- Solana’s 2% surge coincided with POPCAT’s listings on two exchanges.

- Despite this, SOL could remain in a consolidation phase if key market conditions are not met.

Solana [SOL] has struggled with a bearish trend for the past two weeks, having last broken through the $200 barrier about six months ago. At press time, it was trading at $145.

Despite this bearish outlook, Solana surged by 2% in the last 24 hours, a jump that coincided with the listing of POPCAT on Binance and KuCoin.

On the 22nd of August, Binance launched perpetual contracts for the Solana-based memecoin POPCAT, and KuCoin listed a POPCAT/USDT trading pair on its spot market.

As a result, POPCAT surged over 20% following the listings on both exchanges.

Given that Solana often relies on its memecoins during periods of market volatility, could POPCAT be the next catalyst for Solana’s rise? AMBCrypto investigates.

POPCAT’s rise on Solana catches investor interest

Renowned analytical firm Lookonchain revealed on X (formerly Twitter) that following Binance’s announcement of POPCAT perpetual contracts, a whale withdrew 39,816 Solana, worth $5.73 million, from the CEX to buy 10 million POPCAT memecoins.

This underscored the rising dominance of memecoins on the Solana network.

To better understand the impact of meme token on Solana, AMBCrypto analyzed the latest market trends. The finding revealed several key insights.

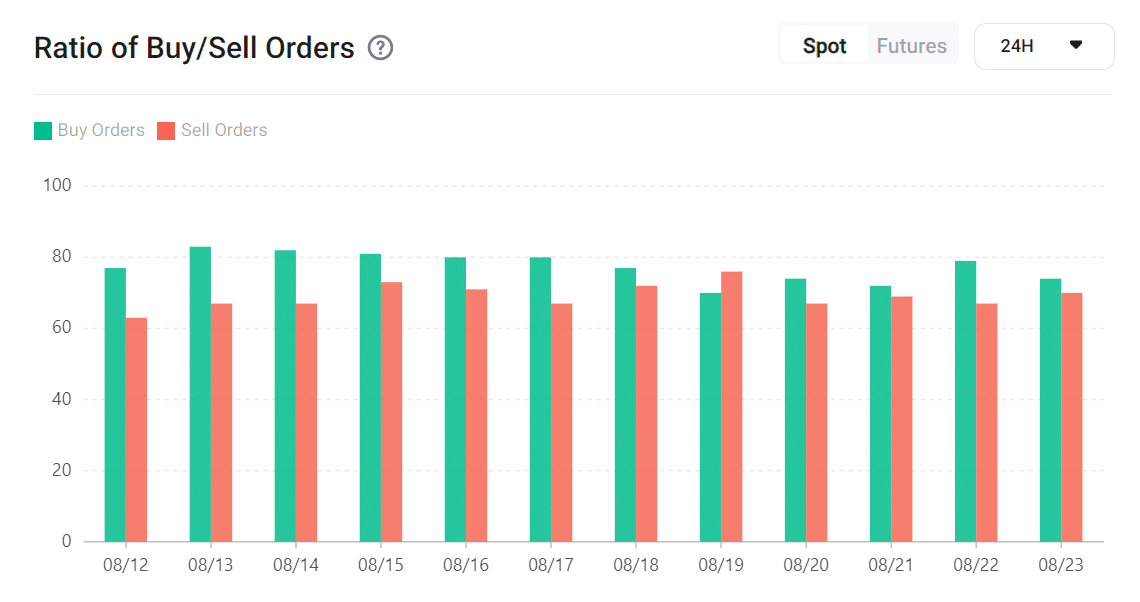

Source : KuCoin

On the day POPCAT officially entered the KuCoin spot exchange, buy orders for SOL outnumbered sell orders by 13%. Meanwhile, the aggregate net exchange flow remained negative.

Simply put, Investors might be buying SOL to participate in the POPCAT memecoin ecosystem, showing confidence in Solana-based projects.

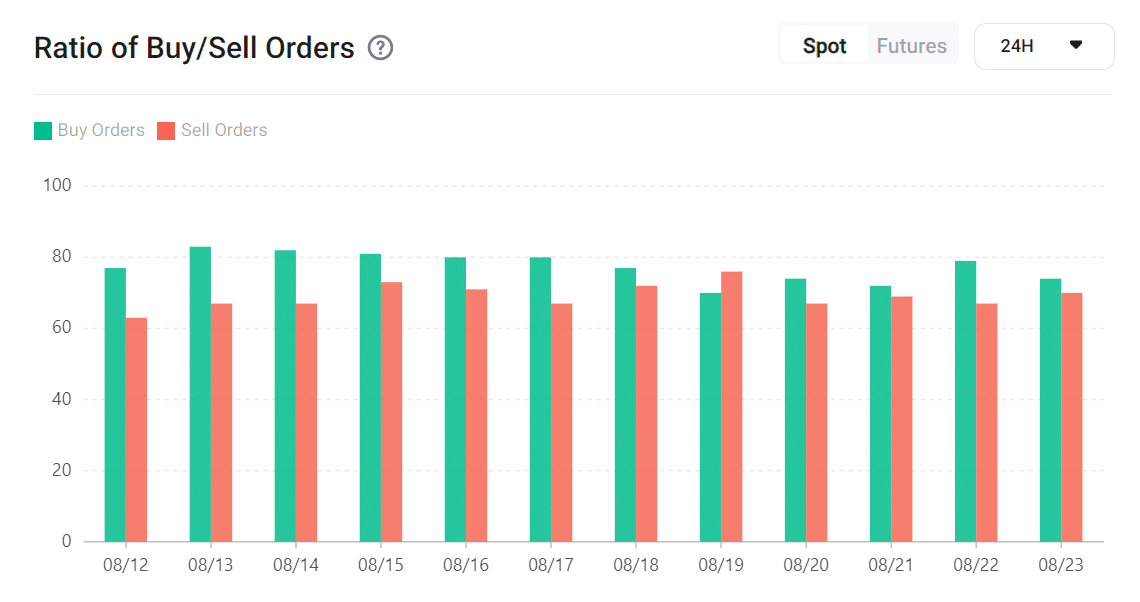

Source : Coinglass

The negative net flow indicates that more Solana is being withdrawn from exchanges than deposited, possibly due to the whale activity mentioned earlier.

This activity may have influenced Solana’s price in a bullish direction. However, AMBCrypto explored whether this trend could sustain in the long run.

Strong conditions needed for guaranteed SOL surge

Since its listing, POPCAT has surged significantly. On the daily timeframe, a strong upward swing has brought the meme token closer to its previous rejection level of $0.6607.

Although POPCAT has shown impressive performance on the daily chart, this does not necessarily guarantee a long-lasting impact on Solana’s price.

For such a guarantee, market conditions would need to favor the altcoin.

Source : Santiment

Surprisingly, despite the recent whale activity, the trading volume for the altcoin did not increase. On the day of the listing, volume on Solana network exceeded $2 billion; however, it has since fallen back to $1.40 billion.

Even more surprisingly, the Weighted Sentiment has shifted from extremely positive to moderately positive.

Read Solana’s [SOL] Price Prediction 2024-2025

While POPCAT’s trading volume could potentially reach new highs, the overall sentiment surrounding Solana has remained notably neutral.

According to AMBCrypto, while POPCAT has played a crucial role in renewing investor interest in Solana, more factors are needed to anticipate a breakout.

Leave a Reply