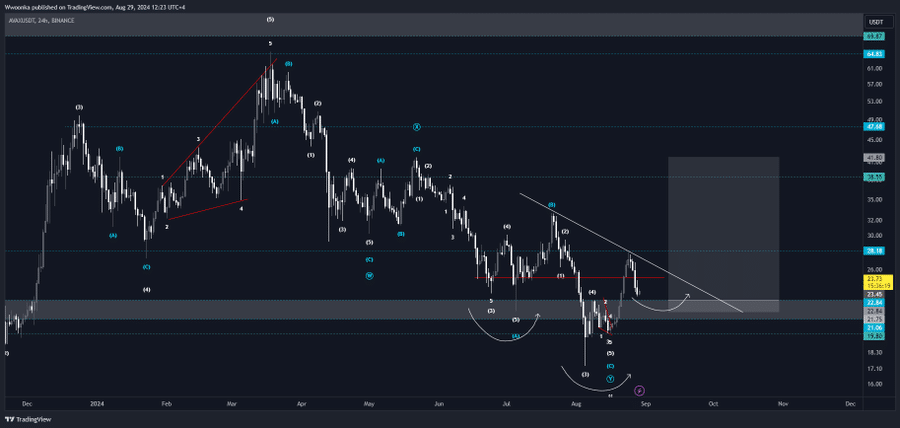

What AVAX’s charts suggest

AMBCrypto then took at look at AVAX’s price charts. Notably, in the last four days, the altcoin had experienced a sharp decline in its price to trade at $23.74. This marked a 1.29% drop in the past day.

Prior to the last five days of decline, AVAX was rising from a low of $19.79 to a high of $28 at press time.

Source: TradingView

Broadly, AVAX’s market sentiment remained bearish. Looking at the Relative Strength Index (RSI), it had declined over the past 24 hours to 48.

Also, the RSI-based MA at 51 remained above RSI, which showed high selling pressure.

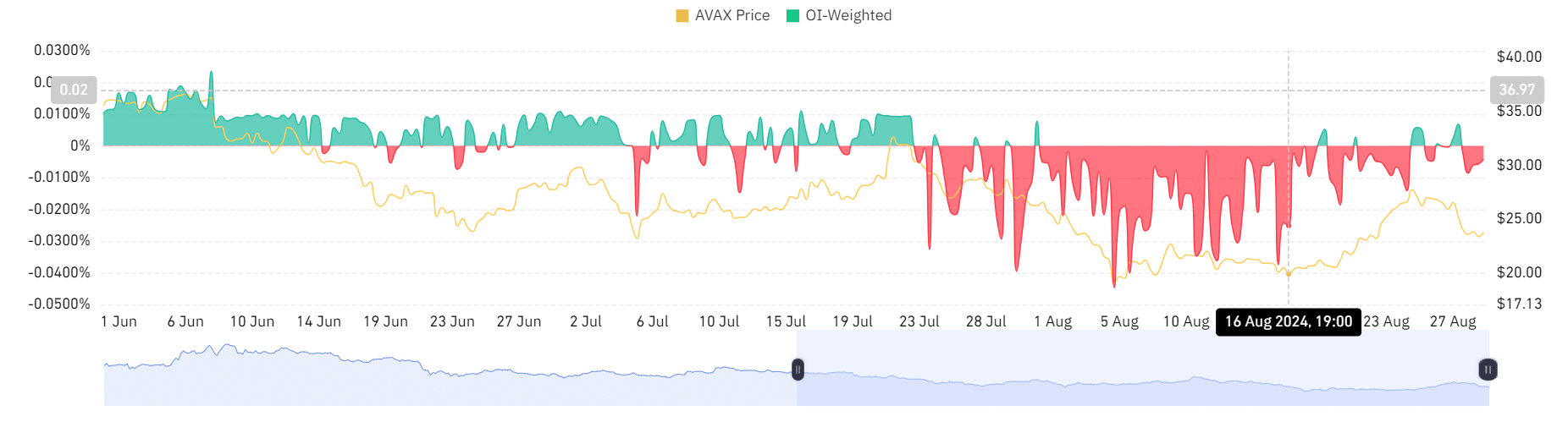

Source: Coinglass

This market sentiment was further supported by a negative OI-Weighted Funding Rate, suggesting an increase in demand for short positions, with many investors betting on the market to drop.

Thus, sentiment was bearish, as investors seemed to lack confidence in the altcoin’s future direction.

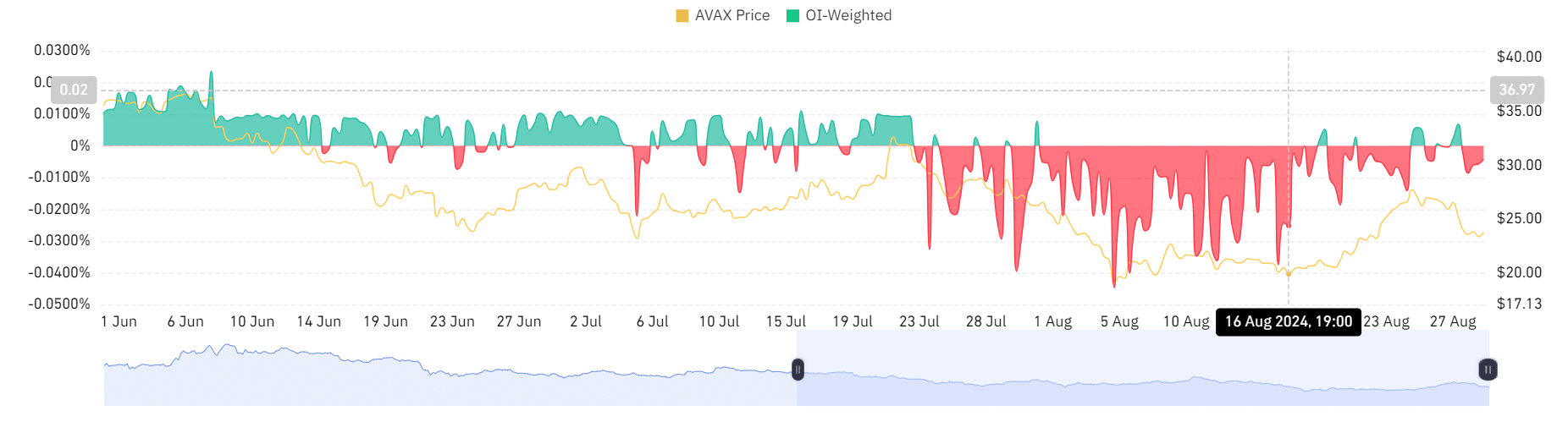

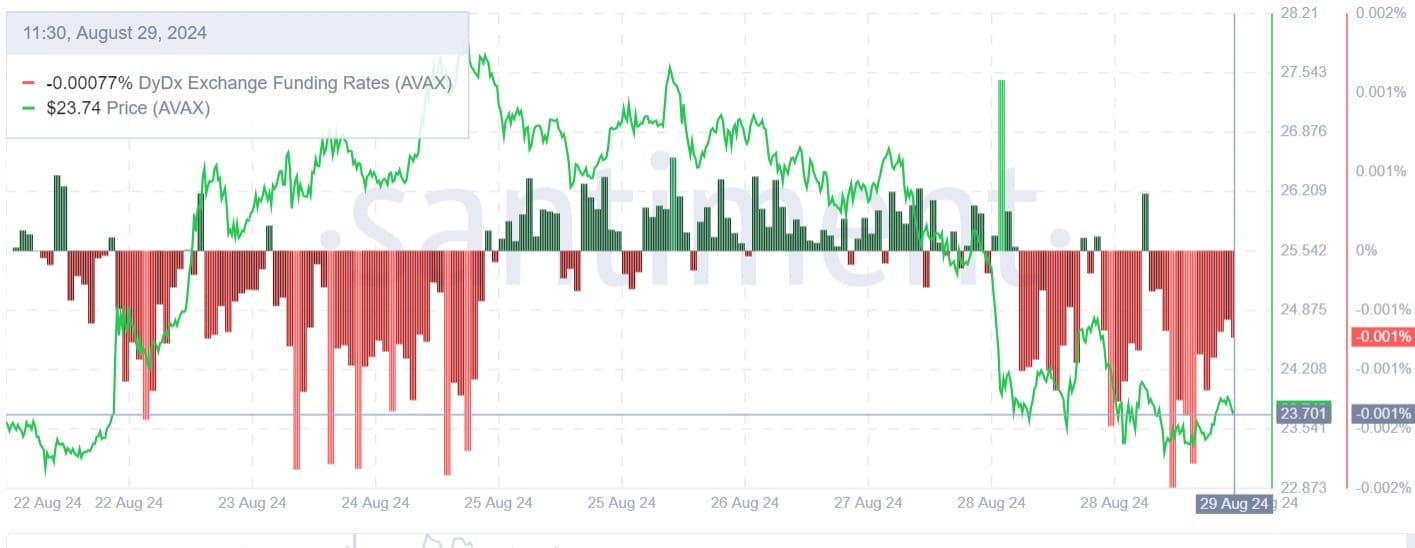

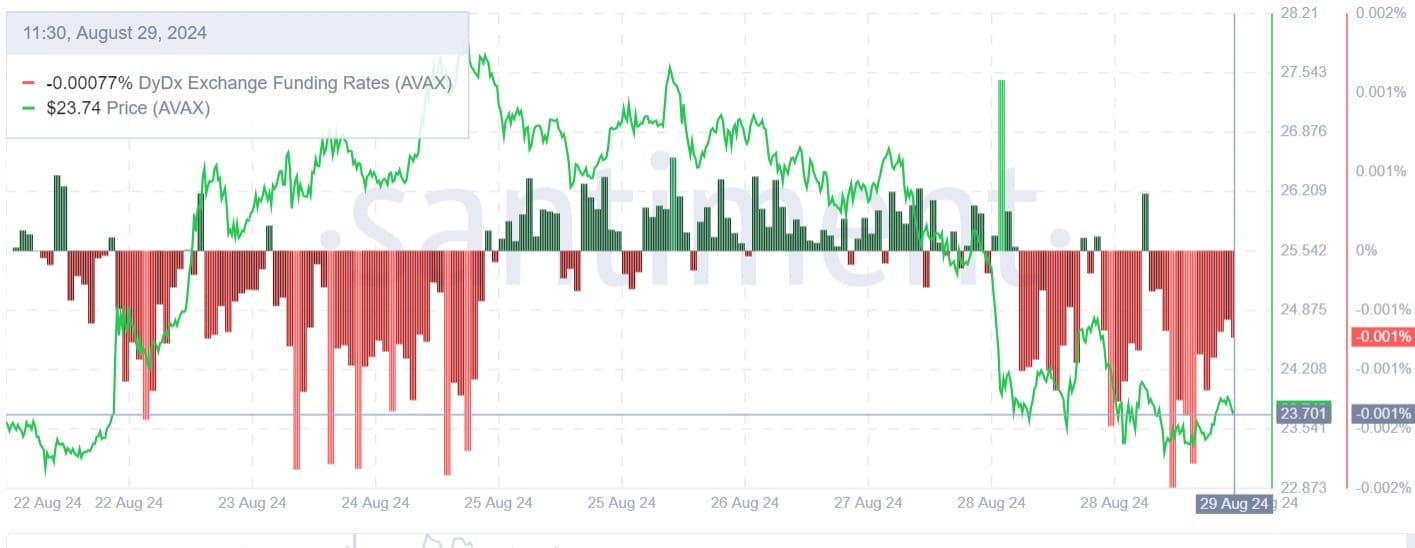

Source: Santiment

Further, AMBCrypto’s analysis of Santiment showed that DyDx Exchange Funding Rate was negative, sitting at -00077 at press time. So, there was higher demand for short positions, compared to long positions.

Read Avalanche’s [AVAX] Price Prediction 2024–2025

Therefore, although analysts are optimistic, if the current market conditions hold, the altcoin will drop to $21.75.

However, trend reversal arising from increased buying pressure would drive AVAX prices to a $27.14 resistance level.

Leave a Reply