- XMR’s trading volume surged by 30% on daily charts as prices rose by 11.7%.

- Monero seems to come back from legal woes as analysts eye a 176% rally.

Over the last few months, Monero [XMR] has experienced considerable challenges. Throughout the year, XMR has struggled to report sustained gains over regulatory issues.

Following this, XMR was delisted by major crypto exchanges such as Kraken and Binance [BNB]. However, in recent weeks, the altcoin has made modest gains, reporting sustained gains on weekly charts.

The recovery has seen XMR trade at $168.80 as of this writing. This makes a 4.94% increase over the past 24 hours. Prior to these gains, Monero had suffered a serious downtrend, hitting a low of $136.08.

Despite the recent gains, XMR was still trailing below its last month’s high of $176. Also, XMR remained 68.88% from its all-time high recorded last in 2018.

Therefore, the recent gains have triggered a new debate about whether the current gains position the altcoin for a long-term rally.

Inasmuch, crypto analyst Murad has viewed the current trend as a replica of the 2016-2017 trend. The analyst cited the similarity in trends for the period that saw the altcoin experience a sustained rally.

Prevailing Market Sentiment

Source: Murad/X

In his analysis, Murad highlighted that the 2016-2017 bull cycle saw a test pump in 2016, a mega pump in mid-2017 and a mega pump in late 2017.

According to Murad, XMR is now ready for another bull cycle. His analysis posited that after two test pumps, the altcoin surged.

This trend was repeated in 2018 and 2021 when the altcoin hit $466. Therefore, if XMR repeated the same cycle, the altcoin will hit 176.07%.

What XMR price charts suggest

Over the last seven days, XMR has surged by 11.7%. Additionally, the altcoin’s trading volume soared by 30.08% to $77.3 million over the last 24 hours until press time.

In the same period, XMR’s market cap surged by 4.94% to hit $3.1 billion.

Source: TradingView

Looking at XMR’s Directional Movement Index (DMI), the altcoin’s uptrend was strong. At press time, the positive index at 31.24 sat above the negative index at 20.7.

This showed that the altcoin’s upward movement was well positioned, with the prices well suited for further increase.

Additionally, the MACD was positive above the signal line, which further supported the altcoin’s positive momentum. Thus, the uptrend will continue or strengthen.

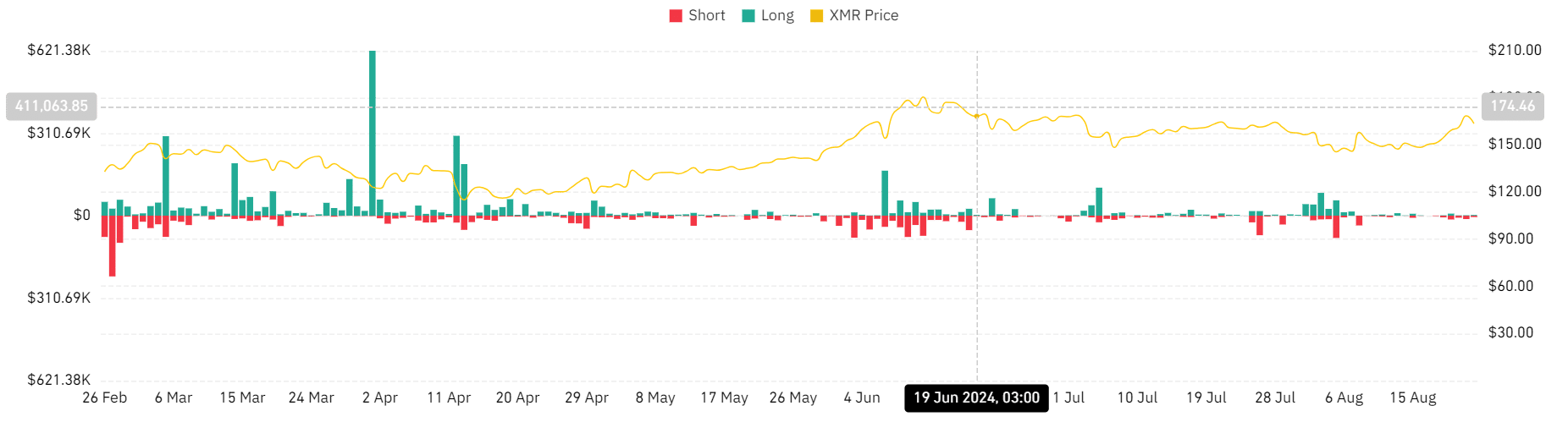

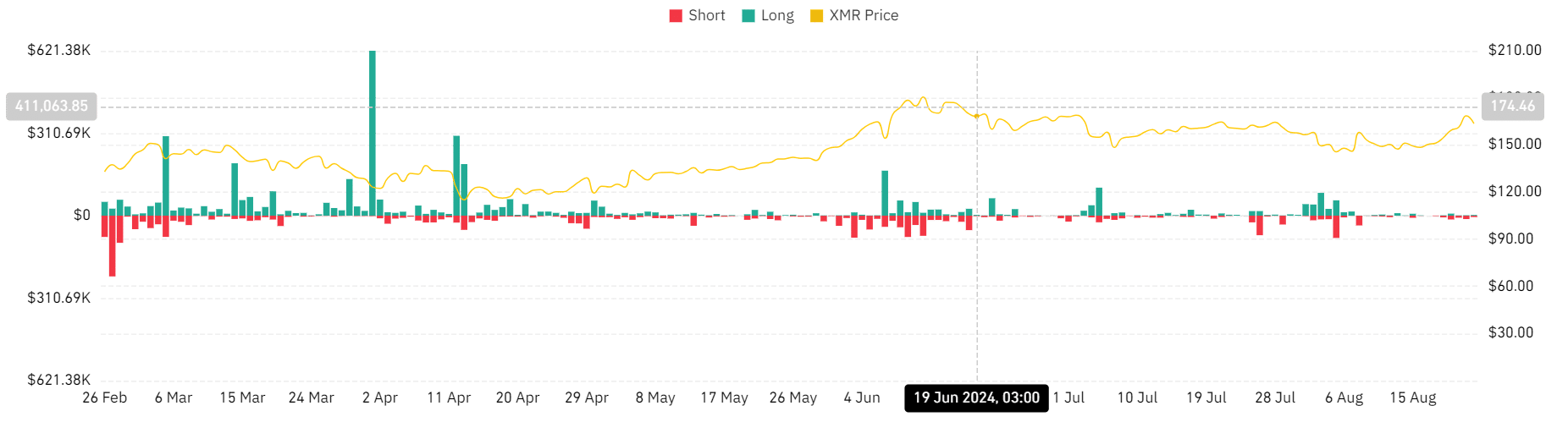

Source: Coinglass

Looking further, AMBCrypto’s analysis of Coinglass showed that long position liquidation has experienced a sustained decline.

Since the market crash on the 5th of August, when liquidations hit $ 57K, it has remained extremely low, reaching only $2.8K at press time. This shows confidence in the altcoin’s direction and prospects.

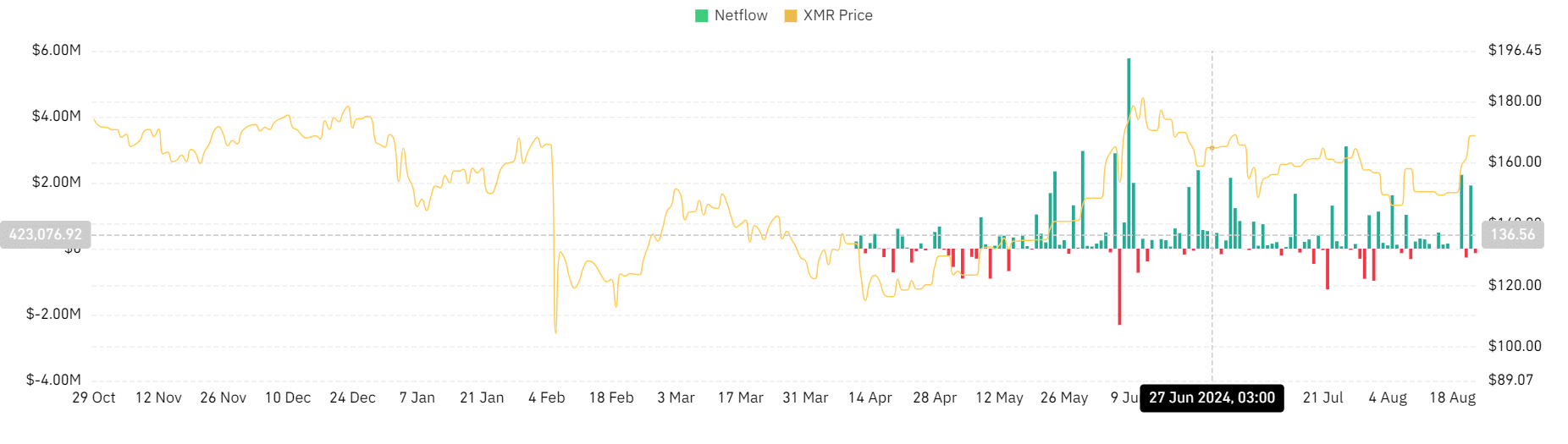

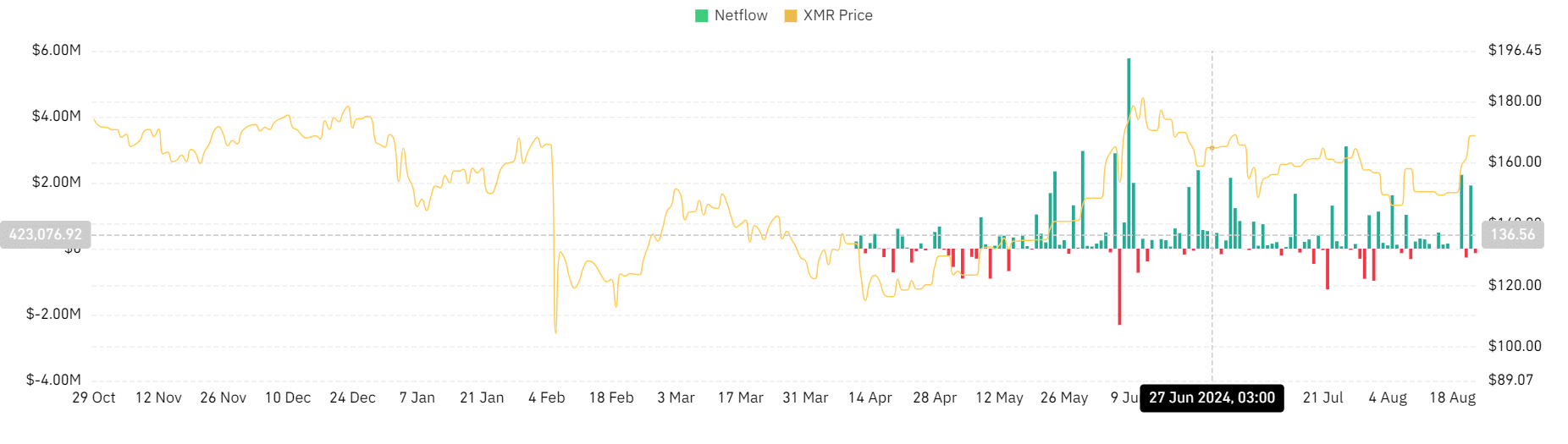

Source: Coinglass

Read Monero’s [XMR] Price Prediction 2024–2025

Finally, XMR has experienced mostly positive netflow for the last two weeks. This showed that investors were interested in holding the altcoin, which is a bullish sentiment.

Therefore, if the current market sentiment maintains, XMR will challenge the next significant resistance level around $175. A breakout from this resistance level will strengthen the altcoin to hit a year-high of $182.

Leave a Reply