- Bitcoin is diverging from its previously observed correlation with the stock market

- Could the decoupling be a good thing for BTC going forward?

Bitcoin has maintained a significant degree of correlation with the stock market for quite some time now. But what happens if it loses this correlation and how will it impact BTC’s price action?

The influx of institutional investors into Bitcoin and crypto in general is the main reason for the correlation with the stock market. Cryptocurrencies therefore benefitted from the influx of liquidity from institutions that sought to diversify their investments.

While this trend did prevail for some time, recent observations indicate that a decoupling might be taking place.

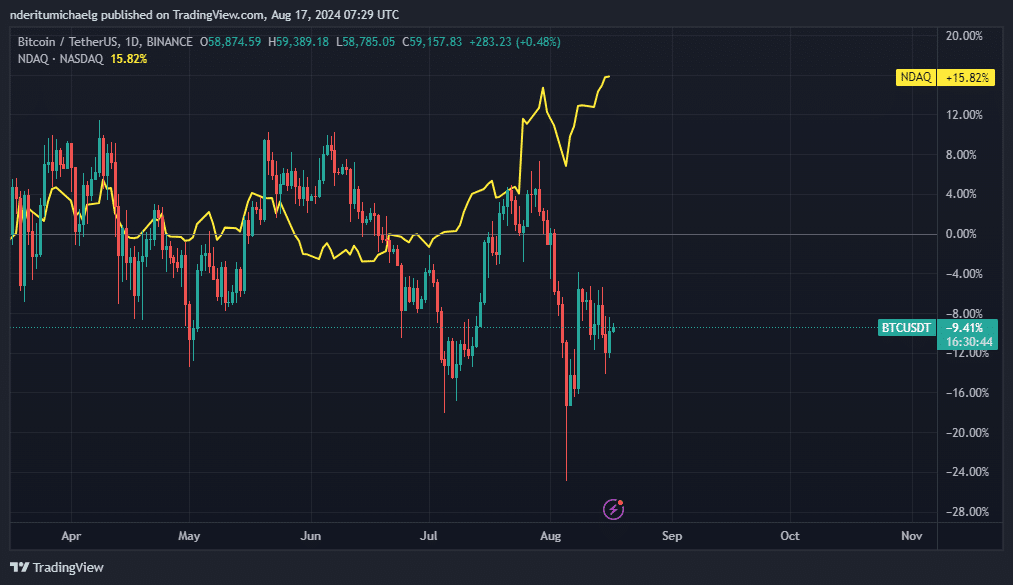

Bitcoin had been moving in tandem with the NASDAQ up until recently. However, BTC’s bearish performance this month underscores growing divergence as the NASDAQ continues to soar on the charts.

Source: TradingView

A sign of the times?

While some may see Bitcoin’s decoupling from its correlation with the NASDAQ as a bad thing, it may turn out to be the opposite. Recession fears recently reached new peaks, raising the risk of a major stock market crash. However, many have also been wondering whether that would lead to a similar outcome for Bitcoin and the rest of the crypto market.

The decoupling raises hopes that Bitcoin may end up weathering a recession much better than the stock market. Since BTC is no longer moving in tandem with the NASDAQ, it also strengthens the plausibility of Bitcoin being viewed as a safe haven asset in case a recession hits.

The end of the correlation may also promote the idea that Bitcoin is maturing as a distinct asset. This may further support the flight to safety narrative – An outcome that would align with the shifting dynamics observed recently in the market.

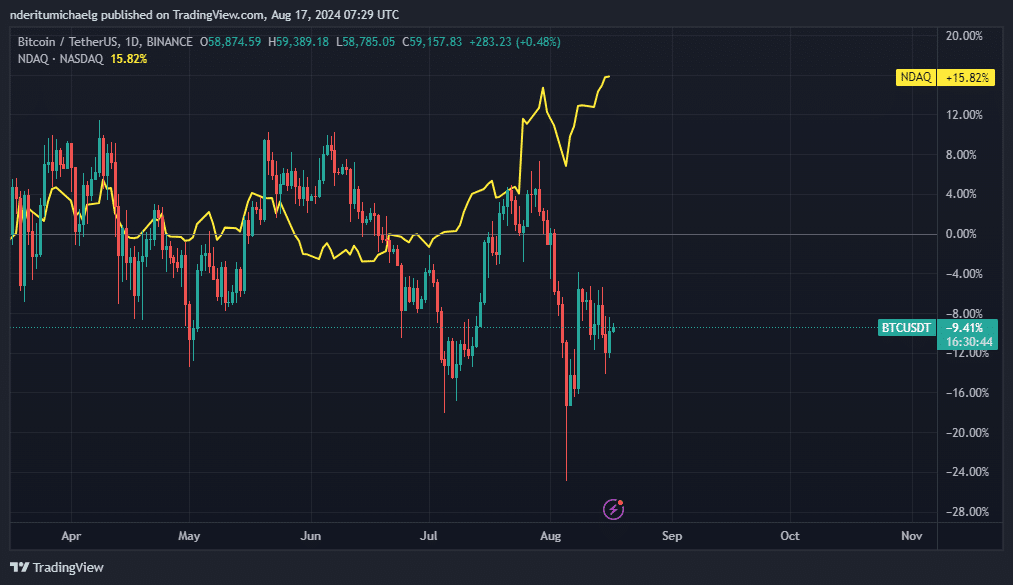

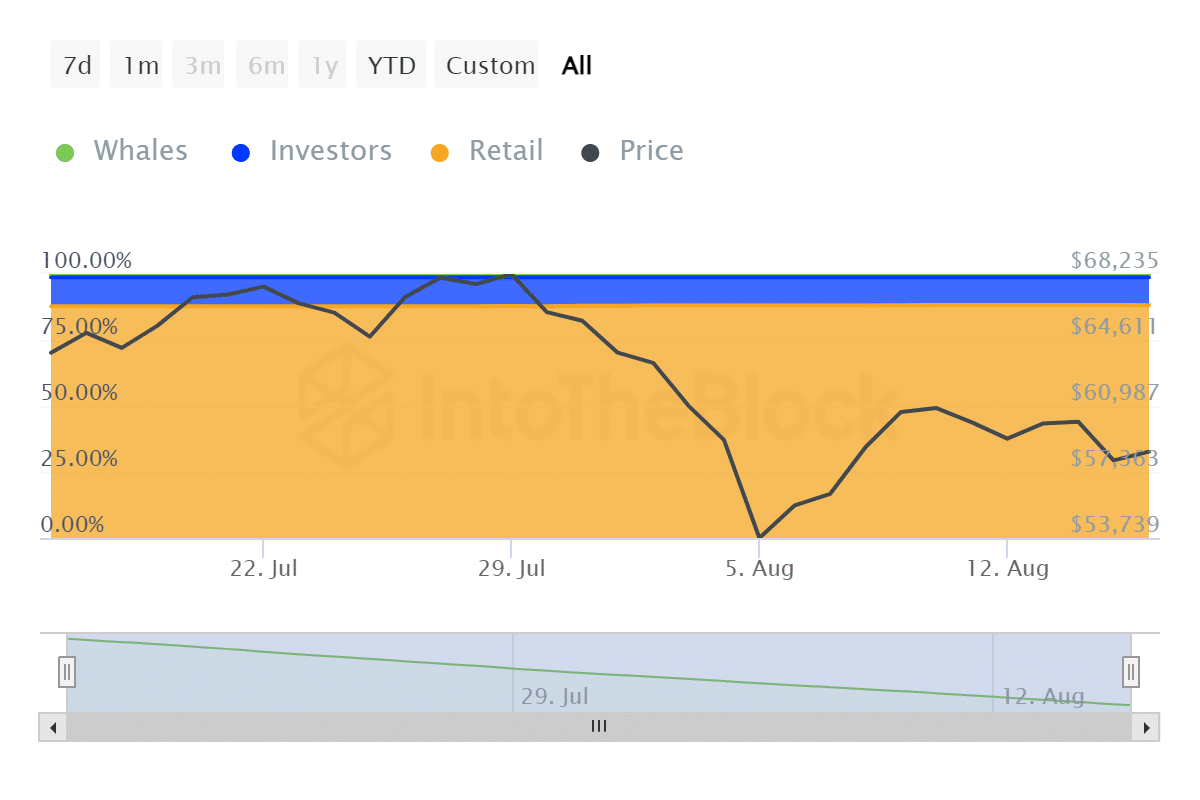

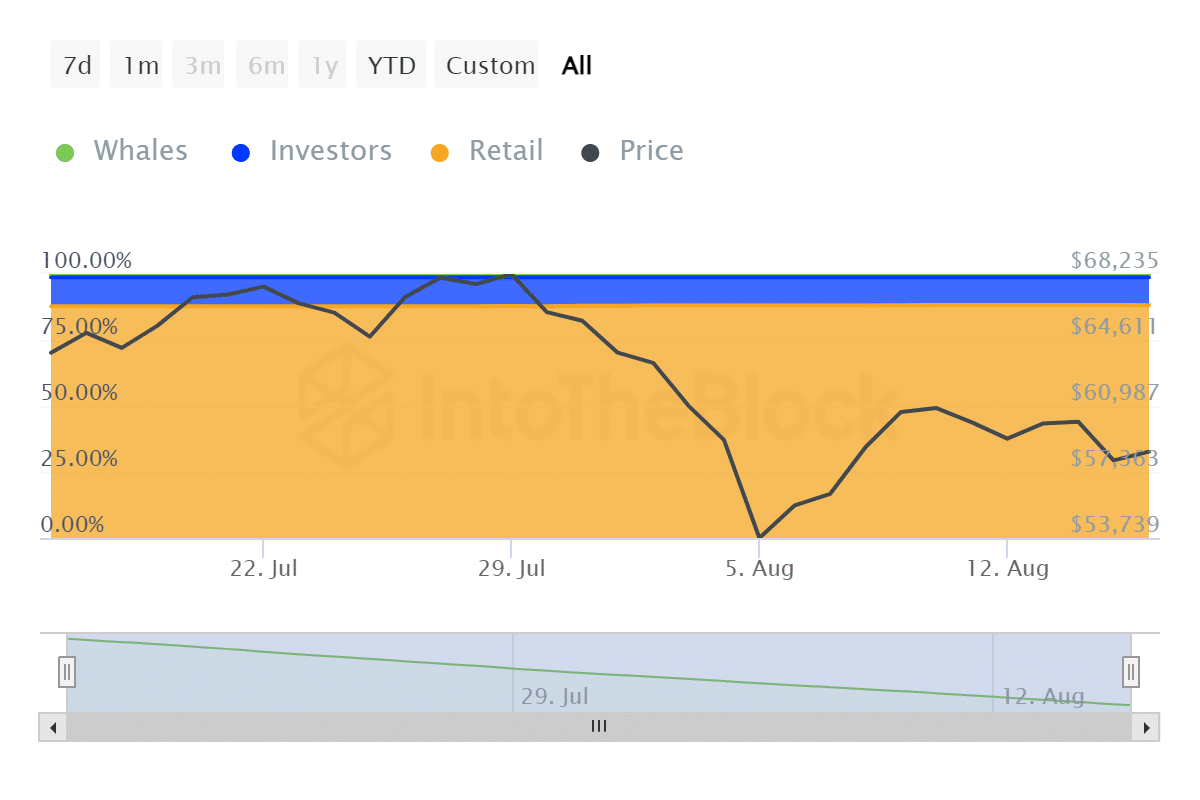

For example – BTC’s lower price tag over the last 4 weeks has attracted more HODLing. In fact, roughly 80% of Bitcoin holders are currently in profit, despite the recent dip – An indication of strong demand at lower prices.

The retail class of the cryptocurrency’s holders added, on average, 2.91 million BTC to their addresses in the last 4 weeks. Institutions contributed to sell pressure by roughly 80,000 BTC. Meanwhile, whale holdings remained unchanged over the same period.

Source: IntoTheBlock

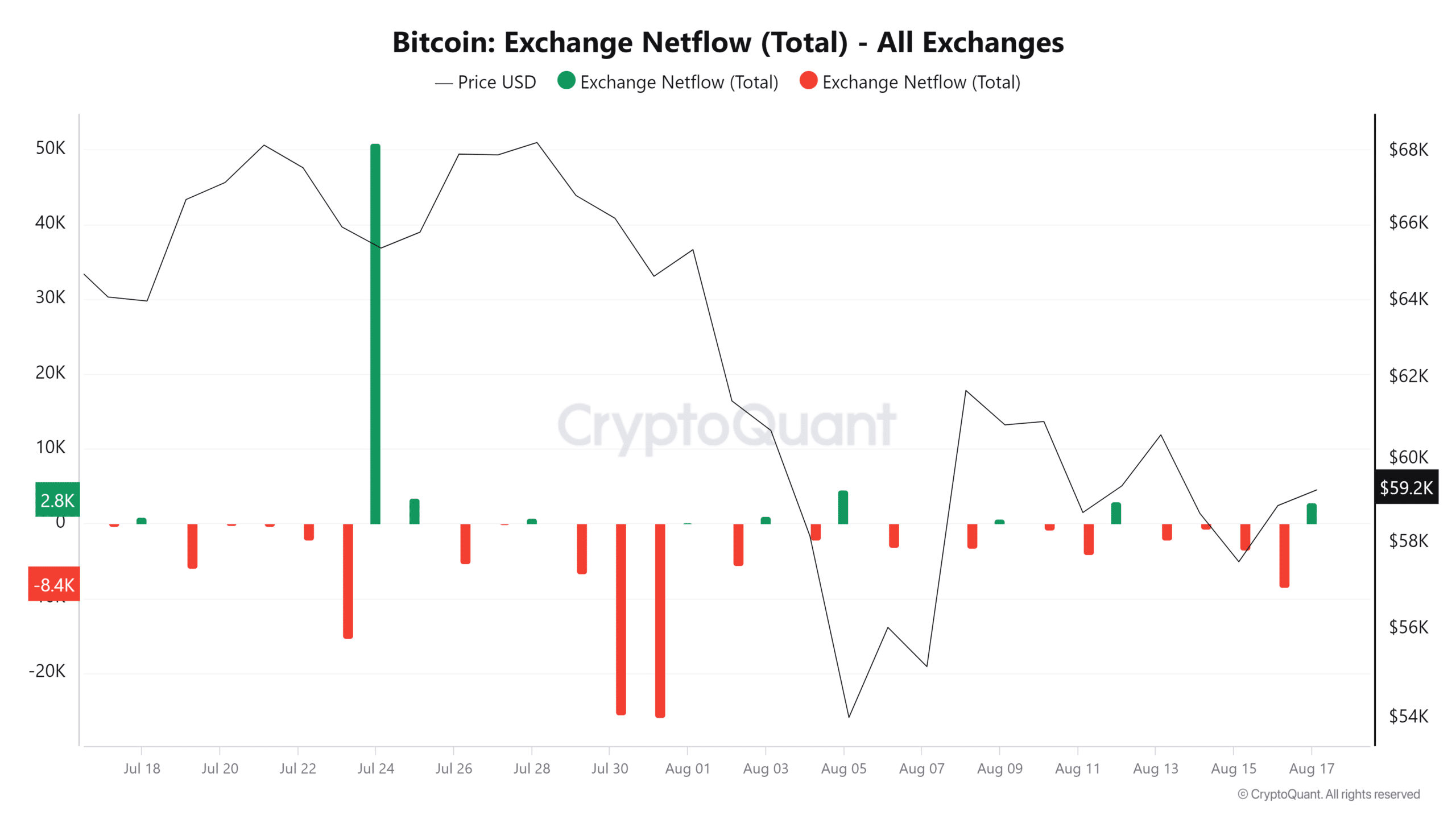

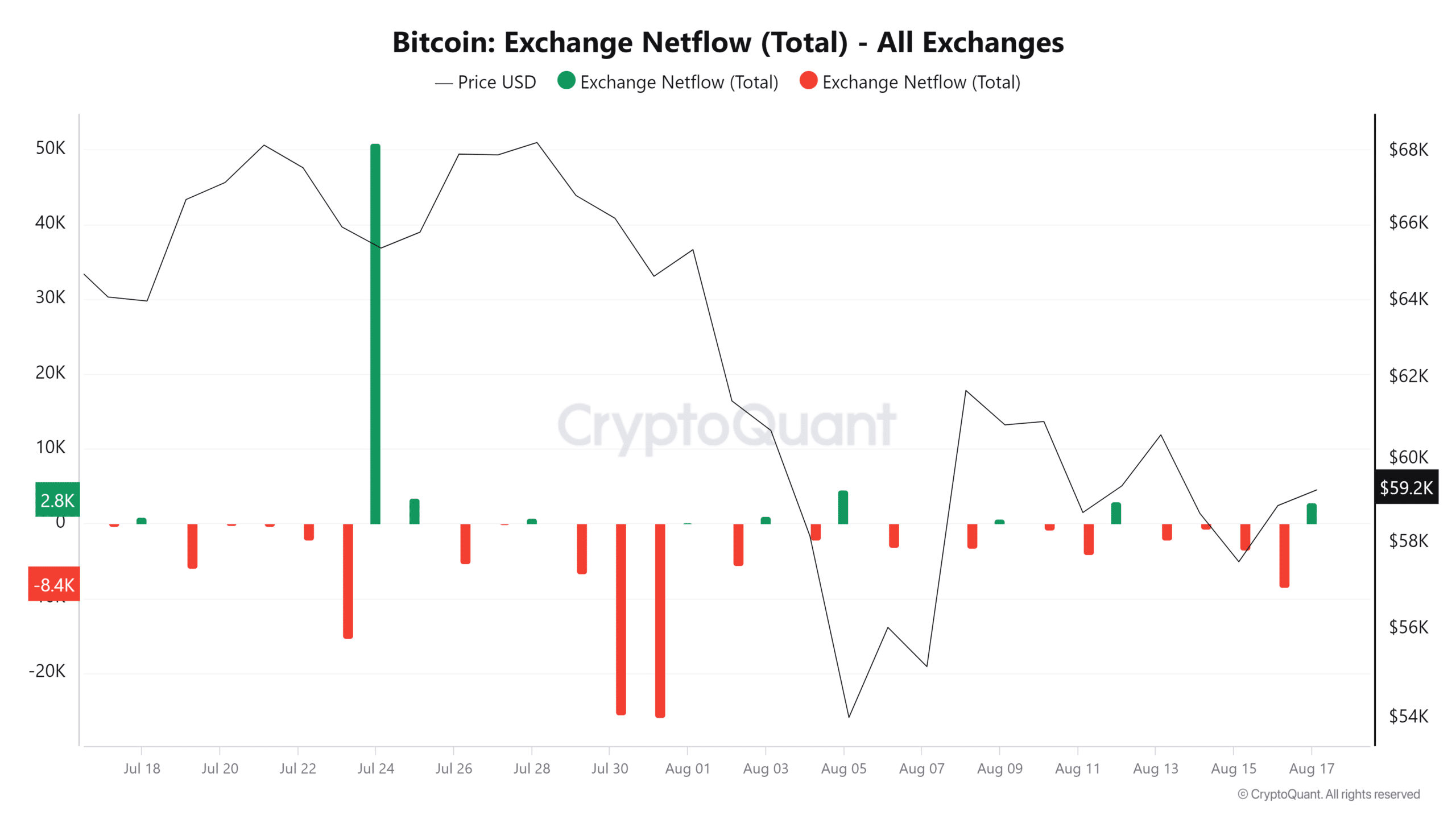

Finally, Bitcoin’s exchange flows highlighted why Bitcoin’s price has been moving in its press time range.

Exchange netflows were negative over the last few days. However, they saw a shift into positive netflows over the last 24 hours, indicating outflows in favor of an uptrend.

Source: CryptoQuant

Bitcoin’s latest price movements reflect the directional uncertainty in the short term. Right now, it is underpinned by the lack of a strong enough catalyst for a strong up or downward swing.

Leave a Reply