- BTC may be mirroring its 2020 price trend, Is a post-COVID pump scenario on the cards?

- QCP Capital analysts projected that the recent BTC dip could be short-lived

Since peaking above $73k in March, Bitcoin [BTC] has been consolidating for six months, swinging between $50k and $70k. According to Bloomberg ETF analyst James Seyffart, however, the current price action mirrors its 2020 pattern.

“Bitcoin right now around $50k-$70k over the last 6 months kinda sorta reminds of BTC trading around $7k – $10k from mid-2019 through early to mid-2020.”

After breaking the $7k – $10k price range in 2020, BTC closed the year nearly at $30k, tripling its value. By 2021, BTC peaked at $69k, more than double its value at the end of 2020.

As highlighted by Seyffart, 2020 and 2024 share more than just similar price patterns. They also share BTC halving events historically associated with massive rallies.

Is a parabolic rally likely for BTC?

Although historical performance doesn’t dictate future outcomes, history always rhymes. Most market cycle analysts still maintain that BTC’s post-halving rally is still on the cards.

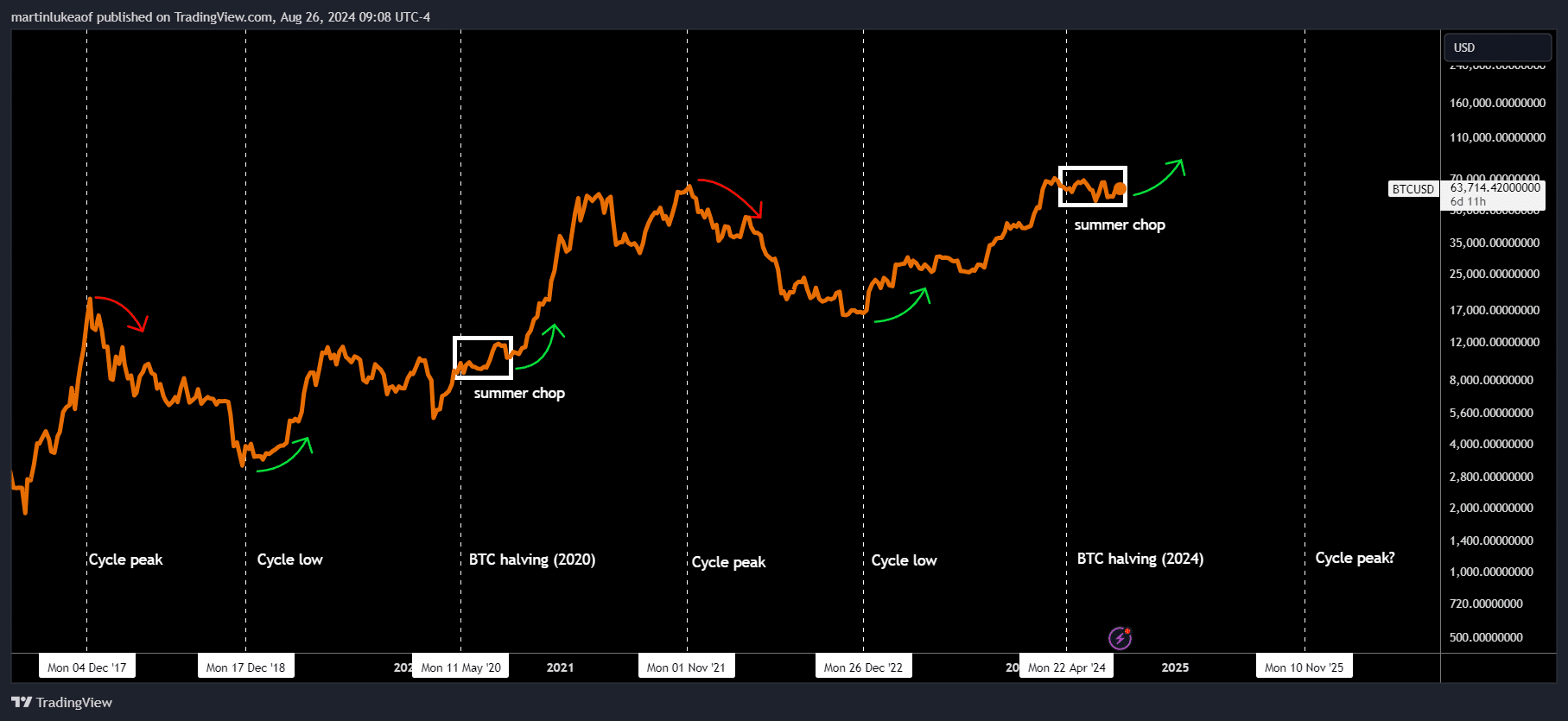

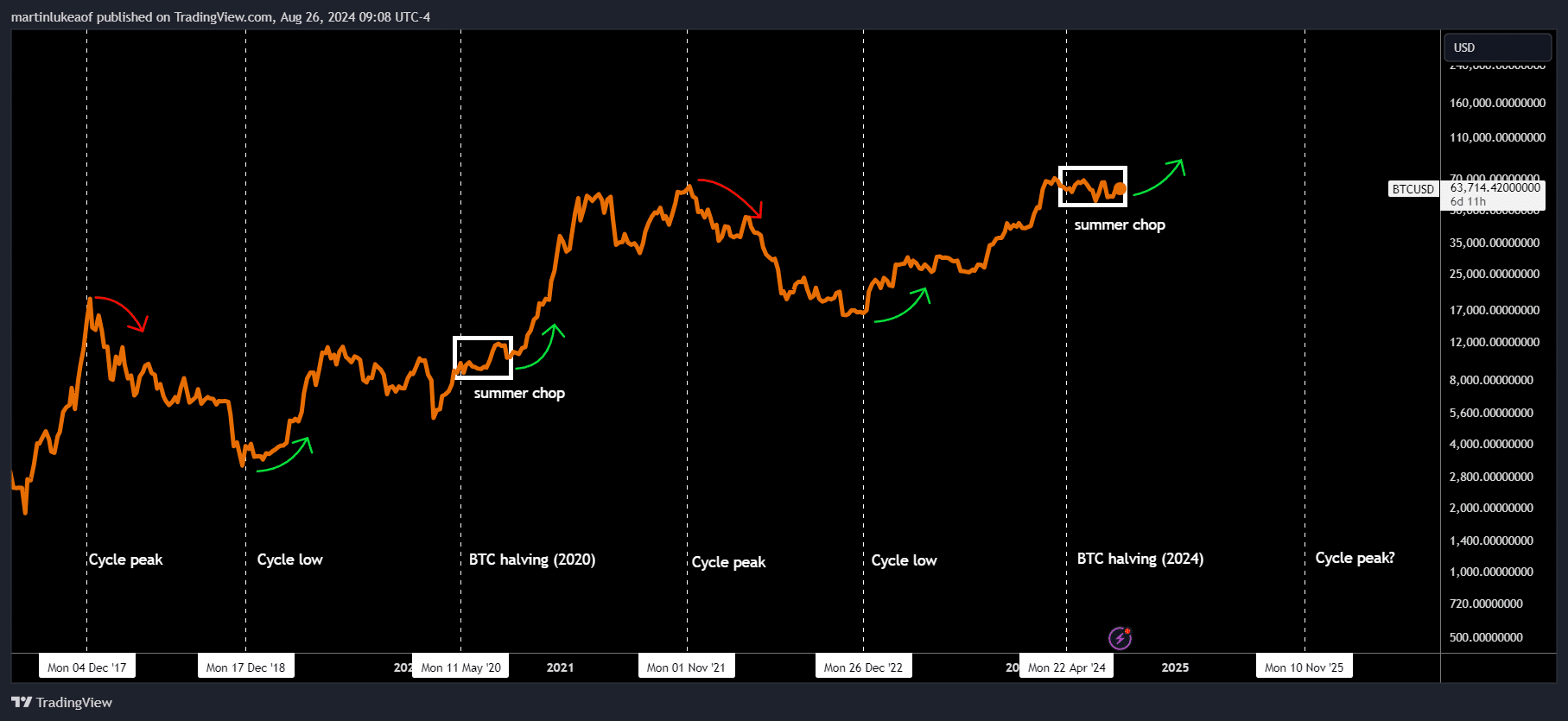

One of the analysts, Luke Martin, shared a similar analysis to Seyffart’s and projected a likely pump after the summer’s choppy market.

“Yup! Very similar setup to mid/summer 2020. Choppy market post-halving, consolidation during uptrend, cycle low ~1.5 years ago.”

Source: X

Similar post-halving projections have been made too, the latest being a price target of $200k per BTC by 2025.

That being said, BTC has been whipsawing over the past few days despite positive signals from the Fed about a potential policy pivot towards interest rate cuts. The world’s largest cryptocurrency recently mounted above $64k, only to slip below $60k, stoking confusion amongst investors and analysts.

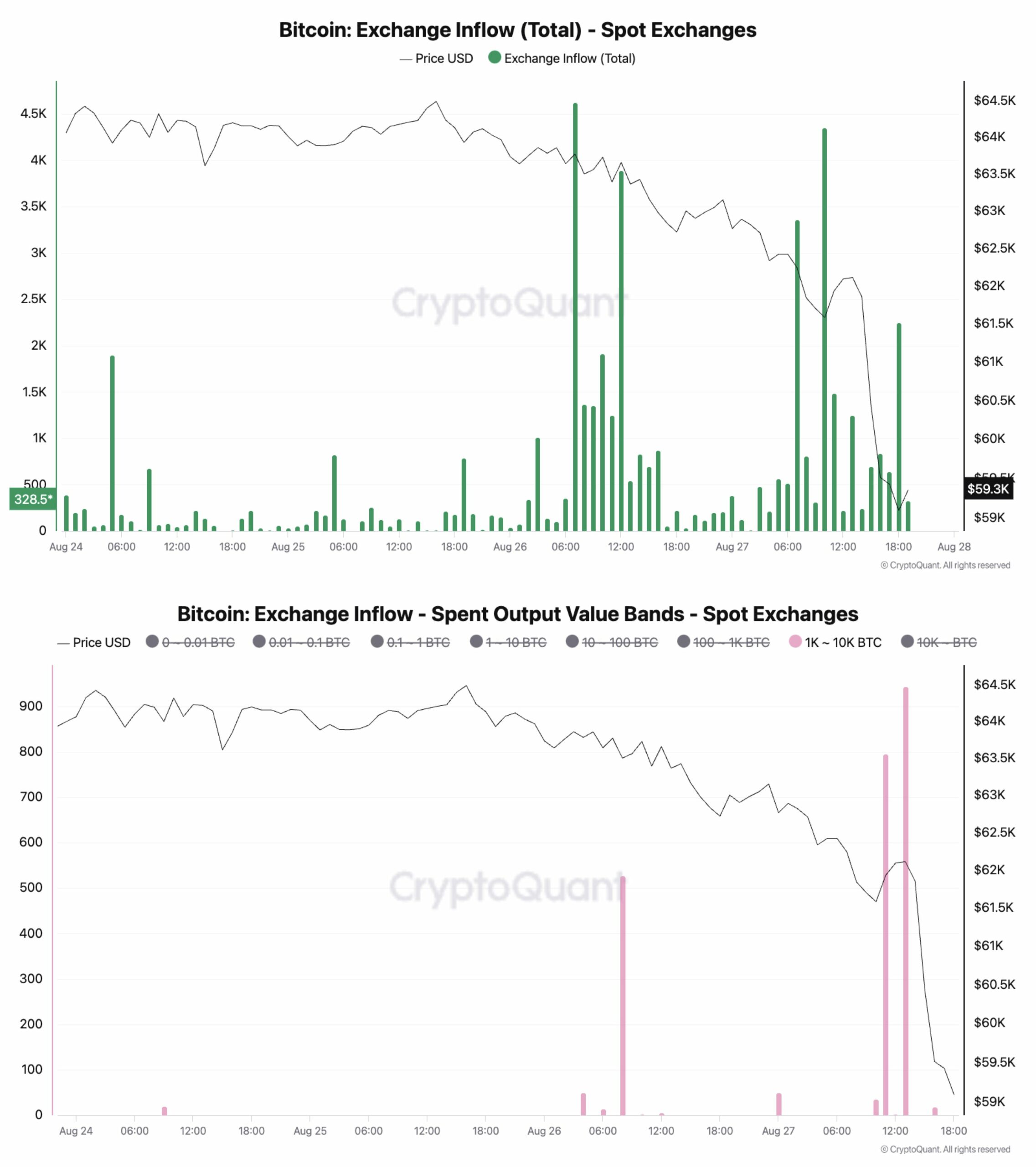

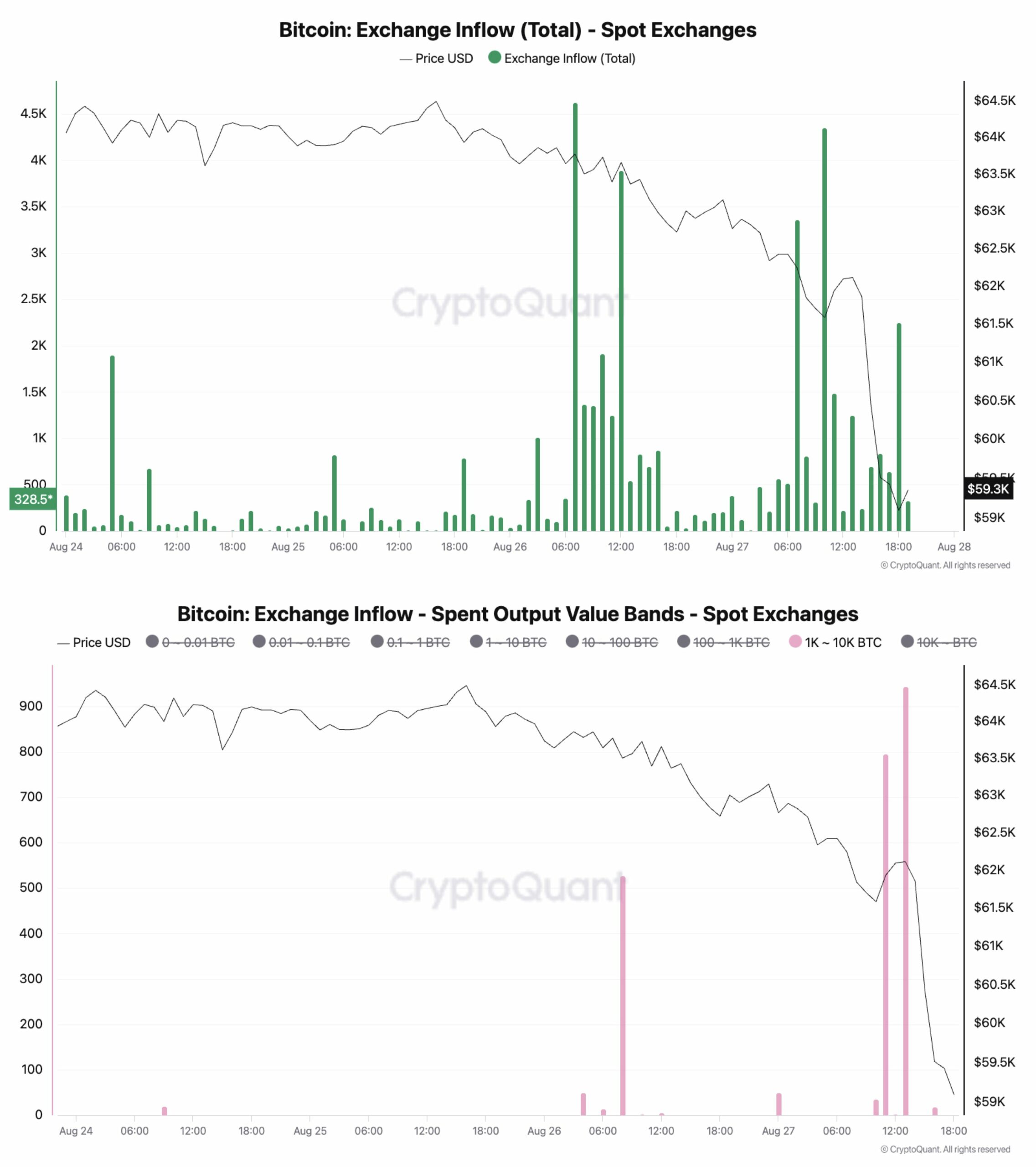

CryptoQuant’s Head of Research, Julio Moreno, noted that a massive BTC dump on centralized exchanges from some large wallets triggered the mid-week plunge.

“There were increasing #Bitcoin inflows to spot exchanges just before today’s sell-off (first chart).”

Source: CryptoQuant

On the contrary, QCP Capital analysts revealed that given the positive macro outlook, the current downward pressure could be short-lived before the next leg up begins.

“We believe that any dip in equities (and crypto) will be short-lived. With Powell and the Fed ready to kickstart a rate-cutting cycle, increased liquidity will eventually push risk assets higher.”

Leave a Reply