- Selling pressure on Bitcoin and Ethereum increased.

- SOL and DOGE also witnessed over 4% price declines in the past 24 hours.

After quite a few days of promising upticks, the crypto market witnessed major corrections as several top coins tumbled.

Therefore, AMBCrypto planned to take a closer look at the states of top cryptos like Bitcoin [BTC], Ethereum [ETH], Solana [SOL], and Dogecoin [DOGE] to find out how the crypto week ahead might look like.

Bitcoin’s week ahead

Firstly, AMBCrypto examined the king of cryptos’ performance. As per CoinMarketCap, after a comfortable rise, BTC witnessed a correction in the last 24 hours as its value plummeted by more than 5%.

At press time, it was trading at $59,451.39 with a market capitalization of over $1.18 trillion.

A possible reason behind this recent downturn could be a rise in selling pressure.

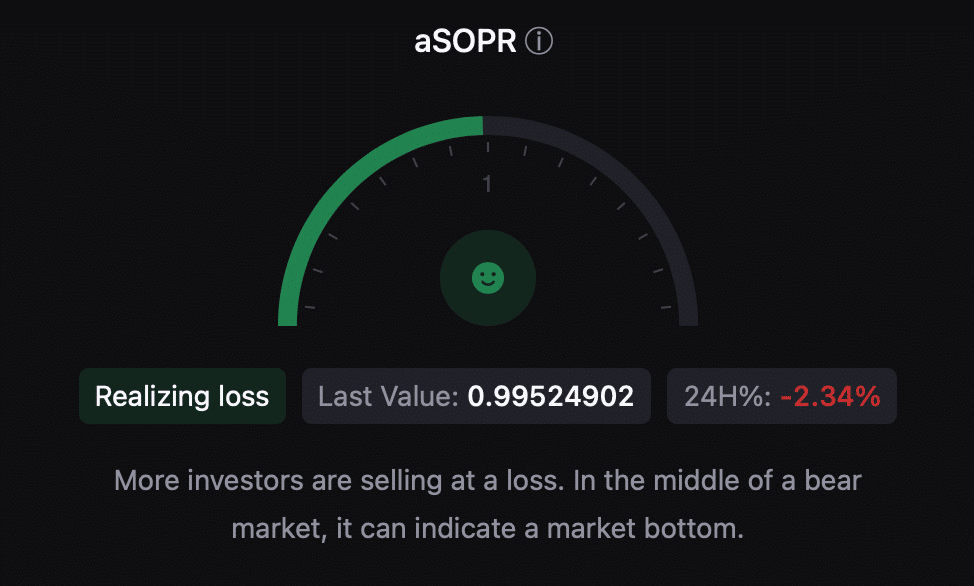

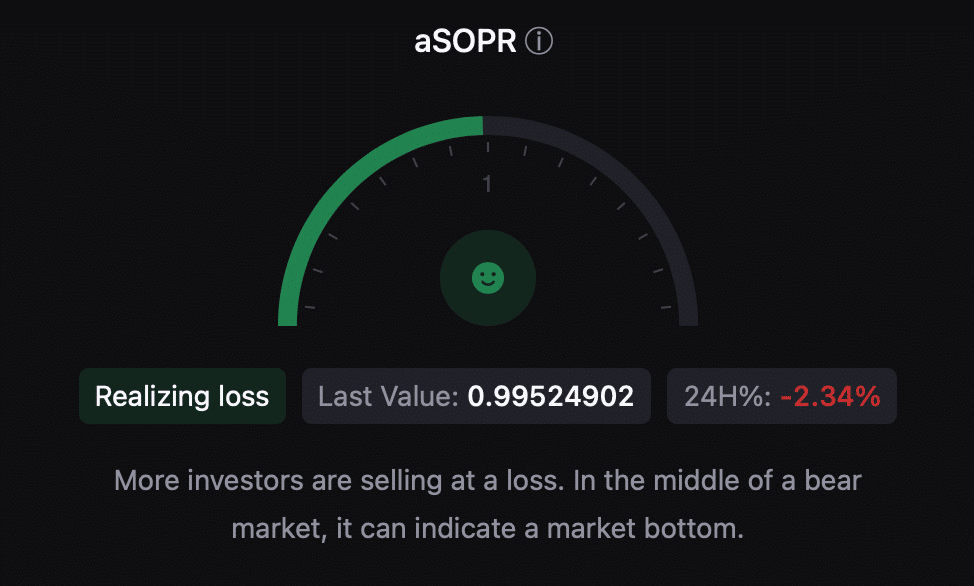

Our look at CryptoQuant’s data revealed that Bitcoin’s net deposit on exchanges was high compared to the last seven-day average, suggesting that investors were selling BTC. Meanwhile, its aSORP turned green.

This indicated that more investors were selling at a loss.

In the middle of a bear market, it can indicate a market bottom.

Source: CryptoQuant

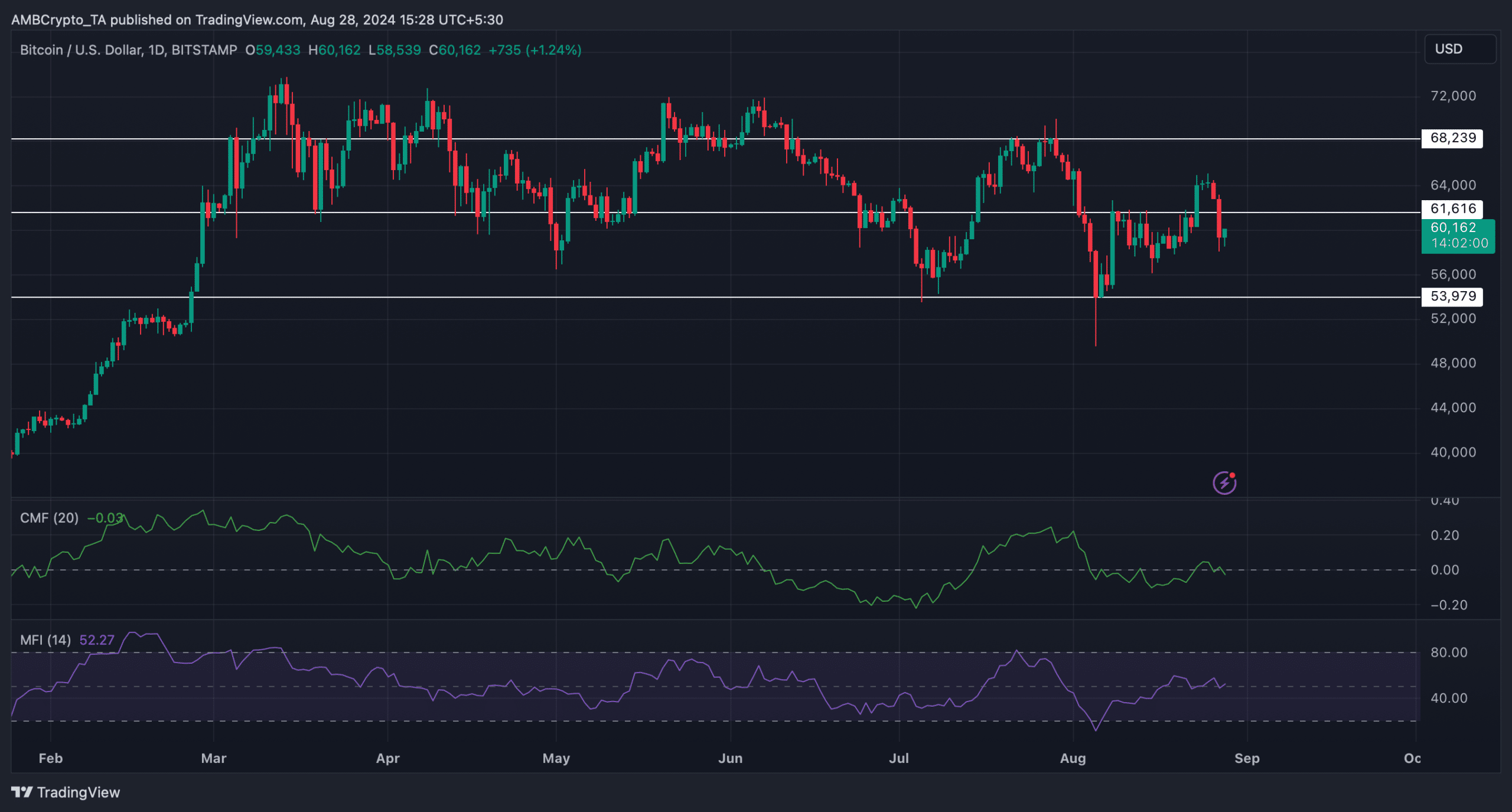

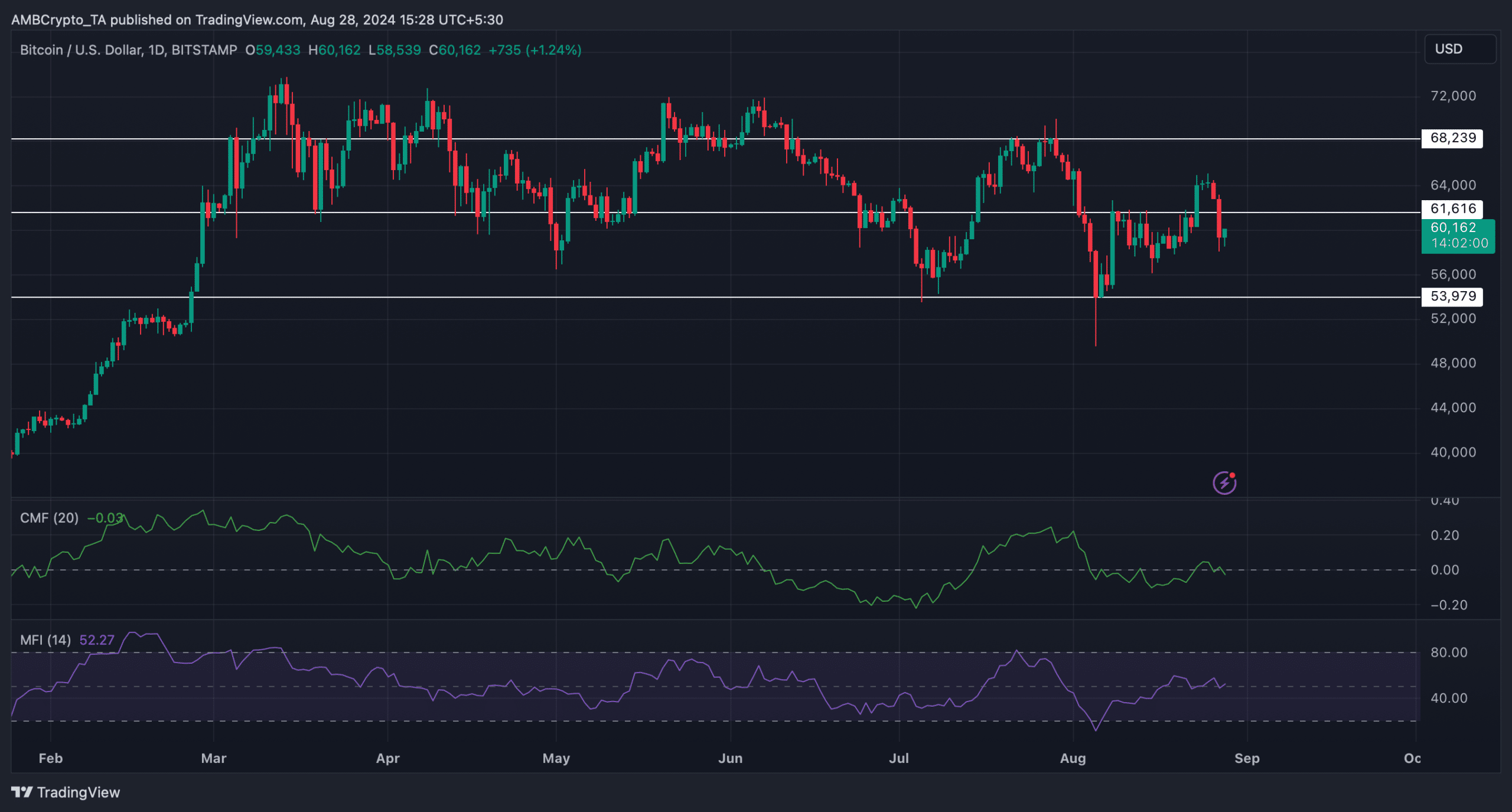

Therefore, AMBCrypto checked BTC’s daily chart to find whether things could turn bullish again. As per our analysis, the Chaikin Money Flow (CMF) remained bearish.

However, the Money Flow Index (MFI) gave hope of a trend reversal as it registered a slight uptick. This might allow BTC to retest $61.6k this week.

Source: TradingView

Altcoins: Assessing the crypto week ahead

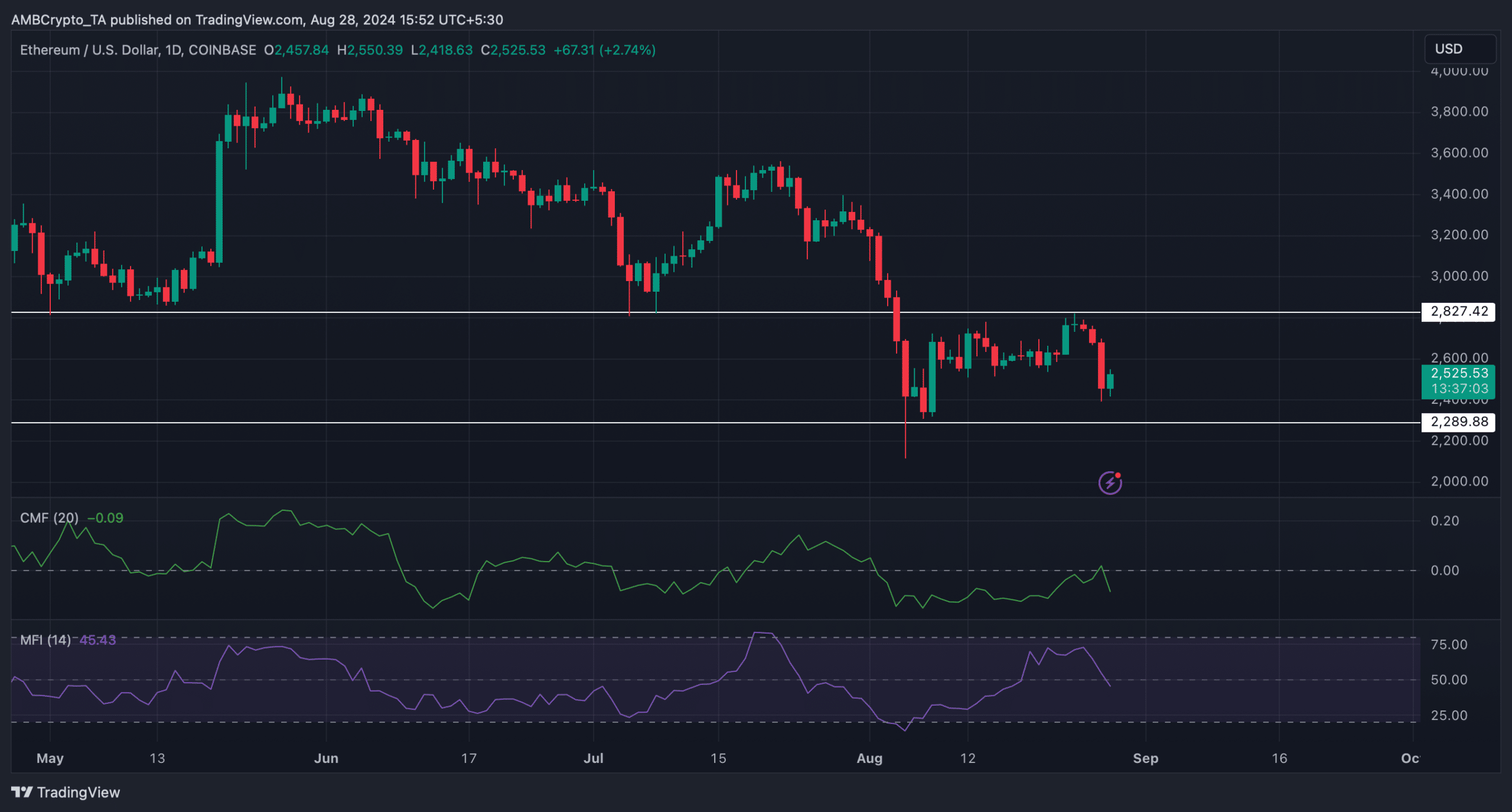

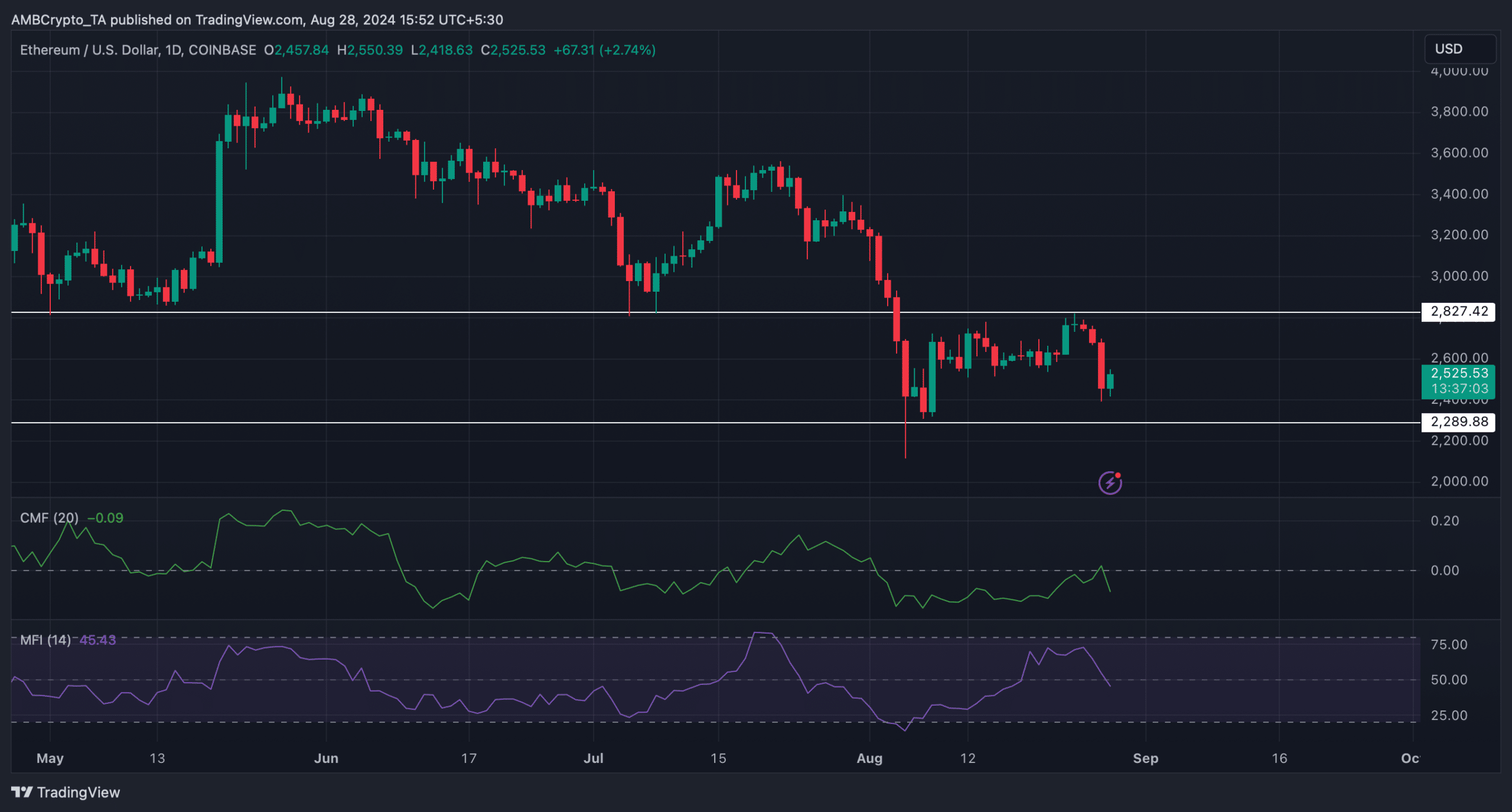

Next, AMBCrypto planned to assess the state of top altcoins, beginning with Ethereum. ETH’s last 24 hours were worse than BTC’s, as the token’s price plunged by over 7%.

At the time of writing, ETH was trading at $2,543 with a market cap of over $306 billion. Like BTC, ETH’s net deposit on exchanges was also high compared to the last seven-day average, hinting at rising selling pressure.

If the selling pressure pushes ETH down further, then the token might drop to $2.28k this week. The chances of that happening seemed likely as both the CMF and MFI registered downticks.

However, if the bulls manage a comeback, then ETH might first target $2.8k.

Source: TradingView

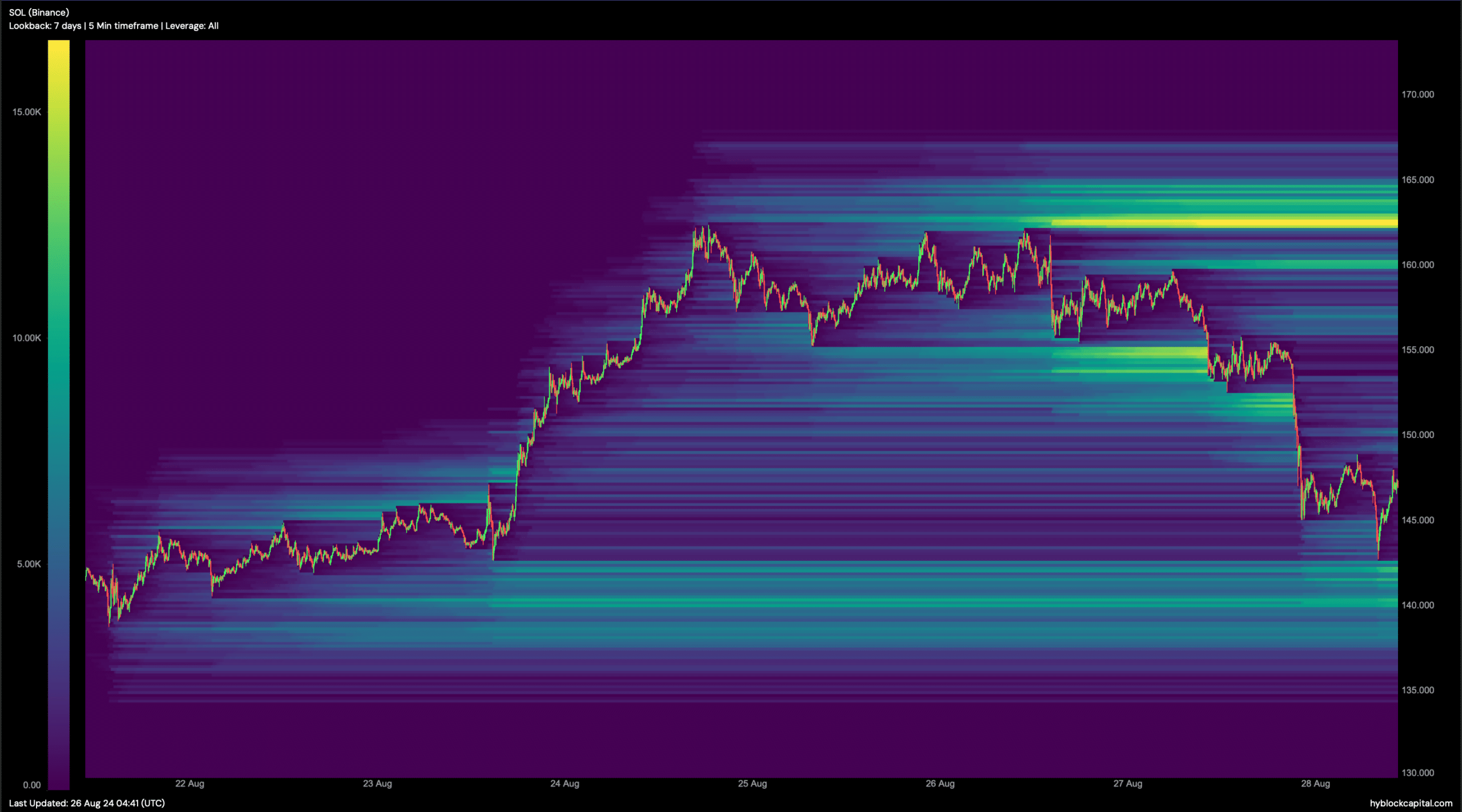

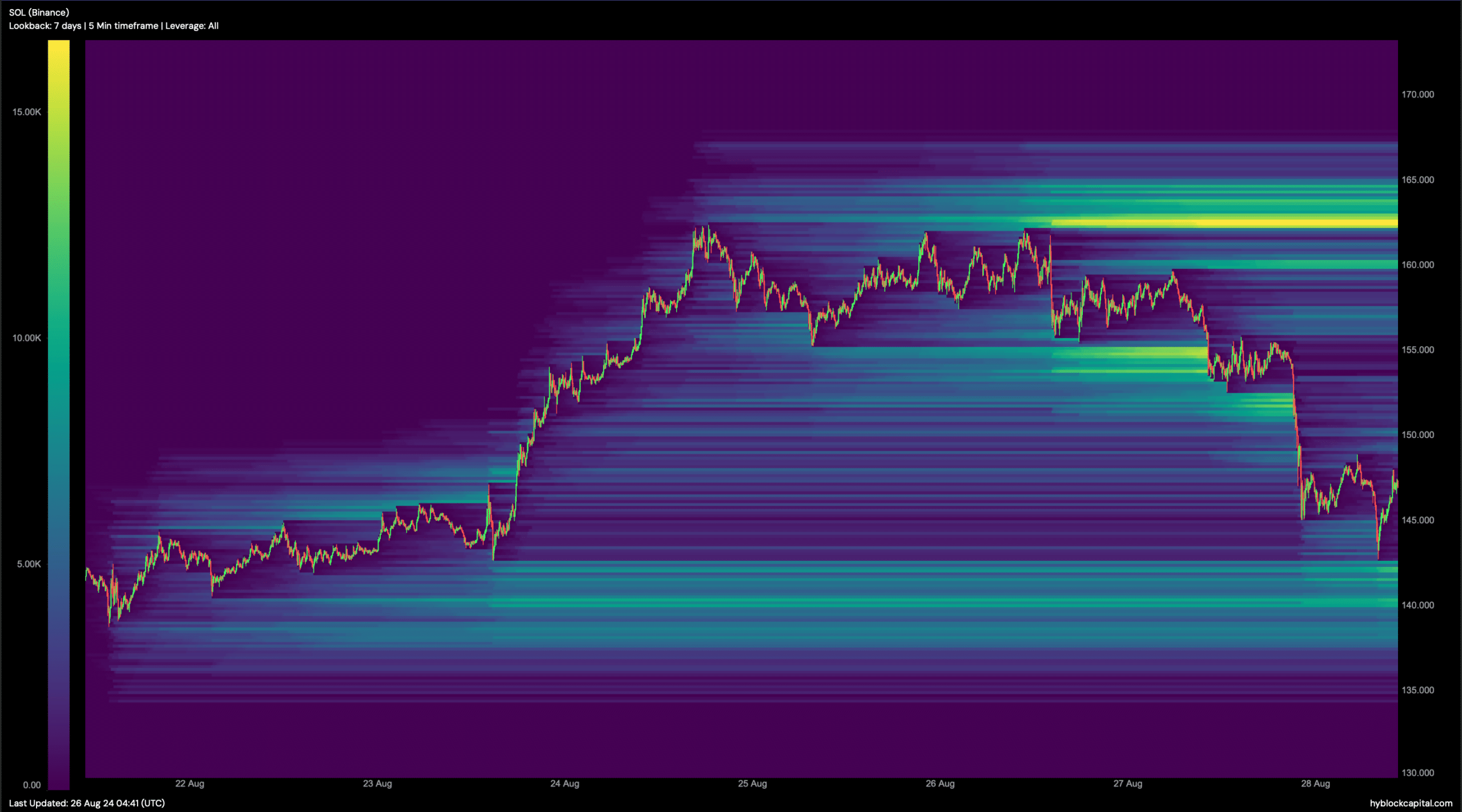

Solana bears also dominated the market in the last 24 hours as the token’s value dropped by more than 4%. At press time, it was trading at $146.99 with a market cap of over $68 billion.

Our analysis of Hyblock Capital’s data revealed that if the bearish rice trend continues, then investors might witness SOL dropping to $140.

Source: Hyblock Capital

Read Solana’s [SOL] Price Prediction 2024–2025

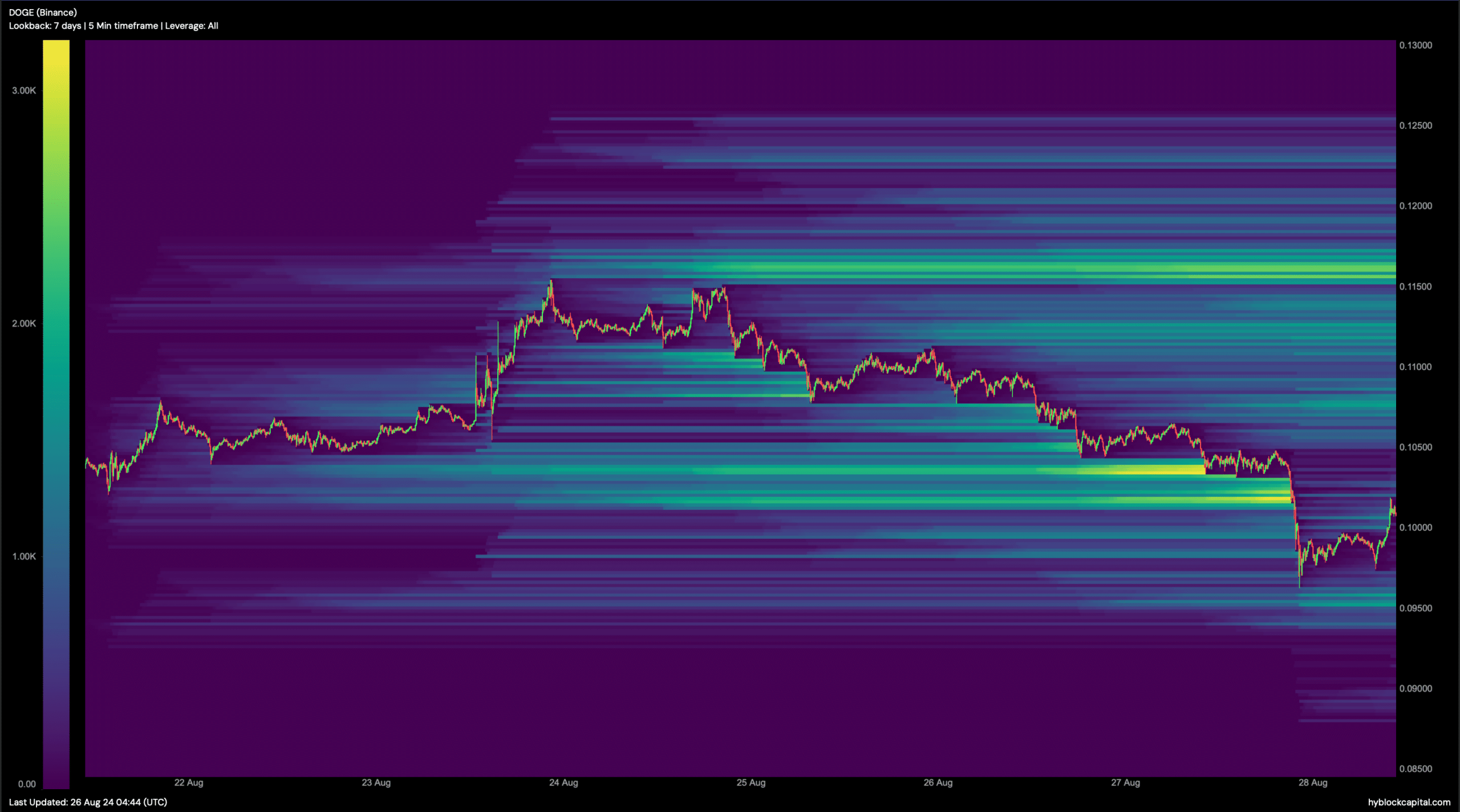

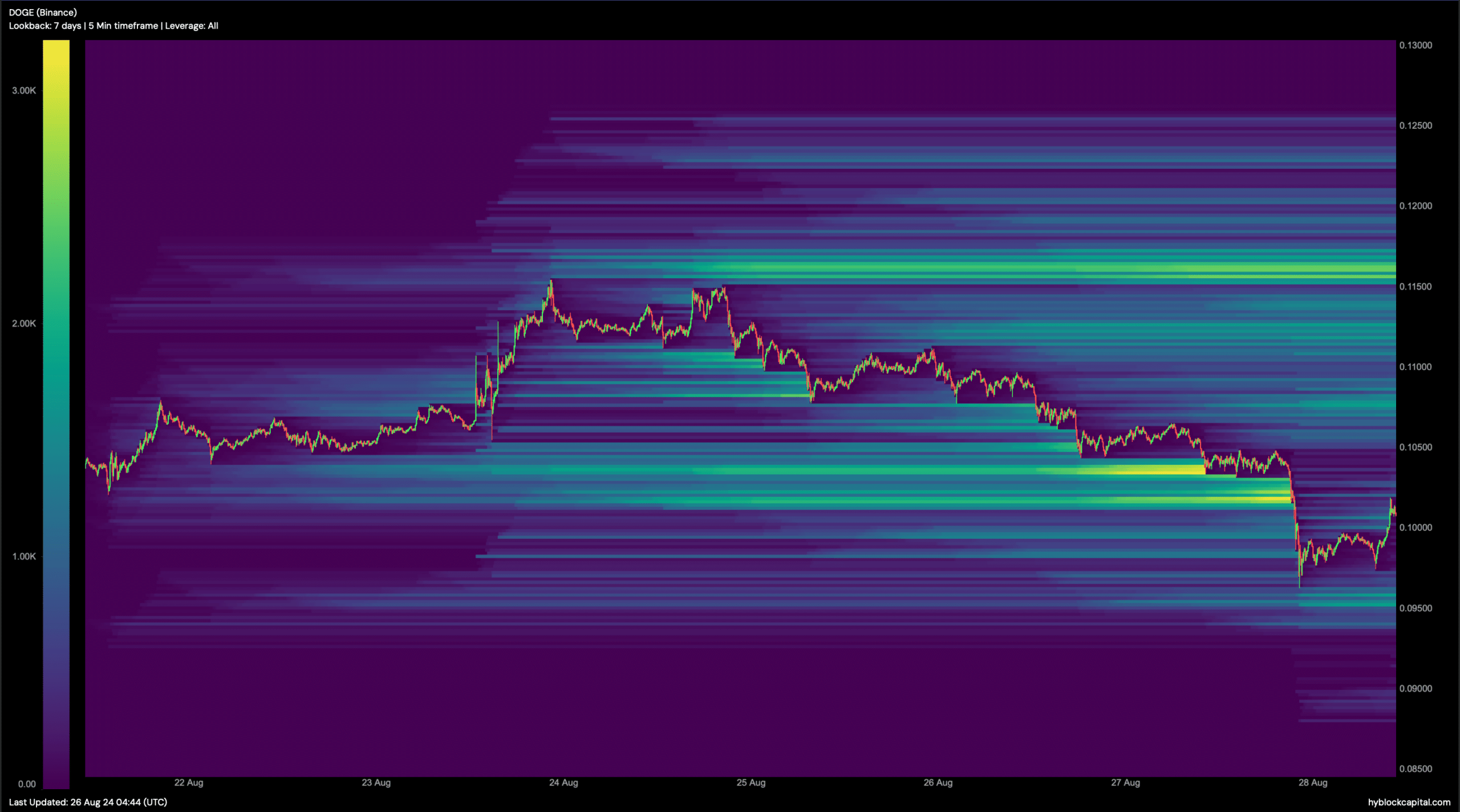

Last but not least, AMBCrypto checked how DOGE, the world’s largest memecoin, was doing. Not much of a surprise, DOGE also witnessed a 4% drop during the past day.

At press time, it had a value of $0.1009. As per our analysis, a continued price drop might push DOGE down to $0.09. However, if bulls step up their game, then Dogecoin might touch $0.11 this week.

Source: Hyblock Capital

Leave a Reply