- Chainlink bulls have remained cautious since the price neared $11.

- The bearish short-term sentiment promised a move toward $8.

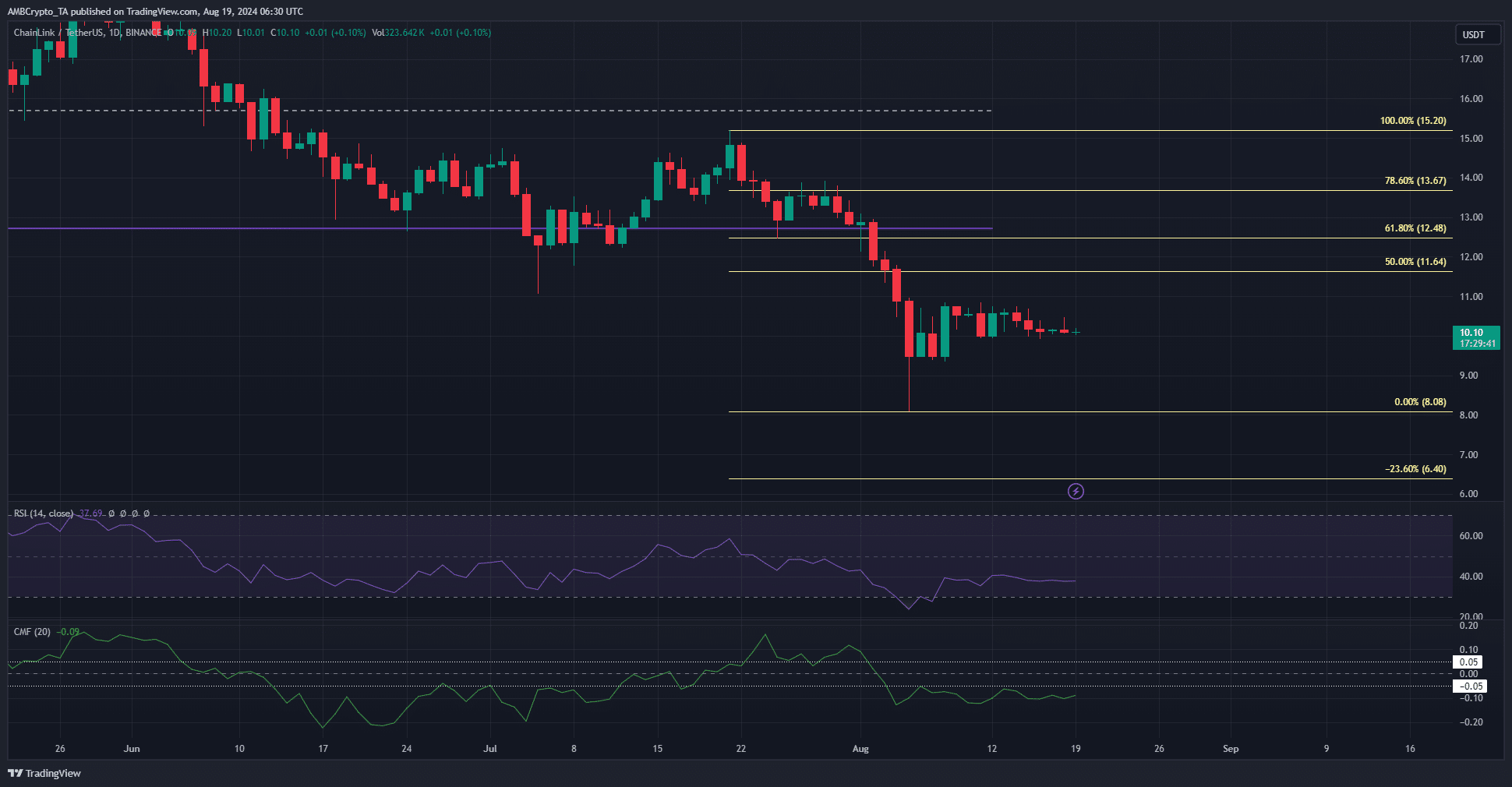

Chainlink [LINK] was trading within a bearish pennant pattern, which promised another downward move for the token. Technical analysis showed that the seller pressure has not weakened over the past few days.

In other news, Chainlink recently integrated four of its services across 12 blockchain networks. This surge in adoption and progress in expansion were promising for investors with a longer time horizon.

The hesitation below $11

Source: LINK/USDT on TradingView

After the heavy losses on the 5th of August, Chainlink bulls drove a price bounce to $10.8 but no further. The sellers have been dominant throughout August as the CMF was below -0.05 to indicate heavy capital outflow.

The daily RSI has also been bearish since LINK fell below the former range lows at $12.7. In the near term, the local lows at $9.45 and $8 are the bearish targets.

The $10.8-$11.2 zone is likely to serve as resistance, and short-sellers can look to enter the market here. Below the $8.08 recent low, the Fibonacci extension level marked $6.4 as another bearish price target.

LINK’s bullish sentiment was quick to evaporate

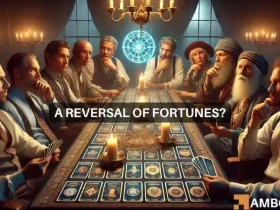

Over the past three days, the Open Interest behind LINK gradually increased as the price went from $10 to $10.4. This 4% move higher was accompanied by a slight uptick in the spot CVD as well.

Is your portfolio green? Check out the LINK Profit Calculator

The past 24 hours shattered the little progress the bulls had made. Chainlink faced rejection from $10.4 and the Open Interest dwindled swiftly to show bearish sentiment.

The spot CVD also took a step downward. The Funding Rate alternated between positive and negative, showing a speculator market whose sentiment was teetering between bullish and bearish.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Leave a Reply