- Market sentiment turned bullish, which can play a crucial factor in AVAX’s bull rally.

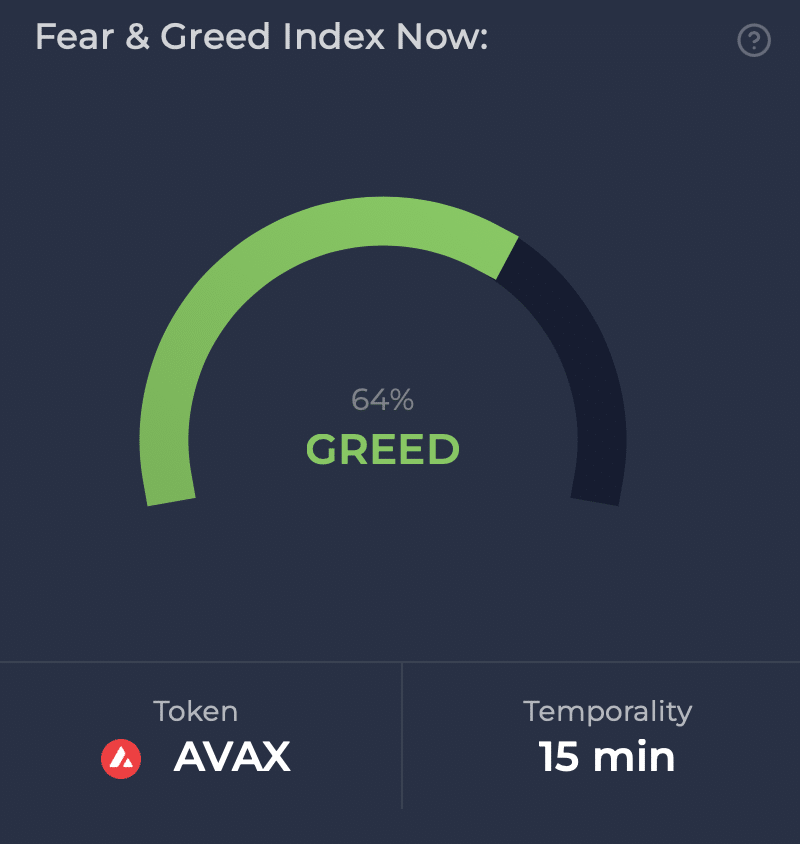

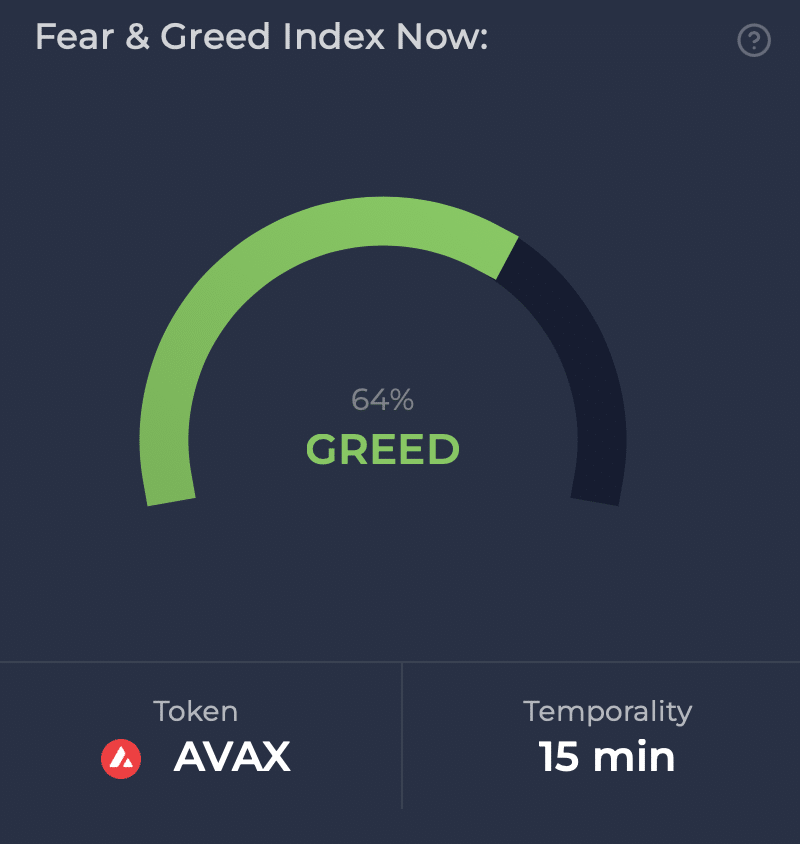

- Fear and greed index revealed that the market was in a “greed” phase.

As the market turned bullish in the last few hours, Avalanche [AVAX] was not left out as it registered a promising uptick. If parallels were to be drawn between 2023’s rally and AVAX’s current state, thighs looked pretty optimistic. Let’s have a look at what’s going on.

Avalanche is pumping

CoinMarketCap’s data revealed that AVAX witnessed a 4% price surge during the last seven days.

In fact, the bulls pushed harder in the past 24 hours as the token’s price surged by more than 6%. At the time of writing, Avalanche was trading at $21.91 with a market capitalization of over $8.8 billion, making it the 12th largest crypto.

Meanwhile, IntoTheBlock posted a tweet mentioning an interesting development. As per the tweet, at the end of 2023, AVAX surged from $9 to $44 in just two months.

In 2024, AVAX was at the mercy of broader market sentiment. A wave of optimism could push it towards the key resistance level at $30, while a downturn in sentiment might drive it down to $16.

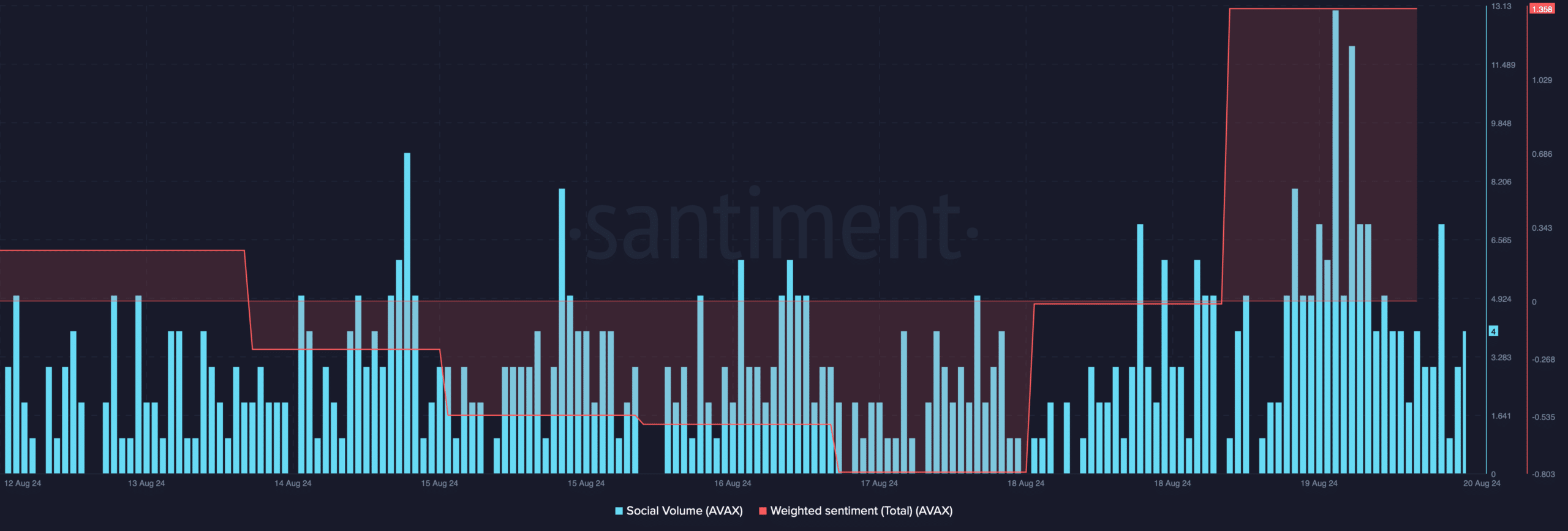

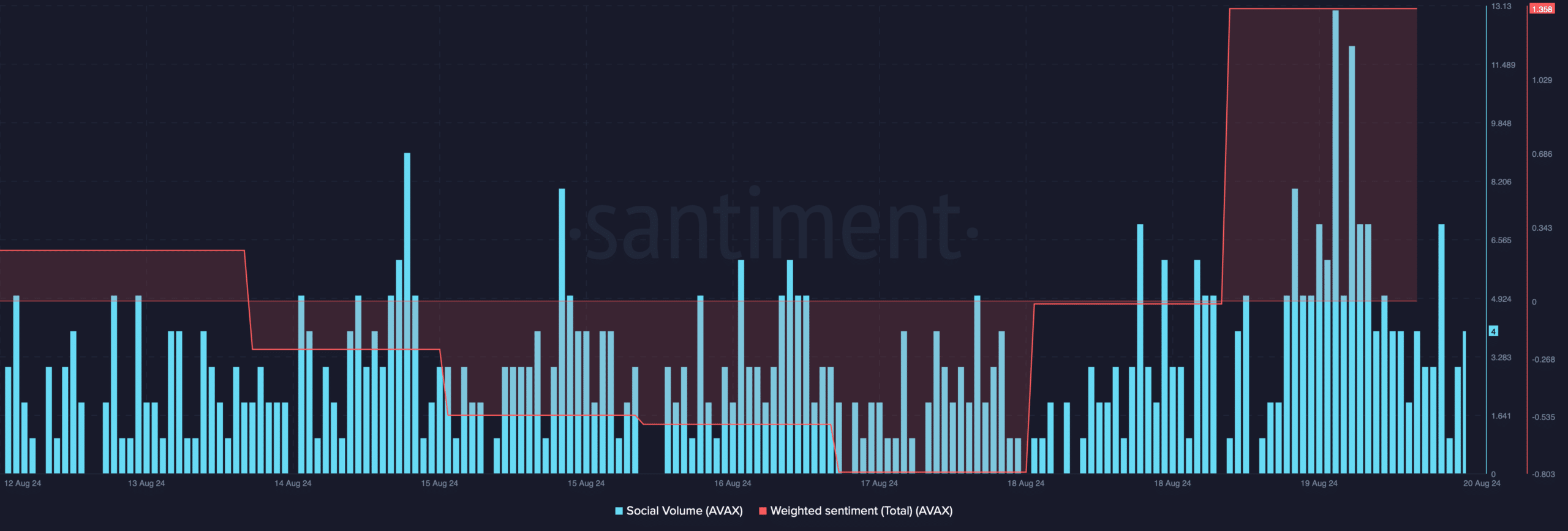

To check market sentiment, AMBCrypto assessed Santiment’s data. As per our analysis, AVAX’s weighted sentiment increased sharply on the 19th of August, meaning that bullish sentiment around the token surged.

Its social volume also followed a similar trend, reflecting a rise in AVAX’s popularity in the crypto space.

Source: Santiment

Will AVAX’s bull rally continue?

AMBCrypto found that AVAX’s trading volume increased by 20% while its price gained bullish momentum. Such a rise in volume acts as a foundation for a bull rally.

However, at the time of writing, AVAX’s fear and greed index was in a “greed” phase. Whenever the metric hits this level, it indicates that the chances of a price correction are high.

Source: CFGI.io

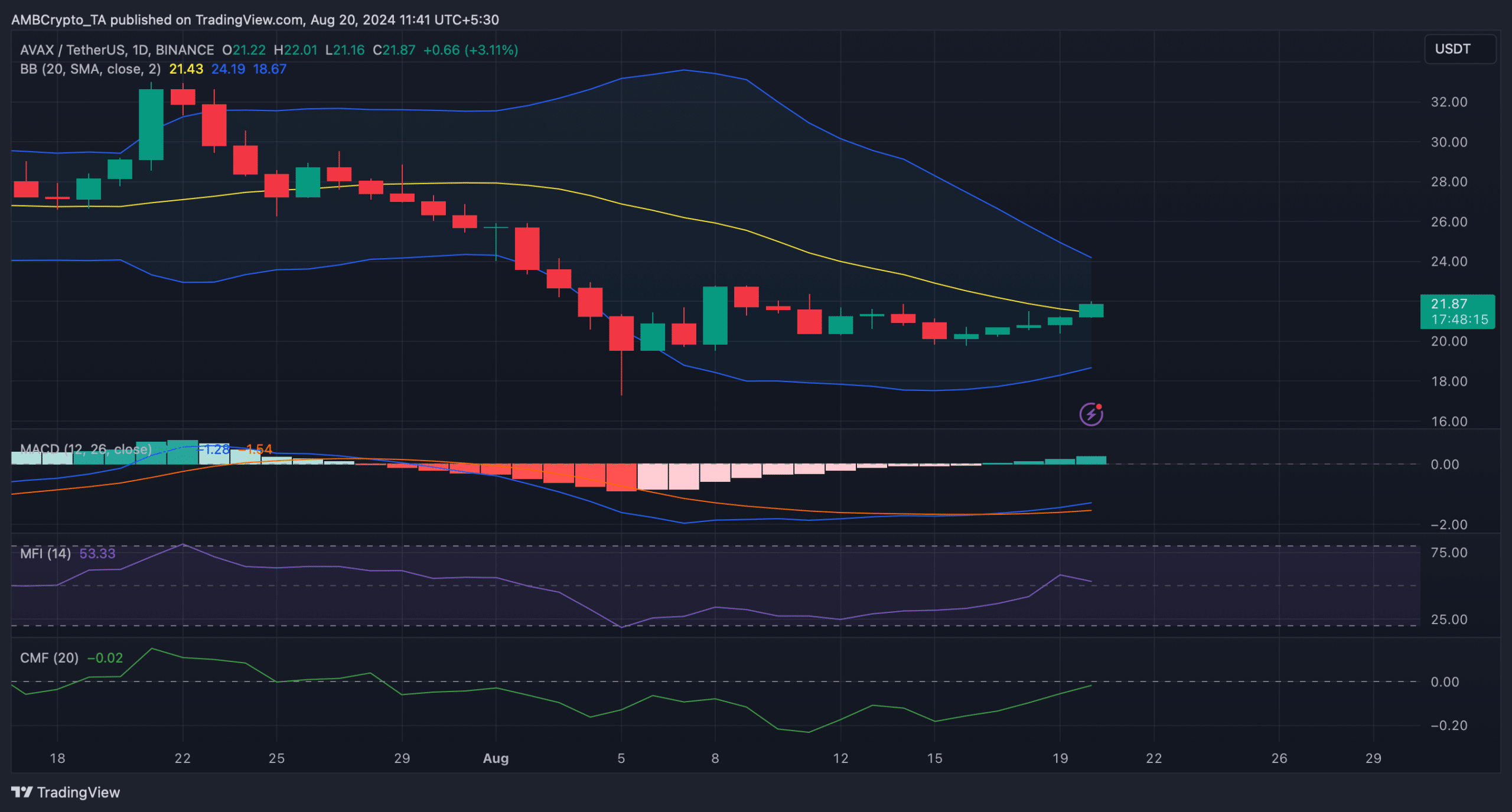

Therefore, AMBCrypto checked Avalanche’s daily chart to find out whether technical indicators hinted at a rally towards $30. The Bollinger Bands revealed that AVAX successfully broke above its 20-day simple moving average (SMA).

The Chaikin Money Flow (CMF) registered a sharp uptick. Moreover, the MACD displayed a bullish crossover. These indicators suggested that AVAX might soon reach $30.

However, the Money Flow Index (MFI) turned bearish as it moved southwards.

Source: TradingView

Is your portfolio green? Check the Avalanche Profit Calculator

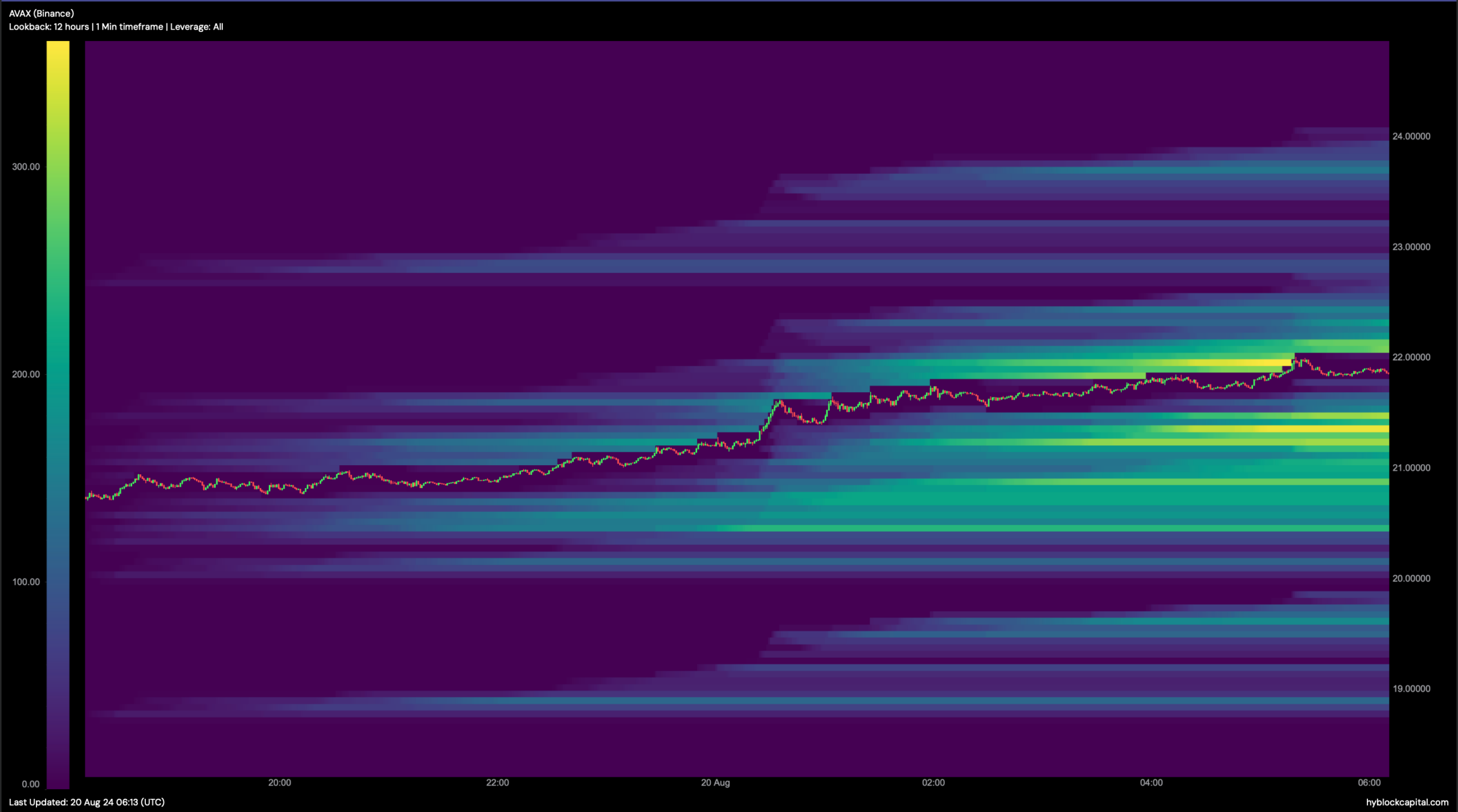

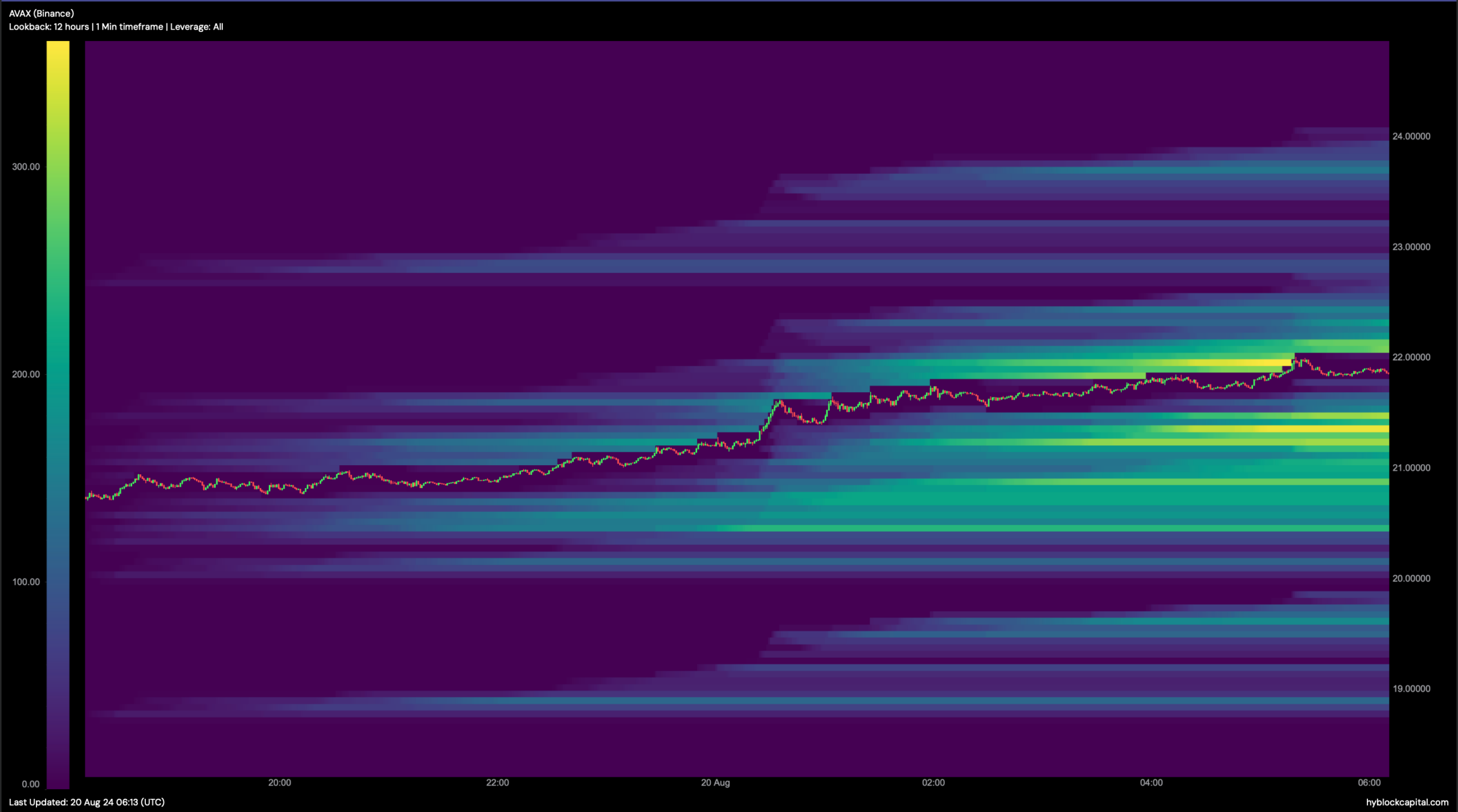

Though market indicators were bullish, AMBCrypto found that a substantial amount of AVAX will be liquidated once its price touches $22.1. A rise in liquidation often results in price corrections.

In case AVAX turns bearish, then investors might expect the token to drop to $20.4 in the short term.

Source: Hyblock Capital

Leave a Reply