Bitcoin and its believers are staying strong no matter what market conditions they have to face. Data shows that 75% of Bitcoin’s circulating supply has not been moved in the last 6 months. This clearly represents that despite the bearish pressure on the market, bitcoin HODLERS are not afraid. So, what this means for the future of BTC, let’s find out.

Long Term Bitcoin HODLING : A Sign of Confidence

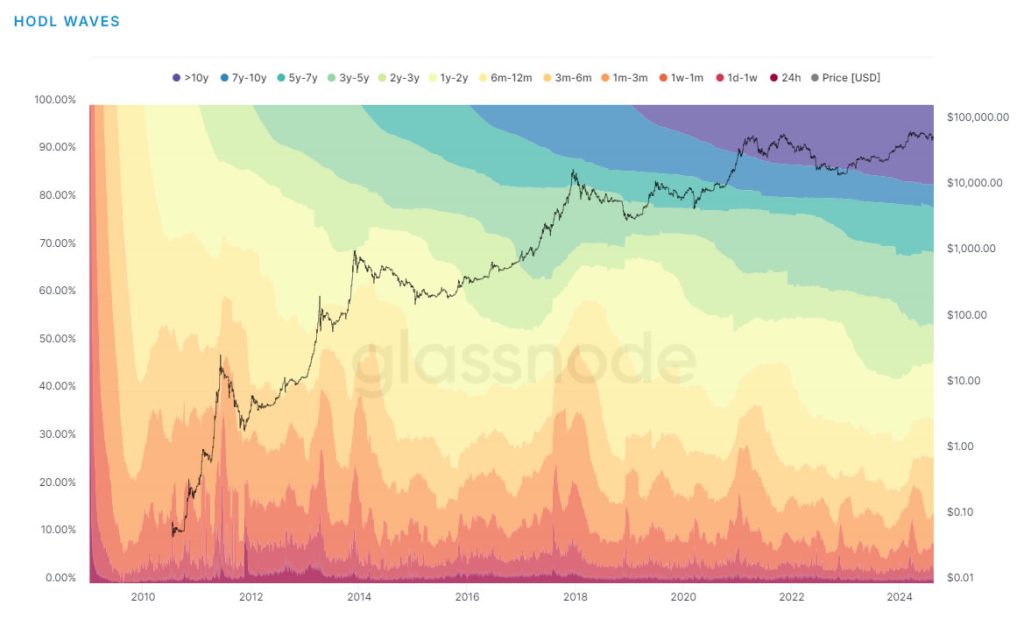

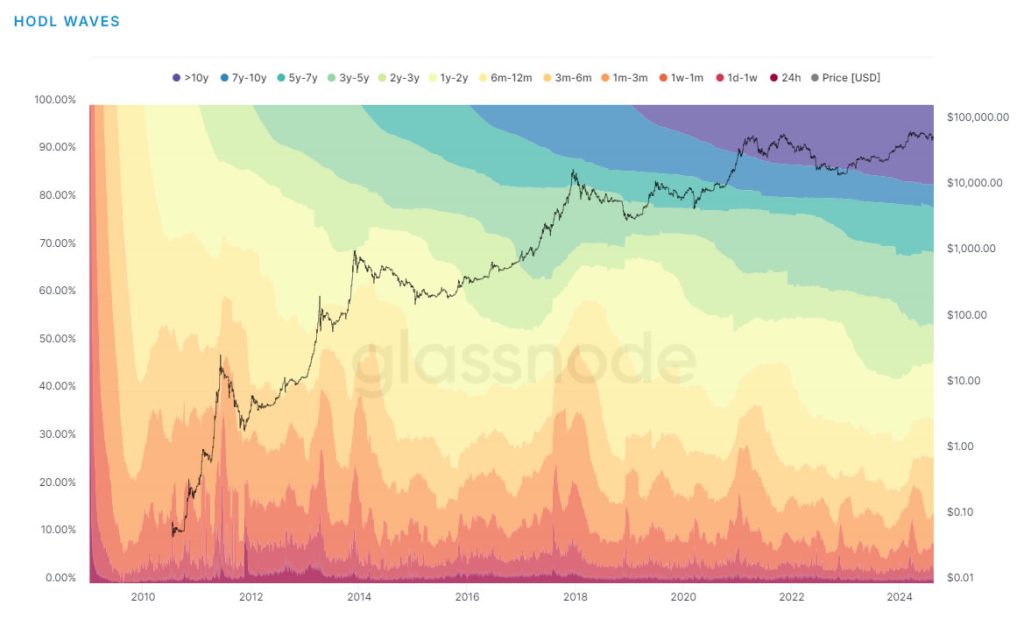

According to HODL Waves chart by Glassnode, almost three quarters of the the bitcoin circulating supply has not moved wallets. This is a sign that a large number of BTC investors believe in its long term value. It is quite interesting to see the shift of big institutions saying “Bitcoin is bad” to “Bitcoin is Dead” to now “Bitcoin is the Digital Gold.”

Even though, the price of bitcoin is down by around 21% from its all time high this year, people are holding their Bitcoin bags. When a large volume of Bitcoin is held in wallets and not traded, it reduces the amount of BTC available in the market. With increase in demand, the price increases. And we all are seeing how big institutions are accumulating Bitcoin and adding them to their portfolio.

Challenges For Short Term Investors

While Long term investors are not affected by current conditions, the short term investors are scared. A tweet from an on chain analyst 80% of the people who invested in Bitcoin since late February 2024, are at loss.

Not just these, but there are more people who bought in 2021 peak time. These people have bought btc above current price. The recent market dips have put these short term investors in a tough spot. This is not happening for the first time. We have seen similar things in previous bull runs. People buy at high prices and when the market takes a correction, these guys panic sell creating a domino’s effects. This deepens the market further.

Bitcoin Miner Under Pressure

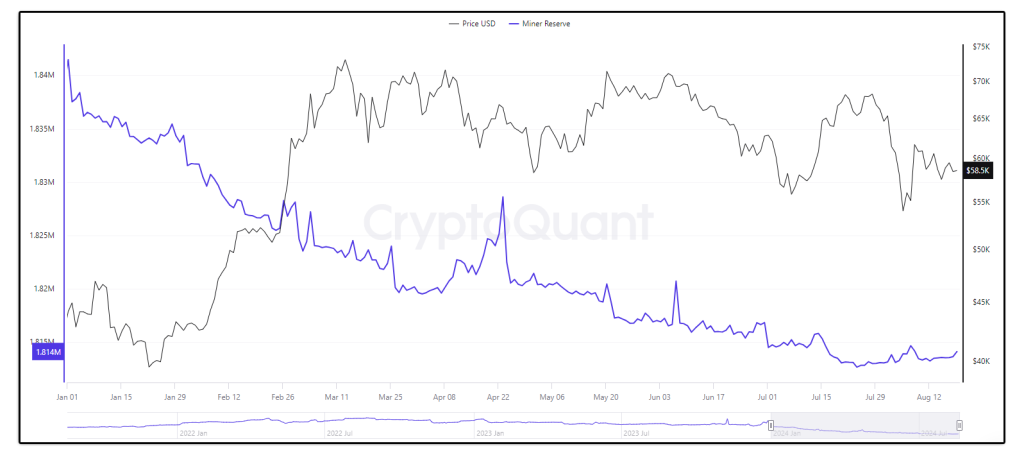

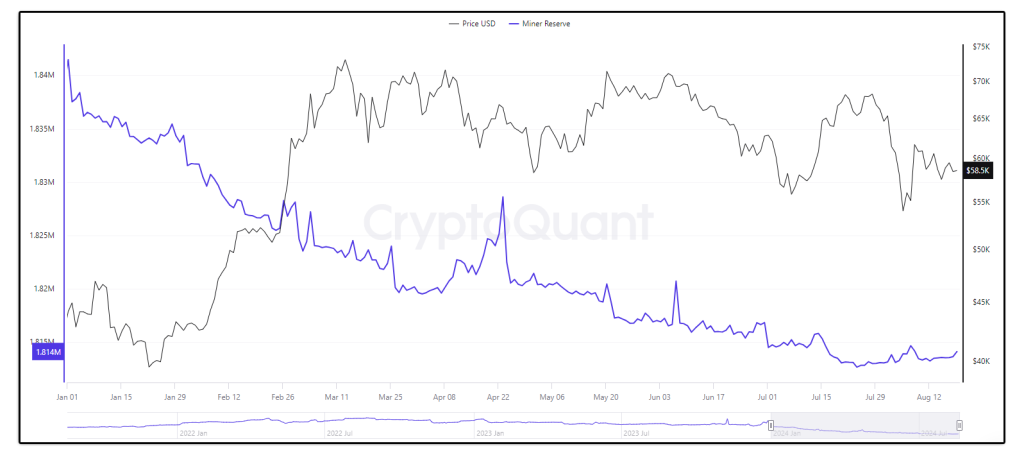

Bitcoin miners are also not immune to these market conditions. They are also feeling the squeeze. CryptoQuant data shows that miners are now working with profit margins that have dropped to the lowest levels since January. Miners have been selling their Bitcoin reserves to continue their business. This might seem alarming, however the market has recovered from such situations in history.

Fearful Market Sentiments

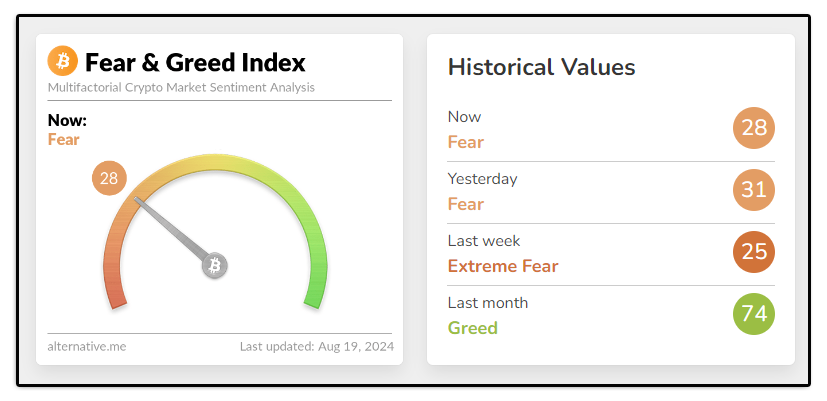

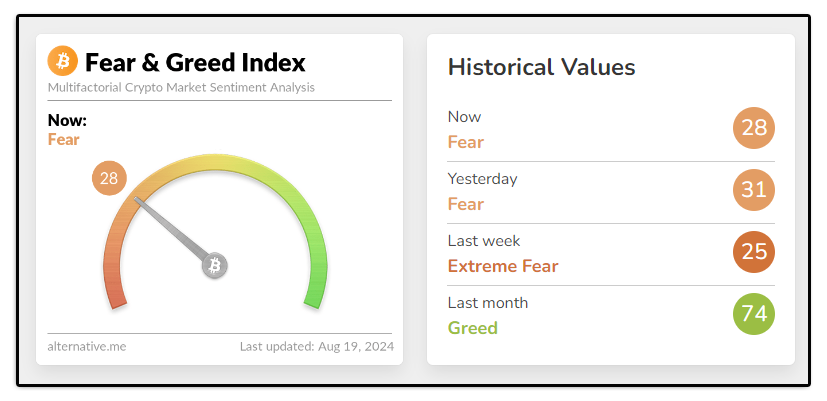

The market mood is very cautious. The Crypto Fear and Greed index has fallen to a fear factor at 28 from its last month greed factor at 74. Since the start of August, this index has been only pointing to market fear.

In my previous article I have shared information why Bitcoin might test the $48,000 zone due to market fear. These reasons are still valid as we have not seen any positive turn in the Bitcoin price. Several factors like the U.S.government moving 10,000 BTC to Coinbase suggests another dip.

The Big Picture

The historical data of Bitcoin shows that before a proper bull run, the market always runs into similar conditions. At present, BTC is in a consolidated zone. The months of August and September have been bearish months for the market over the last 12 years and October gives a high jump. Following these patterns and data being displayed by the charts, we can say that before the rise near October, the market might take another dip. This will wash the panic sellers and open new accumulation opportunities to those who understand the real value of Bitcoin. Various experts are giving different numbers for a bull run, however one thing is common, everyone believes to witness Bitcoin price crossing $100k in the next six months.

Leave a Reply