- Chainlink breaks out with strong momentum.

- Historical correlation and incoming altseason to spur LINK’s bull run.

Chainlink [LINK] has recently broken through a crucial resistance level at $10.6 on the 4-hour timeframe, achieving an impressive 18.58% return on investment.

This breakout was marked by strong momentum, with no immediate retest, signaling potential strength in the price action.

Source: Ola Wealth/X

However, challenges remain in the mid-term downtrend that has persisted since March. The next significant resistance levels to watch are at $13.1 and $16.8. The key question now is whether this strong rally will continue.

Weekly outlook

Over the past week, LINK/BTC has shown resilience, pushing towards the $12 price level. However, to maintain this momentum, LINK needs to break through the 2100 sats level.

If LINK can clear this hurdle, it may start following other DeFi projects and target the 4400 sats level. The recent sweep of weekly liquidity further supports the potential for an upward move.

Source: TradingView

Chainlink [LINK] appears to have completed a mini cycle, with a clear weekly divergence between price action and the RSI.

This divergence indicates that the current upward move could mark the beginning of a new LINK bull run. The fact that many altcoins are showing similar patterns adds further confidence to this anticipated upward trend.

Source: TradingView

Incoming altseason

The broader altcoin market is showing signs of repeating the patterns seen in 2017 and 2021, where altcoins rallied strongly post-halving.

The market cap of altcoins is currently in consolidation, similar to the previous cycles, which often preceded significant rallies.

Source: TradingView

This suggests that an altseason could be on the horizon, potentially benefiting LINK along with other altcoins.

Historical correlation

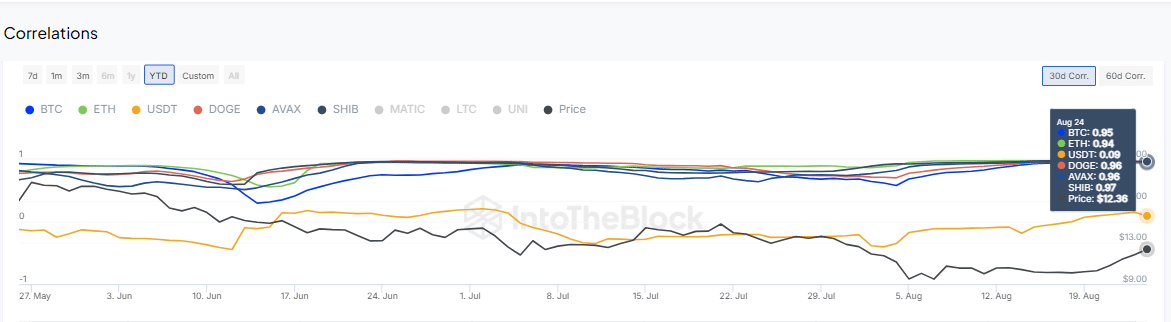

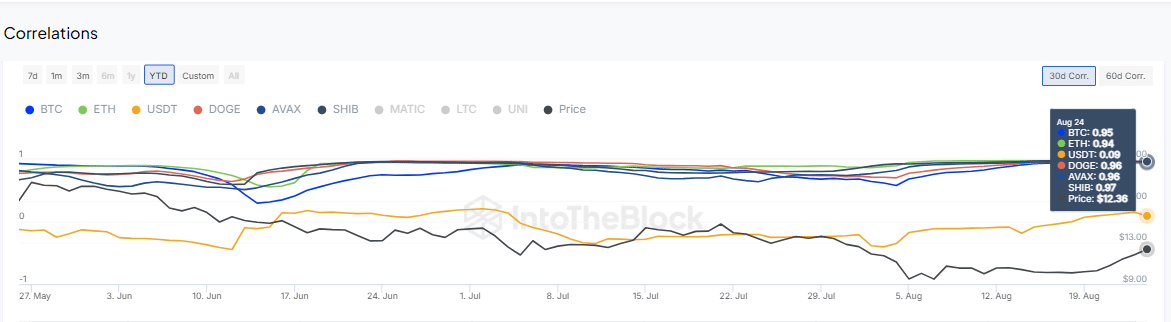

Chainlink’s correlation matrix reveals a strong relationship with major crypto assets: 0.95 with Bitcoin, 0.94 with Ethereum, 0.96 with Dogecoin, and 0.97 with Shiba Inu.

This means that an upward move in these assets is likely to be mirrored by Chainlink. With the Federal Reserve expected to initiate rate cuts in mid-September, leading to a weaker US dollar, this scenario could further bolster Chainlink’s price.

IntoTheBlock

Given that the USD has a negative correlation of 0.09 with Chainlink and other crypto assets, a weak dollar would likely be bullish for LINK.

Is your portfolio green? Check out the LINK Profit Calculator

With key resistance levels being tested and strong correlations with other leading crypto assets, the outlook for Chainlink appears positive.

The upcoming altseason and a potential weakening of the USD provide additional support for a continued upward trajectory in LINK’s price.

Leave a Reply