- Bitcoin has recovered above $60,000, with analysts predicting a possible surge to $116,000.

- Increased whale transactions and rising open interest suggest growing market confidence in Bitcoin’s next move.

In the past few weeks, Bitcoin [BTC] has struggled to break through the $60,000 resistance level, dipping below $58,000 as recently as 15th August.

However, the cryptocurrency has shown resilience, rebounding to reclaim the $60,000 mark and currently trading at $60,820 as of today.

This represents a 3.9% increase in the last 24 hours and a 2.4% rise over the past week, signaling a potential shift in market sentiment.

This price recovery has sparked renewed interest and optimism within the cryptocurrency community. Prominent crypto analyst Javon Marks recently shared a technical outlook on Bitcoin, predicting a significant upward trajectory for the asset.

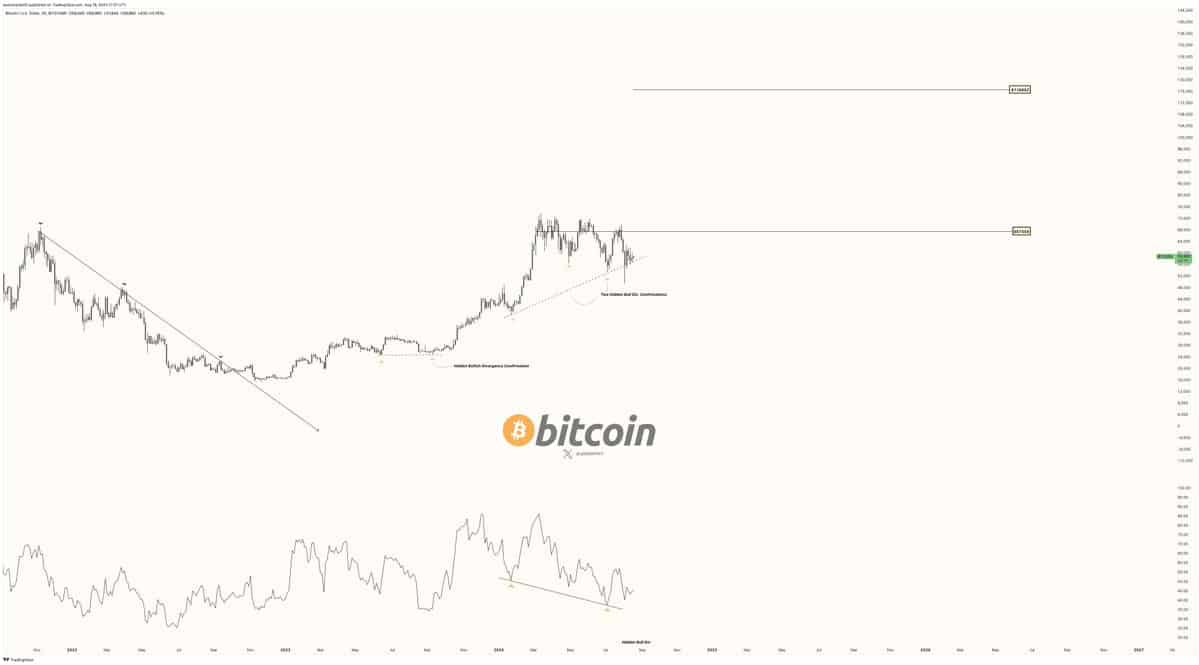

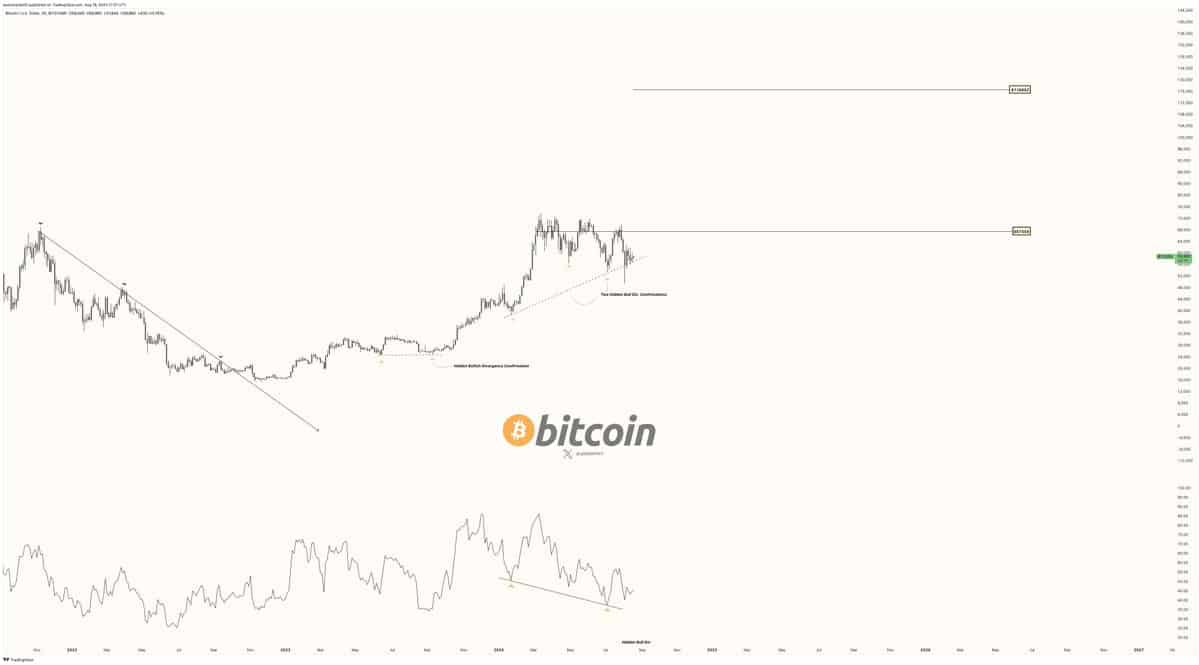

Marks highlighted a key technical pattern, known as the Hidden Bullish Divergence, which he believes could propel Bitcoin to new heights in the coming weeks.

Bitcoin’s path to $116,000: A technical perspective

According to Javon Marks, Bitcoin’s recent price movements suggest that the cryptocurrency could be poised for a major breakout.

He pointed out that as Bitcoin is still coming off of a major Hidden Bull Divergence pattern, sights can remain on a push back above the $67,559 target.

He added that should Bitcoin reclaim this target, it be a “massive breakthrough for the next phase of this bull cycle.

Marks stated,

“With a break and hold above this target, a $116,652 surge for Bitcoin comes into play, and prices could set for an additional +72% climb to reach it, at an even greater speed than many think.”

Source: Javon Marks on X

Marks’ analysis is based on the assumption that Bitcoin’s recent price fluctuations around the $67,559 level the first time were a preparatory phase for the next leg of the bull cycle.

If the cryptocurrency can maintain momentum and break through this crucial resistance again, it could open the door to a surge into the six-figure range.

However, while the technical outlook appears promising, it is essential to consider Bitcoin’s underlying fundamentals to assess the likelihood of such a rally.

Fundamental analysis: Whale activity and open interest

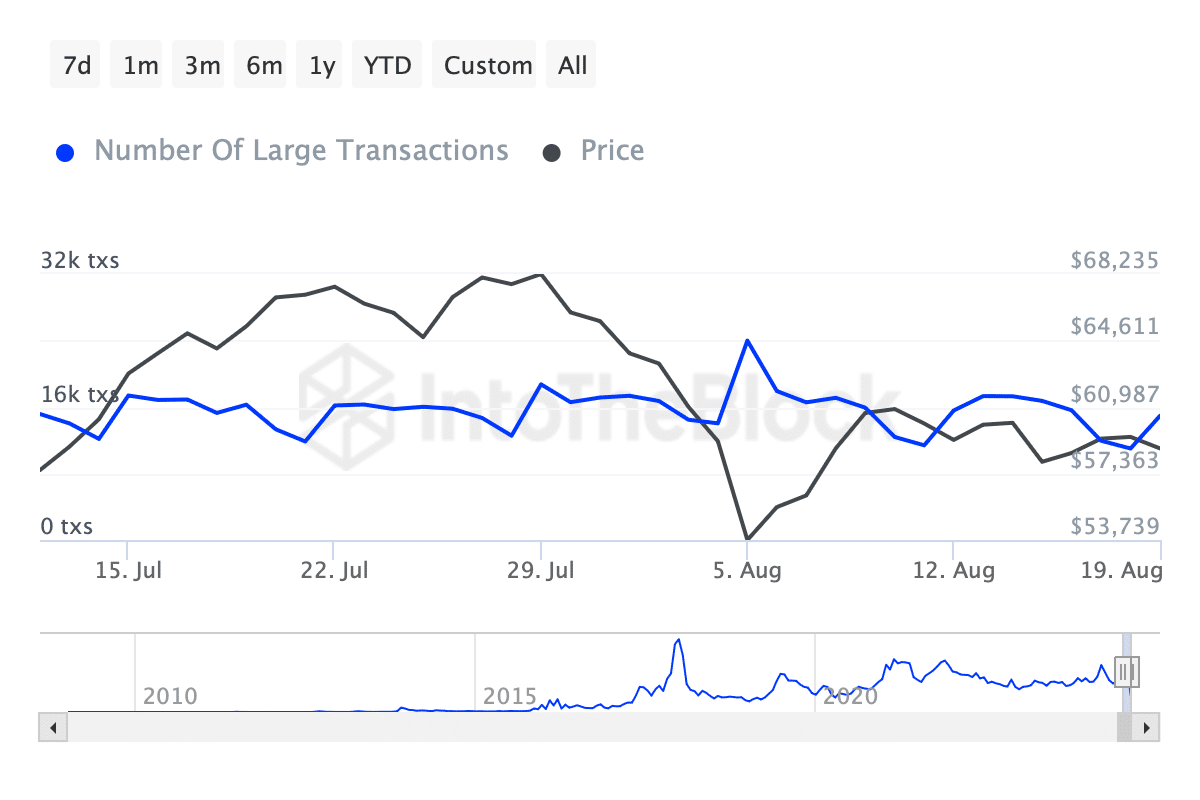

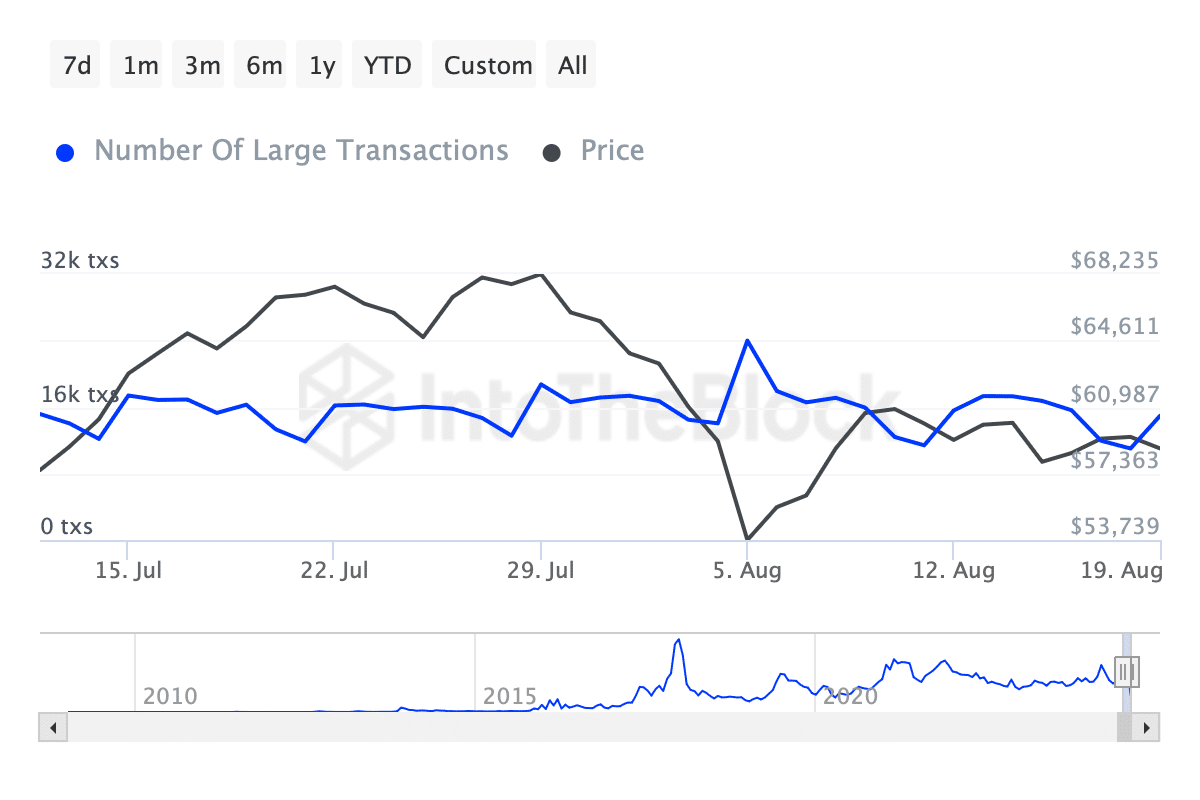

Beyond technical indicators, Bitcoin’s fundamentals provide additional insights into the cryptocurrency’s future price action. One key metric to watch is whale activity, which refers to large transactions involving significant amounts of Bitcoin.

Data from IntoTheBlock reveals that the number of whale transactions exceeding $100,000 has seen a notable increase over the past month. On August 5, these transactions reached a peak of 23.98k before retracing to below 15k.

Currently, the number of such transactions is on the rise again, approaching 15k as of today.

Source: IntoTheBlock

The increase in whale transactions suggests that large investors may be accumulating Bitcoin, which could lead to upward pressure on the asset’s price.

Whales often have the ability to influence market trends, and their growing interest in Bitcoin might indicate confidence in the crypto’s potential for further gains.

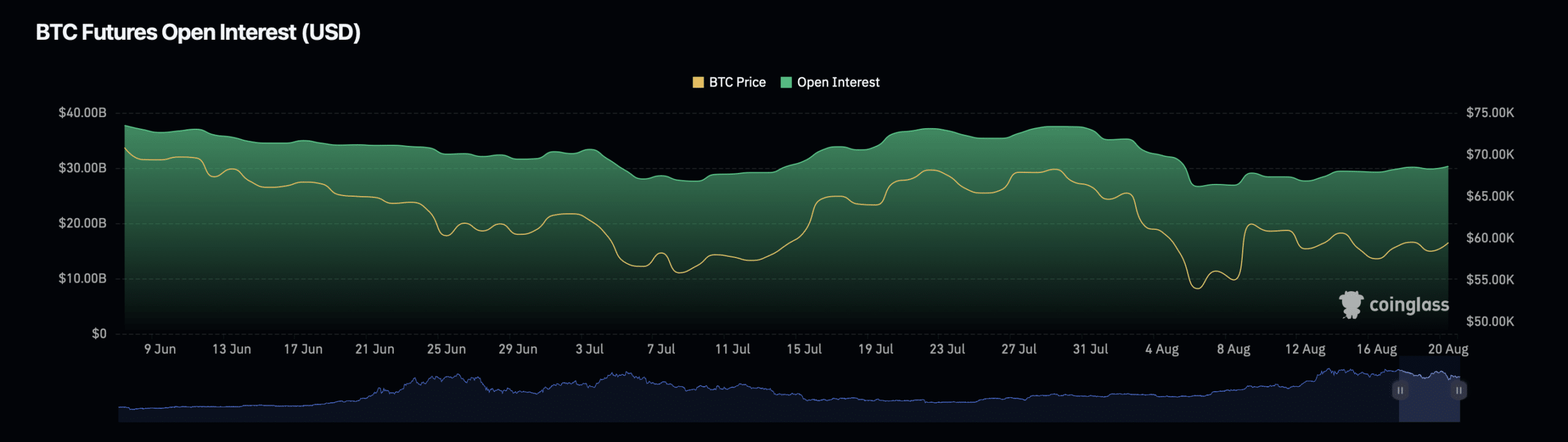

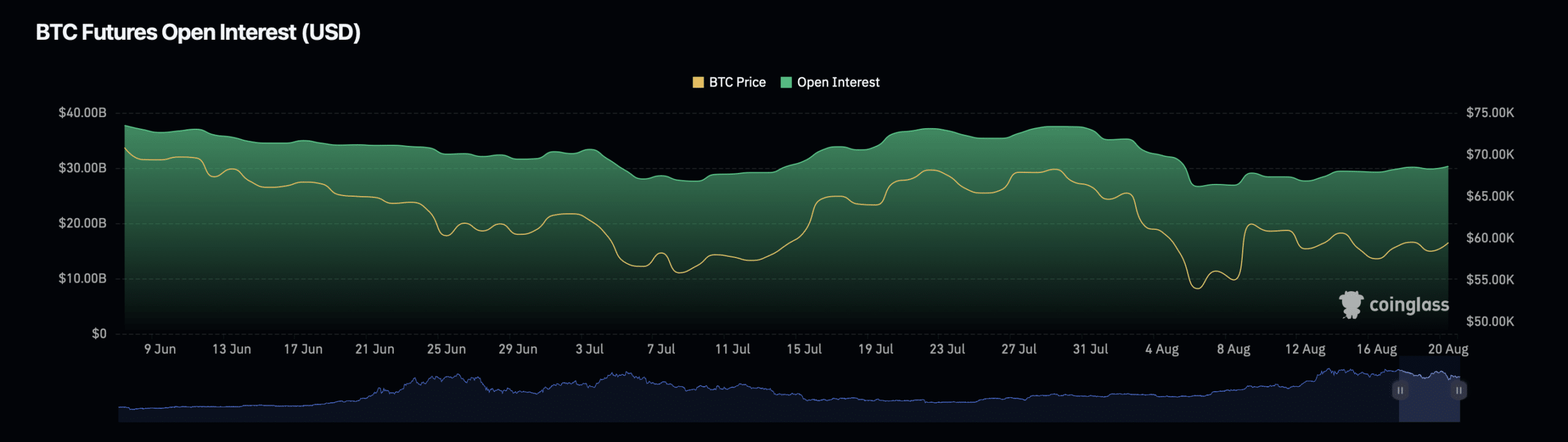

In addition to whale activity, Bitcoin’s open interest, a measure of the total number of outstanding derivative contracts, has also seen a significant increase.

According to data from Coinglass, Bitcoin’s open interest has risen by 3.61% in the past day, reaching a valuation of $31.38 billion. This surge in open interest is accompanied by a 48.49% increase in open interest volume, which now stands at $55.79 billion.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024-25

The rise in open interest suggests that traders are increasingly betting on Bitcoin’s future price movements, further contributing to the bullish sentiment surrounding the cryptocurrency.

However, it would make sense to remain cautious, as increased open interest can also lead to heightened market volatility, particularly if the market moves against the majority of these positions.

Leave a Reply