- Nvidia reported that its Q2 earnings generated $30.04B.

- FET and TAO to benefit from NVDA positive news in the long-term.

The AI sector is experiencing a resurgence this week, significantly outperforming other sectors despite recent market downturns.

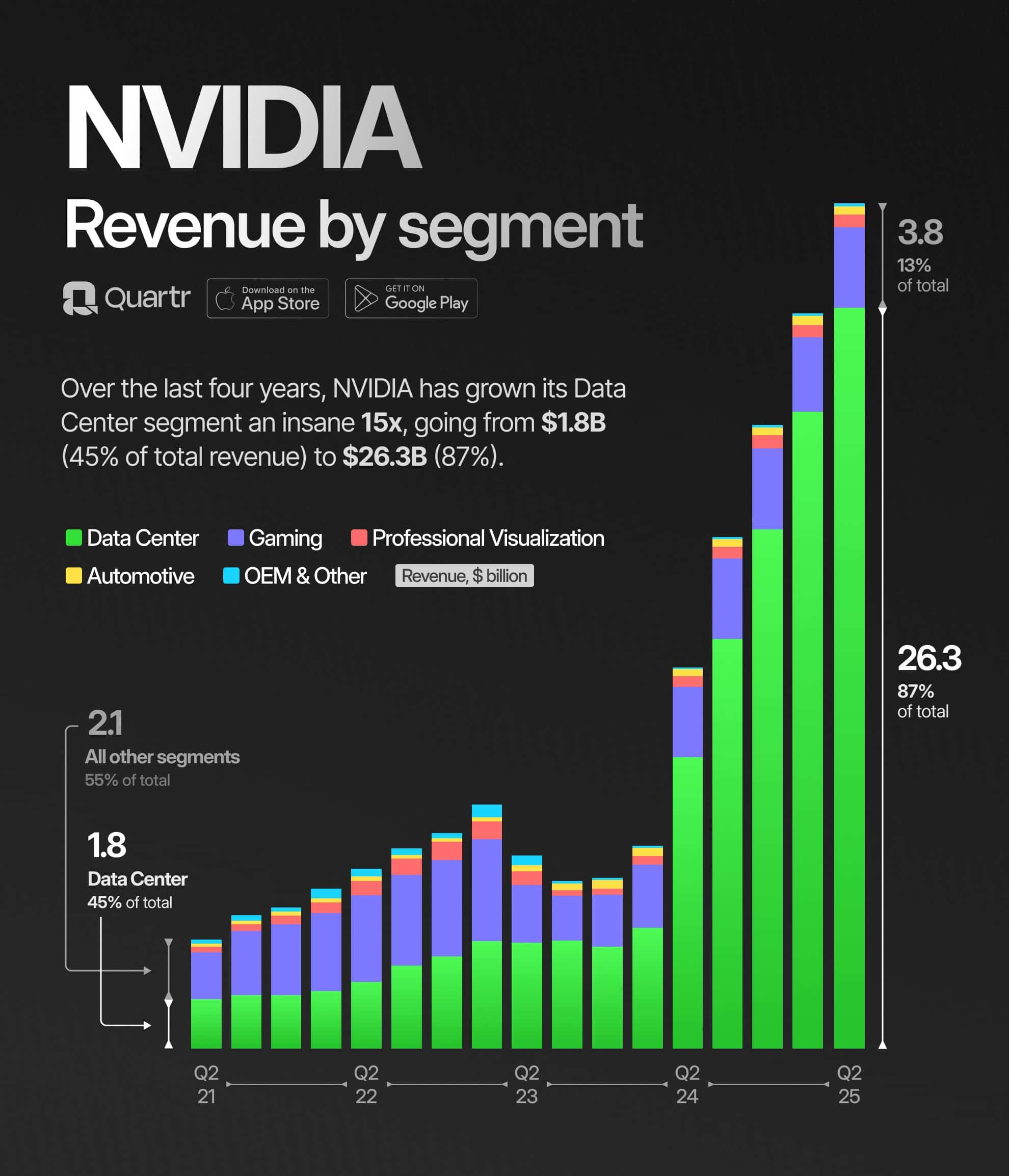

Nvidia [NVDA] recently reported Q2 earnings, generating $30.04 billion in revenue, exceeding expectations by 3.8%. The company achieved an adjusted earning per share of 68 cents, surpassing the anticipated 64 cents.

For Q3, Nvidia projects revenue of $32.5 billion, representing an 80% year-over-year increase, compared to the expected $31.7 billion.

Source: Quartr/X

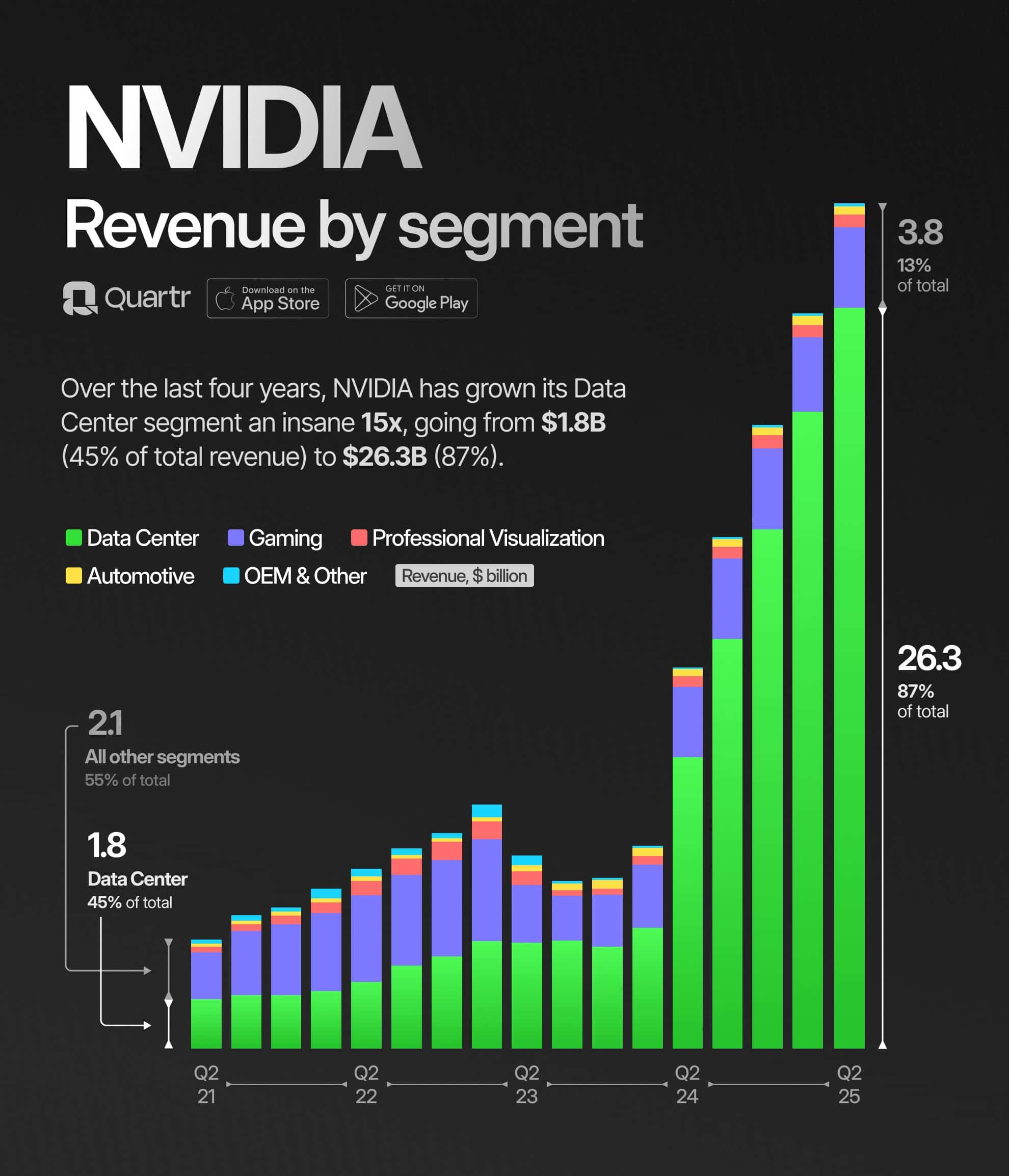

AI projects with most mindshare

Among AI projects, Bittensor [TAO], Artificial Superintelligence Alliance [FET], Near Protocol [NEAR], Arkham [ARKM], The Graph [GRT], and Internet Computer [ICP] have garnered the most attention leading up to Nvidia’s earnings report.

Although AI coins and Nvidia haven’t shown strong correlation in recent weeks, this development is expected to increase interest, potentially driving their prices higher as technical and fundamental indicators align.

Source: Kaito

The positive earnings report from Nvidia has already boosted interest in TAO and FET, positioning them as top contenders in the AI crypto space.

Price action reaction of FET and TAO

Following Nvidia’s earnings announcement, the price action of FET showed promising signs.

FET’s price is expanding from a squeeze, with Bollinger Bands opening up after the price bounced off a support level on the daily timeframe.

Additionally, FET has broken out of a falling wedge pattern, and the expectation is that Nvidia’s strong earnings will drive prices higher. The volume bars turning green indicated that buyers were currently in control.

Source: TradingView

Bittensor is also poised to benefit from Nvidia’s earnings news. TAO’s price action has broken out of a downtrend line, and if it holds this level as support, it could see further gains.

However, if the price fails to maintain this support, it might be wise to wait before making additional investments. Still, with TAO’s current price relatively low, it could be an opportune time to acquire more tokens.

Source: TradingView

Performance overview

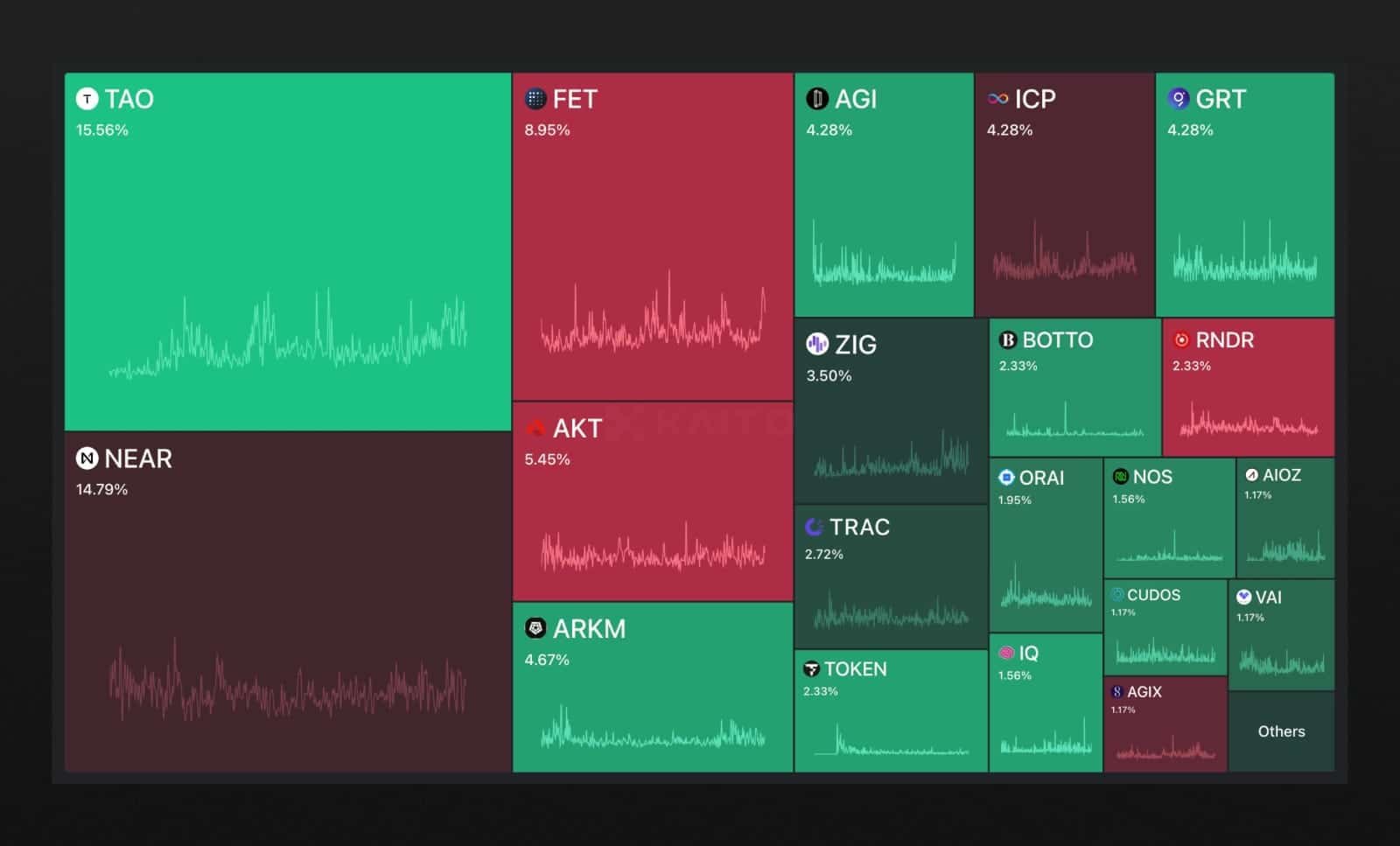

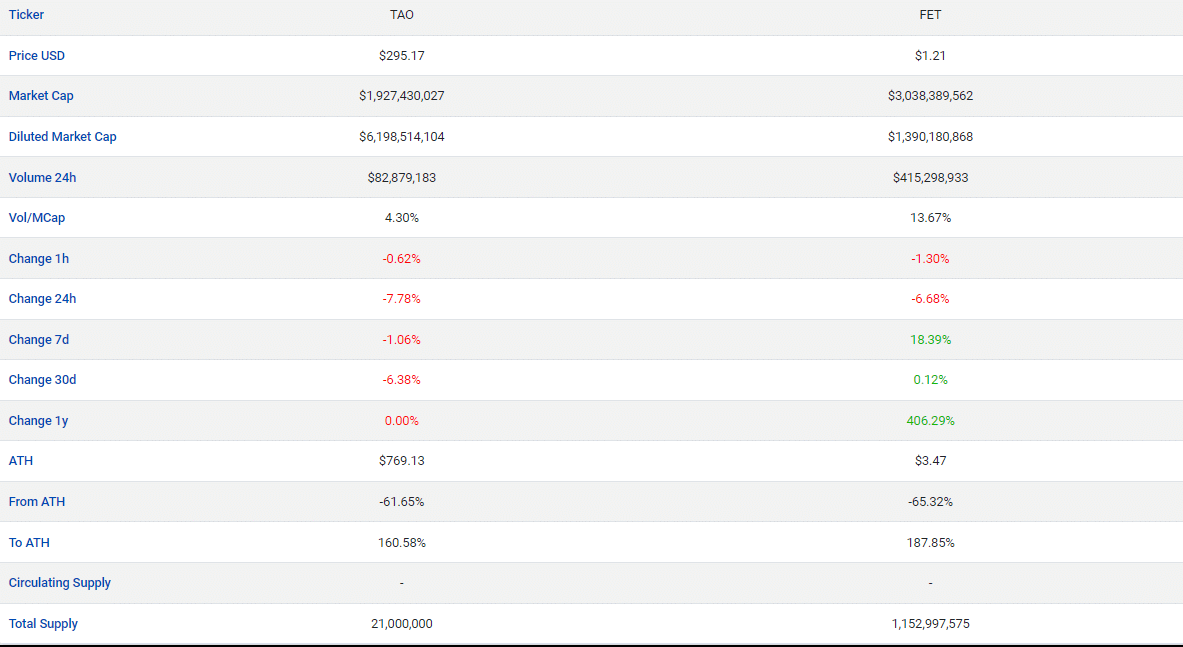

As of the latest data at press time, TAO was priced at $295.17, while Fetch.ai was at $1.21. FET has a larger market cap of $3.04 billion compared to TAO’s $1.93 billion.

FET’s volume-to-market cap ratio of 13.67% suggests greater price stability, making it a more stable investment compared to TAO, which has a lower ratio of 4.30%.

Source: Coinpare

Despite both coins being down over 60% from their all-time highs, FET has shown more consistent gains across key time frames, with yearly returns of +406%.

Read Artificial Superintelligence Alliance’s [FET] Price Prediction 2024–2025

TAO future prediction

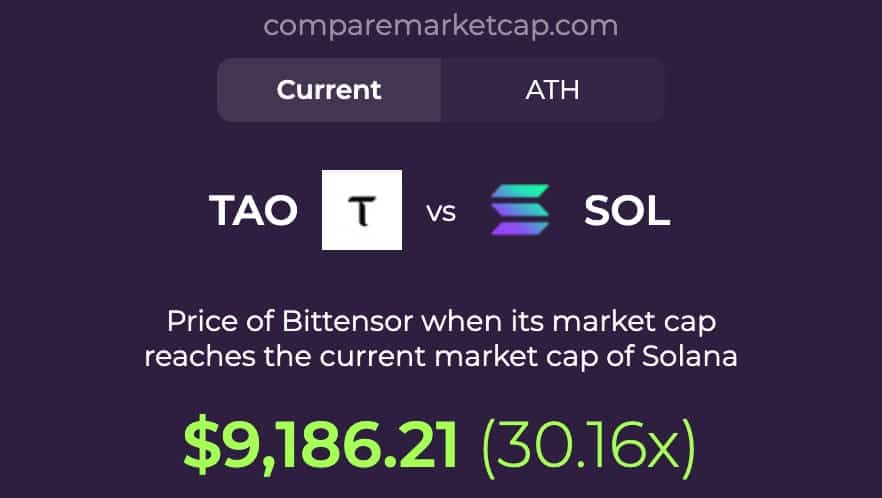

Looking ahead, Comparemarket predicted that TAO’s price could increase more than 30 times if it reaches Solana’s [SOL] current market cap, potentially trading at $9,186 per token.

However, this prediction is contingent on market conditions and Nvidia’s continued influence on AI-related cryptocurrencies.

Source: CompareMarketCap

Leave a Reply