- RUNE’s Social Dominance increased sharply, reflecting its popularity.

- The token’s trading volume dropped along with its price in the past 24 hours.

THORChain [RUNE] showcased remarkable performance last week with its double-digit price increase. But the scenario changed in the last 24 hours as the token’s chart turned red.

Is this a short price correction, or will bears push the token’s price further down?

THORChain’s bullish week

CoinMarketCap’s data revealed that RUNE investors had a profitable week, as the token’s value surged by more than 25% during that time.

However, bears gained control in the last 24 hours and pushed THORChain’s value down by over 2.5%.

At the time of writing, RUNE was trading at $3.91 with a market capitalization of over $1.3 billion, making it the 52nd largest crypto.

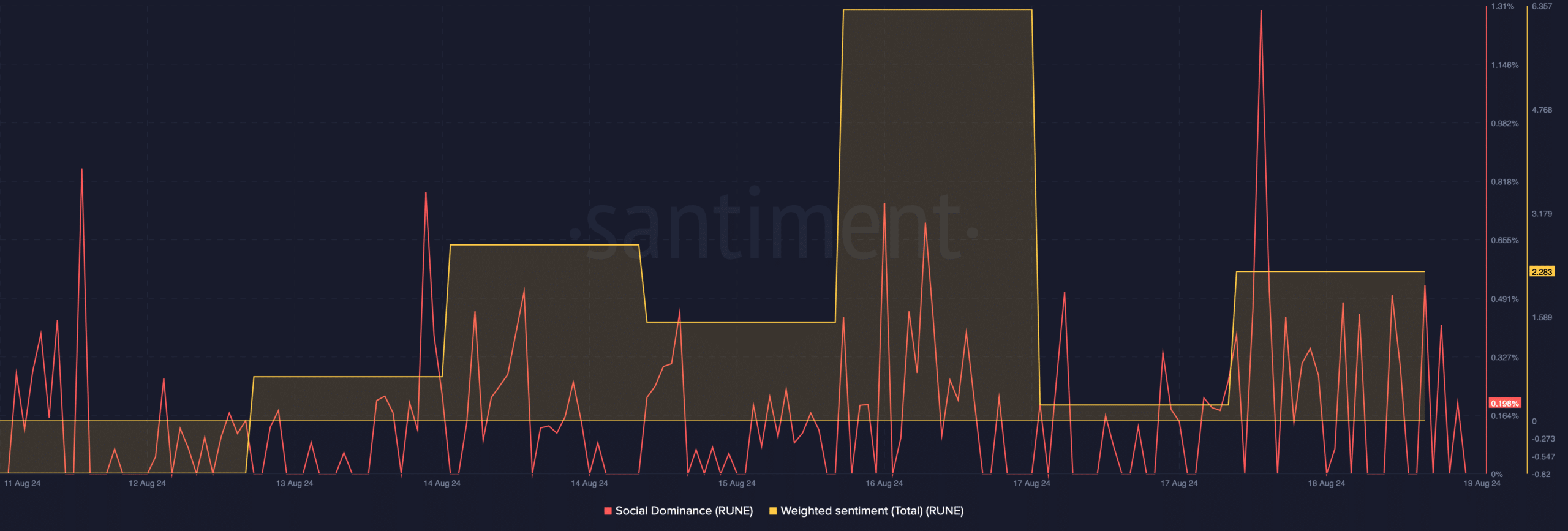

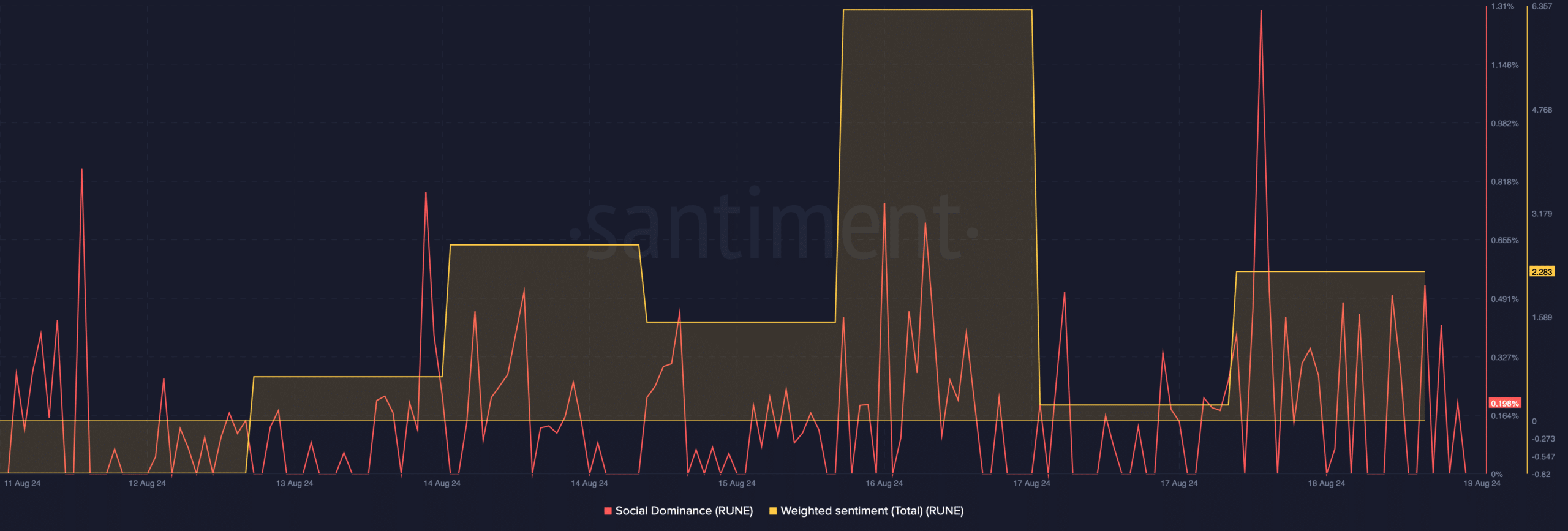

Thanks to the weekly price rise, RUNE’s Social Dominance spiked, reflecting a rise in its popularity. However, after a major uptick on the 16th of August, RUNE’s Weighted Sentiment dropped.

This suggested that bullish sentiment around the token was declining.

Source: Santiment

The recent price drop might just be short-lived, however, as the token was getting ready for a massive breakout. In fact, AMBCrypto reported earlier that RUNE might soon reach $5.

World Of Charts, a popular crypto analyst, recently posted a tweet revealing a falling wedge pattern on THORChain’s chart.

The pattern emerged in November 2023, and since then RUNE’s price has been consolidating inside it. At the time of writing, the token’s price was on the verge of breaking out.

As per the tweet, in the event of a breakout, investors might witness a 200% bull rally in the coming weeks or months. The bull rally might allow the token to touch $10.

Source: X

What metrics suggest

The good news was that while THORChain’s price fell in the last 24 hours, its trading volume also dropped by 32%. Such incidents often hint at trend reversal.

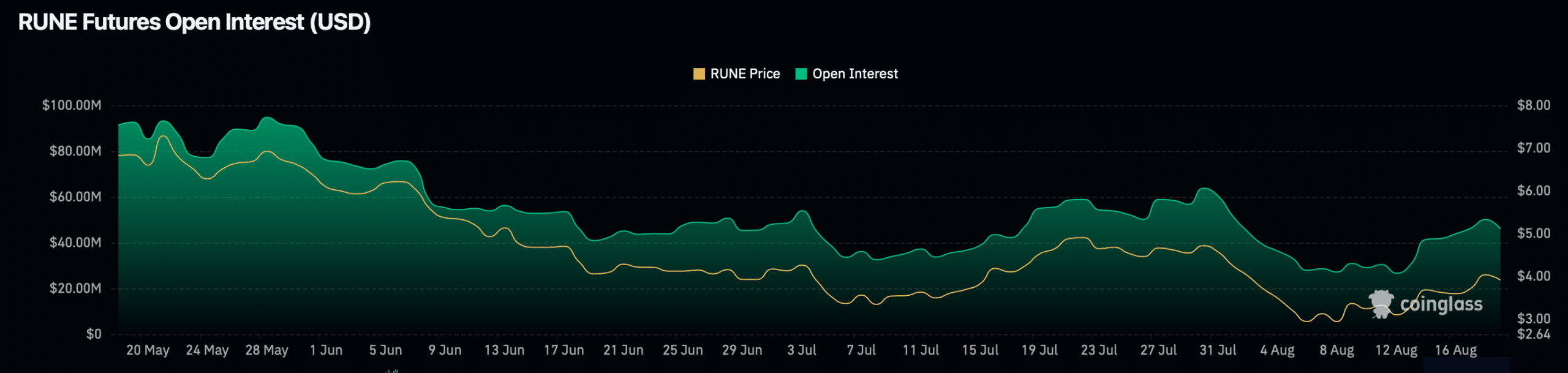

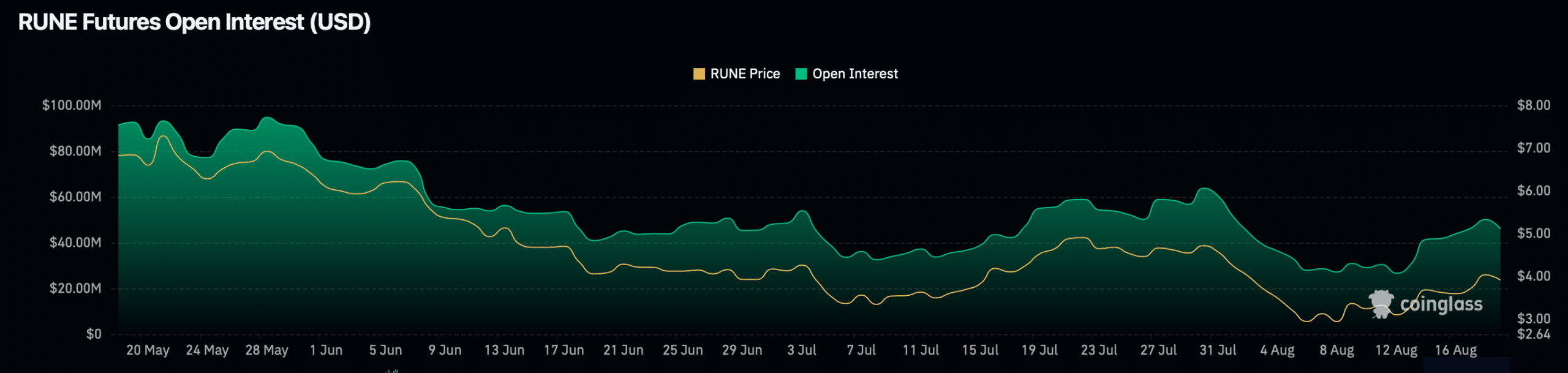

Our look at Coinglass’ data revealed that RUNE’s Open Interest also declined. Generally, a drop in Open Interest also suggests that the chances of the current price trend changing are high.

Source: Coinglass

Read THORChain [RUNE] Price Prediction 2024-25

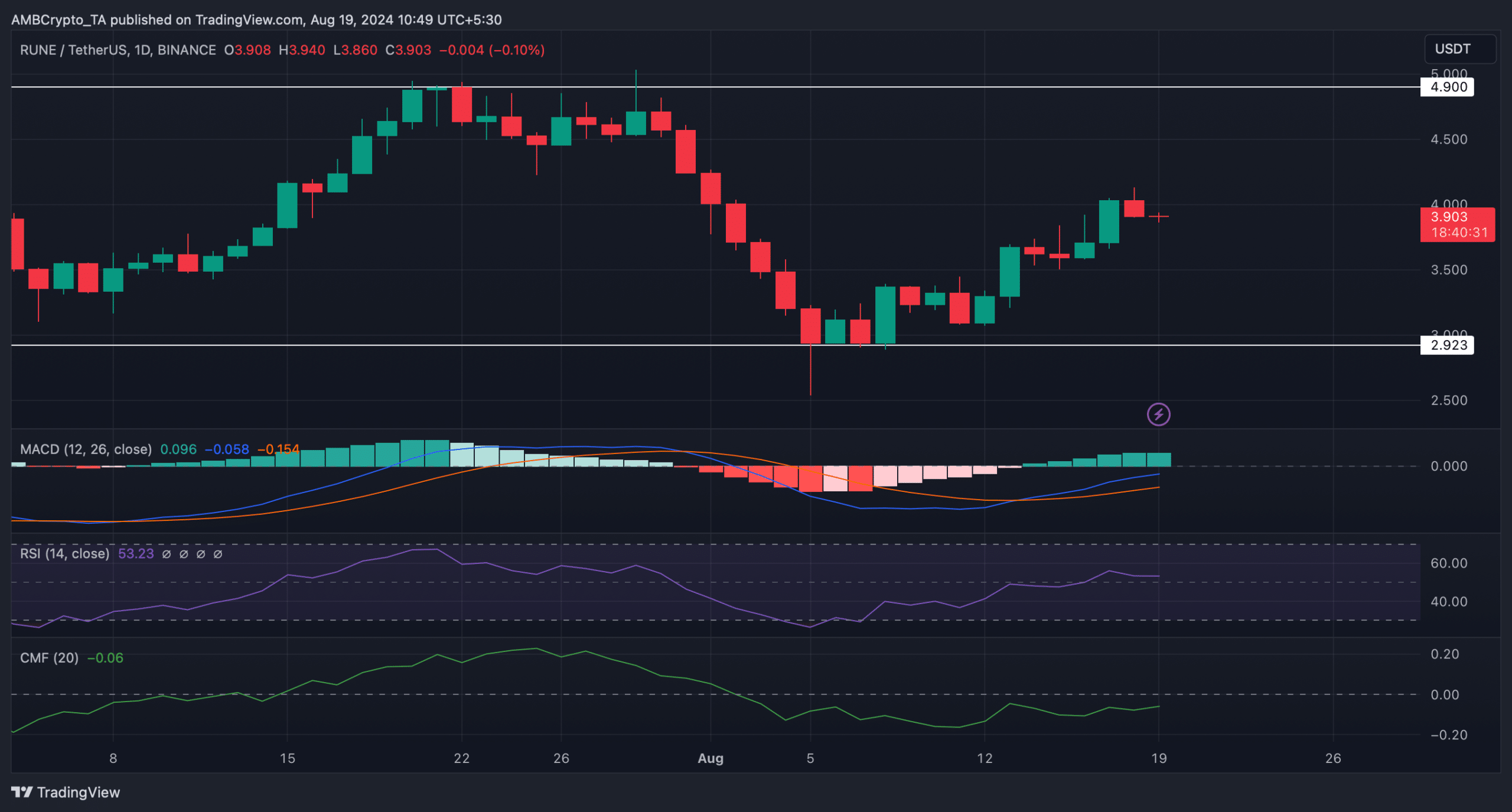

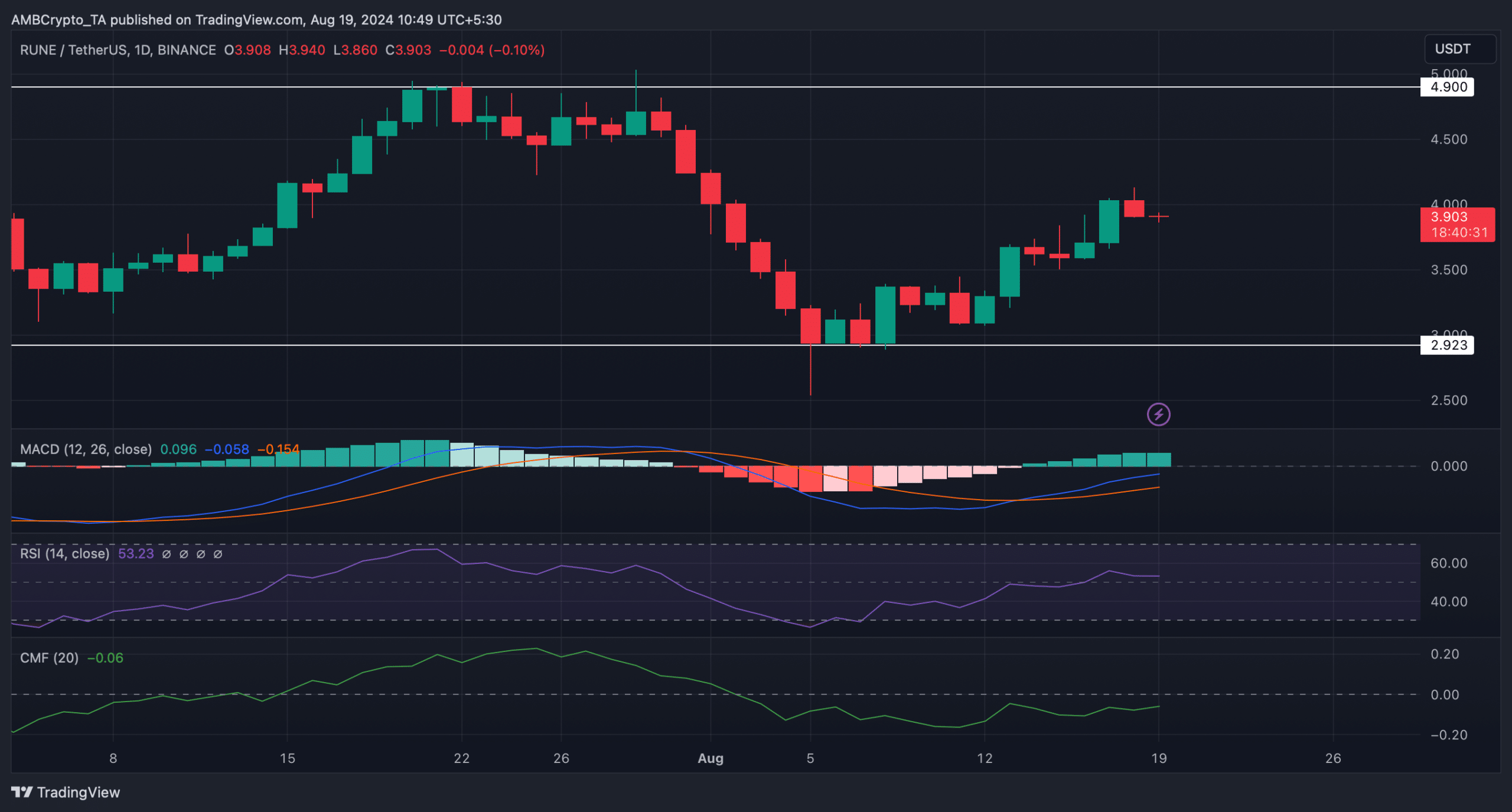

The MACD also displayed a bullish crossover. Likewise, the Chaikin Money Flow (CMF) registered an uptick, suggesting that RUNE was on its way to reclaim $5 in the coming days.

However, the Relative Strength Index (RSI) registered a slight decline and was headed towards the neutral mark. This indicated that the ongoing price decline might continue, which could push RUNE down to $2.9.

Source: TradingView

Leave a Reply